landbysea

Note: I have covered Globus Maritime (NASDAQ:GLBS) previously, so investors should view this as an update to my earlier articles on the company.

Last month, small, Greece-based dry bulk shipper Globus Maritime reported anticipated record results for the first six months of 2022. The company generated $24.2 million in cash from operating activities as market conditions remained strong.

In fact, it has been a busy first half for the company with the decision to order three fuel-efficient Ultramax newbuildings for an aggregate purchase price of $107.8 million. The new vessels are scheduled to join the fleet over the course of 2024.

In addition, Globus Maritime managed to partially refinance the recently acquired Kamsarmax vessel Orion Globe with the company’s existing lender at favorable terms which should result in a $18 million cash inflow in the current quarter.

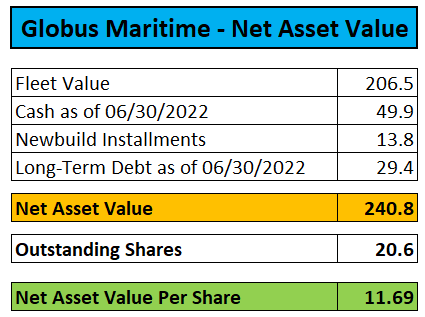

As a result of the company’s strong first half earnings and ongoing strength in secondhand vessel values, net asset value (“NAV”) per share has increased to approximately $11.70:

Company Press Releases / Compass Maritime

In recent months, the discount to NAV has widened to almost 90% as dry bulk charter rates have weakened substantially across all market segments due to a combination of rapidly easing port congestion and underwhelming demand from China.

In addition, the company’s decision to order new vessels ahead of a likely recession apparently increases Globus Maritime’s risk profile quite meaningfully.

With shares trading at a close to 90% discount to NAV, one would expect the company buying back stock hand over fist but with management and directors in aggregate owning a paltry 3.8% of outstanding common shares, interests aren’t really aligned here.

In fact, the CEO is currently extracting approximately $2 million in cash from the company on an annual basis by means of a consultancy agreement and massive bonus payments.

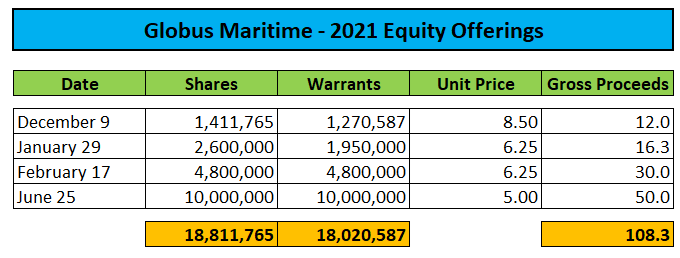

In addition, Globus Maritime has a history of diluting common equity holders.

In aggregate, the company raised $108.3 million in gross proceeds from four registered direct offerings between December 2020 and June 2021.

Since the company’s 1:100 reverse stock split almost two years ago, outstanding common shares have increased by more than 10,000% to approximately 20.6 million.

The offerings also included large numbers of warrant sweeteners with potential to further dilute common equity holders.

Company SEC Filings

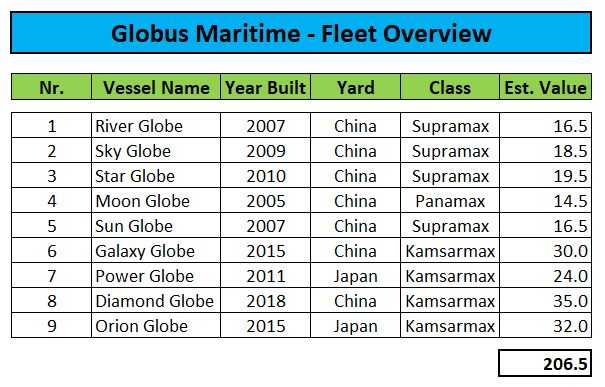

Management has been using the funds to expand the company’s fleet from five to nine vessels over the past couple of quarters:

Company Press Releases / Compass Maritime

While I do not expect Globus Maritime to raise additional equity anytime soon, the company’s tainted history in combination with weaker market conditions and the above-discussed newbuilding risk will likely keep investors sidelined.

Bottom Line:

While Globus Maritime’s shares are trading at bargain levels, weaker market conditions and a heightened risk profile have resulted in the eye-catching discount to NAV widening even further in recent months.

At this point, I do not expect a near-term catalyst to emerge thus my decision to downgrade the shares from “Buy” to “Hold“.

Be the first to comment