DNY59

Adial Pharmaceuticals, Inc. (NASDAQ:ADIL) has made considerable progress in developing of a therapeutic compound based on ondansetron, a serotonin antagonist, for treatment of alcoholism. The company recently completed a Phase III clinical trial of its AD04 compound involving 302 patients diagnosed with Alcohol Use Disorder (AUD), which is characterized by uncontrolled drinking and preoccupation with alcohol. While the overall results of the trial suggested ADO4 treatment demonstrated a beneficial trend, the data was not statistically significant compared to the control group taking a placebo. That said, a predetermined subset of participants receiving AD04 did remarkably well and the subset data was statistically significant.

Our earlier article making an investment case for Adial, described how the company is building on successful work using ondansetron as a safe treatment for severe nausea and vomiting. However, Adial’s AD04 compound is aimed at an underserved market populated by about 30 million adults in the U.S. who suffer from AUD. Only about 7% of diagnosed patients actually get treatment. The rest are left floundering around in detoxification and abstinence programs that often do not work. AUD sufferers miss work, lose jobs, fail in school, and engage in conduct that disrupts family and social relationships. The U.S. Centers for Disease Control and Prevention (CDC) estimates the economic cost of alcohol abuse and dependence in the workplace alone is as much as $249 billion each year in the U.S.

Clearly the economic and social costs are substantial, providing incentive to introduce a new treatment, if an effective one can be found.

When the Onward trial results were announced in late July 2022, traders and shareholders immediately registered their disappointment through a dramatic sell-off of ADIL in the first trading session following the results announcement. The shares gave up 47% of value from the previous day close. Since then, the stock has traded down another 15%. By contrast, Adial leadership took encouragement from the trial results for further study and potentially even applications for commercial approval by U.S. and/or European drug regulators.

This article considers whether the recent Onward clinical trial was indeed a fluff or actually a resounding win in the ‘effectiveness’ race to a lucrative market.

End-point and Beyond

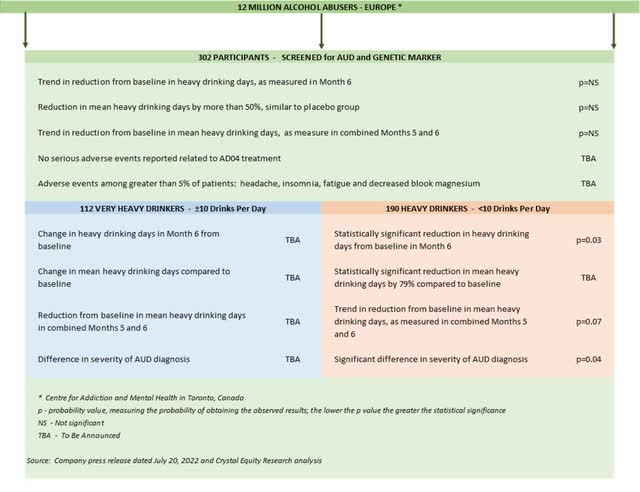

It is worthwhile to step back from the headlines to look at ALL the results from the Onward clinical trial. The study was aimed at determining whether AD04 would bring about a reduction in heavy drinking days among trial participants over a period of six months. The trial compared a predetermined baseline with heavy drinking days in month six as well as a combination of months five and six.

A few more details on the trial design and execution are included at the end of this article. More importantly, summary of Onward trial results is shown in the illustration right below.

Some data points have not yet been disclosed by the company, including specifics related to the puzzling group of Very Heavy Drinkers. Adial leadership has promised those details after the company’s scientists have had a chance to complete the usual analysis needed to plan the next clinical trial or to apply for regulatory approval.

Onward Clinical Trial Results (Crystal Equity Research)

When the final report comes available, it will be the data related to the Very Heavy Drinkers that will be most interesting – 112 folks who average ten or more drinks per drinking day and represent 37% of the total trial group. Given that the 63% flip side of the study, the Heavy Drinker group, rang in a statistically significant reduction in heavy drinking days from baseline, it is this smaller clutch of participants that appears to have skewed the results for the overall trial.

During a conference call in late July 2022, to discuss the Onward study results, Adial leadership pointed to the fact that among the Very Heavy Drinkers, heavy drinking days were reduced by more than 50% in both the AD04 and the placebo group. Reducing heavy drinking days is certainly a desired effect, but regulatory officials, especially those at the U.S. FDA, prefer therapeutic compounds that deliver a statistically significant impact greater than a placebo group.

Scientific Foundation

This is not the first time the ondansetron compound produced eyebrow raising results. A study completed in 1994 and supported by Glaxo Canada, found a reduction in drinking among alcohol-dependent male participants after six weeks of treatment with ondansetron. Significant differences were found when participants drinking more than 10 drinks per drinking day were excluded from the analysis, leaving only the heavy drinkers. The trial tested two dose levels for the ondansetron – 0.25 mg and 2.0 mg. The lower ondansetron dose produced the greatest reduction from baseline in the heavy drinker group, delivering almost four times the number of participants showing a clinically meaningful decrease in drinking.

There is something about the folks drinking ten or more drinks per drinking day! Fortunately, for Adial shareholders, the company’s Chief Medical Officer, Dr. Bankole Johnson, may already have insight into the Very Heavy Drinker group standing out in the Onward trial as well as the similar group in the much earlier trial sponsored by Glaxo Canada.

In 2000, Johnson published a paper on yet another randomized controlled trial of ondansetron among biologically disposed alcoholic patients. This study included 271 participants and divided the participants into two groups based on early- or late onset-alcoholism. Early-onset was defined as developing alcoholism at 25 years or younger and those developing alcoholism after age 25 were categorized as late-onset. Among participants with early-onset alcoholism, ondansetron significantly reduced self-reported drinking compared with placebo. However, in the group with late-onset alcoholism only those taking the placebo had significantly improved drinking outcomes.

Johnson’s paper postulated that there could be a difference in the condition of the 5-HT3 (serotonin) transporter in patients due to damage by chronic alcohol consumption. The hypothesis at the time was that reduced 5-HT3 neurotransmission in patients with early-onset compared with late-onset alcoholism could impact 5-HT3 receptors. This ‘blockade’ could account for ondansetron’s differential treatment effectiveness among groups with differences in alcoholism severity.

The Onward trial appears to echo messages from previous trials, but it will be up to Adial’s scientists to determine if alcoholism severity has any bearing on Onward trial. The message that is important for investors is that Adial scientific team appears well experienced to handle the Onward trial outcome for shareholder benefit.

Next Steps on Path to the U.S. FDA and Europe’s EMA

During the conference call held following announcement of the Onward trial results and in comments since then, management has remained stalwart in their confidence in AD04 to bring relief to AUD suffers. The Onward trial showed clear benefit for the Heavy Drinker group. There is a pressing need for a safe and palatable treatment in a population that has few options. Plans are already being formulated to approach regulators with the Onward trial results and next steps.

One possibility is that the company’s scientists head directly for regulatory approval. At least some preliminary discussion is possible with the EMA (European Medicines Agency) of the European Union that could guide any application for regulatory approval for Europe. Experience in the European market could be beneficial in then clearing the same regulatory hurdle in the U.S.

Alternatively, an additional Phase 3 clinical trial could screen for severity of alcohol consumption as well as the genetic marker. Indeed, the company’s scientists are already well prepared for an additional Phase 3 effort, making it possible to begin enrollment even before the end of the current year. AD04 has already shown effectiveness among the Heavy Drinker group of AUD suffers. Thus, a plan for another AD04 trial focused exclusively on that group is likely to be well received by either U.S. or European regulators.

The key factor for investors to consider is that while not achieving the planned overall end points, the Onward trial gave Adial scientists a large body of encouraging information to impart to regulators. Most importantly, no information arose that indicated AD04 is in anyway harmful or counter-productive. None of the Onward clinical trial participants with AUD who took AD04 were made worse off. We expect these points of fact to be prominent in Adial leadership’s conversations with regulators.

Capital Resources: Cash Kitty and Quest for Partner

Of course, next steps require capital. Many investors may have been expecting a regulatory application before the end of the current year. That goal could have been pushed out beyond the current year and may require additional capital.

Adial has disclosed that the Onward trial required approximately $12 million investment. An additional clinical trial focused on Heavy Drinkers would likely involve just over 500 participants, potentially requiring between $20 million to $30 million in additional capital. Adial leadership is surprisingly sanguine about capital requirements. The team admits to early conversations with potential strategic partners in AD04, which could contribute new capital to the relationship. Such a partner could also bring a ready-made distribution network, a capability that Adial has never developed.

In the meantime, the company has a tidy nest egg to at least begin an additional clinical trial started up or to submit an application for regulatory approval. Adial recently reported financial results for the second quarter, disclosing cash and equivalents totaled $9.2 million at the end of June 2022. The company used approximately $1.0 million per month to support operations during the first six months of 2022. The cash burn rate is likely to remain at this level if the company goes ahead with another clinical trial. Thus, at the current cash usage rate the company can keep the lights on for at least another nine months as well as support additional AD04 development.

Addressable Market Confirmed

While the Onward trial put a wrinkle in the timeline to regulatory approval, it also provided data to quantify the addressable market for AD04. This is a data point that is critical for investors.

The trial confirmed that one third of AUD population has the genetic marker that suggests AD04 could be an effective treatment. The number of potential patients is remarkable.

- In 2020, the National Center for Drug Abuse Statistics reported that 6.7% of Americans who consume alcohol at least one in their lifetime, that is nearly all the 330 million souls in the U.S., will develop AUD. The implication is that as many as 20 million individuals have AUD already or in their future. One-third or 7 million of them have the genetic marker that suggests AD04 could be beneficial.

- The Centre for the Addiction and Mental Health in Canada estimates there are 12 million people in Europe who have AUD. The Onward trial data implies that 4.0 million would exhibit the required genetic marker.

Adial has not suggested pricing for a commercial version of AD04, preventing the counting of chickens before the corporate eggs are hatched. The argument can be made that even at modest prices for a course of treatment, AD04 approved for only heavy drinkers with the genetic marker represents a lucrative revenue stream. If the company’s scientists can crack the Very Heavy Drinker nut, the math could be even more enticing.

If Adial leadership is in conversations with potential strategic partners, there is plenty of opportunity to jawbone. The Onward clinical trial has provided the data on addressable market that helps make real the calculations of market value for potential partners.

Opportunity in Depressed Stock Price

Since the preliminary results for the Onward clinical trial were released in late July 2022, the stock has settled near the $0.60 price level. That implies a valuation multiple of about 1.71 times cash and 1.85 times book value. The biotechnology sector composed of 581 biotech stocks is presently trading at about 6.0 times book value. A good share of this group is similar to Adial – early stage, unapproved drug candidates, pre-revenue, net users of cash. Thus, we conclude that the stock is oversold from the perspective of comparable companies.

For a company that appears to have delivered a ‘win’ on the way to commercializing its innovation, ADIL should get more favorable consideration. Unfortunately, with no near-term catalysts on the horizon, it will take a patient investor realize it.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

Underwriters of the Prime series may have a beneficial interest in, serve as agents of, or act as advisers to the companies mentioned herein.

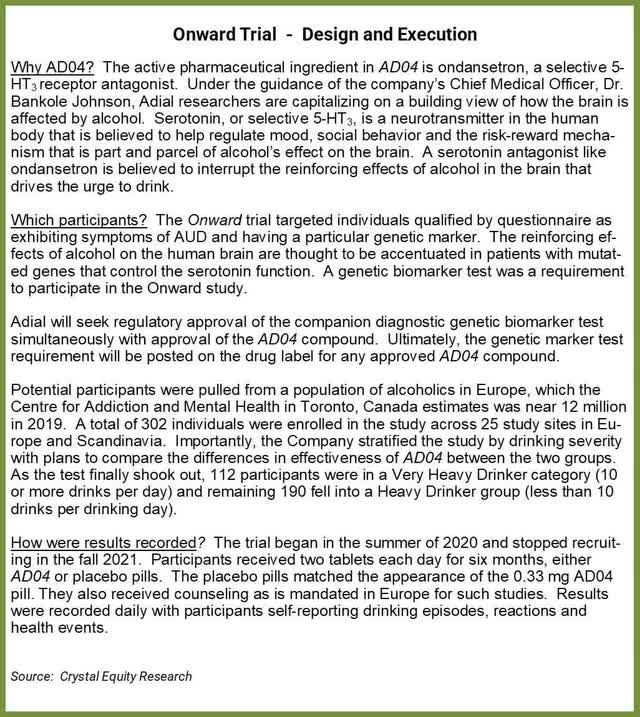

Onward Trial Design and Execution (Crystal Equity Research)

Be the first to comment