gorodenkoff

Note:

I have covered Boxlight Corporation (NASDAQ:BOXL) previously, so investors should view this as an update to my earlier articles on the company.

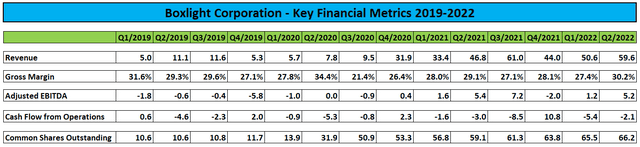

Last month, Boxlight Corporation or “Boxlight” reported better-than-expected second quarter results and affirmed full-year guidance of $250 million in revenue and $26 million in Adjusted EBITDA.

For the seasonally strongest third quarter, management expects to deliver greater than $70 million in revenue and $10 million in Adjusted EBITDA.

To achieve the company’s full-year targets, Boxlight would have to deliver a similar performance in the seasonally weaker Q4. Asked about this issue by an analyst on the conference call, new CFO Gregory Wiggins provided some additional granularity:

Jack Aarde

Okay. Great. Jack Aarde is here, analyst at Maxim Group. Congrats on the solid results guys and welcome aboard to Greg Wiggins, CFO. Congrats on that. A couple of questions for me. I’ll start with a question on guidance. So the third quarter guidance greater than $70 million of revenue, and you maintained the ’22 revenue guide is strong growth. This seems to imply a stronger than typical seasonality in the fourth quarter. Perhaps it’s due to FrontRow or maybe something else. Can you just speak to how much variability maybe your upside is in that $70 million-plus revenue target for the third quarter? And then also if there’s any shifting seasonality dynamics in the fourth quarter?

Gregory Wiggins

Yes. So thanks, Jack. Pleasure the introduction as well. So you’re right, it does from our forecast to project a strong Q4 with a little bit of stronger Q4 then probably under — in the past. However, as we guide forecast for Q3 as we’re guiding north of $70 million and $10 million in adjusted EBITDA. You note that the strength of Q3 will somewhat depend on the level we need in Q4 as well. I think where we kind of look at this is, the pipeline is very strong. We’ve got a strong amount of back orders currently in play. So while there could be potential timing between Q3 and Q4, I think we could potentially see a little bit stronger Q3, which may impact what we ultimately need to do in Q4. But I think for the second half of the year, we’re certainly seeing strong pipeline such that we would meet our full year guidance of $250 million.

Adjusted gross margin of 30.2% came increased to its best level in eight quarters helped by higher-margin contributions from the recently acquired FrontRow Calypso business, reduced manufacturing costs and some easing in freight expense.

Going forward, the company should see substantial benefits from rapidly decreasing container freight rates.

Unfortunately, Boxlight experienced additional cash outflows in Q2 and ended the quarter with $11.6 million in cash and cash equivalents and $59.9 million in debt under its new credit facility with WhiteHawk Capital Partners (“WhiteHawk”).

During the quarter, the company’s weak financial condition resulted in the requirement to amend the credit facility for a second time within just two months at considerably worse conditions (emphasis added by author):

The Second Amendment to the Credit Agreement was entered into for purposes of the Lender funding a $2.5 million delayed draw term loan and adjusting certain terms to the Credit Agreement, including adjusting the Applicable Margin (as defined in the Second Amendment) to 13.25% for LIBOR Rate Loans and 12.25% for Reference Rate Loans, increasing the definition of change of control from 33% voting power to 40% voting power, requiring the Company to engage a financial advisor and allowing additional time, until July 15, 2022, for the Company to come into compliance with certain borrowing base requirements set forth in the Second Amendment to the Credit Agreement, among other adjustments.

During the six-month period ending June 30, 2022, the Company repaid principal of $1.3 million and interest of $3.6 million to Whitehawk.

At the increased rates, annual interest obligations for Boxlight calculate to approximately $10 million.

The company’s ongoing borrowing base issues likely resulted in the requirement to raise additional equity in July:

Boxlight Corporation, a leading provider of interactive technology, digital signage, classroom audio, and services, announced today that it has entered into a securities purchase agreement with a single institutional investor to purchase approximately $5.0 million of its shares of common stock (or pre-funded warrants in lieu thereof) and warrants to purchase common stock in a registered direct offering. The combined purchase price for one share of common stock (or pre-funded warrant in lieu thereof) and one warrant to purchase one share of common stock will be $0.68. Under the terms of the securities purchase agreement, Boxlight has agreed to sell 7,352,940 shares of common stock (or pre-funded warrants in lieu thereof) and warrants to purchase up to an aggregate of 7,352,940 shares of common stock. The warrants will be exercisable six months from the date of issuance, will expire five and a half years from the date of issuance and will have an exercise price of $0.68 per share of common stock.

Boxlight received $4.6 million in net proceeds but in combination with the 7.35 million warrant sweeteners, the offering has the potential to increase outstanding shares by more than 20%.

Please remember that the company will be required to repay $8.5 million to WhiteHawk until February 28, 2023.

In order to comply with the terms of the amended credit agreement, the company will have to either generate substantial free cash flow or raise additional equity as otherwise Boxlight would be in danger of missing out on the scheduled $8.5 million credit facility repayment early next year.

Bottom Line

Boxlight reported better-than-expected Q2 results and affirmed full-year targets but restrictive credit facility conditions apparently resulted in the requirement to further dilute common shareholders at the beginning of Q3.

With $10 million in annual interest obligations and the requirement to repay $8.5 million under the credit facility within the next five months, common equity holders might have to prepare for additional dilution.

That said, H2 results are likely to benefit from significantly reduced freight costs which should boost margins even further.

Given the potential for an upside surprise, highly speculative investors and traders should pay close attention to the company’s third quarter report in November but at this point, I would suggest to remain on the sidelines.

Be the first to comment