Justin Sullivan

Introduction

As a dividend growth investor, I constantly seek additional income-producing assets. On some occasions, I add shares to my existing positions. In other circumstances, I start new positions to diversify further or take advantage of an attractive valuation and growth story. 2022 began with high volatility, and despite the rally over the last two months, there are still compelling investments.

My dividend growth portfolio lacks exposure to the information technology sector. There are two reasons for that. The first one is that many companies in this sector are still expensive. Secondly, paying dividends in the information technology sector is still not as mainstream as in other segments. This article will analyze Oracle (NYSE:ORCL), a company that seems reasonably valued and pays a growing dividend.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Oracle Corporation offers products and services that address enterprise information technology environments worldwide. Its Oracle cloud software as a service offering includes various cloud software applications. The company also offers cloud-based industry solutions for various industries, Oracle application licenses, and Oracle license support services. In addition, it provides cloud and licenses business’ infrastructure technologies, such as the Oracle Database, an enterprise database; Java, a software development language; and middleware, including development tools and others.

Fundamentals

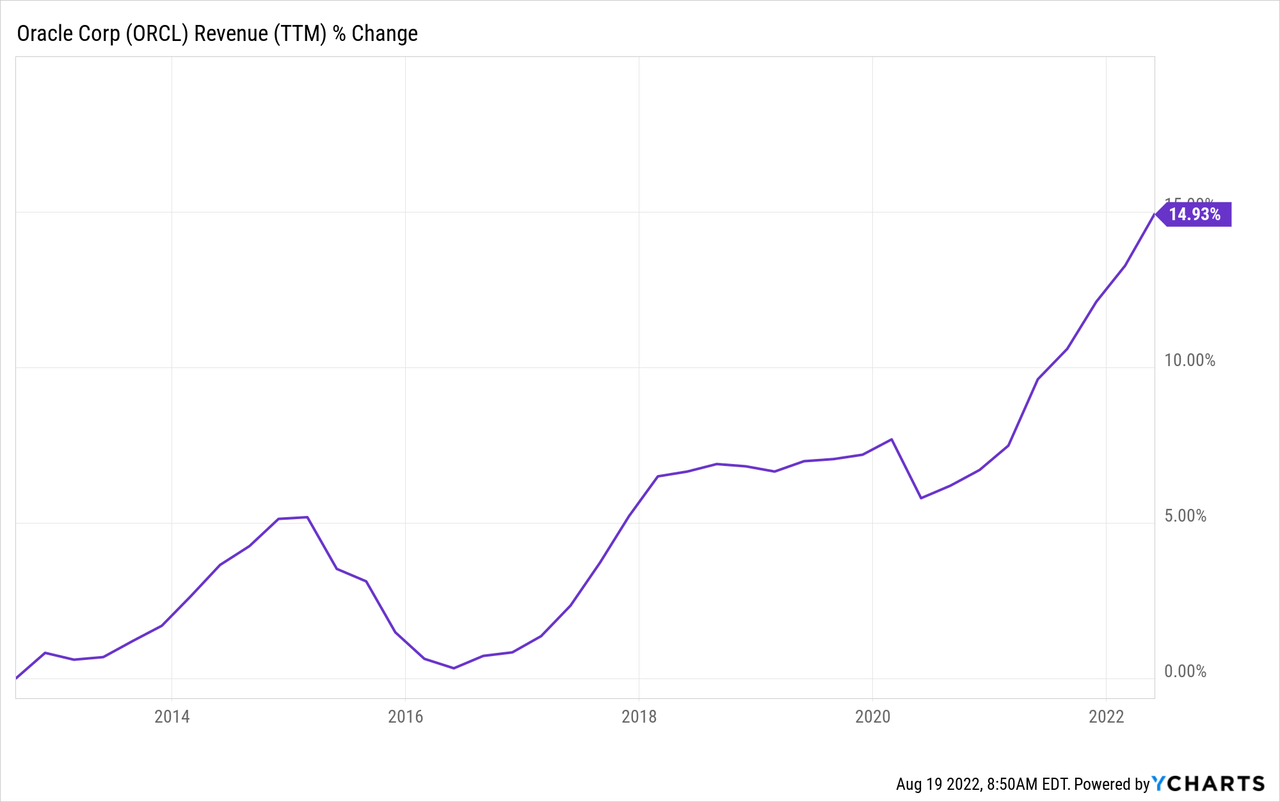

Oracle suffered from a significant stagnation over the last decade. The company had its legacy software and hardware. However, it struggled to find new paths for growth. The company decided to focus on its cloud offering, where it offers both the infrastructure and leading software solutions on top. Therefore, despite a 15% sales growth over the last decade, the company is more optimistic. In the previous twelve months, sales have been up 5% and 7% using the constant currency, with the cloud being the primary growth driver. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Oracle to keep growing sales at an annual rate of ~10% in the medium term.

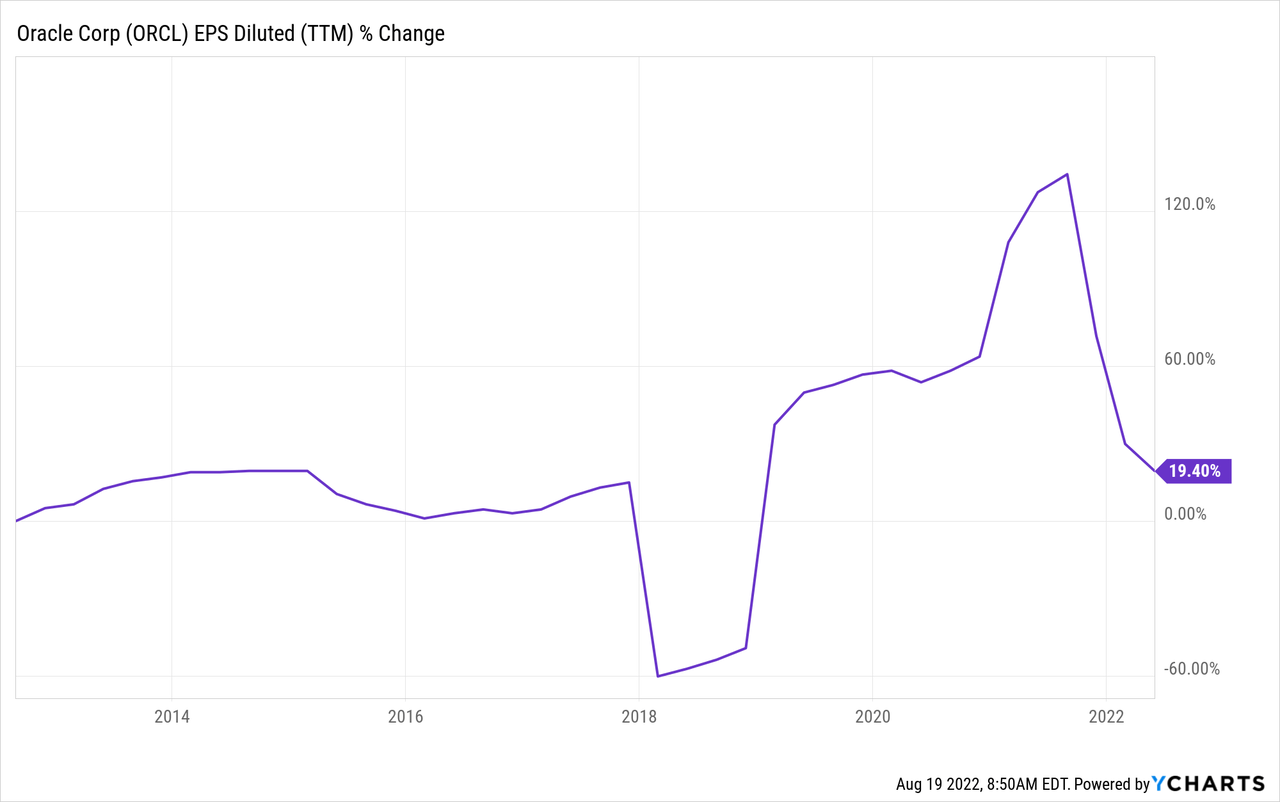

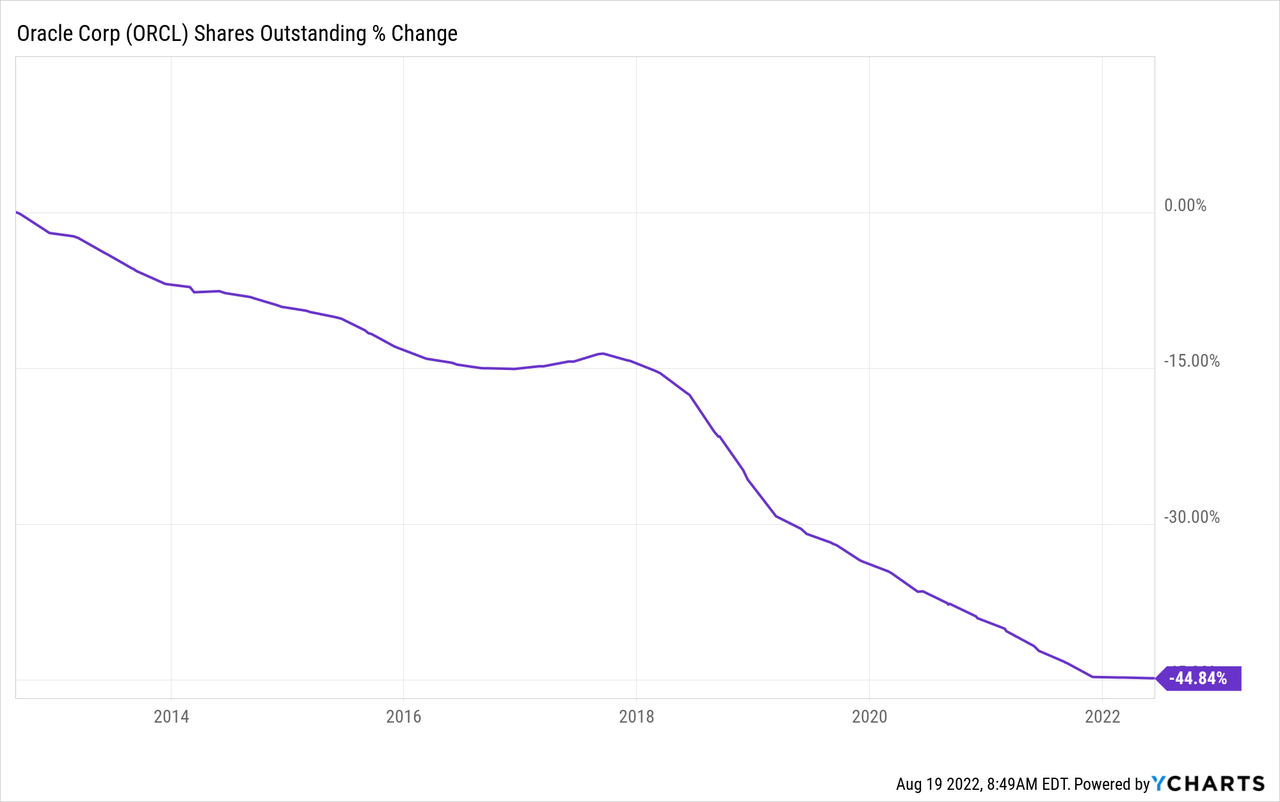

The company’s EPS (earnings per share) has grown much faster. The graph below shows non-GAAP EPS that rose by almost 20% in the last decade. Yet, non-GAAP EPS shows an 82% EPS increase. The combination of sales growth and aggressive buyback fueled the EPS growth. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Oracle to keep growing EPS at an annual rate of ~12% in the medium term.

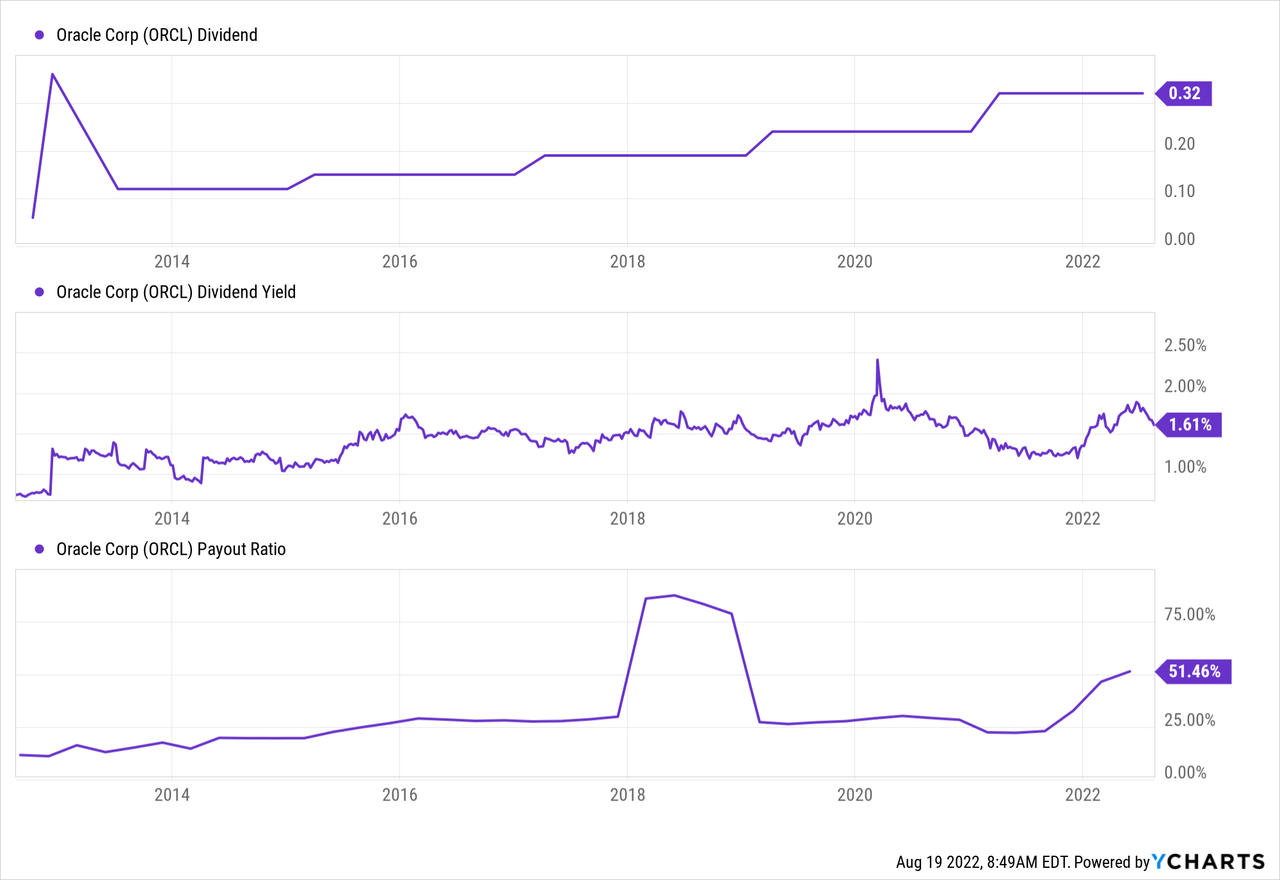

The dividend here is very interesting. I will start by stating that the current dividend is safe, and a dividend cut is unlikely. The current payout ratio is just 52% using GAAP earnings and 24% using non-GAAP EPS. The company increased the dividend nine years in a row and has never reduced it since it initiated it 13 years ago. The current yield is low at 1.6%, but there is much room to grow despite the fact that the dividend has almost tripled in the last ten years.

Investors should expect a double-digit growth rate in the medium term, which is in line with the company’s EPS growth rate. According to the cash flow statement, as seen on Seeking Alpha, the company’s dividend cost $3.4B in the last year, and the free cash flow was above $10B in the last nine years. Therefore, the company has room to grow the dividend and it has enough margin of safety even if the free cash flow declines due to a recession. Investors buying into Oracle will have very positive long-term dividend prospects.

In addition to dividends, Oracle is returning capital to shareholders via buybacks. These share repurchase programs support EPS growth as they lower the number of shares outstanding. Buybacks are most efficient when the company grows, so they can supplement EPS growth using excess cash. Oracle used its money for buybacks even when it struggled to grow, which is risky as growth may require capital. Still, the company reduced the number of shares outstanding by almost 45% in the last decade, adding significantly to the EPS growth.

Valuation

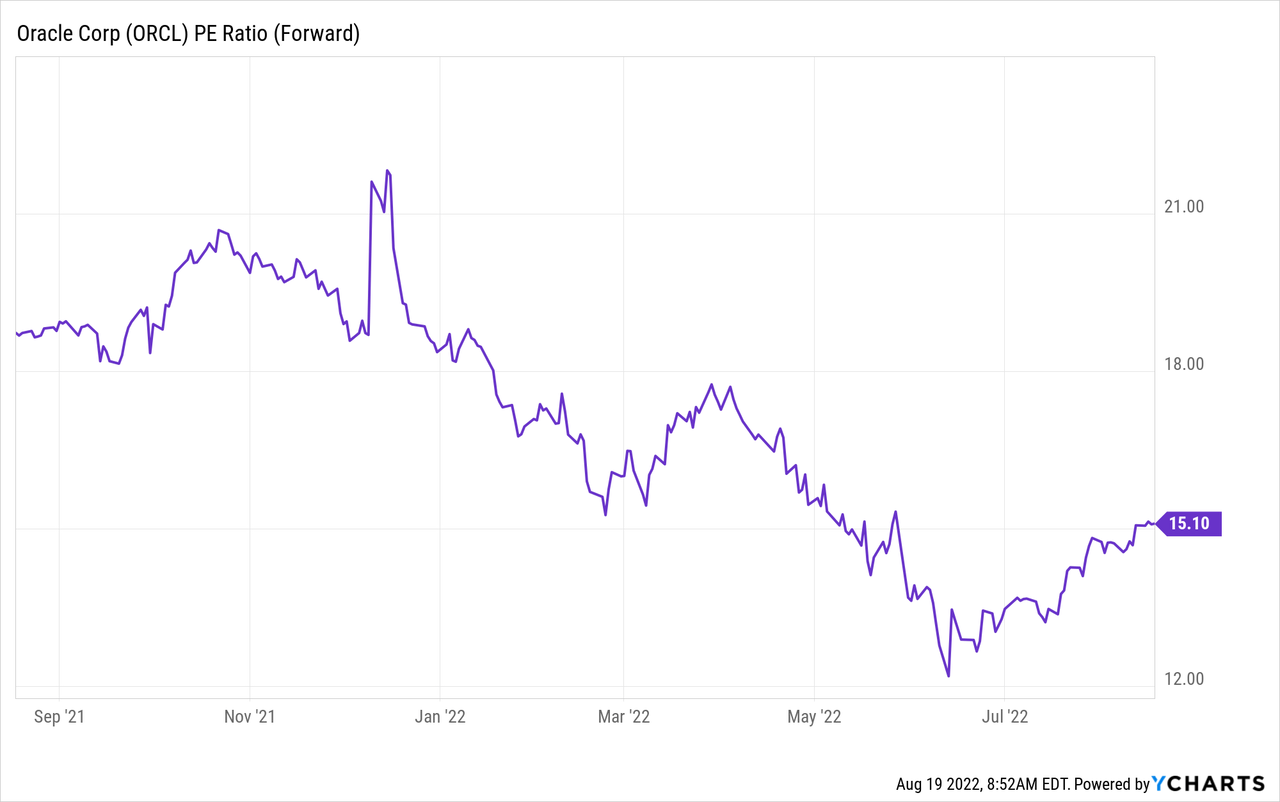

Oracle’s P/E (price to earnings) ratio stands at 15 when considering the forecasted EPS for the next twelve months. As can be seen in the graph below, it is lower than the average valuation we have seen in the last twelve months. The current valuation is close to the lowest in the previous year, which was close to 12. Therefore, paying 15 times the earnings for a company with decent growth seems reasonable.

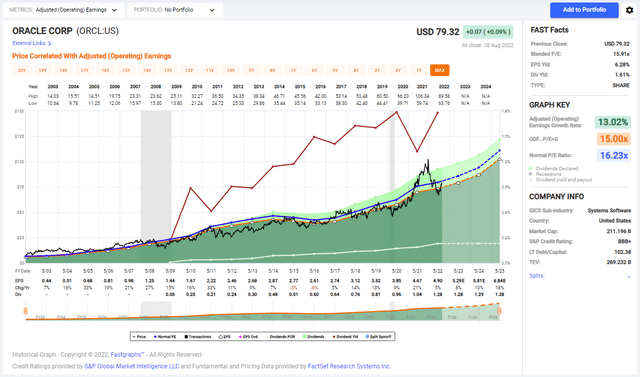

The graph below from Fastgraphs also implies that Oracle’s valuation is at least reasonable, if not attractive. The average P/E ratio for Oracle in the last two decades was 16.2. During these twenty years, the EPS grew at 13% annually. The current forecasted growth rate is in line with the historical growth, while the valuation is somewhat lower. Therefore, the shares of Oracle seem slightly attractive compared to their historical valuation.

To conclude, despite dealing with some stagnation, Oracle has strong fundamentals. Growing sales and EPS lead to increase dividends and buybacks. In addition, unlike some of its IT peers, these fundamentals come at a decent valuation. Paying 15 times earnings for a company that shows proper growth and rewards shareholders with constant dividends sounds promising.

Opportunities

Oracle’s most important growth opportunity is its focus on the cloud business and refining its offering. The company offers cloud infrastructure like Amazon (AMZN), Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and others. It also provides its unique software in cloud-native SaaS versions allowing it to offer a comprehensive solution for many businesses. In the last quarter, cloud infrastructure grew by 36%, and the company intends to keep investing in this high-growth engine.

Another exciting move by Oracle is the acquisition of Cerner for $28.3B. Cerner supplies health information technology services, devices, and hardware. Its products were in use at more than 27,000 facilities around the world. While Oracle may struggle to compete with the cloud giants, this acquisition will make offering a specific comprehensive solution for healthcare facilities easier.

The execution is another reason for investors to be optimistic regarding Oracle. Oracle is led by an experienced team that has shown its execution ability. When I analyzed Oracle a year ago, analysts expected the current year to end with an EPS of $4.6. The year ended with an EPS of $4.9. The management is successfully implementing its strategic growth plan and has already started exceeding expectations.

Risks

Competition is a significant risk for Oracle. Oracle has a tiny 2% market share in the cloud business that it intends to grow. The three largest cloud providers, Amazon, Microsoft, and Alphabet, own roughly two-thirds of the market. Therefore, it may be very challenging for Oracle to turn into a leading provider as even the current double-digit growth won’t be enough to gain significant market share, putting Oracle at risk from these giants.

A recession is a risk for Oracle in the short term. To grow by riding the wave of cloud migration, Oracle needs companies to keep investing heavily in IT. If we see a recession, fewer investments will be made by possible clients. Therefore, we will see slower cloud adoption, and the current forecasted growth rate may decline as growth will require more time.

Another risk is the higher debt level that Oracle is dealing with. Oracle acquiring Cerner is just one example of a transaction that required raising debt. The debt to equity level is higher than 3, and it will limit the company’s ability to keep growing using acquisitions. Moreover, the company will also have to deal with higher interest expenses as the Federal Reserve raises interest rates.

While the debt may be a burden if Oracle tries to acquire additional companies, it doesn’t put at risk the current growth story, which is mostly organic. Also, dividend growth investors should not worry about the safety of the dividend due to the debt. The company paid down $2.5B-$8.25B of debt every year in the last five years. The company issued debt to finance acquisitions like Cerner, but with a free cash flow that is growing and mostly exceeds the $10B mark, the company has more than enough resources to maintain the dividend, pay interest and lower its debt level following the acquisition.

Conclusions

Oracle is not the first name when that comes to mind when you think of big tech. However, this giant company consistently grows and delivers improved results to its shareholders. Growth fuels dividends and buybacks since Oracle prioritize sharing its success with its shareholders and its investment in R&D.

Oracle offers investors a wide range of could services. From the infrastructure to SaaS applications that work on top of the infrastructure. There are also several risks, mainly the fierce competition in the cloud arena. However, at 15 times forward earnings, I believe there is enough margin of safety, and the market will reward any contentious growth story. Therefore, it’s a BUY.

Be the first to comment