RHJ

Investment Thesis

GoGold Resources (TSX:GGD:CA) is a Canadian listed silver producing and development company that operates in Mexico. It also has a U.S. OTC listing (OTCQX:GLGDF). I have covered the company many times before, where my prior articles on GoGold can be found here.

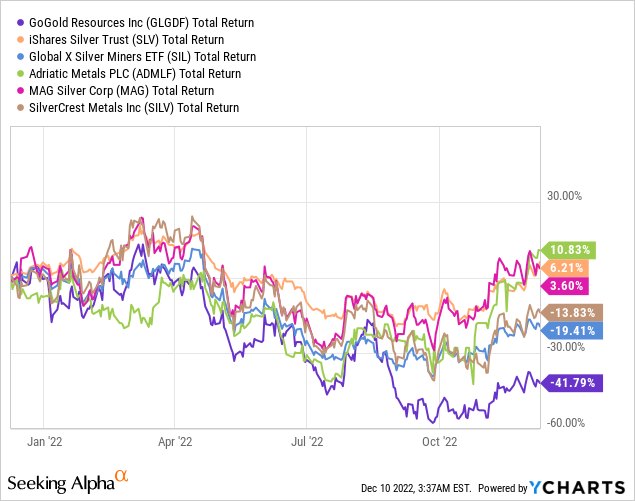

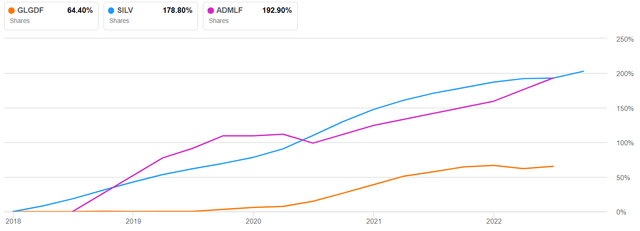

The stock price of GoGold in 2022has drastically underperformed the price of silver, as represented by iShares Silver Trust in the chart below, development peers, and silver miners in general.

Figure 1 – Source: YCharts

Based on the positive developments in 2022, and what is expected in 2023, this underperformance has little to do with the fundamentals of the company. Which is why GoGold is one of my top picks for 2023.

Primary Reason for Underperformance

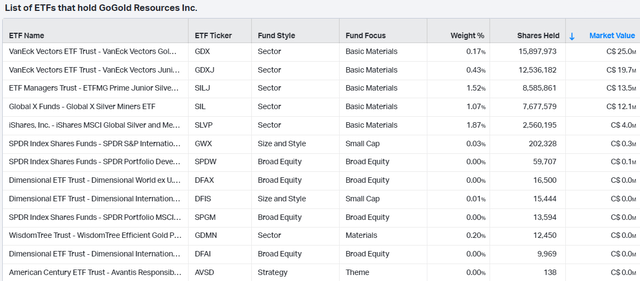

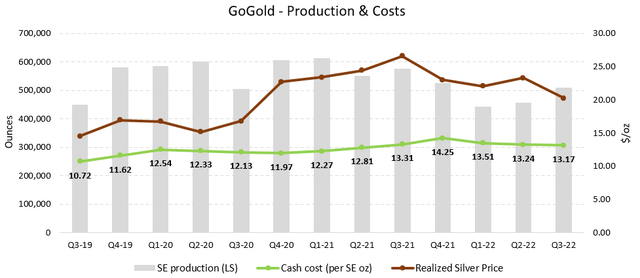

The underperformance does in my view primarily come from the VanEck Vectors Gold Miners ETF (GDX) exclusion at the end of Q3-22, due to falling under the market cap threshold at the time of the rebalancing.

Figure 2 – Source: Seeking Alpha

I am typically not one to blame short sellers for the underperformance as they will eventually have to buy back the shares. However, this time it did have a substantial impact on GoGold’s share price. Short sellers were frontrunning the potential GDX exclusion, where the heavy selling caused the stock to drop below the $450M market cap threshold and be excluded from the GDX, which might not have happened otherwise.

The impact was not just that GDX divested almost 16M shares, but a few of other ETFs that rebalanced at the end of Q3 also divested shares at a time when sentiment was poor for silver miners and GoGold. This can be seen in the two tables below. If we look at the performance in figure 1, we can also see that most of the underperformance in GoGold this year happened towards the end of Q3-22 in conjunction with the GDX rebalancing.

Figure 3 – Source: Koyfin 12th of September 2022 Figure 4 – Source: Koyfin 10th of December 2022

Now, this is what passive money often does, buys into strength, and sells into weakness, which one simply have to accept. Fundamentally though, this changes little for GoGold which is cashed-up and not likely to tap the equity market for substantially more capital in the near term. So, it provides value investors with a good opportunity to buy a quality company at a reduced price, with several potential catalysts over the coming year.

Parral

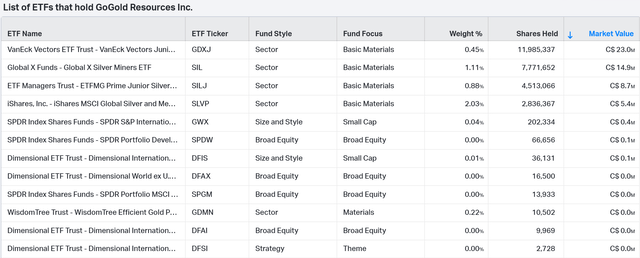

GoGold derives most of its value from the development projects Los Ricos North and Los Ricos South, which can be seen in the valuation section, but the producing asset Parral is still an important component for the company.

It generates very healthy cash flows to cover general & administrative expenses and has also contributed to the capital used for drilling at Los Ricos. Parral produces around 2M silver equivalent ounces per year, with a cash cost in the $13-14/oz range and has a mine life of about 7 years left.

Figure 5 – Source: Quarterly Reports

The cash flow out of Parral is the reason why we have seen relatively little share dilution over the last 5 years, by exploration and development standards. GoGold has so far added more than 240M silver equivalent resource ounces at Los Ricos, with significantly less share dilution than some of the best development companies in the industry.

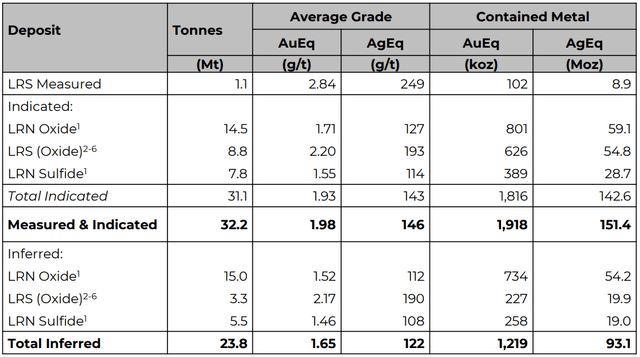

Figure 6 – Source: Seeking Alpha Figure 7 – Source: GoGold Presentation – Los Ricos Resource

Los Ricos

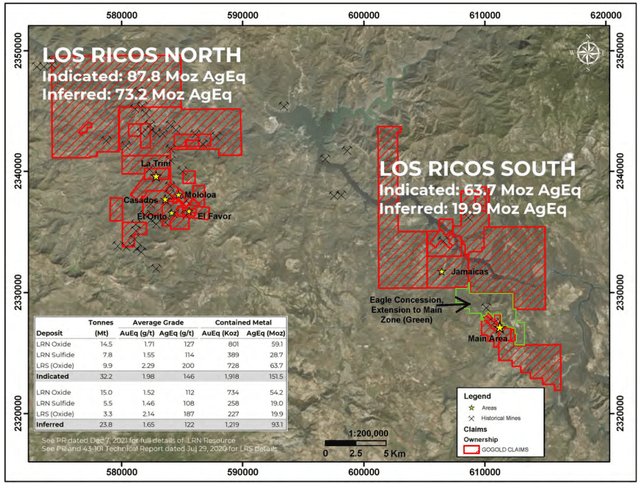

Figure 8 – Source: GoGold Presentation – Los Ricos

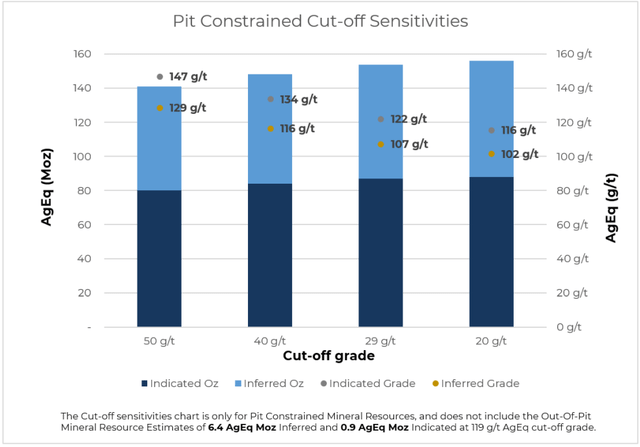

Los Ricos is comprised of two large development areas, Los Ricos South and Los Ricos North. GoGold started the drilling at Los Ricos South less than 4 years ago, where the company presently has a PEA in place. The company then moved onto Los Ricos North a couple of years back, which presently has an impressive initial resource estimate of around 160M silver equivalent ounces at very respectable open pit grades.

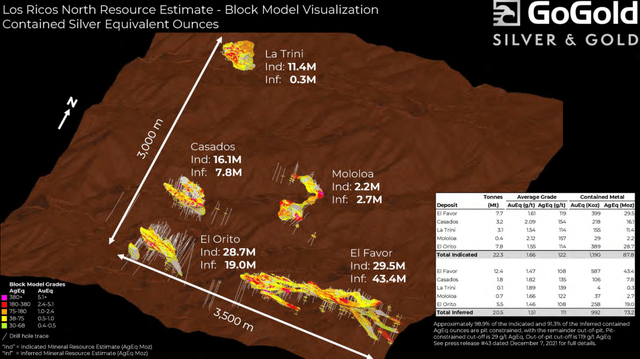

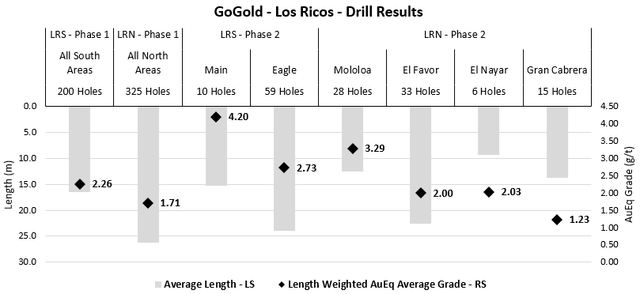

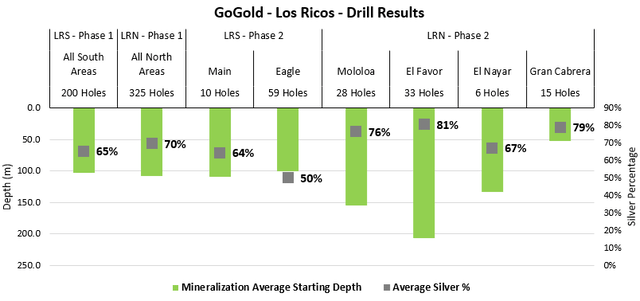

Figure 9 – Source: GoGold Presentation – Los Ricos North Figure 10 – Source: GoGold Presentation – Los Ricos North

During 2022, the company has been focused on the phase II drilling at Los Ricos North, to expand and improve the quality of an already impressive resource. Where GoGold is now expected to release a PEA on Los Ricos North in Q1-23, which will provide us with more reliable economic estimates for the area.

Over the last few months, GoGold has yet again turned its focus towards Los Ricos South, with the addition of the Eagle Concession that is located next to the proposed open pit of the PEA at Los Ricos South.

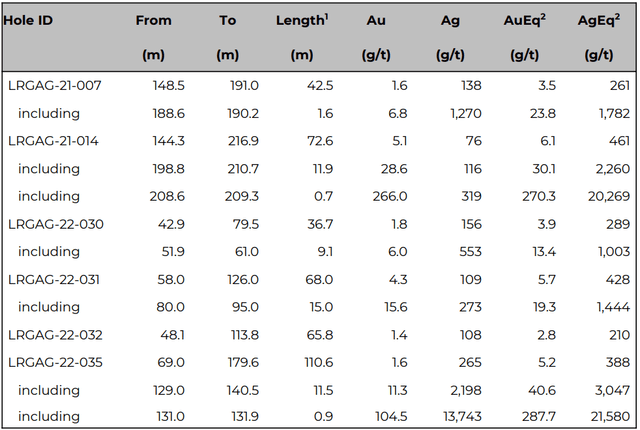

GoGold has encountered many highly prospective areas at Los Ricos over the last few years, but the new Eagle zone looks to be the most impressive area, with very high grades together with very healthy lengths. The average depth is also at a very manageable level.

Figure 11 – Source: My Calculation from Press Releases Figure 12 – Source: My Calculation from Press Releases

Some of the highlights of the Eagle zone have 10-15 meters of more than 1,000 g/t silver equivalent grade. This will both improve the economics of the Los Ricos South project substantially and boost the overall NPV of the project, as the new ounces are adding up quickly.

GoGold is planning to provide an updated resource estimate and/or an updated PEA in Q2-23 for Los Ricos South. A PFS for Los Ricos South should follow later in 2023, likely scheduled for Q3-23.

Figure 13 – Source: GoGold Presentation – LRS – Eagle Highlights

Valuation and Risks

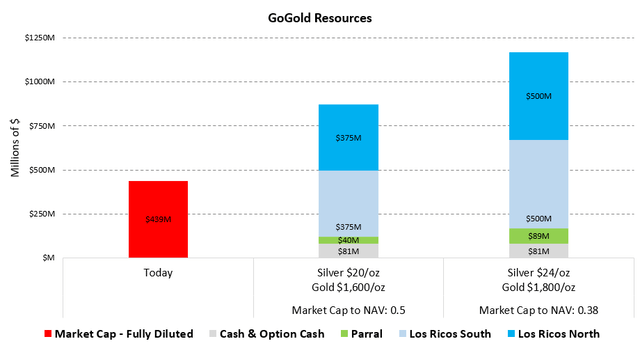

The below chart illustrates my estimated valuation for the various components of GoGold at a couple of different metal price scenarios, where the higher metal price scenario is relatively close to spot prices. The valuation relies on the latest share price and financials as of Q3-22. The value of Parral is derived based on estimated cash flows.

For Los Ricos South, I have conservatively assumed a 25% NPV growth from the numbers in the PEA. I have no doubt the actual resource growth will be much more than that given what we are seeing from the Eagle zone and the phase II drilling from the main area, but it is to account for some inflation on the cost side, and a potential pivot towards underground mining rather than open pit mining.

I have recently revised down my estimates for Los Ricos North, given that it might be slightly less amenable to underground mining compared to Los Ricos South. However, given the large resource of 160M AgEq ounces to begin with, not counting the good phase II drilling at Los Ricos North that can be seen in figure 11. I would still conservatively estimate the value to be about 125% of the PEA at Los Ricos South.

Figure 14 – Source: My Estimates

As the chart above illustrates, we are presently trading with a fully diluted market cap to a conservative NAV around 0.4 given today’s spot prices, which is very attractive both on an absolute level and compared to many quality peers.

GoGold has about $74M in the bank as of Q3-22 and is aiming for a construction decision in late 2023 for Los Ricos South. The latest PEA had an initial capital cost estimate of $125M, but the company has recently communicated that the aim is to focus on a smaller operation with bulk underground mining.

So, my expectation would be that the initial capital cost will decrease some and that most of the additional capital needed can be debt financed. Now, we could certainly see a smaller bought deal in late 2023 if the equity market is more accommodative, but the base case is to see relatively little equity dilution going forward. The substantial insider ownership at GoGold minimizes the risk of large value destructive capital raises.

As with any precious metals miner and silver miners especially, there will always be significant stock price volatility due to the commodity risk, which investors should be aware of. The biggest risk is otherwise the permitting risk for Los Ricos South. We have lately seen very few open pit projects get approved in Mexico, where the delays were initially caused by covid, but the government has also made less than encouraging comments about open pit projects. It is presently difficult to get a clear answer on this point though.

For Los Ricos South and GoGold, the difficulty in permitting open pit projects might not be as big of a roadblock as for other projects. The company has already started working towards an underground project, where a trade-off study is being conducted. The even higher grades at the Eagle zone have also made underground mining more appealing for Los Ricos South regardless of the permitting landscape. The potential permitting challenges with open pit mining impacts Los Ricos North slightly more given the marginally lower grades, but that project is quite a few years from permitting, by which time these open pit permitting challenges might no longer be an issue. I have regardless lowered my estimated value of Los Ricos North until we get more clarity on this point. I have little doubt underground mining is an option in some of the Los Ricos North areas as well, but possibly not for all of them.

Another risk is inflation, both regarding operating costs and especially the construction costs, where we have seen some horrible cost overruns in the industry recently. The focus on a smaller operation for Los Ricos South with a 1,500 tpd mill rather than the 5,000 tpd mill that was part of the PEA will hopefully make it easier to control costs. The PFS should provide much more insights on costs in the second half of 2023 as well.

Conclusion

GoGold is a cashed-up quality silver development company with a smaller producing asset, which offsets substantial share dilution that is otherwise so prevalent in the industry. The stock is presently out of favor due to heavy selling from some of the larger passive ETFs in industry, where their rules have provided active investors with an excellent opportunity to buy low.

I have covered the company for more than 4 years now and management has proven to be very trustworthy. The approximately 20% insider ownership is something I value with GoGold.

My expectation is for a 75% to 100% upside in the next 12-24 months without higher metal prices, provided the Los Ricos South permit is approved. More significant exploration success or higher precious metal prices can offer much more upside than that.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment