Michael M. Santiago

Third quarter results

Goldman Sachs (NYSE:GS) reported third quarter financial results yesterday. EPS was $8.25 and beat the consensus estimate of $7.51 by $0.74 or about 10%. The third quarter EPS per segment is as follows:

Investment banking: EPS of $0.99 (-80.8% YoY growth)

Global markets: $6.70 (8.3%)

Asset management: $0.50 (-83.7%)

Consumer & wealth management: $0.05 (-90.1%)

The total EPS of $8.25 is down 44.8% from previous year’s comparable period ($14.93 in 2021 Q3) so even though estimates were cleared the overall picture look fairly weak. Global markets is again the star performer while the rest of the segments are having a bad hangover from a crazy 2021.

Other items that are worth mentioning here is that Goldman returned $1.89 billion to shareholders during the third quarter. This consisted of $0.89 billion in dividends and $1.0 billion in share repurchases. Perhaps the most “newsworthy” item is that Goldman defined their operating segments anew and will now be reporting under:

- Asset & Wealth Management

- Global Banking & Markets

- Platform Solutions

This will probably be the last time that I report the old segment results here on Seeking Alpha. Enjoy!

Topline

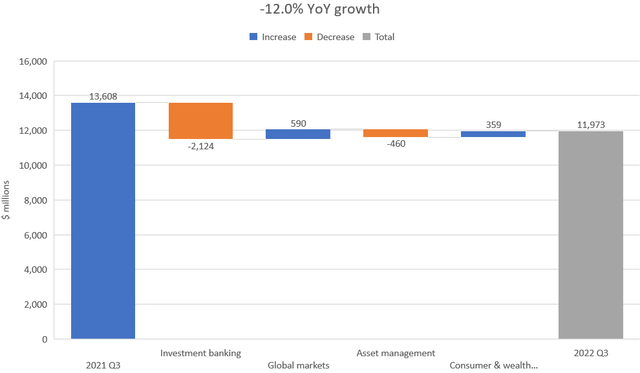

Topline YoY growth by segment (Goldman Sachs financial statements)

Investment banking and asset management are still suffering from the weak markets (more on these later) while Global markets and Consumer & wealth management both saw double digit topline growth. Total revenues came in at $12.0 billion vs. $13.6 in 2021 Q3 and $11.9 billion in 2022 Q2.

Investment Banking

All segments were down from previous year’s comparable period. It’s hard to find any positives here and the weak performance will linger on as long as the negative market sentiment prevails. When markets rebound client activity usually also increases.

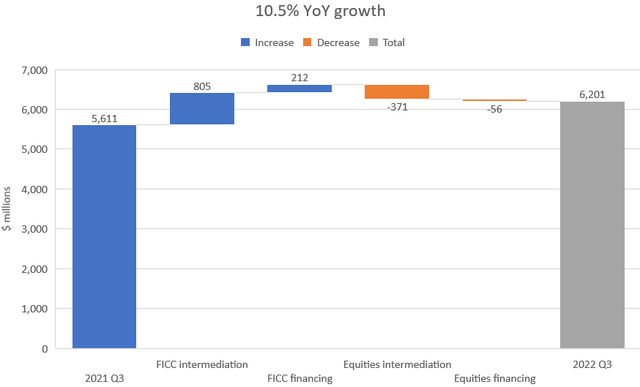

Global markets

Global markets topline YoY growth (Goldman Sachs financial statements)

Clients continued trading, especially interest rate products and currencies (FICC intermediation) which makes sense due to the increased interest rates and strong USD against the Euro, Pound and so on. Global markets held up the whole group (again). It’s a good hedge against the other major segments that need strong markets for clients to be active. As long as market volatility continues this segment should do good. In a low volatility but downward going market I would assume that clients wouldn’t be that eager to trade but it remains to be seen).

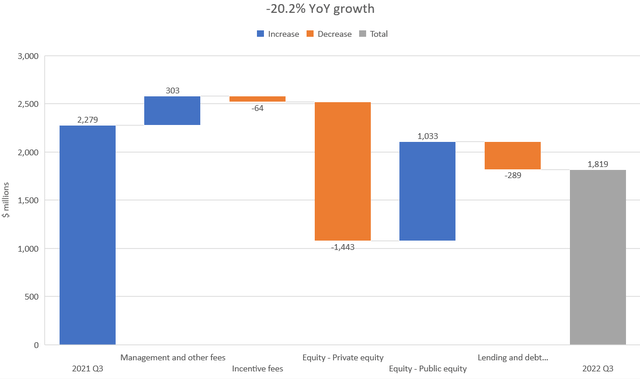

Asset management

Asset management topline YoY growth (Goldman Sachs financial statements)

The acquisition of NN Investment Partners still contribute significantly to the YoY growth of “Management and other fees” (increased by over $300 million or about 42% YoY). Private equity fees continued their downward spiral while Public equity actually recorded good growth due to 2021 Q3 being heavily in the red (I tried to dig what specifically drove the 2021 Q3 losses but couldn’t find anything on it). All in all, the segment is still down about 20% YoY.

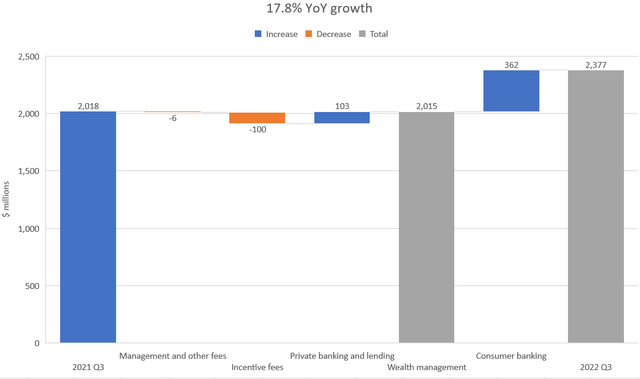

Consumer & wealth management

Consumer & wealth management topline YoY growth (Goldman Sachs financial statements)

Wealth management was essentially flat while consumer banking showed solid growth of 95% due to higher credit card balances and higher spreads on deposits. Provisions for credit losses were -$451 million, up 205% from 2021 Q3, reflecting increased credit cards and net charge offs. Hopefully the trend doesn’t continue although considering core inflation is creeping up plus increasing interest rates, I suspect consumers will have a harder time paying their credit card debts than last year.

Pre-tax earnings

Pre-tax earnings growth by segment (Goldman Sachs financial statements)

As I noted in my previous article on GS, pre-tax earnings moves fairly consistently with topline due to the scalability of banking. Asset management declined significantly more than topline due to operating expenses actually increasing 90% (with topline down 20%). Usually operating expenses move somewhat in the same directions as topline so one should keep an eye out for a more thorough explanation when the quarterly report comes out. Consumer & wealth management was down due to the already mentioned increased provisions for credit losses. All in all, not good except for Global markets.

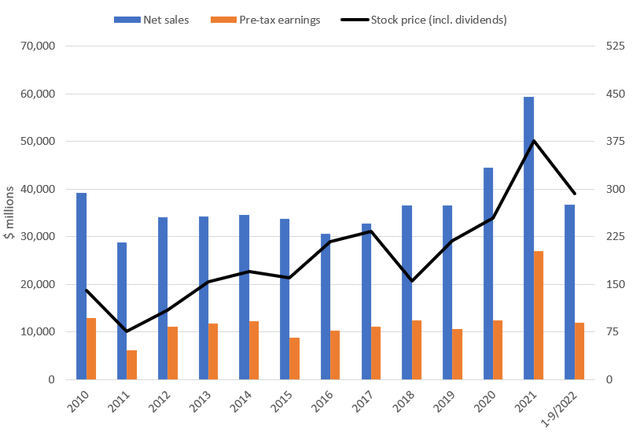

Zooming out

Long-term financial development (Goldman Sachs financial statements)

Although 2022 looks fairly bad when comparing it to 2021 it’s worthwhile remembering that 2021 was a year that broke all records. That’s why I like to look at the bigger picture to see how 2022 is shaping up compared to the longer period. As we can see, pre-tax earnings for the first 9 months of 2022 is already at about the same level as the average yearly pre-tax earnings during the period 2010-2020. Year 2022 will thus be a relatively good year for Goldman.

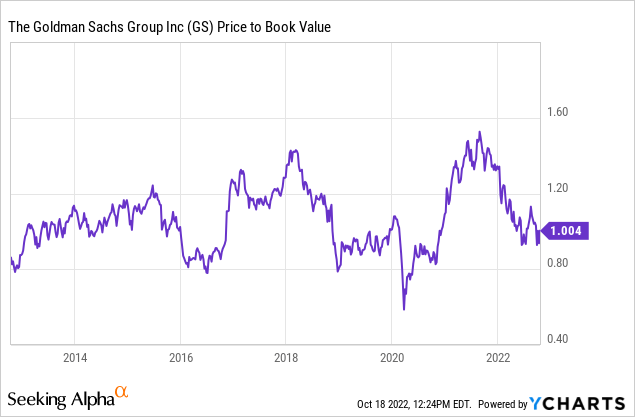

Current valuation is fair

Book value per share (BVPS) increased to ~$302 or 1.7% compared to last quarter (2022 Q2) and TTM EPS fell to ~$37 from ~$44 last quarter. Current TTM P/E is around 8.7x (with current share price of ~$315) compared to 6.8x last quarter (using the share price 30 June 2022 of $297). My point here being that TTM P/E is coming down fast so one should try to forecast 2023 and more importantly the average yearly EPS over the mid- to long-term for GS when valuing the company. Looking at the historical P/E will not serve your purpose (if that is to get satisfactory returns).

A shortcut is to look at P/B which should be around 1.0-1.2x for Goldman. Currently it sits at 1.04x (using diluted BVPS). Assuming Goldman could trade at even 1.2x only implies 15% upside from these prices (and that’s quite an aggressive assumption). At these prices, I’m still staying on the sidelines and waiting for that “right” price.

Be the first to comment