Michael M. Santiago

With the market fearful of a recession and its impact on the portfolios of business development companies, those BDCs that focus on First Liens and have strong credit quality stand to outperform the market.

I’ve increased my stake in Goldman Sachs BDC Inc. (NYSE:GSBD), whose dividend is not only covered by net investment income, but whose dividend yield has risen to an astonishing 12.3% in the last week.

Furthermore, the stock is now trading at a discount to net asset value rather than a premium, making the value proposition even more compelling.

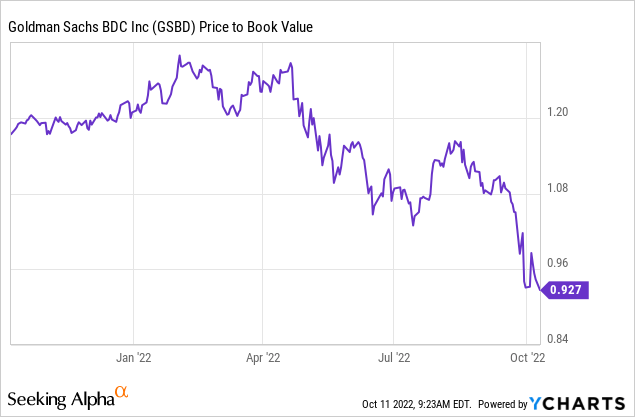

Premium Valuation Turns Into Discount Valuation

Goldman Sachs BDC is one of the more powerful companies in the BDC sector, which is why investors were willing to pay a premium to the company’s net asset value for a long time.

The market tends to reward business development companies with premium multiples only when they have diversified and safety-first portfolios, strong credit quality, and good dividend coverage.

Goldman Sachs BDC checks all of these three boxes.

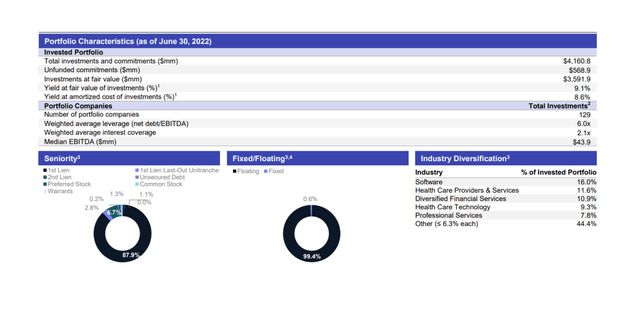

To begin, the business development company prioritizes safety by allocating 88% of its investments to relatively secure First Liens and another 7% to Second Liens, the next debt instrument in line after First Liens.

In 2Q-22, Goldman Sachs BDC invested $3.6 billion of its funds in 129 portfolio companies, with 91% of those investments going to the safest debt investments available, First and Second Liens.

Goldman Sachs BDC also invests in higher risk unsecured debt and equity, but the percentages (around 1%) are so small as to be insignificant.

Portfolio Overview (Goldman Sachs BDC)

Second, Goldman Sachs has excellent credit quality, with only 0.4% of its portfolio investments non-accrual in the second quarter. I believe the BDC’s third-quarter non-accruals will be roughly the same.

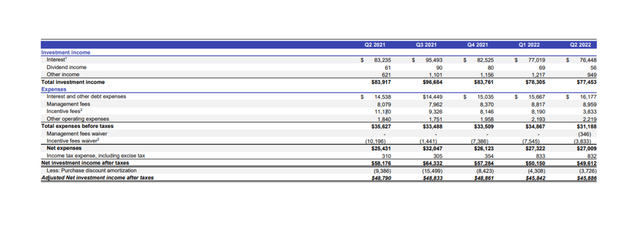

Third, the business development company’s dividend payment is covered by net investment income. As I previously stated, Goldman Sachs BDC paid out 85% of its net investment income in the previous twelve months, indicating that the dividend has a high degree of safety and that only a significant increase in non-accruals would put the current dividend pay-out at risk.

Since 2Q-21, Goldman Sachs BDC has generated between $50 and $64 million in net investment income after taxes per quarter, more than enough to cover the dividend, which costs about $46 million per quarter. The majority of Goldman Sachs’ investment income comes from interest income, which accounted for 99% of the BDC’s total investment income over the last year.

Net Investment Income (Goldman Sachs BDC)

Because the market has become more fearful of a recession, Goldman Sachs is now trading at a discount to net asset value, which is unusual. GSBD has routinely traded at a premium to net asset value as a BDC with higher perceived (and real) portfolio quality.

The current net asset value discount is 8%, allowing dividend investors to invest in the business development company at a price lower than the fair value of its assets.

Why Goldman Sachs BDC Could See A Lower Stock Price

Recessions can (and almost certainly will) increase non-accruals in the BDC sector, making it more important than ever to choose business development companies with strong credit metrics, portfolio quality, and dividend coverage.

Major loan losses would imply net asset value losses and, most likely, lower multiples that investors are willing to pay if interest income growth prospects deteriorated during a recession.

My Conclusion

Goldman Sachs doesn’t deserve this selloff. The business development company has a well-structured debt investment portfolio with a safety-first investment approach that favors high-quality debt, such as First Liens, which are secured loans with a low default risk, making them ideal debt instruments to own during a recession.

I believe that investment allocation will be critical in driving outperformance gains in an increasingly choppy market, and Goldman Sachs BDC is well-positioned to recover from the BDC sector’s selloff. After all, GSBD pays a well-covered dividend, and net investment income has consistently outpaced dividend payments.

Investors can take advantage of this doubling-down opportunity because the BDC’s 12.3% yield is available at a discount.

Be the first to comment