Sean Gallup

Investment Thesis

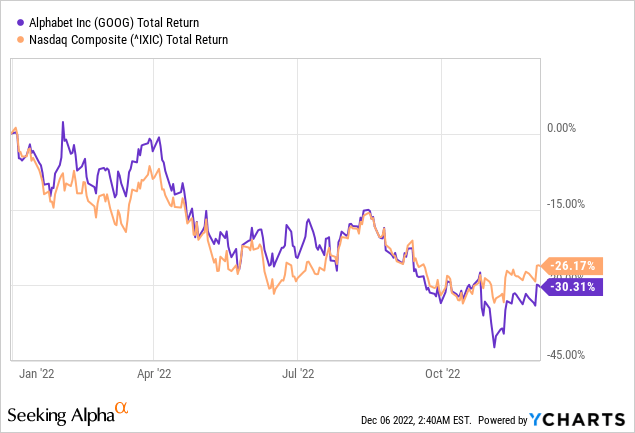

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), is one of the top picks before 2023 due to its reasonable valuation with limited downside, and strong economic moat that can protect its cashflows throughout 2023, amidst the macroeconomic uncertainty that lead to shrinking advertising budgets.

A Global Shift To Retail Media & CTV

Alphabet’s advertising business is not immune to macroeconomic growth risks as recent ad pricing weakness could slow growth to around mid to high single digits in its $150 billion core-search business in 2022. In addition, network-ad sales face pressure amid the removal of cookies, while Play store segment sales struggle with lower take rates. Last but not least, Data-privacy regulations pose a risk to the ad business.

On the contrary, a shift in global advertising budgets to retail media and connected TV (CTV), the fastest growing segment of the $600 billion-plus digital-ad market, may support Alphabet and Amazon (AMZN) more than social media companies, since Snap (SNAP) and Meta (META) may continue to face headwinds to top-line growth in 2023 amid stiffer competition from TikTok and Apple’s (AAPL) privacy changes.

Strong Balance Sheet To Navigate A Crisis

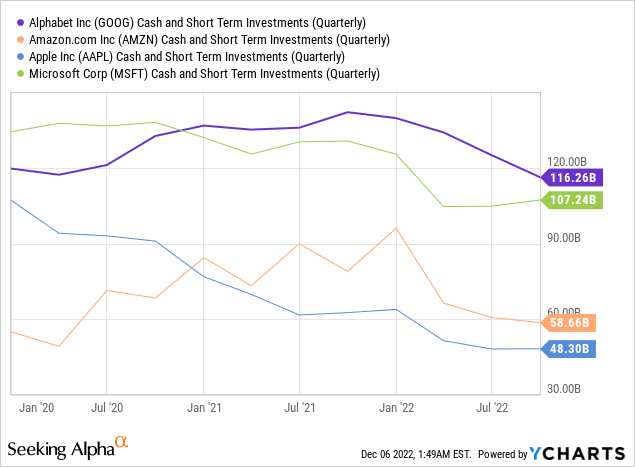

Alphabet’s balance sheet, measured by its cash position, is the strongest among peers, including Apple, Microsoft (MSFT), and Amazon, a lead that will likely be maintained in 2023. Despite an increase in shareholder returns, Alphabet’s more conservative financial policy relative to peers has kept its cash and liquid investments position to $116 billion.

Alphabet’s cash position has continued to climb over the past decade and could be mildly higher if share buybacks don’t grow beyond its current $70 billion authorization. However, while potential regulatory fines or M&A could reduce Alphabet’s excess cash, the company differs from peers via a conservative capital structure with much less debt than Apple, Microsoft, or Amazon. In addition, unlike Apple, which has a net cash-neutral target, Alphabet hasn’t disclosed balance sheet targets.

Google Search Resilience

In the earnings call of the Q3 2022 results, the firm highlighted resilience in search ads, supported by solid spending from customers active in retail and travel. The management attributed the significant slowdown in the search revenue growth pace primarily to currency effects and the lapping of last year’s strong performance.

However, there have recently also been pullbacks from some advertisers, such as those active in financial services, in areas like insurance, mortgages, and crypto sub-categories. In addition, a decline in user engagement in gaming after the surge during the pandemic also has adverse effects. It is not only resulting in lower commissions captured by the Play store (Play revenues again declined in the quarter, also impacted by last year’s cut in fee rates) but also adding pressure to advertising sales. As a result, the management has seen lower spending on ads to promote gaming apps in all its advertising activities; search, the Google advertising partner network, and the YouTube platform.

As many firms are faced with demand uncertainty, advertisers may shift more of their spending to search ads. Search ads are bought to spur online sales and stimulate offline retail activity and purchases of services. Moreover, search ads are known for their greater direct effectiveness than other formats, which can also be measured well. This advantage recently became larger due to the trend of users switching to stricter privacy protections, to which policy changes of Apple may continue to contribute. Due to the rising attention to privacy, many rivals have a weaker ability to use personal data for effectively targeting and measuring their ads.

Considering the lapping of extraordinary growth in 2021, Q3 Search results validated that advertisers are more inclined to allocate budgets to mature platforms such as Google Search, where performance is more predictable in a soft environment, as opposed to other platforms of more experimental nature.

YouTube & Shorts Update

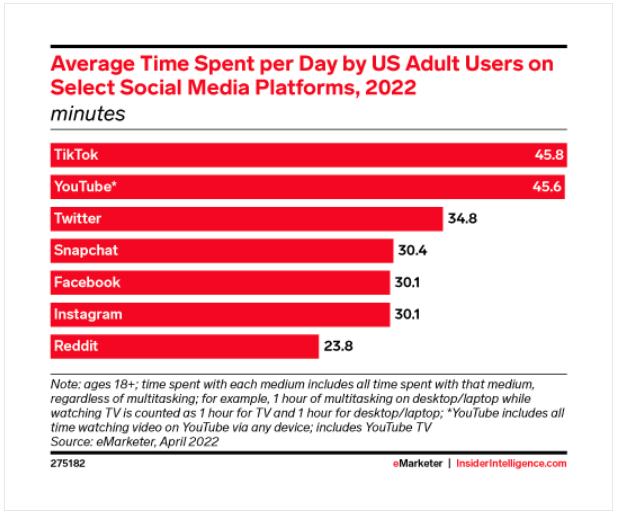

The pullback in advertising also hurts YouTube, and the video platform is confronted with the growing success of TikTok, the app of Chinese origin that pioneered short videos. YouTube’s response to TikTok, Shorts, is quite successful, with currently 30 billion daily views and 1.5 billion users who log in every month to watch the new format. Shorts compete head-to-head with TikTok in terms of average time spent per day, with only 2 seconds difference in favor of TikTok.

In the near term, the shift in user engagement to Shorts will hurt revenues, but recent initiatives may help YouTube to improve the trend. In September, introduced a revenue-sharing model for Shorts creators, a first for the short video format and announced the launch of Shorts ads in 2023. As a result, YouTube remains well-positioned to attract advertisers that want to target a relatively young audience that hardly watches linear TV but spends significant time-consuming video and music content across various devices.

eMarketer

Cloud Remains The Key To Upside Growth

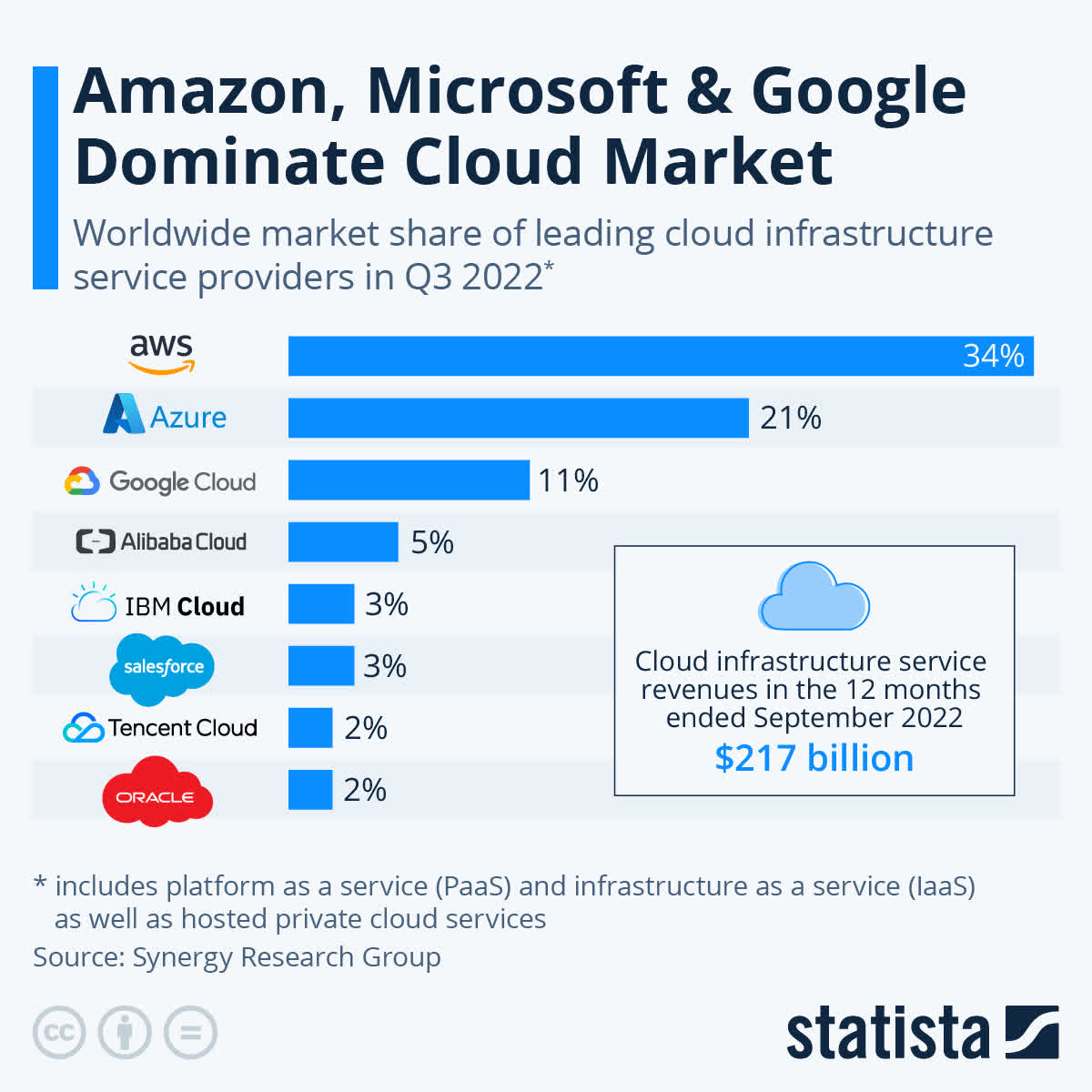

The only activity with improved sales growth in Q3 2022, 38%, versus 36% in the prior quarter, was the Google Cloud unit, which produces almost 10% of total sales. The COVID 19-crisis has boosted online learning and remote working, benefiting the usage of many services and products.

Growth continues to be driven by increasing cloud adoption and cybersecurity needs as businesses look to reduce IT costs and digitalize. Google Cloud’s infrastructure and platform services still have a small scale compared to the businesses of cloud leaders Amazon and Microsoft.

However, adopting hybrid and public cloud services by enterprises and public institutions is still in the early phase. Alphabet is well positioned, supported by its advanced technical infrastructure and strength in data analytics, to capitalize upon the sizeable structural growth potential of enterprise cloud services.

Statista

Continued Efforts To Sustain Profit Margins

Google’s Operating income came in at $17 billion, 13% below expectations due to revenue shortfall and OpEx growing higher than expected. Going forward, the pace of cost cuts appears to be similar to statements made last quarter, which is to slow down hiring, but the impact would be more apparent in 2023. While Alphabet remains committed to its long-term investments, such as AI, YouTube, and cloud, management will adopt a more cautious spending approach.

Given the attractive opportunity set within Search and YouTube (Shorts and CTV in particular), the company will continue to invest in those high-potential segments to drive long-term results, which could create ongoing pressure on near-term margins. As part of its effort to improve operating performance, Alphabet will significantly slow hiring in Q4 2022 (management expects QoQ addition of less than half of Q3’s) and 2023.

As a result, while the company’s profit margins would remain under pressure going forward in 2023, the overall margin impact could be potentially offset by the company’s slow hiring (headcount addition in Q4 is expected to slow to less than 50% of the number added in Q3) and potential headcount reductions. Google’s CEO recently said that he hopes to improve efficiency by ~20%, alluding to potential cuts.

Concluding Thoughts

Despite the macroeconomic uncertainty and shrinking advertising budgets that directly affect Alphabet’s business, the conglomerate remains well-positioned to navigate an economic downturn in my view. Alphabet can utilize its massive cash surplus for more M&A activity in 2023 at cheaper prices, and more buyback activity to generating economic value for investors.

Be the first to comment