Михаил Руденко/iStock via Getty Images

Instead of an investment thesis

What has been rumored before is now confirmed – China started to soften its zero-covid policy to save CCP’s regime from further unrest through additional economic stimulus.

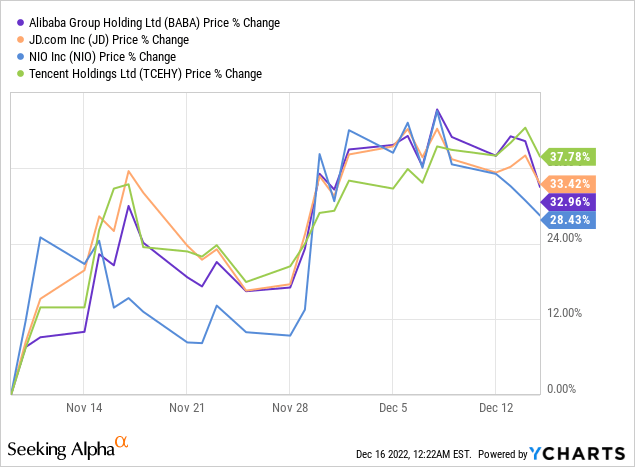

As my friend – SA fellow contributor Danil Sereda – wrote in his article on Alibaba (BABA) on November 9, the rumors of China reopening at that time, once materialized, should have a positive impact on Chinese stocks traded on the U.S. stock exchanges. And since then, indeed, most Chinese stocks have greatly increased in price:

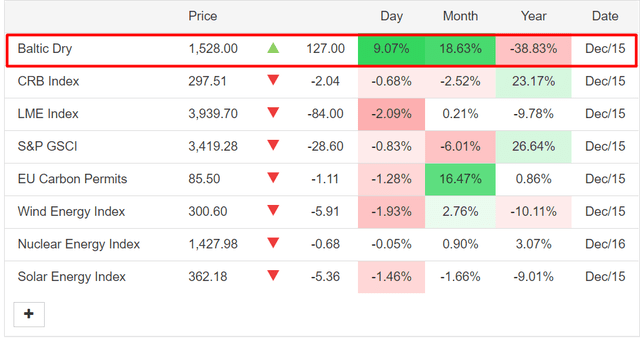

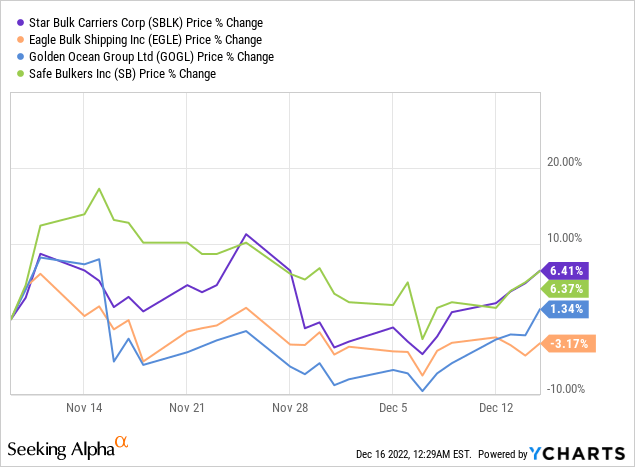

What I think most investors still do not see is the fact that despite the momentum that the Baltic Dry Index has shown over the past month, dry bulk carriers still remain static:

TradingEconomics and author’s notes

I believe this should change in the medium term – I pick Golden Ocean Group (NASDAQ:GOGL) and Star Bulk Carriers (NASDAQ:SBLK) as 2 great bets to ride the wave of China reopening.

My reasoning

Just yesterday, Goldman Sachs analysts – Marcio Farid, Gabriel Simoes, and Henrique Marques – wrote in their note on Vale (VALE) that the GS team had expected the reopening in China to be gradual and not to happen until Q2 2023. However, recent government actions have led to a much faster reopening, including easing border controls, removing testing requirements, allowing quarantine at home, and speeding up vaccination of the elderly. So GS Macro team now expects China’s Covid policy to be an “effective reopening with control.”

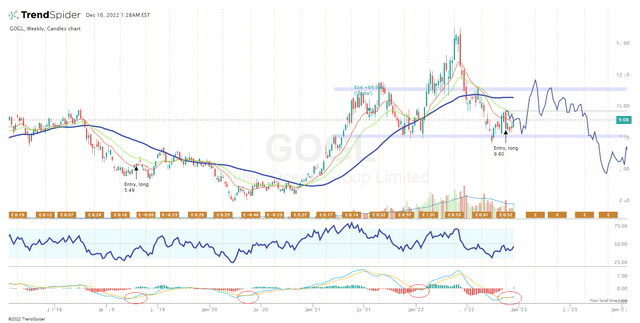

For the past few months, we clearly saw a clear picture of cyclical repricing of dry bulk shipping companies – as the Baltic Dry Index fell over 38% YoY due to the worsening lockdowns and macro situation in China, the stock market began to set a sharp decline in the future financial performance of dry bulk shippers, turning the bull run we saw in 2020-2021 into an uninterrupted downtrend.

With China now signaling to reopen way faster than was priced in and we know it’s one of the world’s major commodity consumers [Chinese dry bulk imports accounted for 50% of the whole market in 2021, according to BIMCO], I see the potential for another reversal in dry bulk shipping companies – this time to the upside, which will extend their bull cycle for another few months at least.

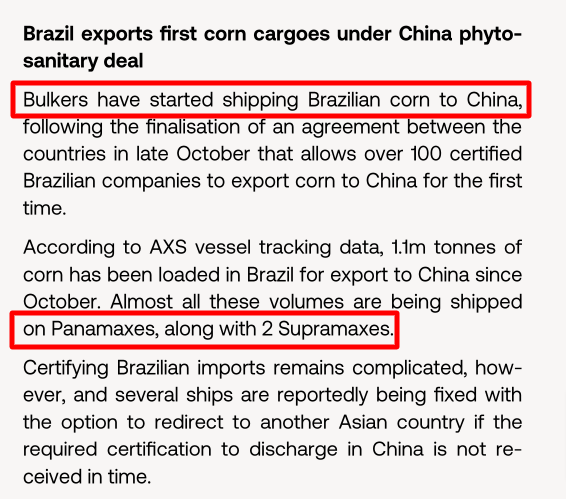

In addition to China, we also need to understand that Russia’s ongoing war with Ukraine is causing many countries to restructure their usual trade chains with inefficient, longer routes – this is how Braemar describes the Chinese situation with corn:

Braemar data, shared by E. Finley-Richardson with notes

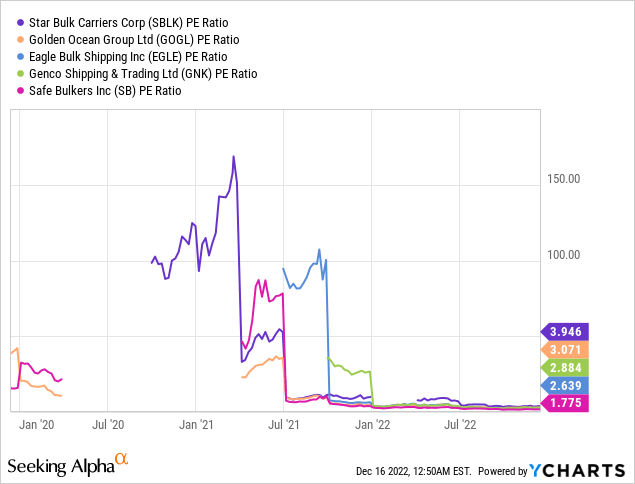

Most of the fleet of companies I look at is contractual. The market has previously repriced TCE rates’ prospects in the future. Therefore all companies began trading at a steep discount to their historical multiples, despite strong TTM levels of revenue, EBITDA, etc.

We are now likely to see an increase in TCE rates due to increased demand from China. However, the current cycle is slightly different from the previous ones – companies not only paid huge dividends in 2021/22 but also reduced their debt levels [read debt-to-equity ratios] sharply:

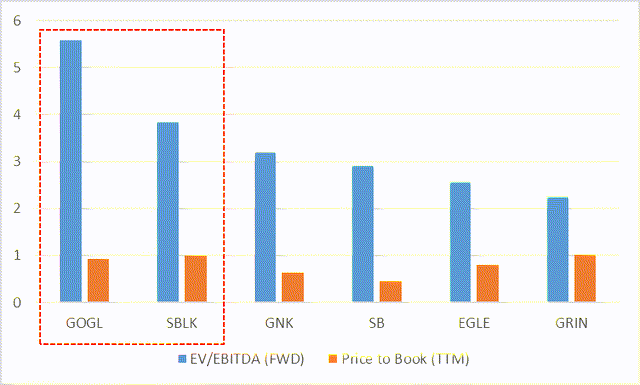

That is, from now on, their free cash flow will make it easy to continue paying high dividends if share prices really stay high enough. With forward EV/EBITDA of 4-5x and very low debt on the balance sheet, I think buying shares at current levels looks like a very interesting idea in the medium term, as the cycle seems to be a bit longer than priced in.

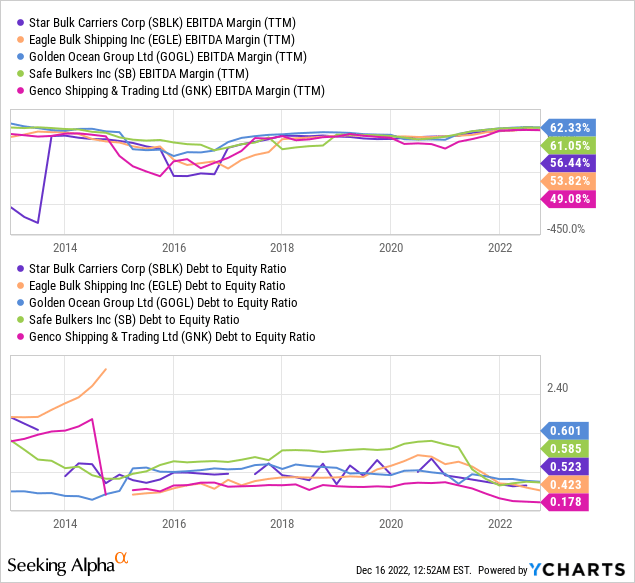

If we assume that there will be a reassessment of expectations in this market and that TCE rates will remain strong longer than expected, then the dividend yields will become too attractive to ignore – the risk that they will be cut will diminish. That’s why I think GOGL and SBLK are potential candidates for a strong recovery – their dividend yields will re-attract investors enchanted by shipping stocks once all of the above becomes more apparent.

YCharts data with author’s notes

SBLK has the highest forward dividend yield in the group, while GOGL has the best Chinese market exposure thanks to its fleet structure. These two facts are already enough to bet on a recovery of demand for commodities in China through these two companies.

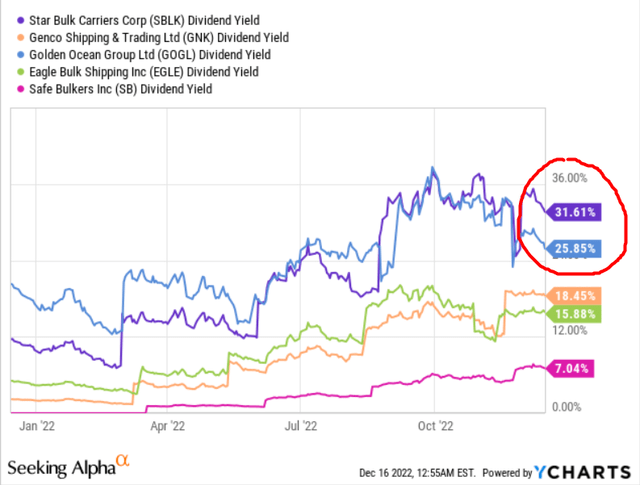

The technicals look promising

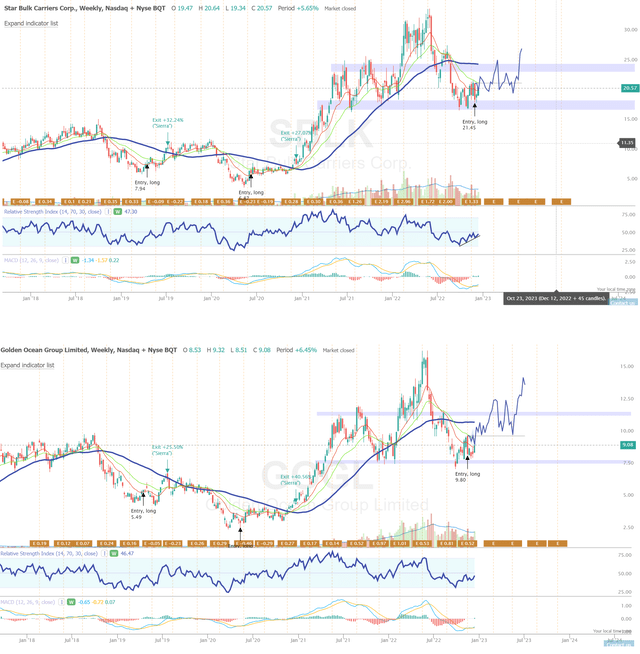

I recommend you pay attention to the MACD trading strategy, which is to open a position when the stock trend changes. That is, we buy the stock when the MACD line crosses the signal line upwards and exit the position when the first line crosses the latter downwards. In the last 6 years, an entry signal has occurred 4 times in the weekly chart of GOGL. In the SBLK weekly chart, there was the same number of moments. This is not surprising, as both stocks have an average correlation of about 0.8 (which, by the way, has now reached 0.93).

TrendSpider, GOGL (weekly), MACD crossover strategy, author’s notes TrendSpider, SBLK (weekly), MACD crossover strategy, author’s notes

The backtesting results show a clear advantage of this strategy over the performance of stock prices over the same period. However, the condition of crossing the MACD lines as an exit is a limiting factor – 3 out of 4 signals are not exploited in both cases. For this reason, I decided to work around the strategy – how about setting “RSI > 65” as an exit condition? Then we lose in terms of upside potential, but we get more trades – and the more there are, the higher the representativeness of the sample.

TrendSpider, SBLK and GOGL, author’s input conditions

As you can see, both SBLK and GOGL triggered another buy signal just 1-3 weeks ago. Since then, however, they have corrected slightly – for this reason, there is now a technical opportunity to get in on these names at slightly lower prices.

Risks and Takeaway

Risk #1: the above-mentioned trading strategies did not do without losses – this is a certain risk that cannot be discounted.

Risk #2: the same technical analysis – if we remove the indicators and look only at the price action – speaks of the possibility of the formation of the “head-and-shoulders” pattern. The risk of a serious fall greatly increases, since we are technically at the stage of the formation of the “right shoulder” in both SBLK and GOGL stocks.

Risk #3: the names I chose – both GOGL and SBLK – are among the most expensive in the entire peer sample. This fact may limit their upside potential.

Author’s calculations, based on Seeking Alpha data

But at the same time, they are among the most stable companies with the most predictable cash flow in the coming quarters – perhaps this characteristic contributes to a premium on their multiples.

Risk #4: There is a strong possibility that dry bulk carriers will lose a significant amount of demand for their services against the backdrop of a potential recession in mid/late 2023, so their TTM financials will not save them from a decline.

Despite the risks that I outlined above, I still believe that the risk-reward ratio of GOGL and SBLK is shifted quite favorably toward potential profitability today. I recommend adding both companies to the medium-term portfolio and waiting for a new upswing in their stock prices.

Be the first to comment