Oselote

Quite recently the gold prices rallied after a relatively good CPI inflation report in the US. I say “relatively good” because the CPI inflation rate turned out to be lower for October than many analysts had expected. This made the gold prices rally since the Federal Reserve considers inflation to be the key factor nowadays to decide on its monetary policies. The prices for the yellow metal have been staying under substantial pressure since the Fed’s dramatic policy change at the beginning of 2022. I will now explain why gold prices should rally further.

Gold price rally and CPI inflation report

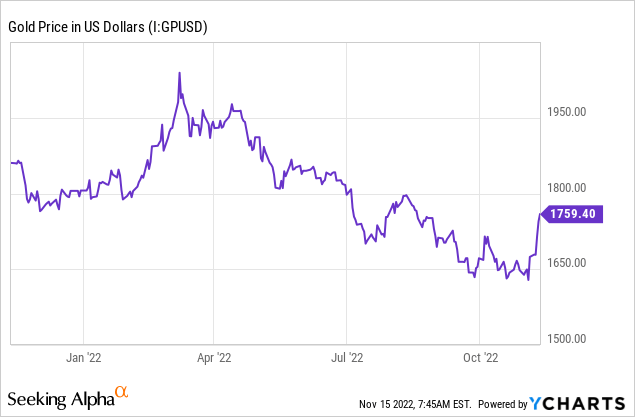

Gold prices have been facing substantial pressure since the beginning of the year due to the Fed’s radical policy shift. The third quarter of this year was not particularly favorable for the prices of the yellow metal either. Only the end of last week allowed the yellow metal to appreciate somewhat.

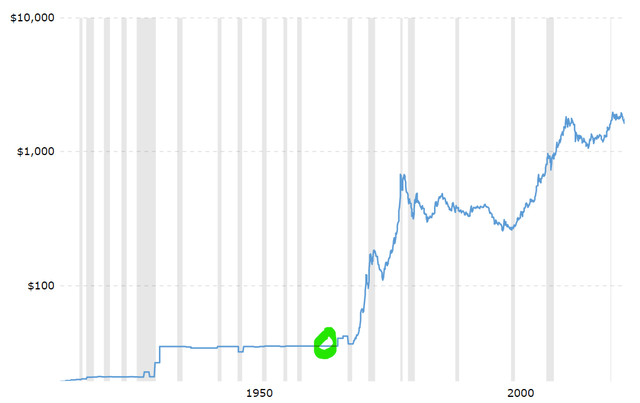

This can be well seen on the diagram above.

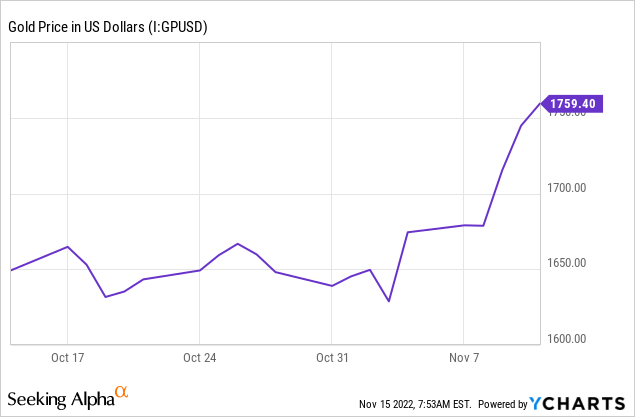

Last week’s rally, however, made the gold prices surge from around $1680 to almost $1760 per ounce as of the time of writing.

The closely watched CPI (consumer price index) in the US for October published last week was 0.4%, substantially below estimates. The monthly PPI of 0.2% was also far below expectations of 0.4%. But I would like to focus more on the CPI. The CPI increase of 0.4% in October on a seasonally adjusted basis was the same as in September. The all items index rose by 7.7% for the 12 months ending October. Although it might sound high, this was the smallest 12-month rise since January 2022.

The biggest factor contributing to inflation was shelter. Over half of the monthly price index increase was due to that. But indexes for gasoline and food also increased. The energy index jumped by 17.6% for the 12 month period ending in October. The food index, meanwhile, rose by 10.9% over the last year. This does not sound very inspiring but all of these price rises were lower than for the period ending in September. Even better is the fact the prices for the used cars, medical care, clothing, and airline fares decreased in October. If we exclude the food and energy components, the CPI totaled 6.3% for the period of last 12 months.

These statistics could possibly be a sign of the slowdown in inflation and maybe a sign of monetary policy softening. Do not take me wrong: the Fed still looks hawkish and more interest rate raises are highly likely ahead. But there might already be some signs of monetary easing coming sometime soon. If that is true, the gold prices should do well in the near future.

Central banks are buying gold

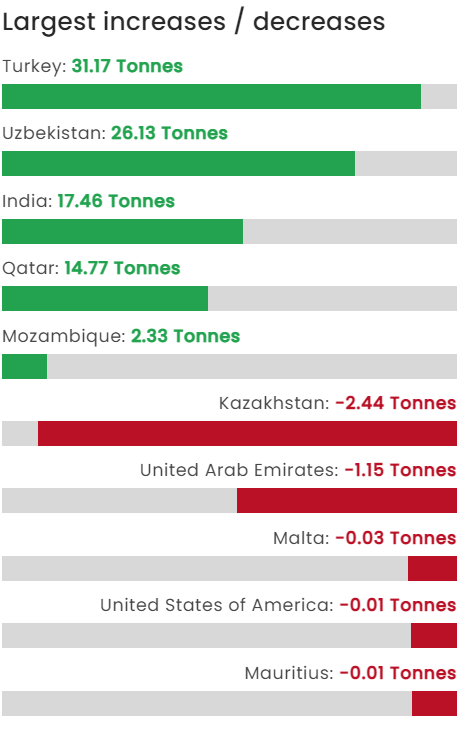

Interesting is also the fact of how central banks behaved in 3Q2022. I think we all agree that these financial institutions seem to have better knowledge than ordinary investors. So, the central banks took the third quarter as a good opportunity to increase their purchases of gold. Funny enough, total gold buys totaled almost 400 tonnes in the last quarter. This means so far in 2022 the total gold purchases were 673 tonnes. This is already the highest level of any full year since 1967. The 3Q2022 was also the largest single quarter in terms of gold buys for the central banks back to 2000. Also, in the last quarter the gold purchases were almost two times greater than the previous record of 241 tonnes in Q32018.

According to the data taken from the World Gold Council, the largest gold buyers were Turkey, Uzbekistan, India, and Qatar.

World Gold Council

Source: World Gold Council

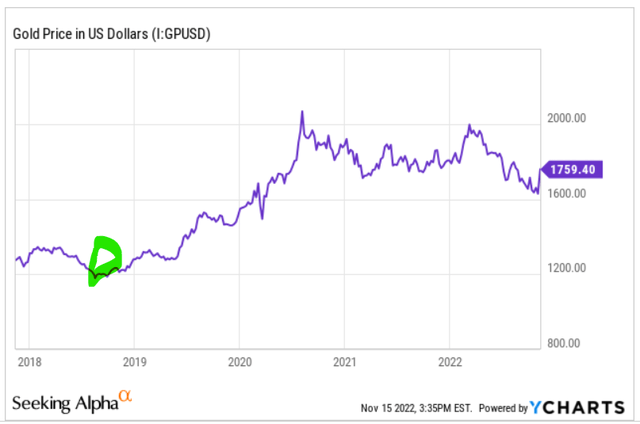

The countries mentioned above, especially Turkey might have just wanted to support their falling currencies. But let me also show you what happened to gold prices when central banks started to massively buy up physical gold. I decided to illustrate these massive gold buys by central banks with a few graphs.

The first one shows the post-2018 gold price rally. As I mentioned above, 3Q2018, marked in green by myself, was a popular time for central banks to make gold purchases.

The end of 1960s – the beginning of the 1970s was the time when the central banks stopped artificially holding the prices down to ensure stability. You could read more about the “Gold Pool Agreement” here.

Source: Macrotrends.net

The point I am making is that a similar situation might be happening now. The big players like central banks seem to know the yellow metal is undervalued but the rest of the market has not fully realized this just yet.

Risks

There are certainly risks to the bullish thesis I am making now. The first one is that the inflation readings I have mentioned above are still very high for the Fed. The consumer and producer price indexes in other countries are also high enough for central banks to be hawkish. Monetary tightening, meanwhile, is very bearish for the prices of precious metals, especially gold.

At the same time, this too shall pass. As I have mentioned above, the inflation rate growth might have slowed down. So, the Fed might get more dovish since its main priority nowadays is to control inflation but it does not want to provoke excessive unemployment either.

Debt and Derivatives

Now let me go on with my bullish thesis. In my previous articles I mostly covered the US national debt. It is high as opposed to the country’s GDP but other nations are not doing well in terms of indebtedness either. Among them are the leading EU member states but most importantly Japan. This is not limited to national debt. We should also bear in mind corporate debt and individuals that borrow heavily. If central banks can service their debt by printing more money, companies and private households cannot afford to do so. The US is still in a relatively good position since the USD is still the world’s reserve currency. But higher interest rates still make the servicing of the debt more and more problematic, especially for businesses and individuals. That is not the only problem. Many banking and hedge fund clients as well as other market participants borrow heavily in order to trade securities. Do I need to say that when the market is going through good days, they do well but when the market collapses, they lose plenty of money too?

But the problems do not end here. Obviously, there are also derivatives that form a very large bubble and are often not supported by any real goods. I took the example of gold in order to illustrate that there is much more paper gold than there are physical gold bars. So, if many paper investors demand their physical gold, there won’t be enough yellow metal to go around. However, many modern derivatives carry some sort of interest. If the rates rise, these derivatives fall in value, making their holders suffer book value losses and their issuers increase the servicing expenses of these derivatives.

The more indebted a country is, the worse it is for its currency. But the scale of the total global debt is really big. Some analysts estimate it is currently standing at around $2 quadrillion. That is $2 trillion times 1000, over and above the US national debt of around $30 trillion.

Geopolitical instability

Unfortunately, the problems do not end here. There is also very high geopolitical instability. The coronavirus pandemic and the resulting lockdowns seem to be almost over. But many sanctions were imposed against Russia, the world’s biggest supplier of natural resources. The US-China relations are also very poor. There is plenty of uncertainty with the US elections and many countries around the world are facing falling living standards. I can continue talking on the subject for a long time but I am sure you agree there are more than enough things to worry about on the political front as well.

Conclusion

All that obviously brings us to a very good but undervalued investment asset, namely gold. In the near future there might be technical corrections for the yellow metal. During the December Fed’s meeting gold prices might suffer in the short run, for example. But I am confident in the beginning of next year the price will exceed the $2000 mark.

Sure, everything is possible and the commodities prices heavily depend on central banks and therefore the macroeconomic factors. But it seems to me that the gold price rally is not over in the long run.

Be the first to comment