Pavliha/E+ via Getty Images

Quest Diagnostics (NYSE:DGX) is a company I’ve been reviewing for a few years and updating on for some time. Now, I’ve been waiting for the right time to get into DGX for a bit, and the time might be coming for us to do just that.

However, Quest Diagnostics has some challenges that need to be considered before you go straight into investing in the business here. In this article, I’ll show you what I’m looking at with regards to this, and what makes this business a bit trickier.

Since my last article, the company hasn’t dropped even 6%. It gives it a bit more appeal, but indexes have dropped far more – and it also doesn’t include the concerns I have for DGX.

Here I’ll show them to you.

Updating on Quest Diagnostics

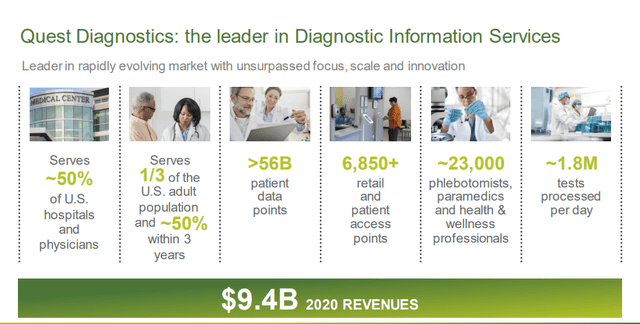

The fundamentals of Quest are well-established. The company serves a large portion of US hospitals and physicians, which by itself denotes quality and upside for a business like this. The combination of servicing hospitals and physicians with tests and the like, as well as being among the national leaders in overall patient data (1.8M tests per day, 6800+ access points nationwide), make the company, at least theoretically, excellent.

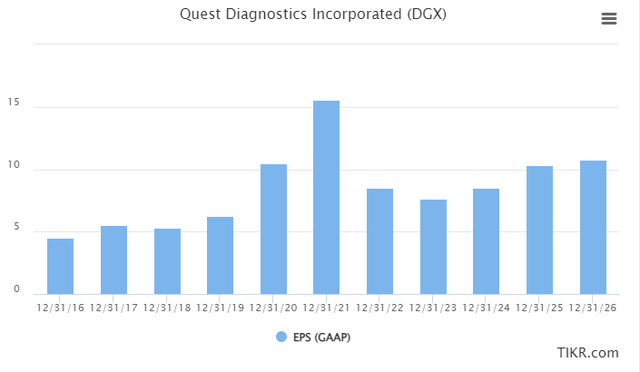

And remember – market share itself here is an argument. Lab tests in the US are an $80B+ billion market, and DGX is among the leaders here. The problem is that COVID-19 brought to the company a massive, non-recurring windfall of cash due to testing. Since that began, the company has been trading up, its normal EPS growth cycle is broken, and its valuation metrics are distorted. Because COVID-19 testing is as non-recurring as it is in the long-term, there’s an expected overall dropoff in earnings/profits over the next few years, even with the company’s non-COVID 19 growth.

Yes, COVID-19 testing might not disappear anytime soon – but even the company expects those volumes to start to drop off in the coming months and quarters.

As I mentioned in my previous article, I expect the company’s earnings growth related to this to disappear in 2022-2024. Even with the company establishing new partnerships, the avenue to keeping that growth going, and that valuation going in turn, seems slim at best.

Quest Diagnostics Presentation (DGX IR)

The picture that investors should focus on when looking at DGX is therefore two-fold.

The fundamental picture, which is absolutely fine and where DGX is a stellar company with a superb lab market exposure and market share, and that’s really made a windfall of cash from emergency use authorizations from COVID-19, that has enabled the company to push ahead with growth and expansion plans as well as multiple crucial strategic partnerships.

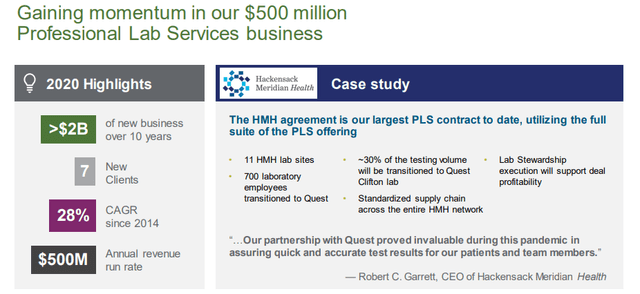

It’s also wrong to say that the company has no plans to accelerate growth outside of COVID-19. The company has plenty of plans to do just that. A combination of Health plan expansions, Hospital health systems, Advanced diagnostics, and direct-to-consumer testing – all of these are targeting accelerated revenue growth, new revenue sources, and increased market shares for the coming few years that the market may well be underestimating the company’s earning ability based on these upsides.

DGX targets a 2%+ accreditive, annual growth in revenues, and a 2022-2024 revenue growth of 4-5% specifically, with a 7-9% adjusted EPS growth during these years. The company has also made plenty of progress on the way through its foray into health plans, and its excellent positioning in hospital health systems.

However, none of these advantages or positives fully address the earnings issue that we have looking at us from over the horizon – which is the drop-off from COVID-19 testing. S&P Global analysts currently expect GAAP EPS to come in at declines for the next two consecutive years, where earnings drop to well below $8/share, less than half the level of 2021, which was the “high” for the company. A normalized earning number, pre-COVID for DGX was close to $6/share on an annual basis.

Therefore, the company is a play between these two things – COVID-19 trends and drop-offs, and how quickly the company can address the shortfalls and bring back other sources of new revenue, and revenue growth, which can prop things up here. The analysts believe this upward trend to materialize – at least eventually – but we may be looking at 2025 or 2026 before we see numbers that come even close to those seen in 2020-2021.

This brings me to my current, updated valuation thesis for Quest Diagnostics – which is worth considering if you’re interested in the company.

Quest Diagnostics – The Valuation

In my last article, I called quest Diagnostics “too volatile”. My reasoning for this stance is easy to show you. It’s based on the 2022-2024E EPS, which is expected to decline. I do not want to buy a company that’s overvalued on future earnings, even if that company is qualitative. It would, to me, be like trying to swim upstream, and that is before considering what sort of macro we’re in.

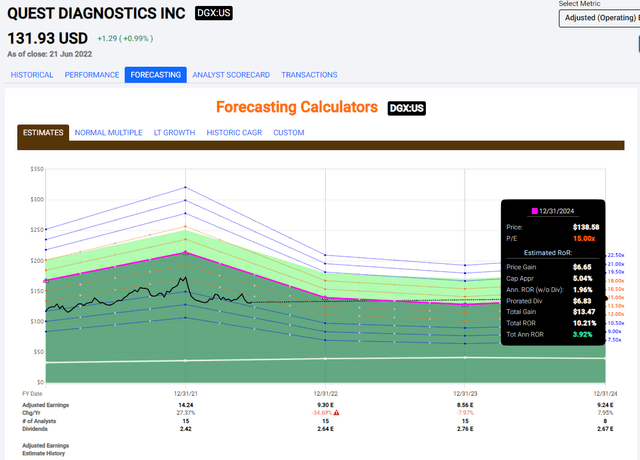

Add the two together, and it’s my stance that the combination is absolutely toxic for your returns until 2024-2025E. Quest Diagnostics based on 2021-2022 EPS trades at around a 10X P/E – but for any normalized level, it’s closer to 16-17X. This might be in line with UBS’s price target of $139, at current prices of $140, but it’s still above my PT.

I want a 10-12% conservative upside to a good valuation. I don’t get that here. A conservative FV upside to a 15X P/E at today’s valuation gives us an annualized RoR of less than 4% until 2024. It’s better than in my last article, but it’s very far from “good”.

Quest Diagnostics Upside (DGX IR)

So despite the company having dropped from its highs, I don’t believe it fair or accurate to call DGX “undervalued” here. There are a number of years in front of it of EPS likely lower than we’ve seen until now. As you can see from FactSet forecasts, these analysts actually consider the EPS upside higher than S&P Global – yet returns are still well under 5% when considering a 15x forward P/E.

This nicely summarizes the issue with DGX today. Forward earnings are going to be negative for the foreseeable future, at least until 2024-2025. This is not something I or other analysts expect on our own – it’s the company’s own forecast and commentary regarding its numbers and trends. This is the company’s own forecast.

Even if the company slightly outperforms, which I doubt, the resulting returns wouldn’t be all that impressive anyway. There are dozens of companies, given current macro, that would offer investors higher potential upsides here.

S&P Global gives us a price target for DGX with a range of around $129 up to $185, with an average of $147. My own PT is closer to $115 now, which would give the company an insufficient upside at today’s price.

I’ve looked for forecast adjustments that could justify the higher upside that other analysts are giving the company here. I’ve found none to do this. The company is BBB-rated and has low leverage, but also a low yield and doesn’t have the growth-related upside I’d want to see with companies where I would invest at such multiples seen to historical and future levels.

Because of this, I remain unconvinced that despite the company’s quality, this marks a good investment in today’s market. What I would rather do with my money at this time is to put it to work in companies that offer me a better valuation, and better upside, as well as a better overall yield.

It’s because of this, that I consider this company to continue to warrant a “HOLD”.

Thesis

The DGX thesis is this:

- This is a great player in the healthcare services/lab market. It has the proven and admirable ability to make attractive returns from superb customers and markets. At the right price, this company is a definite “BUY” to me.

- However, at $140, this company is too expensive. I currently don’t see an appealing RoR for the company based on current valuations.

- I would be interested at $120/share.

- DGX is a “HOLD”.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

DGX is currently a “HOLD”.

Be the first to comment