Claude Laprise

Just over two months ago, I wrote on Gold Royalty Corp. (NYSE:GROY), noting that positive developments outweighed the negatives and that any pullbacks below US$2.20 would offer buying opportunities. The stock headed into this buy zone in late September and again in mid-October and has since seen a draw-up of nearly 37% ($3.00 per share) before running into its declining 200-day moving average. This sharp rally can be attributed to a slight improvement in sentiment sector-wide due to a rising gold price and continued positive developments across the portfolio, including the acquisition of a 10% NPI on an asset shaping up to be a massive contributor for i-80 Gold (IAUX). Let’s take a closer look below:

Carlin Complex – Nevada Gold Mines (Gold Royalty REN NSR & NPI) (Barrick Presentation)

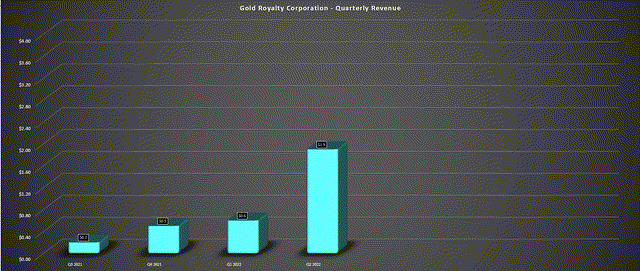

As noted in my most recent update on Gold Royalty Corp. (“GRC”), the company had a much better quarter in fiscal Q3, with record quarterly revenue of $1.91 million, a more than 200% increase on a sequential basis. This was driven by a significant contribution ($1.35 million) from Newmont’s (NEM) Border Mine in Canada, and GRC is now on track to see attributable GEO production of more than 2,500 GEOs this year, having seen earned GEOs of ~1,400 year-to-date. Unfortunately, the negative development is that operations at Beaufor will not be contributing nearly as many planned ounces in FY2022 to GRC, with operations suspended in late September while the stockpile is processed before placing the Beacon Mill on care & maintenance.

GRC holds a $2.50 per tonne royalty on material processed through the Beacon Mill from Beaufor operations and a $1.25/tonne royalty on all material processed through the Beacon Mill subject to a 1,000 tonne per day ceiling. GRC also holds a 2.75% NSR on McKenzie Break, Croinor Gold, and Swanson, which are potential spokes for the Beacon Hub (Mill).

Gold Royalty – Quarterly Revenue (Company Filings, Author’s Chart)

The other negative development discussed in my most recent article was the potential ban on open-pit mining projects in Colombia with a Presidential win by Gustavo Pedro. This has impacted the future outlook of royalties held on Titiribi and La Mina (two open-pit projects in Colombia), where GRC holds a 2.0% NSR on each asset. I was not assigning any value to these assets as I don’t have a strong view of GoldMining Inc.’s (GLDG) ability to advance these projects to production. That said, a future ban on open-pit mining has dampened the long-term outlook for these assets for those investors that might have been placing value on them in their valuation for GRC. The good news is that the positives continue to outweigh the negatives from a big-picture standpoint, and this has continued since my last update:

Recent Developments

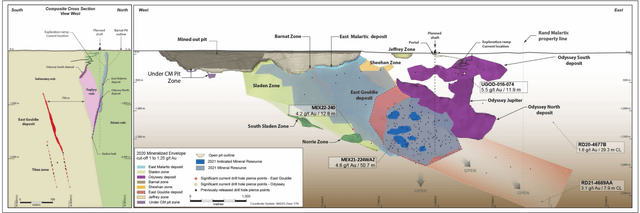

Canadian Malartic

For starters, Agnico Eagle (AEM) has announced its intention to acquire Yamana Gold (AUY) with Pan American Silver (PAAS), a deal that would give Agnico full ownership of the Canadian Malartic asset (shared 50/50 currently). This is an upgrade, given that this project will now be owned by the most aggressive exploration company in the sector, evidenced by a 2022 budget of ~$355 million, with Malartic being a clear focus of this budget. Additionally, Canadian Malartic continues to deliver from an exploration standpoint, with mineralization intersected over 1.3 kilometers east of East Gouldie and to the west of East Gouldie in the Sladen Zone. In addition, Odyssey’s internal zones are also delivering positive results, and the mine plan is being optimized with these results.

Canadian Malartic Exploration Success (Agnico Eagle Presentation)

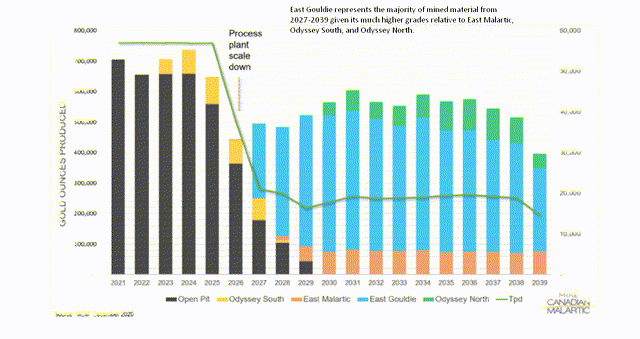

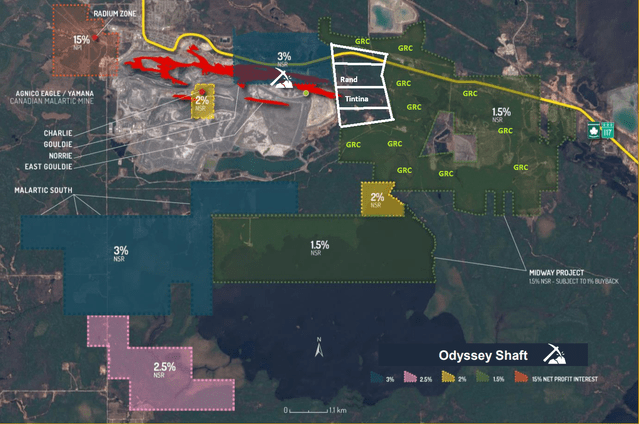

While the continued resource and ultimately reserve growth at Canadian Malartic is positive for GRC, its major royalty ground lies south and east of Odyssey Underground, with royalty ground including Charlie, Gouldie, Norrie, East Malartic (3% NSR), and Odyssey (3% NSR). This ground makes up a portion of the existing Odyssey Mine Plan. Still, the breadwinner is East Gouldie, hence why I preferred Osisko Gold Royalties (OR) when it comes to exposure to this asset, given that it has a higher royalty on the most prized and highest-grade deposit (East Gouldie). Looking at the chart below, we can see that East Gouldie (blue-shaded area) is by far the largest contributor to the mine plan, based on this now-dated report.

Canadian Malartic Mine Plan (2020) (Canadian Malartic Partnership Technical Report)

The good news is that drilling is heading east toward Midway ground, and production from this area could eventually contribute if East Gouldie continues to extend further to the east. That said, the current extension to East Gouldie lies on the Rand Property block with this royalty owned by Tintina Mines, and even if production does head onto Midway ground (past the white-shaded block), there is an option to buy down two-thirds of this royalty (1.5% NSR that can be reduced to 0.5%). So, while there’s no question that the consolidation of this asset is an upgrade, as is the exploration success, GRC benefits most from extensions to the south that aren’t subject to buy-downs or the Radium Zone. That said, in the Radium Zone, I can’t imagine it’s a high priority to mine due to the extremely high 15% NPI vs. other ground with much more relaxed royalty levels.

As of March 2022, the Canadian Malartic Partnership re-purchased this royalty held by Tintina on Rand for $7.0 million.

Gold Royalty Corp – Malartic Royalty Ground (Company Presentation, Author’s Notes/Drawings (GRC + White Shaded Area))

REN

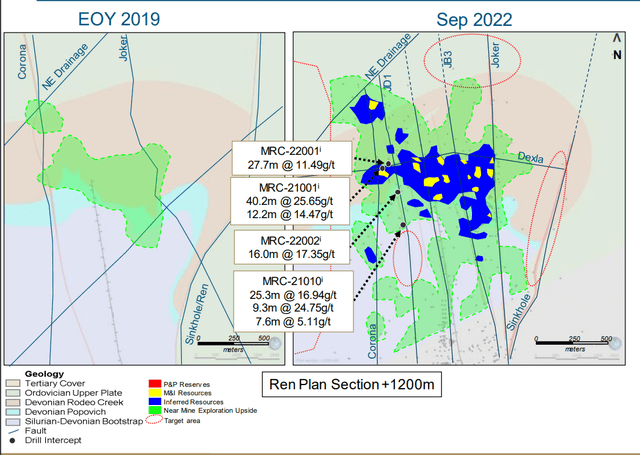

Moving to the REN deposit, which sits north of Banshee and Meikle and east of Bootstrap at the Carlin Project, it is currently home to a 1.2 million ounce inferred resource (~5.2 million tonnes at 7.3 grams per tonne of gold) and a ~50,000 ounce indicated resource (~0.11 million tonnes at 14.40 grams per tonne of gold). Barrick (GOLD) noted that it expects resources at REN to increase further at its year-end update, and drilling west of resources shows promise in the 1.5+ kilometer Corona Zone. There also looks to be additional resource upside on the JB Corridor. This is a positive development for GRC, which owns a 1.5% NSR and 3.5% NPI at Ren, and just as importantly, Corona lies just 250 meters from existing infrastructure, making it a highly attractive future mining area.

REN Drilling (Company Presentation)

Barrick noted in its Q3 update that this year’s drilling will continue to test the western Corona Corridor and JB Zone and that MRC-22-002 drilled within the Devonian Rodeo Creek formation hit 16.0 meters at 17.35 grams per tonne of gold, a phenomenal intercept. This has helped to confirm the presence of high-grade mineralization between MRC-21-010 (25.3 meters at 16.94 grams per tonne of gold) south of existing inferred resources and MRC-21-001, which hit 40.2 meters at 25.65 grams per tonne gold. Given that RED is a project managed by the ~$65.0 billion combined market cap Nevada Gold Mines LLC, this is an excellent deposit to have a royalty on, especially when it’s sitting just north of one of the world’s largest mining operations with considerable processing capacity (Carlin Complex).

For now, it’s unclear when REN will begin contributing to GRC’s revenue, but with a Feasibility Study likely to be completed by 2024, I would expect that it’s possible we could see REN moved into a mine plan by early 2026.

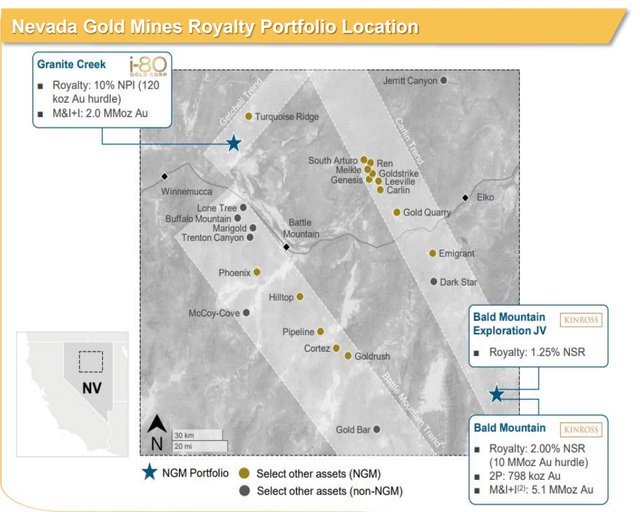

Nevada Royalty Portfolio Acquisition

The most recent acquisition by GRC might have been a little of a head-scratcher for some investors, with the company paying ~$27 million in shares for a 2.0% NSR on Bald Mountain (payable only after another 8.6 million GEOs are produced), a 1.25% NSR on the Bald Mountain joint-venture zone, and a 10% NPI on Granite Creek. At first glance, this Bald Mountain NSR isn’t going to generate any revenue until post-2055, even assuming a ~250,000-ounce production profile at Bald Mountain (only pays after 10 million ounces produced vs. ~1.4 million GEOs produced currently). Meanwhile, there’s no guarantee that the Bald Mountain JV zone ever heads into production. Therefore, GRC essentially paid ~$27 million for a 10% NPI on Granite Creek, which is obviously less attractive than a 10% NSR based on revenue vs. profits.

Nevada Portfolio Acquisition by GRC (Company Presentation)

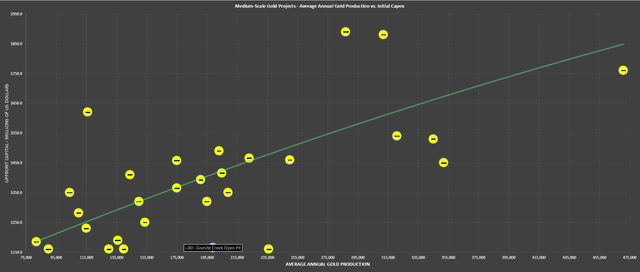

However, if one is familiar with the Granite Creek Project, there’s a good chance this will pay off nicely for GRC over the long run. Beginning with Granite Creek Open Pit, this future project (CIL/heap leach oxide project) has phenomenal economics in a top-3 mining jurisdiction and is expected to produce ~199,000 ounces per annum based on its PEA at sub $1,000/oz all-in-sustaining costs. Notably, it has very low capital intensity with less than $170 million in upfront capex (including CIL plant construction and adjusted for inflation), making it one of the most impressive open-pit heap leach projects globally.

As shown below, the average project with a production profile of this magnitude is expected to cost ~$400 million to build, with Granite Creek Open Pit benefiting from having industry-leading grades. i-80’s Granite Creek Open Pit Project is shown at the bottom of the chart, highlighting its very modest upfront capex yet impressive production profile.

i-80 Gold – Granite Creek Open-Pit Economics vs. Other Undeveloped Projects (Company Filings, Author’s Chart & Estimates)

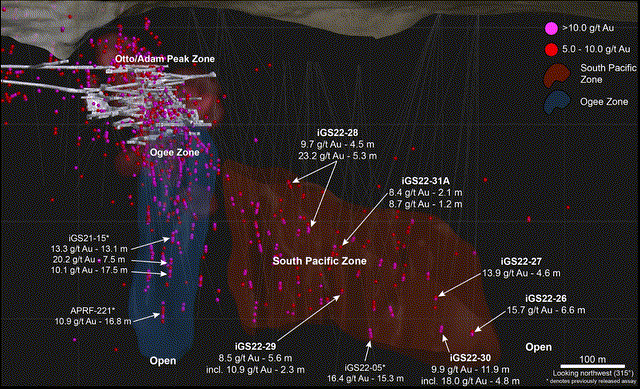

Regarding more near-term contributions (Granite Creek Open Pit looks to be an H2-2026 opportunity earliest), Granite Creek Underground has begun shipping ore to Nevada Gold mines autoclave under a toll-milling agreement and is expected to send material to i-80’s Lone Tree facility post-2024. As it stands, this is expected to be a ~1,000-ton-per-day operation, translating to a ~90,000-ounce production profile at industry-leading costs. However, the most recent development is the continued delineation of the South Pacific Zone and wide high-grade intercepts at depth in the Ogee Zone. Notably, both are more attractive mining areas than the historical Otto/Adam Peak horizons due to better ground conditions.

For those unfamiliar, Granite Creek Underground lies less than 10 kilometers away from the ~20-million-ounce Turquoise Ridge Mine, and drilling is currently focused on mineralization within 500-meter depths. However, Turquoise Ridge extends to over 1,500 meters, and grades improve at depth, suggesting considerable long-term upside for this underground mine. Meanwhile, the newly discovered South Pacific Zone dwarfs the previous mineralized footprint in size (shown below) and is right next to i-80’s existing underground development. In addition, it likely extends for at least 400 meters north of the existing mineralized footprint based on a high-grade hole that hit mineralization drilled by Homestake.

I-80 Granite Creek Underground (i-80 Company Presentation)

Based on the potential for the South Pacific Zone to host well over 1.0+ million ounces at 10 grams per tonne of gold and further growth from the Ogee Zone, it looks like Granite Creek Underground could ultimately host more than 2.0+ million ounces of gold based solely on current discoveries. This would increase the previous ~6-year mine life (~600,000 ounces) to 15+ years, making this a significant and long-life contributor to GRC’s annual revenue/cash flow. In fact, if Granite Creek Underground and Granite Creek Open Pit both head into production, the combined production could come in at ~275,000 ounces per annum, allowing for an easy payback given GRC’s 10% NPI.

The Granite Creek 10% NPI does not kick in until 120,000 ounces are produced, so I wouldn’t expect this to begin contributing to GRC’s bottom line until closer to mid-2024 earliest.

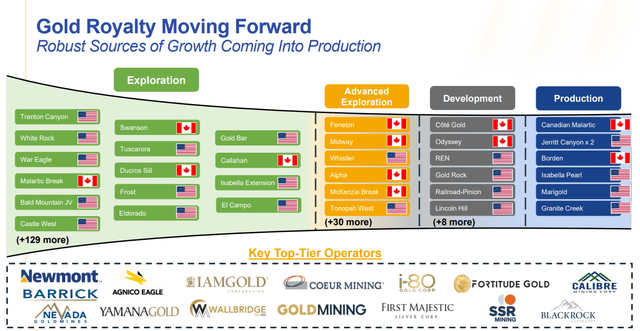

Future Growth

Moving over to future growth, GRC may have a portfolio of ~200 royalties, but I would argue that a significant amount has little value and little hope of heading into production. Additionally, there is a very high concentration of exploration assets among just a few explorers/developers, which I see as a negative given that the most attractive royalty assets are those which are the top priority of a company. That said, of the projects that are in production, in development, and in advanced exploration, GRC certainly has a solid portfolio and an industry-leading jurisdictional profile with a heavy focus on Canada and the United States.

Gold Royalty Corporation – Organic Growth Upside (Company Presentation)

In addition to those projects discussed already, Fenelon would be a massive contributor if it heads into production later this decade ($6.0+ million in revenue per annum), Gold Rock would be a nice minor contributor, and Railroad-Pinion is also expected to be a decent contributor (0.44% NSR) and looks to be a top priority for Orla Mining (ORLA) once permits are received. Finally, the company has some decent assets in the exploration category, including Trenton Canyon, held by SSR Mining (SSRM); Rodeo Creek, owned by Nevada Gold Mines; War Eagle, held by Integra (ITRG); and Lone Tree, also owned by i-80 Gold, among several others. So, GRC certainly has some depth in its portfolio. Still, I would argue that the ~200 royalty figure for GRC is a misleading metric, with this portfolio being much less impressive than the average royalty portfolio with 200 assets (GRC’s is more concentrated to a handful of operators and has less development/producing assets).

Based on this growing portfolio and the addition of a producing asset in Granite Creek and Cote near-term, GRC could have one of the highest revenue growth rates in the sector (though partially helped by its small scale vs. peers), with the ability to grow revenue from ~$5.0 million in FY2022 to $35+ million in FY2027. This would translate to a ~47% compound annual growth and assumes a limited upside in gold prices. Let’s take a look at the valuation:

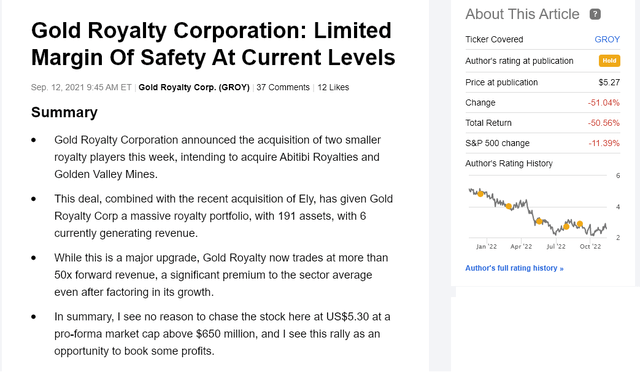

Valuation

Based on ~165 million fully diluted shares and a share price of $2.58, GRC trades at a market cap of ~$426 million. At first glance, this would appear to be a very rich valuation, given that GRC is expected to generate ~$25 million in revenue in FY2026 (17x 4-year forward sales). However, it’s often a mistake to value royalty/streaming companies on a price-to-sales basis, given that this doesn’t capture any value for organic growth that’s already bought and paid for and considerable upside in the portfolio (exploration/development assets, new discoveries, upside in precious metals prices). So, while I don’t think GRC is that cheap at US$2.58, the stock is at least becoming more reasonably valued than where it traded when I warned against owning the stock above US$5.20 per share.

Gold Royalty Corp – September 2021 Article (Seeking Alpha Premium)

If we balance GRC’s mostly Tier-1 jurisdictional focus and the fact that several assets are held by large operators with the fact that it’s a small-scale royalty company (sub 5,000 GEOs per annum), I believe a fair P/NAV multiple for the stock is 1.0. After multiplying this by an estimated net asset value of US$540 million, I see a fair value for the stock of US$3.27, translating to a 26% upside from current levels. While this may suggest a decent upside from here, I prefer a minimum 35% discount to fair value to justify starting new positions in small-cap stocks; the stock would need to head below US$2.13 to move into a low-risk buy zone. Hence, I don’t see enough margin of safety to justify buying after this ~25% rally off the lows.

Summary

While I was not a huge fan of GRC’s royalty portfolio nor its valuation, while the stock traded above US$5.00 per share, positive developments across the portfolio continue to outweigh the negatives. This is especially true given the continued exploration success at Granite Creek Underground, which is making this look like a potential ~90,000-ounce per annum asset with a 15+ year mine life, which entirely excludes upside from the open-pit project. That being said, I prefer to buy at the right price or not at all, and while GRC is reasonably valued at ~0.80x P/NAV, I see more attractive bets elsewhere in the sector. To summarize, I am Neutral from US$2.58 but would consider buying the stock below US$2.13.

Be the first to comment