utah778

[The company reports in Canadian dollars, so the figures in this article are in CAD$ unless otherwise noted.]

goeasy (OTCPK:EHMEF) (TSX:TSX:GSY:CA) is the largest subprime consumer lender in Canada that was founded in 1990. It aims to become a one-stop provider for all forms of credit to non-prime consumers. It has a presence in all 10 provinces in Canada.

At the end of 2021, goeasy saw growth opportunities in the province of Quebec, which is the second-largest province by GDP, making up about 20% of the nation’s GDP and represents a large untapped market opportunity. Other areas of focus include Toronto and Vancouver, where there’s high population density.

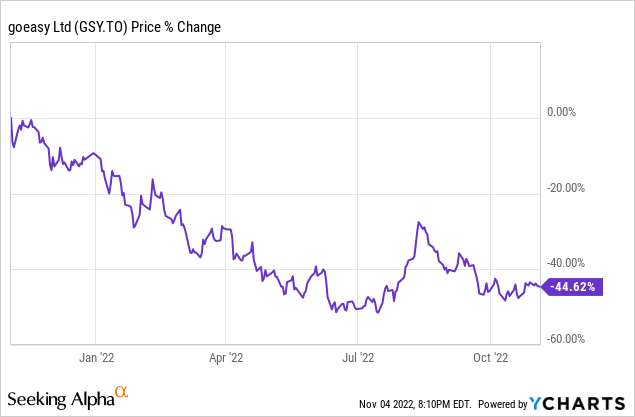

The stock had a super run-up during the pandemic, supported by quantitative easing at the time. Additionally, because of the quantitative tightening that has occurred this year, including rising interest rates, consumers are spending less and economic growth is declining. Consequently, the stock has been under immense pressure, falling off a cliff by close to 45% in the last 12 months.

The dividend didn’t remotely help, as even after accounting for dividends, the stock’s total return was still -43% in the period. This is the short-term pain that investors must endure for the potential of long-term wealth creation.

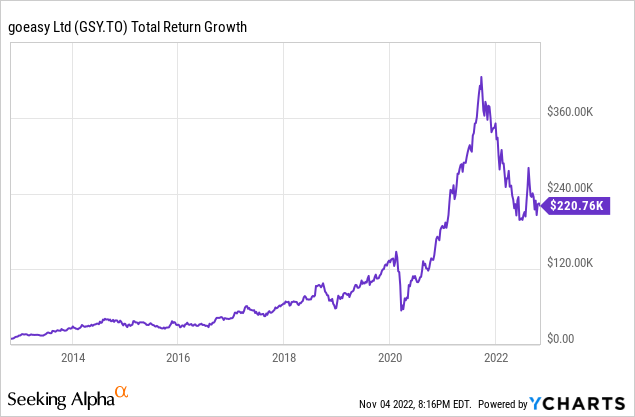

Despite this considerable correction, the stock still delivered extraordinary total returns of 36.3% in the last 10 years — fabulous returns versus benchmarks iShares S&P/TSX 60 Index ETF’s (TSX:XIU:CA) and SPDR Portfolio S&P 500 Growth ETF’s (SPYG) returns of 8.3% and 13.2%, respectively, in the period. Below is a graph showing the growth of an initial investment of $10,000 in GSY stock.

This was a golden period during which the Canada interest rate remained low and allowed the company to grow.

You can compare the 2 graphs above. Particularly, when interest rates were close to 0% in the period after the onset of the pandemic in 2020, goeasy stock had a super rally. However, it gave back a lot of gains when rising interest rates were forecasted and in progress.

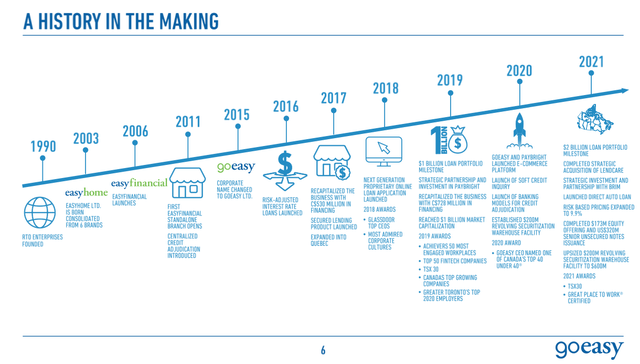

goeasy’s Track Record of Growth

Over the decades, goeasy has found ways to grow — expanding its product range, distribution channels, and geographic footprint. goeasy launched and grew its easyhome and easyfinancial brands across the country from roughly 2000 to 2020.

From 2011 to 2021, it increased its adjusted earnings per share (“EPS”) at a compound annual growth rate of 29.1%. Its next leg of growth is coming from continued product, channel, and geographic expansion complemented by M&A.

For example, in April 2021, goeasy acquired LendCare for $320 million. It partly funded the acquisition with a $172.5 million bought deal equity offering of subscription receipts at $122.85 per subscription receipt, which was a fair multiple of about 11.8 times 2021 adjusted earnings.

In a related press release, Jason Mullins, goeasy’s President & CEO stated, “By widening our range of near-prime products and adding new industry verticals to our point-of-sale lending channel, we accelerate our growth and expand our addressable portion of the $200 billion non-prime consumer credit market.”

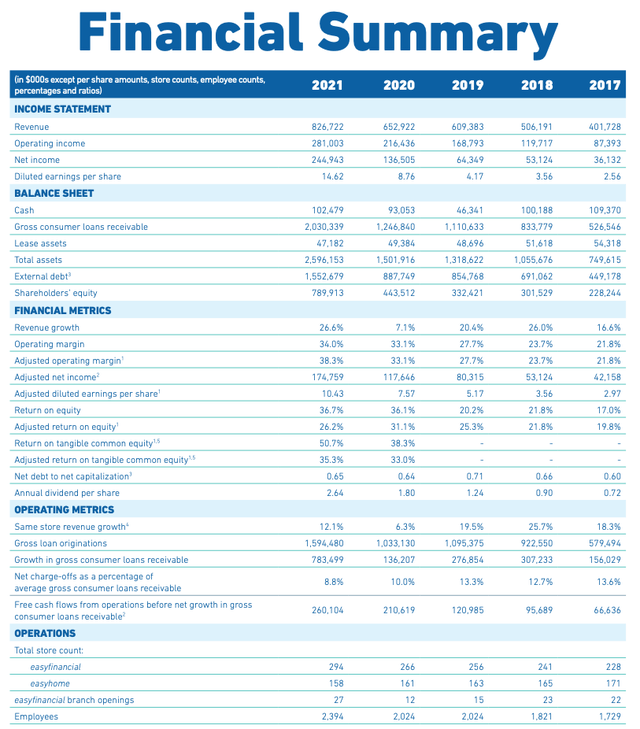

Here’s a quick glance at its financial summary data, which showed a double of revenues, a triple of operating income, and 5.7x diluted EPS in the period, as well as high returns on equity (“ROE”). An expansion of operating margin helped in its rising profitability. It expects to further expand its operating margin steadily to 37%+ by 2024.

goeasy’s five-year adjusted ROE is 24.8%. Its ROE actually spiked higher in 2020, helped by lower cost of revenue, as there was an abundance of money supply at the time, such as from government program handouts during the pandemic.

Recent Results

In the first half of the year, goeasy reported record revenue of $434 million, up 30% year over year. As well, operating income jumped 38% to $165 million. Adjusted net income rose 15% to $92.6 million and climbed 12% on a per-share basis. (Adjusted earnings were adjusted for the acquisition of LendCare, corporate development costs, and fair value mark-to-market impact on investments.)

Look out for goeasy’s Q3 results to be released after the market closes on November 10 as well as the earnings call on November 11.

Valuation

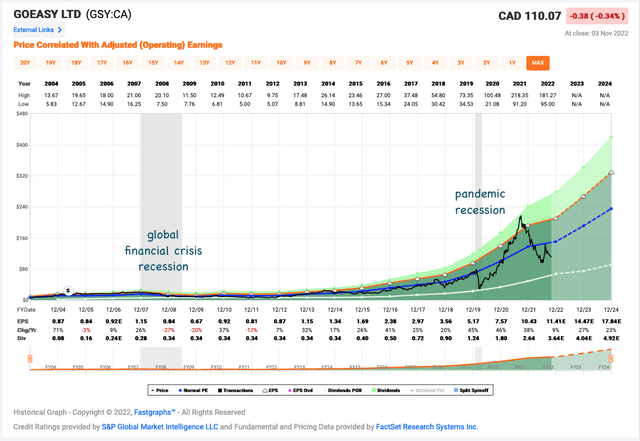

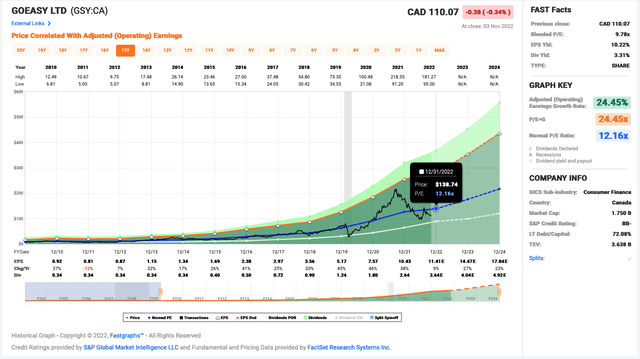

At under $110 per share, the growth stock trades at about 9.8 times its blended earnings, which is a discount of approximately 20% from its long-term normal valuation.

Some analysts think the stock is even cheaper than that. Across 9 analysts, goeasy stock has an average 12-month price target of $199.20, which is a gigantic discount of 45% that could translate to near-term price appreciation of 81%.

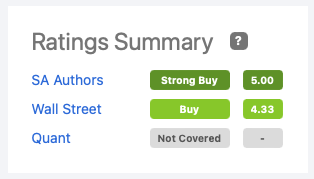

goeasy also earns a “Strong Buy” rating from SA Authors and a “Buy” rating from Wall Street. I’ll soon add my “Buy” rating to the mix. I’m hesitant to recommend it as a Strong Buy because of the current unfavourable macroeconomic environment (quantitative tightening and rising interest rates).

Seeking Alpha

Dividend

goeasy has paid an increasing dividend every year since 2015. Its 5-, 10-, and 15-year dividend growth rates are 39.5%, 22.7%, and 17.3%, respectively. Its payout ratio is estimated to be sustainable at about 32% of adjusted earnings this year. The dividend stock offers a yield of about 3.3%.

Risks

If goeasy is a great value and a long-term winner, why isn’t more investors piling into the stock right now? Every stock comes with risks.

High-Risk Customers

goeasy targets high-risk customers. These are non-prime customers who aren’t able to borrow from traditional means. So, they end up using goeasy’s products and services and paying higher interest rates to goeasy.

For instance, its target net charge-off rate for 2022 and 2023 is 8.5% to 10.5%. That said, goeasy also has the objective to help its customers improve their financial position.

In our direct lending channels, our team…takes the time to walk our customers through their credit report to help them better understand the steps to improve their credit score… By progressively offering our customers lower rates of interest for on-time payments… we aim to help our customers reduce their cost of borrowing and put them on a journey back to qualifying for credit from a traditional bank. — 2021 Annual Report

Additionally, goeasy filters its customers carefully. It has taken more than a decade to develop and refine its models, which are “statistically 2x more predictive at projecting loss risk than a generic credit score.”

Systematic Risks

As mentioned earlier, quantitative tightening and rising interest rates are depressing goeasy stock’s valuation. But this is happening across the stock market, particularly to growth stocks that had high multiples before, which is why growth stocks has generally had the largest price decline in this market downturn.

Recessions can also drive a huge sell-off in the stock. Many economists, including a report from Royal Bank of Canada (RY)(TSX:RY:CA), forecast a recession to occur in Canada as soon as Q1 2023.

However, perhaps due to its improved underwriting process over the last +10 years, in the pandemic recession, it did not experience a huge cut in its adjusted earnings as it did during the global financial crisis recession.

F.A.S.T. Graphs with author annotation

Investor Takeaway

A percentage of the Canadian population will always be non-prime and require products and services from goeasy. As goeasy continues to expand its products, channels, and geographic presence, it should sustain above-average growth.

goeasy is a higher-risk but higher-growth dividend stock that pays a decent dividend yield of 3.3% with a 15-year dividend growth rate of 17.3%. Its S&P credit rating of BB- is non-investment grade. The undervalued stock could be an excellent addition to a diversified stock portfolio to help accelerate growth while providing a nice, safe dividend.

Assuming a 15% adjusted EPS growth rate and a P/E expansion to its long-term normal P/E, the stock can approximately deliver annualized returns of 22.8% over the next five years. If materialized, it could double investors’ money in about 3 years and 2 months.

Be the first to comment