marchmeena29/iStock via Getty Images

Golub Capital BDC (NASDAQ:GBDC) is an asset management firm worth investigating if you want some passive income paid to your account once a quarter. Golub Capital employs a security-first investment strategy, maintains a carefully constructed investment portfolio, and provides investors with a well-covered dividend yielding 7.8% on their investment. In addition, the company has interest rate upside.

Safety-First Portfolio Model

Golub Capital is a business development company (BDC) that generates significant investment income from its expanding portfolio of high-quality loans. The BDC primarily invests in first lien senior secured loans, which are extremely safe loans in which the borrower is extremely unlikely to default. Even though the default probability for first lien senior secured loans is not zero, it is very low.

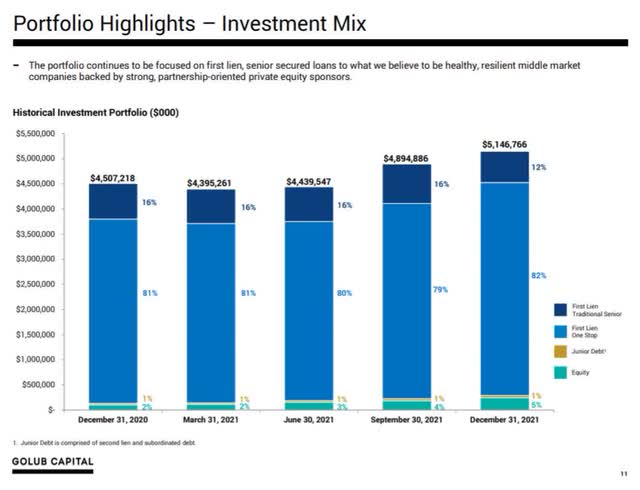

Golub Capital’s loan portfolio is made up of 82% of these first lien senior secured loans, with the remaining 18% split between other first lien (one-stop) loans (12%), equity (5%), and junior debt (1%). The last two asset classes in this summary, equity and junior debt, carry more risk than Golub Capital’s large first lien senior secured loan portfolio, but they also provide the BDC with the opportunity to earn higher returns.

Despite the fact that Golub Capital’s portfolio has undergone some changes, the allocation of investor capital to first lien senior secured loans has only changed in minor ways in 2021.

Investment Mix (Golub Capital BDC)

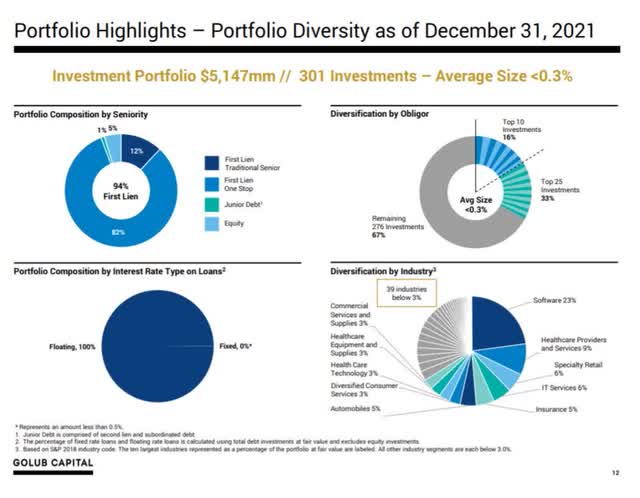

In December, Golub Capital’s portfolio included 301 different investments with a total value of $5.15 billion across all asset classes. Golub Capital’s top ten investments account for only 16% of total assets, indicating a defensive portfolio orientation.

Golub Capital also values lending to industries that are not overly exposed to the economy’s cyclical swings, which is why the BDC invests in companies in the software industry, healthcare, specialty retail, IT, and insurances. These less-cyclical industrial sectors account for 49% of BDC investments. All of Golub Capital’s loans are floating rate, giving the BDC an advantage in the event of rising interest rates.

Portfolio Diversity (Golub Capital BDC)

Credit Quality

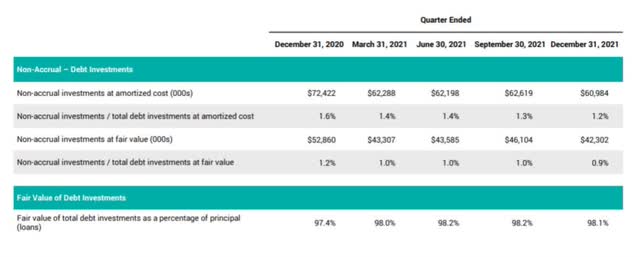

The portfolio of Golub Capital is of high quality and has been for some time. The non-accrual ratio, which is a measure of portfolio health and quality, has decreased from 1.2% in December 2020 to 0.9% in December 2021, indicating a positive trend. In addition, the non-accrual ratio fell in each of the last two quarters of 2021. The lower a business development company’s non-accrual ratio, the higher the loan quality, and the better the portfolio performance.

I am satisfied with Golub Capital’s non-accrual ratio, but an increase in the non-accrual ratio is a risk for any asset management or business development company, and it would indicate potential losses in the near future.

Non-Accrual Ratio (Golub Capital BDC)

Profitable Portfolio Investments

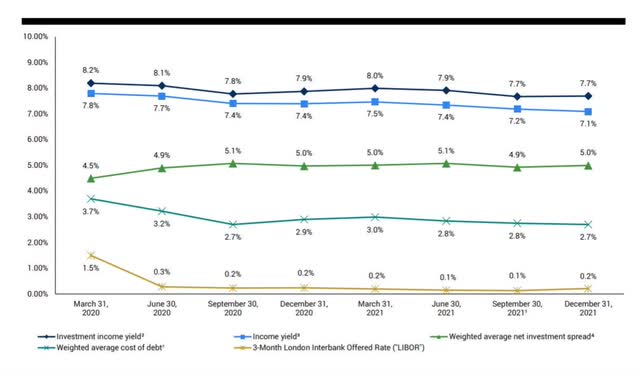

Golub Capital invests funds at a much higher rate than its capital costs, as one would expect from an investment firm. The net investment spread, which is the difference between investment income yield and weighted average cost of capital, has remained fairly stable over the last two years, hovering around 5% quarterly.

Net Investment Spread (Golub Capital BDC)

Dividend And Net Investment Income

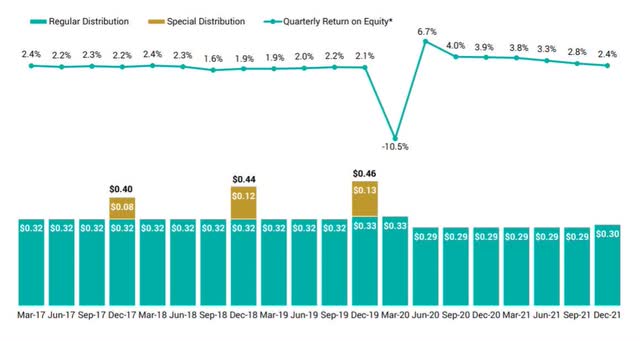

Golub Capital reduced its dividend in 2Q-20 due to the pandemic, which created significant uncertainty in the credit market at the time. Golub Capital increased its quarterly dividend to $0.30 per share in the fourth quarter due to a strong rebound in total investment income. While I don’t anticipate a special distribution anytime soon, the company has enough net investment income to continue paying its new $0.30-per-share dividend.

Distributions (Golub Capital BDC)

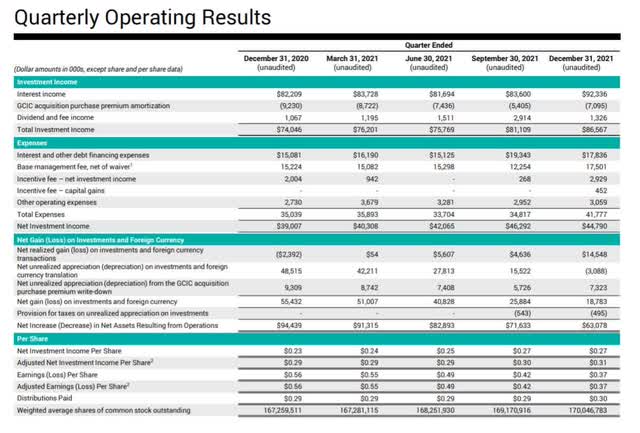

Golub Capital’s total investment income was $86.6 million in 4Q-21, up from $74.0 million the previous year. Higher returns and interest income from the company’s loan investments were primarily responsible for the increase in total income.

In 2021, the BDC covered its dividend with adjusted net investment income and had a pay-out ratio of 98%. The amortization of the purchase premium, which is included in Golub Capital’s net investment income, is excluded from adjusted net investment income.

Quarterly Operating Results (Golub Capital BDC)

P/B Ratio

The P/B ratio of Golub Capital is 1.0x, indicating that the BDC’s market value equals its book value. Golub Capital’s stock has primarily traded in a range of 0.95x-1.05x book value over the last year, and the current P/B ratio is roughly in the middle of this range. Golub Capital is probably fairly priced here, but you buy it primarily for its 7.8% dividend yield. Over time, book value growth and higher interest income may result in a higher P/B ratio.

Why Golub Capital Could See A Lower Valuation

Many business development companies trade at or near book value, with only the highest and lowest quality BDCs trading at or near book value. Any economic event, such as a recession, that has the potential to affect Golub Capital’s borrowers’ ability to repay their loans, even if they are senior secured loans, poses a risk to Golub Capital’s valuation multiple. If defaults rise and the non-accrual ratio rises, Golub Capital may begin to trade at a discount to book value.

My Conclusion

Golub Capital is a good buy because of its safety-first portfolio model, which focuses on high-quality loans to companies in recession-resistant industries.

Golub Capital has strong credit quality, and the stock, which trades at book value, is a good buy for investors who want an 8% yielder in their portfolios to generate passive income.

Be the first to comment