NicoElNino

Summary

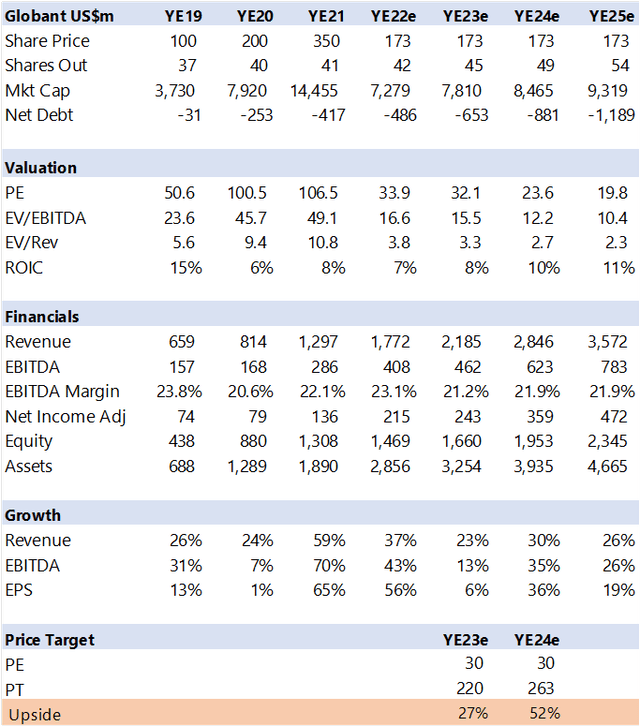

I’m updating Globant S.A. (NYSE:GLOB) estimates and price target, incorporating 3Q22 results, 4Q22 guidance, and a slower growth scenario in 2023, as clients may look to reduce or focus IT spending faced with a demand slowdown as well as cost pressures. The situation is far from dire, and I see Globant a key growth company with solid cash flow generation and reasonable valuations relative to growth.

Results update

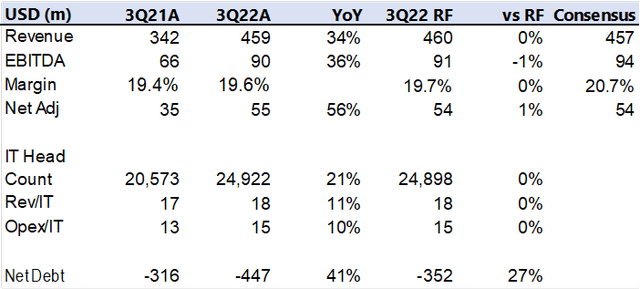

The company reported marginally lower results vs. consensus and my estimate but guided for a strong 4Q22. Some of this is due to M&A, where acquisitions closed post 3Q22. The key 3Q22 take away was very solid pricing power, as seen in revenue per IT headcount growth of 11% while total headcount grew 21% YoY.

Globant 3Q22 Review (Created by author with data from Globant and Capital IQ)

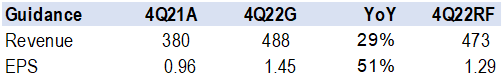

Guidance for 4Q22 is substantially above my previous estimate and was initially well received by the market until Disney (DIS) 3Q22 results and guidance spooked investors. DIS is one of Globant’s key clients, with over US$200m in revenue, or 11% of total.

Globant 4Q22 guidance (Created by author with data from Globant)

Reducing 2023 growth outlook

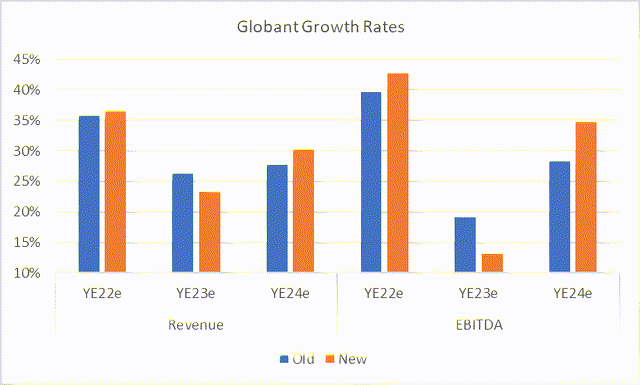

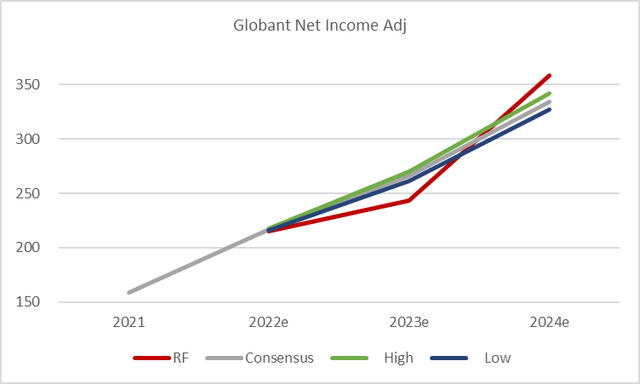

The Disney guidance along with many other job-cut announcements and generally less optimistic demand and margin scenario for 2023 provoked a revision of Globant’s growth potential. My previous estimate looked for revenue growth of 26% in 2023, which I lowered to 23%. This has a bigger impact on margins, given wage pressures and EBITDA grows 13% vs 19% previously. As can be seen, I am now below consensus for Net Income in 2023. The key to the 2023 outlook will be Globant’s guidance post 4Q22 results, at which time I hope to be wrong.

Reducing Revenue and EBITDA (Created by author with data from Globant )

Consensus Net Income estimates (Created by author with data from Globant and Capital IQ)

That said, recent comments from Globant management continued to support an above-average growth story. Globant’s key services drive productivity and efficiencies.

Globant Management comment on 3Q22 results call (Created by author with data from Globant)

Valuation

In addition to lower estimates, I also reduced the P/E target to 30x vs 35x on lower growth and higher Fed Funds rates for longer. I continue to believe Globant warrants a significant premium to the tech sector on its outstanding business track record, sector focus, and high cashflow.

Financial and Valuation Summary (Created by author with data from Globant)

Conclusion

Despite the near-term turbulence, Globant is a secular growth company in a large and growing addressable market. It is highly profitable, free cash flow positive, and has excellent earnings visibility. Globant valuation is not cheap, but reasonable vs. its growth. In my view, Globant can deliver 20%+ annual growth for the next 5yrs.

Be the first to comment