Daria Nipot/iStock Editorial via Getty Images

With a market capitalization of $1.7 trillion, and as a household e-commerce name, Amazon (NASDAQ:AMZN) needs no introduction. I am initiating Amazon as my top large cap idea for 2022 and provide my SOTP valuation for the company below.

Investment thesis

Amazon is my top large cap idea for 2022 for the following reasons:

1. We will likely see meaningful margin expansion in e-commerce business due to price hikes in Prime as well as from the normalization of supply chain and fuel costs.

2. Amazon’s international e-commerce business provides optionality that could bring about huge addressable markets with long runway for growth in the future.

3. AWS continues to have strong industry tailwinds due to digital transformation of businesses and leverages on its industry leading position to continue to re-invest in its business and scale up.

4. Advertising is increasingly gaining traction and taking market share especially in e-commerce digital marketing wallets as top global advertisers are seeing that advertising on Amazon provides value add to sellers, companies and authors.

5. Amazon is increasingly becoming investor friendly as seen by growing share repurchases recently as well as stock split and improving disclosures on business segments.

6. Amazon’s near term investments in fulfilment and logistics as well as in data centers continue to set the stage for long term growth as the investment spend enables the company to stay relevant in an ever changing world.

Based on my SOTP valuation for Amazon, I derived a target price of $4,850 for Amazon, implying an upside of 44% from current levels.

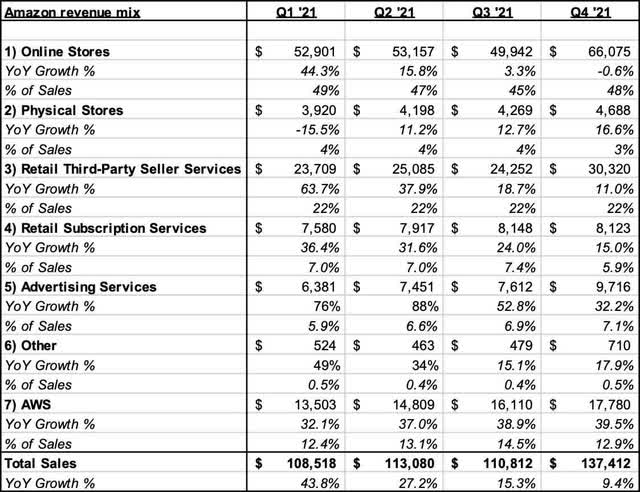

Amazon’s revenue mix

To understand the Amazon business model better, I have included the revenue mix of Amazon based on their quarterly reports below. The core business Amazon can be broke down into e-commerce, Amazon Web Services (AWS) and advertising services.

Within e-commerce, the retail subscription services segment comprises of the revenues generated from the prime membership, which provides Amazon with recurring revenues for e-commerce. AWS revenues comprise of its revenues derived global sales of compute, storage, database and other services for businesses.

Within the advertising services segment, this includes revenues of advertising services to sellers, vendors, publishers, authors, and others, through programs like sponsored ads, display, and video advertising.

Revenue mix of Amazon (Author generated)

E-commerce

Amazon announced a price hike for Amazon Prime in the US, with the monthly fee increasing from $12.99 to $14.99 and annual membership increasing from $119 to $139, representing a 15% and 17% increase respectively.

However, on the negative side, Amazon is impacted by the higher fuel costs since it affects the cost to transport e-commerce goods to customers. In 2021, Amazon had $77 billion in shipping costs, which includes sortation and delivery centers and transportation costs. Based on an analysis of a potential increase in transportation costs and the impact to Amazon, it was found that every 500bps of incremental transportation cost growth assumed results in an additional $800 million to $1.5 billion in spending on transportation.

However, management did comment that the higher transportation costs is a contributing factor to the price hike for Amazon Prime membership in the US. I am of the opinion that we are currently seeing higher than normal shipping and transportation costs as well as fuel costs due to supply chain issues caused temporarily by the pandemic. With that logic, this transportation cost will normalize as we move towards a post-pandemic world and when supply chain backlogs and issues are finally resolved. As such, this makes me more optimistic that there could be margin upside given the price hike in Amazon Prime membership in the near term when the supply chain situation improves and well the fuel costs normalize once again. I am of the opinion that margin expansion opportunity for Amazon’s e-commerce segment as supply chain and pandemic challenges normalize is not yet priced into the market which could bring an earnings upside for Amazon.

Furthermore, the market has been worried about the deceleration of 1H22 due to high base in e-commerce, the potential for eComm revenue reacceleration on the back of easier growth comps and elements of next day/same day delivery

For the financial year of 2021, international e-commerce made up 27% of Amazon’s total sales and grew at a pace of 22%, faster than the 18% growth that the North America market saw. Amazon is doubling down on its workforce and logistics capabilities in Europe as it looks outwards for growth opportunities.

Amazon is also looking to grow in international markets like Latin America and India, both of which it will face intense competition, especially in India, where it competes against players like MercadoLibre (MELI) and Walmart’s e-commerce business in India, Flipkart. With the purchase of Souq.com, Amazon has also expanded into the Middle East. It has also expanded into Southeast Asian markets like Singapore.

I am of the opinion that international e-commerce has a long term growth potential and will add to the list of opportunities for upside in the years to come.

As Amazon continues to re-invest in its business, I am of the opinion that in the next few years, we will continue to see higher returns from the efforts it has taken in the past to double fulfilment capacity, improve next day or same day delivery, Amazon Prime Now, for example, and these will further solidify Amazon’s industry leading position in e-commerce. As mentioned earlier, we could see margin expansion as supply chain challenges and fuel costs ease and further upside in international e-commerce revenues as Amazon expands globally.

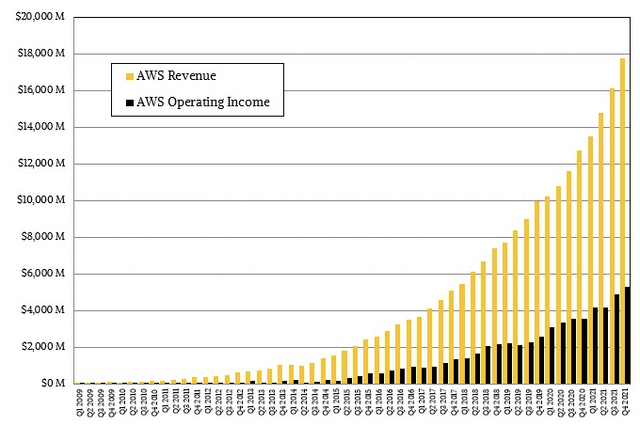

AWS outperformance

For 4Q21, we continued to see strong outperformance by AWS as it grew 40% to $17.8 billion, compared to the street’s expectations of $17.3 billion. In my opinion, this is one of Amazon’s powerhouse segment that will drive outperformance in the stock in the future. This is not just due to the favorable industry dynamics within the cloud computing segment, but also due to Amazon’s unique competitive advantage in the segment.

I believe that we will continue to see outperformance in AWS that is driven by the accelerating demand for digital transformation and rising public cloud adoption. This in turn is driven by structural changes in enterprise and consumer behaviors in the wake of the COVID-19 pandemic. The long term outlook of cloud adoption remains strong as I expect that we will continue to see strong digital transformation related spending. The cloud computing market could be worth $69 billion by 2025, implying it will continue to grow at 15% per year and will continue to increase its cost rate by 2025 to a net value of almost $800 billion by 2025.

In addition, we continue to see healthy backlog growth for AWS, with total commitments for future services not yet recognized up 48% year on year, compared to the up 48% year on year in 2Q21. As we move into 2022, this backlog growth will then flow through to reported revenues, leading to an upside to revenue estimates.

This next graph showing the growth of AWS revenues and operating income really shows me the power of continued investments into a fast growing business to build scale, which brings about compounding effects to the business down the road. As such, the continued success of AWS comes from the continued efforts to improve its unique competitive advantage, build on its scale and invest deeper into the cloud computing business.

AWS exponential growth in revenues and operating income as it builds scale (Nextplatform)

As such, I am confident in Amazon’s playbook in cloud computing and execution continues to be solid given the impressive customer list and strong demand. I am of the opinion that we will continue to see industry leadership in cloud computing in its revenues and margins.

Advertising

Amazon broke out its Advertising line which provides greater clarity into the Amazon’s advertising business. This improved disclosure and communication to investors help investors understand the underlying businesses better to help generate more accurate forecasts. Advertising sales grew 32% year on year.

I have done several channel checks with the digital advertising industry and these conservations have pointed to growing Amazon advertising business. I am hearing from the industry that Amazon continues to take market share in e-commerce digital advertising budgets. Although Amazon is mostly viewed as a low-in-the-funnel advertising channel for direct response advertisers, my conversations with people in the industry suggest that many advertisers are starting to place greater focus on top-of-the-funnel campaigns during the last holiday season to reach new consumers and drive brand/product awareness ahead of the Black Friday.

A survey done by Citi found that top global advertisers commented that Amazon advertising is innovating at a fast pace, launching over 40 new features and self-service capabilities in the last quarter and making it easier for sellers, companies and authors to grow their businesses by helping customers discover their products.

I am also of the opinion that we could see Amazon benefit from the post IDFA world. This is due to the company’s access to huge amount of 1P in-depth consumer data, like a customer’s detailed purchase history. This should then translate to sustainable revenue growth in the advertising segment for Amazon here on.

Also, one final point would be that I think we could see Amazon take share from traditional TV advertisers as they redirect their ad spending to top streaming platforms in 2022.

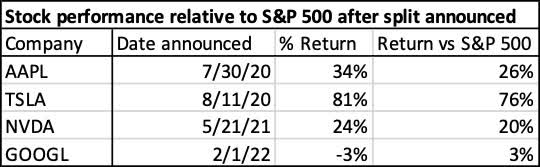

Increasingly shareholder friendly

On 9 March 2022, Amazon announced that its board approved both a 20-for-1 stock split as well as authorized a repurchase program of up to $10 billion that will not have an expiration date. The stock split was the first since 1999, and the 4th since Amazon’s IPO in 1997. As a result of the stock split, each Amazon stockholder holding shares at the close of 27 May 2022 will have an additional 19 shares for every Amazon share held, which is expected to be reflected sometime about 3 June 2022.

Although stock splits do not technically alter the fundamentals of the company, stock splits have been seen as a shareholder friendly move to making share ownership more accessible to a larger group of investors, especially so for Amazon. This is because of Amazon’s price per share of more than $3000, which is one of the top 5 highest priced stocks in the US. As illustrated below, with the shareholder friendly action of stock splits executed by other big tech names, there were generally higher returns relative to the S&P 500.

Effect of stock splits on share prices of big tech relative to S&P 500 (Author generated)

With regards to the share repurchase authorization, Amazon had a previous $5 billion share repurchase authorization that was approved in 2016, and based on that previous program, it was already repurchased $2.12 billion of Amazon shares. This implies that Amazon has repurchased about $800 million incremental stock since buying back about $1.3 billion YTD till 2 February 2022.

In my opinion, we are starting to see some shifts in Amazon becoming more shareholder friendly as evident from the stock split and repurchases done recently. I think this is definitely positive and likely due to the change in stance taken by the new CEO, Andy Jassy, who took over from Jeff Bezos late last year.

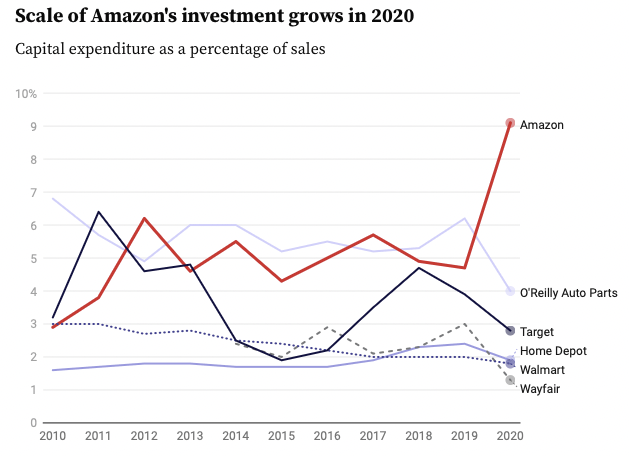

Near term investments

Amazon continues to invest in its logistics and fulfilment capacity in order to compete with its other online retailer peers. As seen below, Amazon has ramped up capital expenditures as a percentage of sales to 9% during the pandemic in 2020, at a time when others were scaling down on their investments.

Amazon’s capex as a % of sales (UBS)

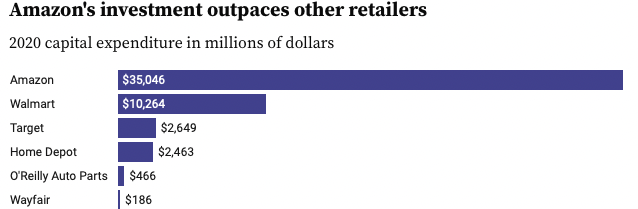

When looking at the dollar amount of investments, Amazon was spending more than triple that of Walmart, the retailer with the second largest capital expenditures in 2020.

Amazon’s capex in 2020 in dollars (UBS)

In addition, to take on competitors in the fulfilment and logistics space like FedEx (FDX) and UPS (UPS), its first quarter 2021 results showed that Amazon increased capital expenditures by an insane 80% over the last 12 months as it continued to invest heavily in fulfilment capacity and logistics. This means that Amazon invested heavily into more warehouses and increasing its fleet of airplanes, trucks and vans.

This step up in capital expenditures serves to achieve Amazon’s goal to manage its own deliveries and improve the delivery process, thereby relying less on third parties like UPS. Furthermore, on the demand side, these capital expenditures are necessary to catch up to the huge demand for e-commerce that raised from the pandemic.

Amazon announced that AWS will be spending $2 billion to build and operate data centers in the UK. As illustrated earlier, the investments by AWS will go a long way to developing and maintaining AWS global lead in cloud computing.

In my opinion, these near term investments into the business are deemed necessary for the long term growth of the business due to the need for scale in these businesses. Although it may come at the expense of lower margins in the near term, I think that this positions Amazon well for the future to outcompete and outlast its peers that are slow to invest in the future in light of the ever changing world.

Competition

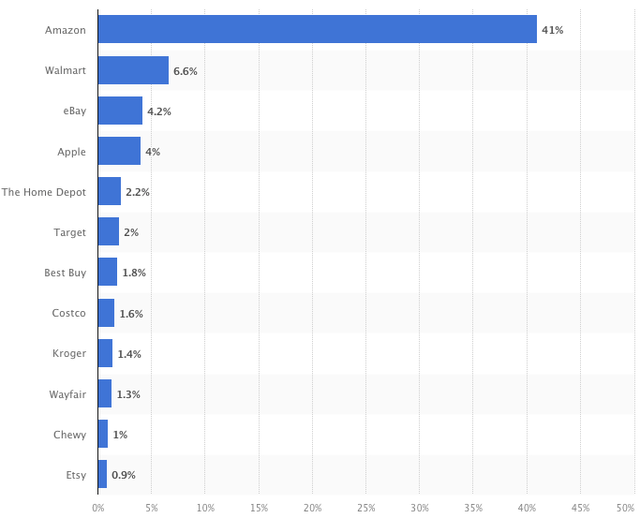

Amazon is in an enviable position in e-commerce, especially in the US. In 2021, it is the largest player in the market with a dominant 41% of market share, while the second largest player is tiny compared to its scale.

Market share of e-commerce retailers in the US (Statista)

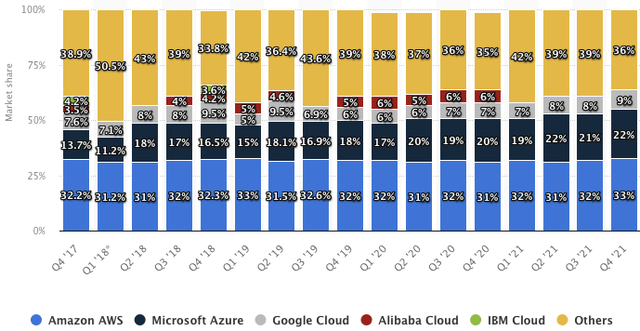

In the cloud computing space, although Amazon is up against the biggest names in big tech, it has maintained its number 1 position globally. As of 4Q21, it has 33% of the global market share, with Microsoft Azure close at 22% market share and Google cloud at 9% market share.

Market share of cloud infrastructure vendors globally (Statista)

Valuation

Amazon is trading at 50.6x/36.8x 2022F/2023F P/E. Free cash flows to grow to $27 billion in 2022F and $45 billion in 2023F, implying a free cash flow yield of 1.6% and 2.6% respectively.

Based on my SOTP valuation for Amazon, I derived a target price of $4,850 for Amazon, implying an upside of 44% from current levels.

SOTP valuation for Amazon (Author generated)

Risks

Competition

Although I believe Amazon has unique competitive advantage and benefits from the flywheel effect, it is not a monopoly and there are competition in both the e-commerce segment and cloud computing segment that may impact future growth in revenue and earnings and as well as potentially on the multiple Amazon should trade at. As mentioned earlier, competitors in the e-commerce space include Walmart (WMT), eBay (EBAY). In the cloud computing space, its competitors include Microsoft (MSFT) and Google (GOOG).

Lack of scaling in its higher margin businesses

With Amazon’s advertising, cloud and third party selling and subscription business commanding the higher margins in the business, if Amazon is unable to scale successfully, this could have a material impact on its bottom line.

Unexpected investments

Although management has not yet announced any unexpected investments, should there be an unexpected investment in its many initiatives it’s focused on, this could definitely impact my margins assumptions, creating a headwind for gross and operating margins.

Volatility in the macroeconomic environment

As we have seen early in 2022, when investors risk appetite shrinks, it could impact demand for growth stocks like Amazon. Furthermore, Amazon’s e-commerce, cloud computing businesses would be impacted by shifts in macroeconomic environment should consumer or business demand wane. For example, as an enabler of online retail and with a business model that earns fees from online retail transactions, a slowdown in consumer spending could weigh on its e-commerce business.

Conclusion

I believe that Amazon is a top large cap idea for 2022 and Amazon is a core long term holding for investors. Amazon is exposed to several long term drivers like e-commerce, cloud computing, digital advertising, streaming, AI driven computing, for example.

On top of that, we are likely to see sustained industry leadership in e-commerce and cloud computing as it continues to re-invest heavily into both businesses. Furthermore, I am of the opinion that we will see a meaningful margin expansion when supply chain and fuel costs normalize, as well as growth upside from international e-commerce market, as well as growing advertising revenues. In addition, aside from the margin expansion to come, we will likely also see Amazon maintain 15%+ growth in free cash flows in the coming years. Based on my SOTP valuation for Amazon, I derived a target price of $4,850 for Amazon, implying an upside of 44% from current levels.

Be the first to comment