RelaxFoto.de/E+ via Getty Images

NORW, a slightly better option than ENOR

Investors looking for access to Norwegian equities have a couple of options to choose from; there’s the iShares MSCI Norway Capped Investable Market Index ETF (ENOR) and then there’s the Global X MSCI Norway ETF (NORW) which was formerly known as the Global X FTSE Nordic Region ETF. There’s not much difference between ENOR and NORW, particularly as they both track the same index- the MSCI Norway IMI 25/50 Index, but when it comes to cost efficiency and yields, NORW just about beats in all categories; NORW’s expense ratio works out to 0.5%, vs 0.55% for ENOR, whilst you also get a slightly better yield of 2.44%, as against the corresponding figure of 2.28% for ENOR. Not that this should be a major deciding factor in your selection process but it,’s also worth noting that NORW has been around for a longer period of 12 years, versus ENOR’s history of 10 years; during this time NORW has built up AUM to the tune of $73m (ENOR’s AUM- $52m).

There are both good and bad macro factors to consider before pursuing NORW.

Growth outlook

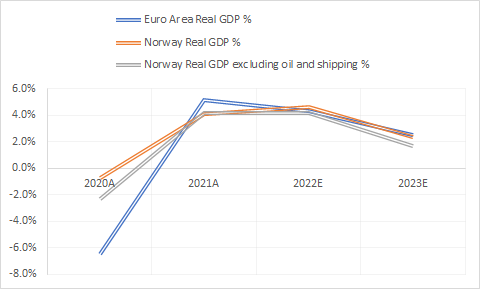

If you consider the growth forecasts laid out by the OECD, it’s something of a mixed bag for Norway. Unlike the Euro area which will see real GDP fall from 5.2% in 2021 to 4.3% in 2022, Mainland Norway (excluding the contribution of oil and shipping) will serve as a beacon of stability with growth expected to come in at 4.2% for the second successive year. But after that, the outlook doesn’t look so great as growth is expected to collapse to 1.7% in 2023 even as the Euro area grows by 2.5%. Having said that, if you include oil and shipping in the GDP picture things look a lot rosier with growth expected to expand to 4.6% in 2022, from 4.1% in 2021 before declining to 2.4% in the following year (largely in line with the Euro area).

OECD

Domestic consumption dynamics

One of the key drivers of Norwegian GDP over the next two years will likely be the trend of private consumption spending. This is poised to surge by 7.9% in 2022 but it is also the variable that will see the biggest drop off in 2023, coming in 520bps lower (particularly on account of the transmission of tighter monetary conditions). Pandemic-induced stimulus and restrictions during 2020 and 2021 have helped the household savings rate (as a % of disposable income) surge to double-digit levels; at the end of 2021, this likely stood at 13.4%. You would think this would translate into fairly strong consumption spending in the months ahead, particularly as the country is now poised to come out of pandemic restrictions that were put in place in December. Work-from-home restrictions will be lifted whilst restaurants will be permitted to serve alcohol beyond 11pm. Mobility and the tourism sector too could get a boost as the country has also lifted the previous 10-day quarantine mandate that was required for visitors from abroad. According to OECD, the Norwegian hospitality sector is witnessing a strong spike in job vacancies. What also works for Norway’s health system is that over 75% of the population has been vaccinated with two shots whilst half the population has also received a booster shot. All in all, it’s worth noting that the Norwegian consumer confidence indicator is at its highest point since Q3-19.

How will overleveraged households cope with policy normalization?

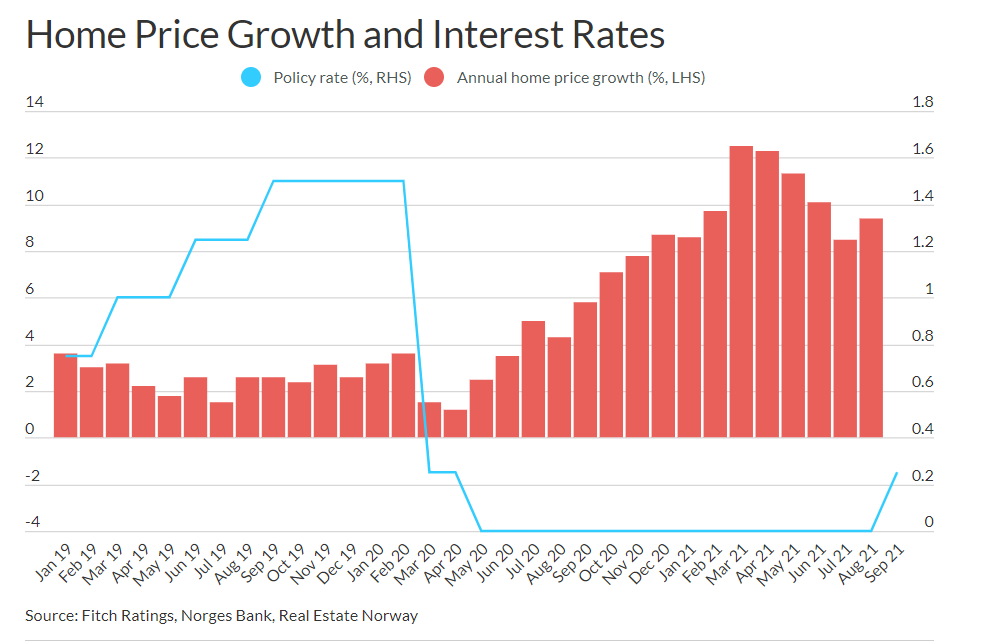

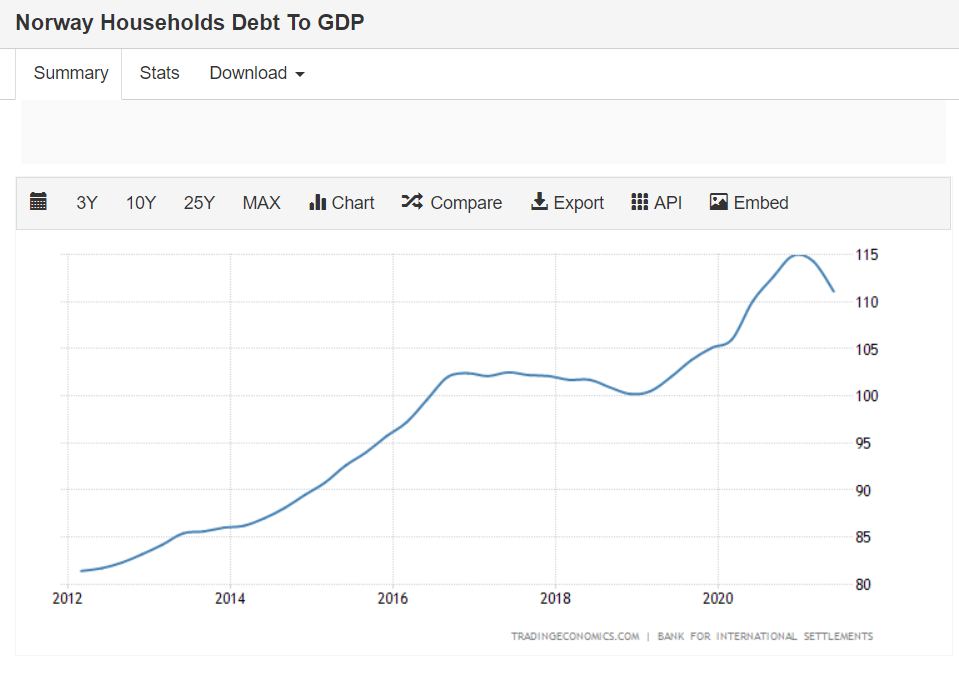

As you can see from the image below, the Norwegian central banks’ loose monetary policies during much of the pandemic era have served as a notable cog in driving housing inflation in Norway. House price growth which was previously below the 4% mark until H1-20, spiked to levels of 10-12% growth. In addition to a hot housing market, also note that aggregate debt taken on by Norwegian households has been greater than the level of GDP for a few years now.

Fitch Ratings

Trading Economics

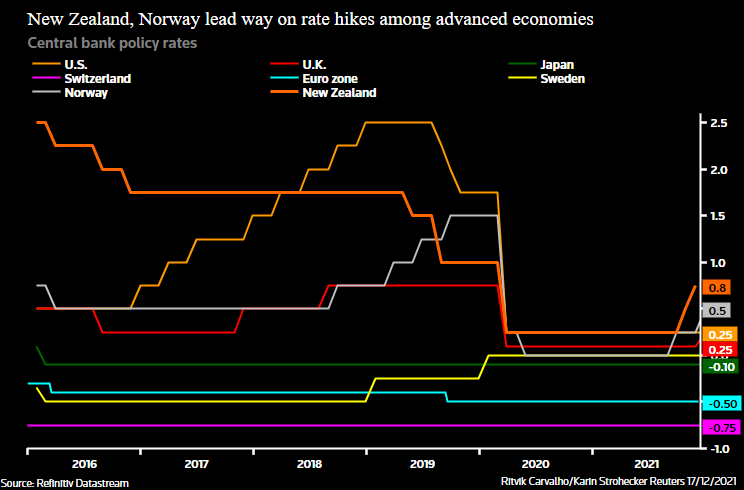

A hot housing market coupled with excess household leverage is a tricky concoction to manage and this has prompted the Norwegian central bank to be at the forefront of the global rating tightening cycle alongside its New Zealand counterpart. The Norges Bank had hiked its benchmark policy rate last September and then followed it up with another hike in December. It is now believed that rates will be hiked three more times in 2022, taking the key rate to 1.25-1.5% by the end of this year.

Reuters

There are some signs that the bank’s efforts may be paying off; for instance, the existing house price index has been on a downward spiral over the last four months, whilst domestic loan debt growth too has been sliding and came in at its lowest mark since March. The risk here is that they tighten so aggressively that it jeopardizes consumption spending. We’ll have to wait and see how this pans out.

Krone and savings banks to benefit

Nonetheless, the Norges Bank’s aggressive pivot with interest rates should continue to support the performance of the Norwegian Krone even as the ECB continues to be fairly conservative in its approach. Besides this, the bank also has a long-standing policy of buying Krone on a daily basis to help fund public spending initiatives. A Reuters poll expects the Norwegian Krone to hit levels of 9.8 versus the Euro by the end of 2022. This would imply further appreciation of 2%.

The pivot in rates will also be very useful for the trajectory of the net interest margins (NIMs) of over 100 savings banks which account for 45% of the retail lending market. Given the policy environment for much of the last two years, NIMs have understandably been under pressure. These banks are more reliant on the traditional banking activities (accepting deposits and giving out mortgages), and don’t have the requisite diversity that their larger peers have.

Commodity export momentum to slow

The NOK and the Norwegian economy also benefit from the country’s long trade surplus position. Do note that as recently as Dec-2021, the country’s trade surplus hit record highs of NOK 106bn; much of this was driven by the shipments of higher shipments of mineral fuels, lubricants and related materials which were up by 233%; incidentally, these products have traditionally accounted for nearly half of Norway’s export portfolio.

Trading Economics

Norwegian exports are currently growing at over 100% levels, but I don’t believe this is sustainable. The country has benefitted from large increases in natural gas prices even as it increased supplies across Europe, but I feel the situation may have peaked here for now and we should see some normalization in the months ahead. Russian supply has spiked in recent days whilst the weather patterns too are expected to normalize. Higher wind output from Germany and UK will also ease the pressure on gas-fueled plants.

Bloomberg

The other interesting thing to note is that Equinor which is NORW’s top-holding benefits immensely from high spot prices in the gas market. Alongside Gazprom (both these entities account for 60% of European supplies), Equinor is one of the few entities that have short-term contracts predominantly linked to prices of gas traded on exchanges. Previously most contracts were long-term based and linked to the price of oil. Market reports suggest that Equinor has been making billions of dollars in extra revenues per month on account of spot trading.

Closing thoughts

Stockcharts

As far as valuations go, it doesn’t appear as though there’s much of an edge in holding Norwegian equities relative to the European equities in general. NORW trades at a weighted average forward P/E of 13.3x, in line with the iShares Core MSCI Europe ETF which trades at 13.7x. Even if you look at the relative strength ratio to better understand how these two ETFs are positioned, I’d say the picture is quite inconclusive.

Be the first to comment