undefined undefined/iStock via Getty Images

The Chinese economy is facing some large headwinds:

China’s economy faces its worst downward pressure since the spring of 2020 when it was hit by the first wave of Covid-19, according to Nomura Holdings Inc.

The slowdown in China’s growth worsened in the first quarter and markets should be concerned about a further slide in the second, Nomura Holdings Inc. economists including Lu Ting wrote in a note Saturday. Economic activities “may notably deteriorate across the board” in March, weighed down by increasing mobility restrictions across the country and a continued property sector slump, they said.

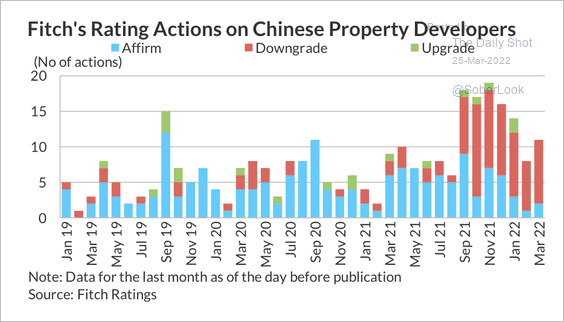

Real estate related debt is being downgraded:

Downgrade to Chinese property developers (Fitch ratings/from The Daily Shot Twitter Feed)

China helped to pull the world out of the Great Recession through massive fiscal spending. That may not be happening now.

Keep your eye on these negotiations:

In a world contending with no end of economic troubles, a fresh source of concern now looms: the prospect of a confrontation between union dockworkers and their employers at some of the most critical ports on earth.

The potential conflict centers on negotiations over a new contract for more than 22,000 union workers employed at 29 ports along the West Coast of the United States. Nearly three-fourths work at the twin ports of Long Beach and Los Angeles, the primary gateway for goods shipped to the United States from Asia, and a locus of problems afflicting the global supply chain.

The contract for the International Longshore and Warehouse Union expires at the end of June. For those whose livelihoods are tied to ports – truckers, logistics companies, retailers – July 1 marks the beginning of a period of grave uncertainty.

This is occurring just as China is ramping up lockdowns to contain Covid. Combined, those two could prove to be devastating to supply chains.

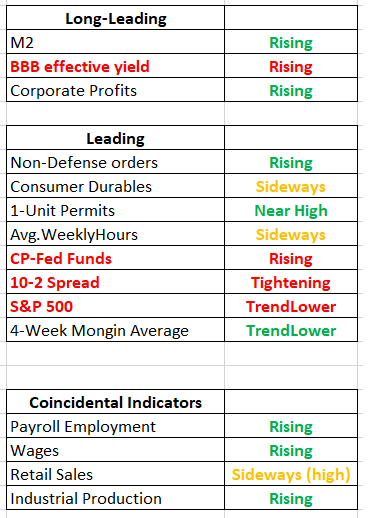

Consider this table:

Shorthand for long-leading, leading, and coincident indicators (FRED and author’s shorthand)

This is my shorthand table to keep track of the long-leading, leading, and coincident indicators. Notice that financial market data is now turning bearish. The bond market data is especially important. It shows that these investors are concerned about growth prospects, especially in light of a hawkish Fed.

As I noted over the weekend, the longer-term trends are neutral or lower but the shorter-term trends are bullish. Now, the main thing we’re looking for is to see if the shorter-term trends can continue moving higher with the hope they pull the longer-term averages with them.

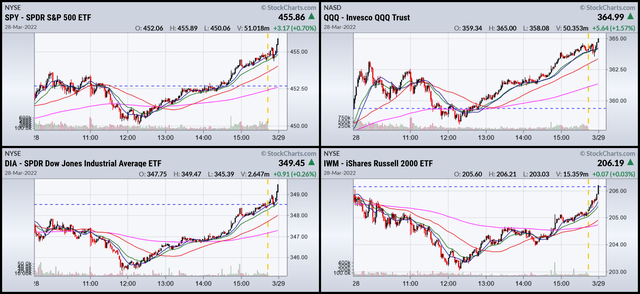

Today was a good start in that direction:

1-day SPY, QQQ, DIA, and IWM (Stockcharts)

Starting around noon, the markets started a rally that lasted into the close. Best of all, all the indexes closed on a high note, meaning traders are comfortable holding positions overnight.

3-day SPY, QQQ, DIA, and IWM (Stockcharts)

The indexes continue to make progress. The DIA is consolidating above the 200-day EMA while the SPY continues to rally above that point. The QQQ advanced above that key level today. The only laggard is the IWM, which continues to consolidate below the 200-day EMA.

Overall, this was a good start to the week.

Be the first to comment