Gold Price (XAU/USD), Chart, and Analysis

- US Treasury yields eye multi-week highs.

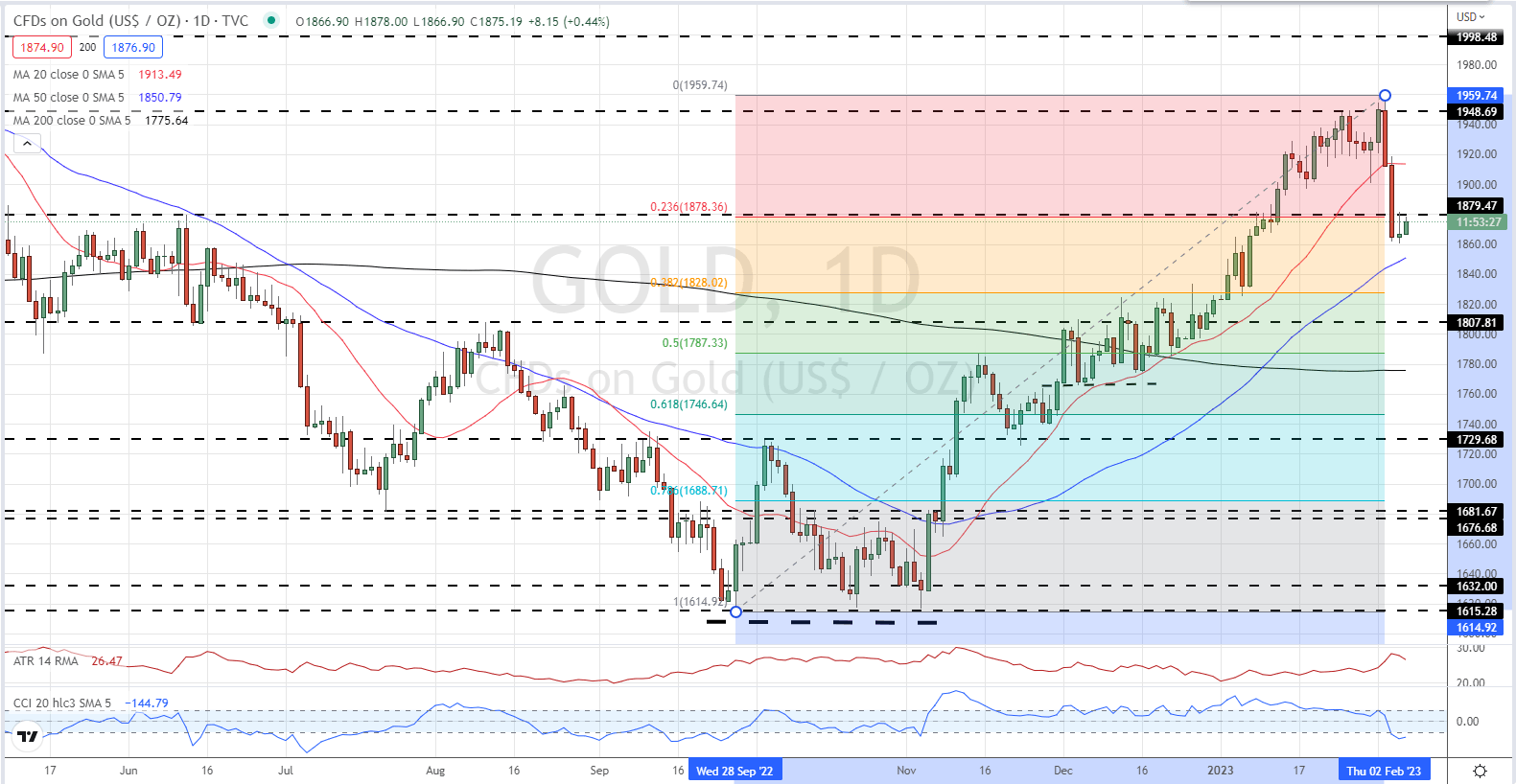

- Gold looks oversold but remains vulnerable to further downside.

Recommended by Nick Cawley

How to Trade Gold

The yield on the interest-rate sensitive UST 2yr is sitting just below levels last seen at the end of last year after last Friday’s blow-out US Jobs Report sent bond yields spiraling higher. With expectations now of higher yields for longer, gold will struggle to regain its recent lofty levels.

US Treasury 2-Year Yields

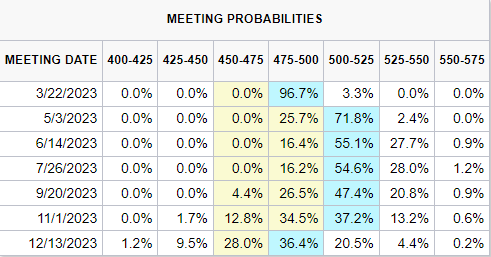

Later in today’s session (17:40 GMT), Fed chair Jerome Powell will speak at The Economic Club of Washington, his first public speech since last Friday’s blockbuster US Jobs Report (NFP) sent US Treasury yields sharply higher. Post-NFPs, financial markets have re-priced the US interest rate outlook for this year with a 25bp hike baked in for the March FOMC meeting and a further 25bp rate hike now seen as a very strong possibility at the May meeting. It is likely that chair Powell will double down on his hawkish rhetoric, citing last Friday’s Jobs Report as evidence of a robust US economy, as he continues to focus on pushing inflation back to target.

Later this evening in the US (2100EST/0200GMT), US President Joe Biden will deliver his second State of the Union address from the White House. President Biden is also expected to highlight the strength of the US economy since the Democratic Party came to power, and will likely point to the current 3.4% unemployment rate – a multi-decade low – as proof of his administration’s economic competency. The President may also have to try and fend off calls to give more detail about his party’s handling of the Chinese balloon incursion which has increased further tensions between the two countries.

For all market-moving events and data releases, see the real-time DailyFX Calendar

Gold has found short term support just above $1,860/oz. a level that came into play last year, while resistance is now seen at $1,878/oz. the 23.6% Fibonacci retracement of the late September to early February move. Secondary support may be seen off the 50-day moving average, currently at $1,850/oz.

Gold Price Chart – Daily Chart – February 7, 2023

All Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 4% | 4% | 4% |

| Weekly | 14% | -25% | -3% |

Retail Traders Increase Their Long Positions

Retail trader data show 67.39% of traders are net-long with the ratio of traders long to short at 2.07 to 1.The number of traders net-long is 5.67% higher than yesterday and 17.98% higher from last week, while the number of traders net-short is 4.01% higher than yesterday and 27.89% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bearish contrarian trading bias.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment