Bill Oxford/E+ via Getty Images

Fundamentals

The Russia-Ukraine situation is still unclear. Russia may be using talks of peace as an opportunity to redeploy its troops to the east of Ukraine. Russia is making various demands, such as demanding rubles for their oil and gas. Europe now faces a dilemma about how to respond. Europe’s geopolitical picture is changing. Ukraine is the breadbasket of Europe, with 25 or 30 percent of the world’s grain production. Food and energy, therefore, are in danger of major shortages and price increases, some of which have already occurred.

A Soft Landing: Unlikely

In a March 29, 2022 interview, Bill Dudley, Bloomberg Opinion columnist and former Federal Reserve Bank of New York President, said he does not think the Fed can achieve a “soft landing,” slower growth and lower inflation without triggering a recession.

Dudley said history is not on Chairman Powell’s side in his quest to tighten the money supply while avoiding a recession, linked to rising unemployment rates. Dudley believes the Fed has waited too long to start reducing stimulus at a time when inflation rates are already far above their target of an average of 2 percent inflation. “The Fed’s application of its framework has left it behind the curve in controlling inflation,” Dudley said. “This, in turn, has made a hard landing virtually inevitable.”

We were at basically zero percent interest rates at a time when the economy was calling for higher rates. Within a few months we have moved to discussing whether the Fed will raise rates to how fast the Fed is going to raise rates.

Hopefully some of the transitory causes of inflation, such as the 40 percent rise in used car prices, is not going to continue. However, inflation has entered wages, which makes it far harder to control. In a year, Dudley hopes that inflation will be at 3 percent, which is alright, and not 4 or 5 percent, which would require the Fed to act aggressively.

If we do enter a recession, the Fed will have to reverse course and provide more stimulus to the economy. “It is a blunt instrument,” Dudley said. It is very hard to use fiscal policy to avoid recessions.

Dudley watches the bond market for a sense of what is going on. The bond market thinks the Fed will overdo it and then have to reverse course in late 2023-2024. He thinks interest rates will hit 4 or 5 percent, which is higher than the bond market is factoring in.

Inflation and Inverted Yield Curve

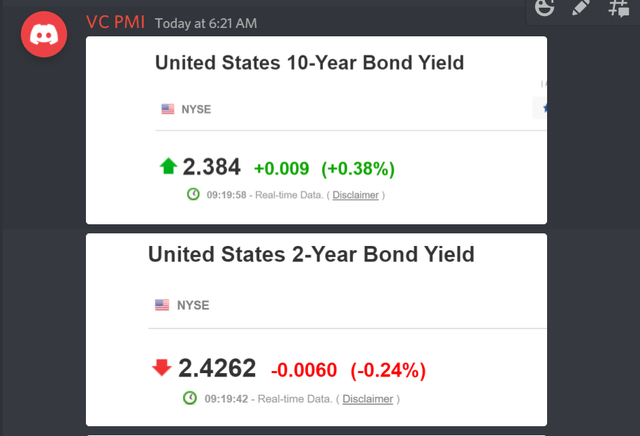

The yield curve appears to be inverting. The Two-Year note is at 2.44, while the 10-Year note is above that, having hit almost 2.50. The 30-year is also at 2.50.

“Inflation is skyrocketing,” Patrick MontesDeOca, Equity Management Academy CEO, said.

For 50 years, the relationship between short and long term interest rates has been a reliable indicator of a recession coming on.

Grains, natural gas and oil are rising sharply in price and it is not going to change anytime soon. There will be food shortages in the Third World, and gas and oil shortages in Europe. Russia may try to use their leverage over food, gas and oil to control the economies of Europe and the United States. Soybeans hit 17.59 recently – a record price. Any talk of an alternative to oil and gas is all rhetoric. Russia is trying to take advantage of the weakness of Western leaders and the high debt levels globally. Inflation rates can’t be allowed to go up or debt repayments will default, but the market is speaking and raising interest rates by itself, regardless of what governments want. This is going to cause trouble for short-term financing and companies that have high debt. Defaults are going to start and spread.

“There is a huge negative yield on the US dollar of about 6 percent right now, which is why investors are demanding a higher return,” MontesDeOca said.

With inflation and shortages, we could be seeing a runaway market in commodities. The government released oil from its reserves, which has helped, but it won’t last. Oil could hit $200 a barrel soon, while grains hit $15 a bushel. We are running the risk of inflation that is much higher now than in the 1970s. Currencies are falling in buying power.

Precious Metals

We had a weak opening this morning, April 1, 2022. In silver, we recommended covering any short positions and to go long. Some buyers are coming into the market. The market is moving into an area of accumulation of supply. We are nearing extreme levels below the mean, which means there is a high probability that buyers will come into the market and the price will revert back up. The Buy 1 level is at $24.67, which is an excellent level at which to get into the market and go long.

Gold is also down to a buy level, where a reversion back up to the mean is highly probable. The daily average is $1940 and the weekly average is $1945. Trading above those levels means that the price momentum is bullish. Gold hit $2078 on war news, but if you bought then, you were caught in a bull trap. However, the long term picture remains the same: buy and hold gold – the long-term trend is up.

“I believe wholeheartedly that you should convert fiat currencies into gold and silver,” MontesDeOca said. “Silver, especially, could be an explosive market soon.”

Be the first to comment