Chris Hondros

Every income investor’s portfolio should include business development companies (“BDCs”) that generate consistent and reliable passive income.

Goldman Sachs BDC, Inc. (NYSE:GSBD) is one of the best and safest business development companies in my opinion, with a current yield of 10.3% generated by a portfolio of high-quality loan assets in the First Lien category.

In the second quarter, the BDC covered its dividend with net investment income, and I believe the stock deserves to trade at a premium to net asset value.

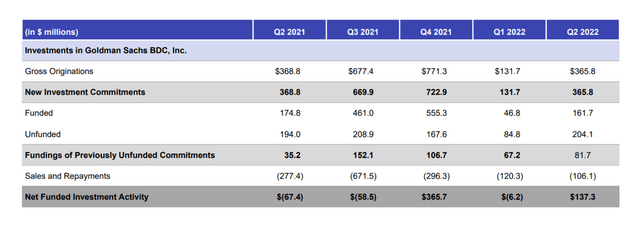

Taking A Look At Goldman Sachs BDC’s Net Investment Activity

In terms of new investments, the business development company had a strong second quarter. Despite the fact that GDP fell into negative territory, indicating a recession, after 1Q-22 GDP also fell, investment activity remained strong.

Gross originations increased in the second quarter after a slower first quarter, thanks to $365.8 million in net new commitments from Goldman Sachs BDC. 98% of these commitments were made to First Liens, which continue to account for the vast majority of the trust’s loans.

After deducting $106.1 million in sales and repayments, Goldman Sachs BDC’s portfolio grew $137.3 million in the second quarter, making it the second-best month in a year in terms of net funded investment activity.

Investment Activity (Goldman Sachs BDC)

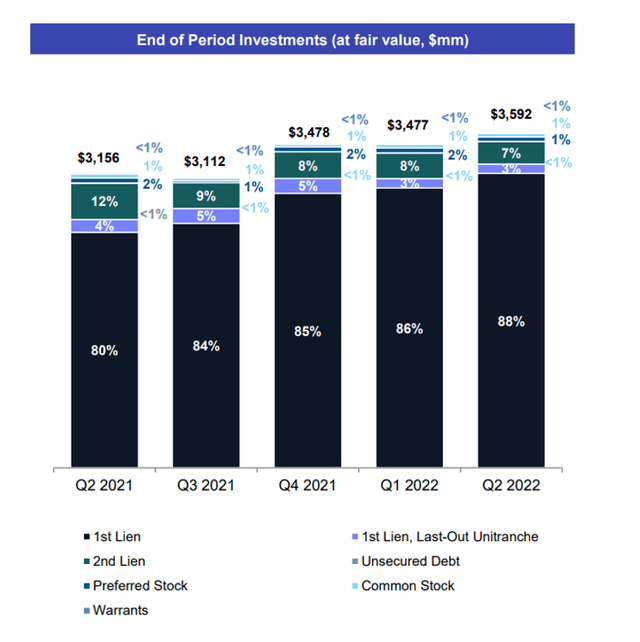

High Quality, First Lien-Heavy Investment Portfolio

Because of strong net investment activity in 2Q-22, the business development company increased its portfolio value by 3% QoQ, to $3.6 billion. The portfolio was made up of 91% highly rated First Liens.

In the last year, Goldman Sachs BDC has allocated more funds to the safest debt instruments (First Liens), a strategic move to improve the quality of the BDC’s investment portfolio. The shift in portfolio composition foreshadows a recession and, potentially, increased loan default risks.

End Of Period Investments (Goldman Sachs BDC)

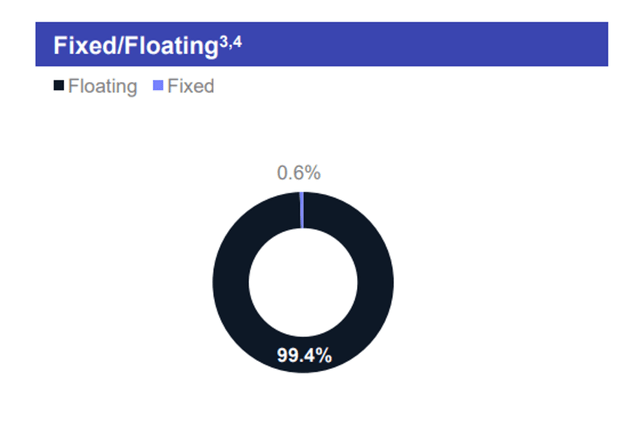

Floating Rate Exposure

Almost all of Goldman Sachs BDC’s investments are in floating rate loan assets, providing the firm with NII upside. In June and July, the central bank raised interest rates by 75 basis points each, and further increases are expected. Higher interest rates will benefit Goldman Sachs BDC because its loans will generate more interest income.

Floating Rate Exposure (Goldman Sachs BDC)

Non-Accruals Indicate Strong Portfolio Quality

The non-accrual ratio is an important ratio for business development firms. As borrowers face financial difficulties, some fail to make interest payments to Goldman Sachs BDC, posing a repayment risk. The non-accrual ratio calculates how much of the portfolio value of Goldman Sachs BDC is at risk at the end of each quarter. Non-accruals accounted for 0.4% of the BDC’s portfolio fair value as of June 30, 2022. The non-accrual ratio was 2.2% in 1Q-22, but two companies were removed from the list because they made repayments during the quarter.

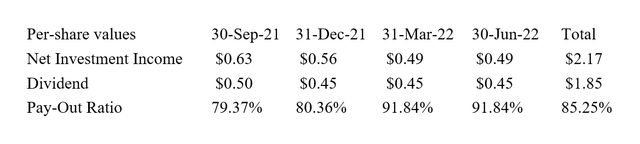

Strong Coverage Makes Goldman Sachs A Sleep-Well-At-Night BDC

Goldman Sachs BDC’s dividend was out-earned by net investment income in 2Q-22, giving the dividend a moderate margin of safety. In the second quarter, the BDC earned $0.49 per share in net investment income and paid out $0.45 per share, implying a pay-out ratio of 92%. Goldman Sachs BDC’s payout ratio was only 85% over the last year.

Dividend And Pay-Out Ratio (Author Created Table Using BDC Information)

Premium To Net Asset Value

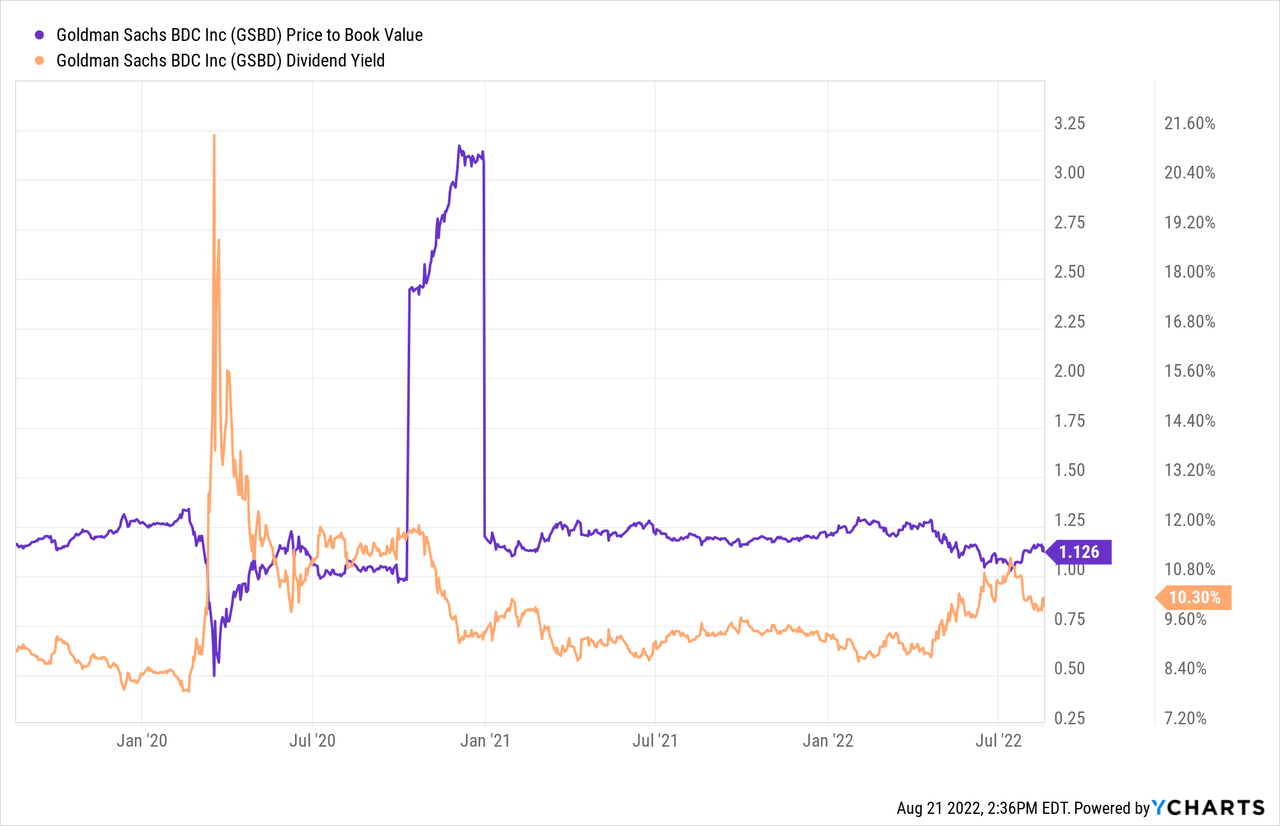

Goldman Sachs BDC is one of the few business development companies that trades at a 12% premium to its net asset value, owing to its strong portfolio health.

Although the company has traded at higher net asset value multiples this year, I believe the 12% discount is reasonable and may even slightly undervalue the BDC.

Goldman Sachs BDC’s stock currently pays 10.3% in terms of yield. Main Street Capital Corp. (MAIN) and Hercules Capital Inc. (HTGC) are two other BDCs that trade at a premium to net asset value.

Why Goldman Sachs BDC Could See A Lower Stock Price

In the most recent quarter, two companies repaid their debts to Goldman Sachs BDC, resulting in an improved non-accrual ratio of only 0.4%.

Having said that, non-accruals tend to rise during recessions, exposing the BDC to the risk of higher loan defaults and a lower net asset value.

Because Goldman Sachs has a clear focus on high-quality First Liens, which account for more than 90% of its portfolio, the risk of significant loan losses is probably low.

My Conclusion

Goldman Sachs BDC benefited from strong net investment activity in the second quarter, with almost all new investments being First Liens. The BDC’s core focus on the highest quality debt instruments, in my opinion, makes Goldman Sachs BDC one of the better (safer) companies to own in the sector, especially if you believe loan defaults will rise during a recession.

The BDC also has strong dividend coverage, and the 10.3% stock yield is appealing to investors seeking passive income.

Be the first to comment