Vertigo3d

The Macro Picture

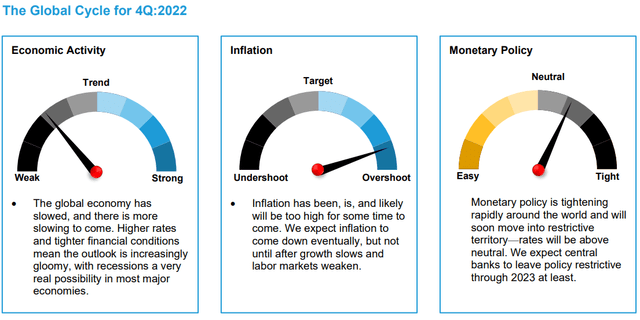

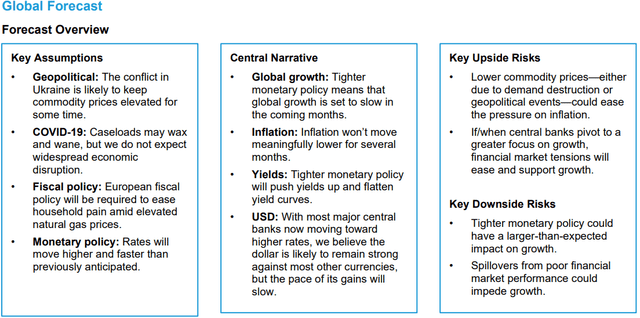

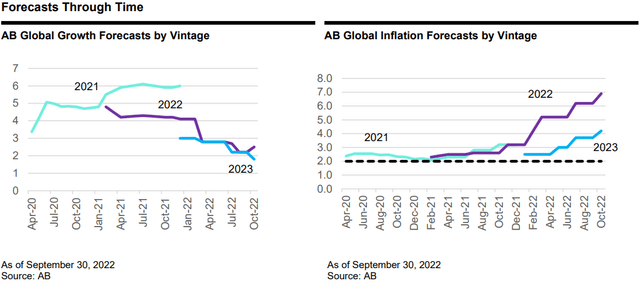

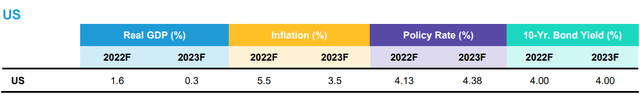

Inflation remains persistently high, dominating everything else in the macro outlook. Because inflation is too high, real growth is slowing; the probability of a near-term recession has risen sharply; monetary policy is rapidly tightening; and financial markets have been repeatedly buffeted by volatility. Inflation is the key variable going forward.

The primacy of inflation poses a massive challenge, because no inflation model is sufficient to give investors or policymakers a high degree of confidence in the future path of prices. While broad brushstroke observations about inflation are reasonably reliable over time, they tend to work across decades, not months.

For example, we have argued for years that rising populism and deglobalization would drive inflation higher in future – but is today’s inflation what we anticipated? Not at all. We expected, and continue to expect, inflation to be slightly above pre-pandemic levels in the future, but we certainly did not anticipate the recent massive spike in prices, nor would we attribute that spike primarily to populism or to deglobalization.

Central bankers rely on a relationship between the labor market and inflation, correctly observing that tighter labor markets generally drive inflation higher. But models based on that premise badly underestimated the magnitude of the current price shock as well. The net result is that central bankers are, to paraphrase one of Federal Reserve Chair Powell’s speeches, stumbling around in the dark, trying to avoid running into the furniture in their efforts to set policy.

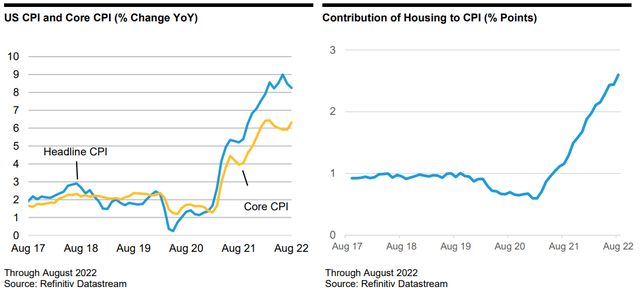

As we see it, the near-term picture suggests that inflation will remain elevated. In the US, core inflation (excluding energy and food) is set to outpace headline inflation, driven largely by increasing shelter costs. We believe that the roughly 20% rise in home prices over the last year has yet to be fully felt in the inflation data.

In the 2007/2008 cycle it wasn’t until 15 months after home prices peaked that shelter inflation began to move lower. If that experience repeats in this cycle, it won’t be until next summer before shelter inflation moves lower, and shelter is the largest category within the inflation basket.

The labor market remains strong as well, and that should keep services prices elevated. We expect price pressure from services to be sufficient to keep overall core inflation elevated even though goods prices are decelerating as global supply chains reboot and energy prices decline.

In Europe and the UK, soaring natural gas prices mean that inflation will stay close to 10% for the remainder of the year. It is alarming that European natural gas prices remain almost 10 times their precrisis levels as the winter heating season approaches.

This is clearly a result of the Russian invasion of Ukraine, and inflated prices may not be the worst of it: if supplies are limited owing to the war, energy rationing may be necessary this winter, which would very likely throw the European economy into a sharp recession rather than the milder version we anticipate.

Smaller developed-market economies, too, are suffering from high inflation. In Australia, New Zealand and Canada robust housing markets have pushed prices higher. And in Scandinavian countries commodity prices have pushed inflation higher as well. Simply put, there are no western developed economies immune to rising inflation.

It is often observed that the best cure for rising prices is rising prices. The logic is that, if left alone long enough, rising prices will eventually hurt consumers to the extent that they pull back on purchases, reducing demand and rebalancing the system.

While that may be true, it would be a brave central banker indeed who chose to try that particular experiment in the current environment. Even if this laissez-faire approach did work, “eventually” would very likely be an intolerably long time to wait.

As a result, central bankers are not relying on high prices to self-correct, and we are in the midst of a very aggressive cycle of rate hikes. Policymakers around the world are moving rates by 50, 75 or even 100 basis points (b.p.) at a clip, scrambling to slow demand enough to bring inflation under control.

We believe that process has significant room yet to run and anticipate at least another 100–150 b.p. of tightening from major central banks in the next few months.

The tightening that has already taken place is beginning to have an impact—there are signs of an economic slowdown globally. Housing markets are cooling sharply as mortgage rates rise, and tighter financial conditions are dampening growth in general.

We think there is much more economic pain to come. It will simply not be possible for central banks to bring inflation under control without slowing growth and weakening labor markets. While in “normal” times, market participants might view a central bank raising rates into an economic recession as a policy mistake, in this environment we think it may be necessary to do just that.

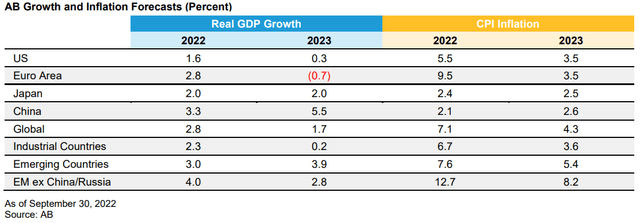

We expect a recession in both the eurozone and in the UK, with growth likely to be consistently negative for several quarters. In the US, we forecast growth to be at or near zero for several quarters: better certainly than in Europe, but not good in any absolute sense.

Whether that is officially determined to be a recession or not is a semantic question rather than a substantive one – the outlook is gloomy, no matter what words one wishes to use to describe it.

That said, it’s important to put our expectations in context. While inflation is putting immense pressure on the global economy, we believe that this too shall pass. Central bankers are taking the appropriate steps to bring inflation down.

While that process will be painful, we believe that it will eventually be successful. Even during what will be challenging months to come, there are reasons to expect that the coming downturn will be minor compared with past recessions. Household finances, buoyed by pandemic-era stimulus, are robust, corporate balance sheets are strong, and the global financial system does not seem particularly vulnerable to asset price bubbles.

That means that rather than a sharp downturn, we expect a milder, grinding slowdown that persists for several quarters but does not cause the same economic and social dislocation as the last two recessions.

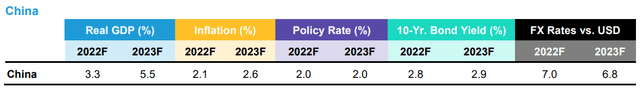

We also expect the Chinese economy to rebound in 2023 after a poor performance in 2022. This year’s growth was plagued by repeated bouts of COVID-related shutdowns and bottlenecks in global trade. Both seem to be fading, and the political imperative to keep growth on its medium-term upward trajectory should lead to increasing support as 2022 turns into 2023. While that won’t be enough to push the global economy onto a faster growth path, it is another reason to expect the coming downturn to be milder rather than more severe.

What does this mean for financial markets? Until inflation is declining in a sustainable way, investors should not expect support from central banks. Quite the contrary: one of the primary ways that monetary policy transmits to the economy is through financial markets.

Higher interest rates, lower equity prices and wider credit spreads are, unfortunately, part of the solution to the inflation problem. Much of the work has already been done, but we think it is nonetheless premature to sound the all-clear. We expect market volatility to be with us for the next several months at least.

Outlook

- Inflation remains too high, but the primary driver has switched from goods to services. Because services prices tend to be more persistent than goods prices, that rotation means inflation is likely to stay higher for longer.

- Rate hikes from earlier this cycle are already weighing on activity, most notably in the housing market. We expect that impact to persist and for the slowdown to broaden into other sectors of the economy.

- Rate hikes are set to continue, and the rapid pace of monetary tightening is yet another reason to expect growth to slow.

Risk Factors

- If inflation does not fall as expected the Fed’s plan to raise rates to only moderately above neutral will be at risk – and every rate hike increases the odds of a hard landing.

- Commodity prices pose two-sided risks. Falling gasoline prices were a welcome relief over the summer, but geopolitics remain uncertain, and prices could go either up or down from here.

Overview

With each month of elevated inflation, the path toward an economic soft-landing narrows. Worryingly, it is now services inflation in general, and shelter inflation specifically, that is the primary driver of price pressures. Because there is a lag between the peak in house prices and the time at which those prices become evident in inflation data, we expect that inflation will remain elevated well into 2023. That means that the Federal Open Market Committee is unlikely to pivot to a focus on growth for several months, if not quarters, to come.

As long as the Fed remains in tightening mode, financial markets will remain under stress. Tighter financial conditions are a precondition for rebalancing the economy, so market turbulence serves the central bank’s purpose at this stage in the cycle: investors should not expect the Fed to ride to the rescue.

We expect the policy rate to rise beyond 4% and to stay there for a prolonged period; that means that growth in 2023 is likely to be modest at best. We anticipate several quarters of growth averaging around 0% quarter on quarter. The National Bureau of Economic Research may or may not eventually determine it to be a recession; it won’t feel good irrespective of what it is eventually called.

The good news is that both household and corporate fundamentals start this downturn in solid shape. Even as the labor market weakens, as we expect it will, strong household finances should cushion the blow. That won’t prevent a slowdown, but we expect it will be enough to prevent a downward spiral.

Risks, however, remain – if inflation does not begin to moderate soon, the mild recession that seems likely at this stage could become something more severe. Conversely, if inflation comes down faster than expected, policymakers may have less work to do than appears likely at this stage. These are uncertain times, and the key variable to monitor is inflation.

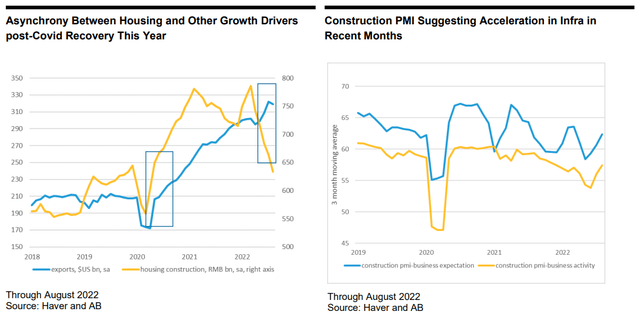

Outlook

- China’s economic growth has rebounded in the third quarter after a significant contraction in the second, but the magnitude of the rebound has been weaker than expected so far. This is primarily because of slower recovery in private demand due to multiple shocks, including the resurgence of COVID-19, hot weather, suspension of mortgage payments and power shortages. One key difference from the post-COVID rebound in 2020 (when the housing recovery was synchronized with other drivers) was that housing investment didn’t rebound following the April shock, but continued to weaken significantly. Private investment recovery in the manufacturing sector has also been weaker. On the other hand, government-supported investment, like infrastructure investment and high-end manufacturing, has been strong and accelerating in recent months. This tug of war between still-sluggish private demand and stronger public demand has been driving growth dynamics in recent months.

- Therefore, in order to achieve sustainable recovery, it’s important for the government to support private demand so far as possible, and especially to stabilize housing activity. In the meantime, continued strong fiscal support is also much needed.

Risk Factors

- Material uncertainty remains around COVID-19 developments, although our baseline assumes no more outbreaks like Shanghai’s and less draconian local restrictions.

- Slower and/or weaker than expected recovery in housing activity—if sentiment around the sector doesn’t improve or even gets worse—could pose downside risks for growth.

Overview

In addition to COVID-19 (which is still creating significant uncertainty), two key variables are important for the growth outlook in coming months—policy support and housing recovery. Regarding policy, continued strong fiscal support is much needed.

Following the policy support from the first batch of RMB300 billion of infrastructure funding, and the frontloading of this year’s local government special bond quota, there is another batch of at least RMB300 billion infrastructure funding set up in September, along with an additional RMB500 billion local government special bonds to be issued before October.

And the People’s Bank of China will also lend another RMB200 billion in the fourth quarter to support investments upgrading equipment. These incremental measures are necessary to support government-driven investment in coming months, amid the still-nascent recovery in private demand.

Since the fourth quarter last year, despite support from the notably larger policy efforts than the same period in the 2014–16 recovery cycle, housing activity hasn’t picked up appreciably. The major factors, in addition to the COVID-19 shock, could include worsening expectations for housing prices and income/employment, less accommodative mortgage supply and a mismatch between local policy relaxation and downward pressure across cities.

Sustainable stabilization in housing activity needs improvement across all these variables. It’s very likely that housing policy will ease further. But the impact on housing sentiment remains unclear. Stabilizing expectations for house prices and the housing sector is important.

Delays in housing completions and the recent suspension of mortgage payments has weighed on expectations, which could potentially create a negative feedback loop. Therefore, guaranteeing housing completions – and so avoiding a negative feedback loop – is one of most important tasks currently for the government.

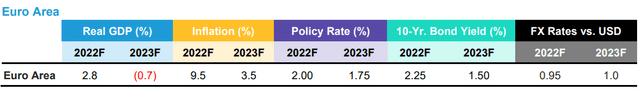

Overview

We expect the euro-area economy to slide into recession in the coming quarters. Real incomes are falling in the face of a massive natural gas price shock that is pushing inflation to unacceptable levels. The risk of fuel rationing as winter approaches is very real and would make an already unpleasant outlook even worse.

There are no good options for the European Central Bank (ECB). High inflation has been largely commodity-based but is now developing into a broader phenomenon, and this is forcing higher policy rates just as the growth outlook deteriorates. The ECB has no choice: its inflation-fighting mandate dictates that it continues with higher rates, though we expect that the central bank will reverse course sooner than most peers in 2023.

Fiscal policy will likely do what it can to ease pain on households. We hope that means targeting support programs that keep houses warm and businesses open in the winter. But if natural gas supplies are durably disrupted by the war in Ukraine, fiscal policy alone won’t be enough, and the economy will slide still further.

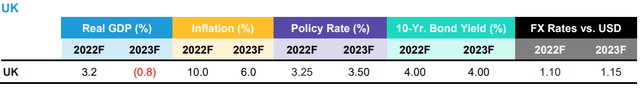

Overview

The Truss government takes office in challenging times. Inflation is far too high and, were it not for the recently announced natural gas price caps, would move higher still in October and beyond. Even with prices capped, inflation may breach 10% later this year, a rate unseen in decades. Nonetheless, the government appears prepared to embark on a very large fiscal stimulus that is intended to support growth but that is likely also to delay the convergence of inflation to target.

To date, growth has held up reasonably well in the UK, buoyed by a strong labor market. But slowing activity globally, and in the euro area specifically, will slow the economy; so too will the accumulated weight of natural gas tariffs on households that are losing ground in real income terms.

The Bank of England, like other major central banks, has little choice but to continue raising rates, especially considering the fiscal program announced late in the quarter. As in the euro area, diminishing household financial wherewithal may limit the scope of rate hikes somewhat, but that’s more likely a 2023 story than a 2022 story – for now, rate hikes will continue.

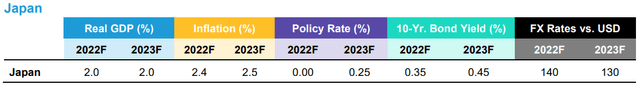

Japan is an outlier. Inflation has yet to reach 2.0% on a sustainable basis, leaving the Bank of Japan (BOJ) as the only major developed-market central bank not to move toward tighter policy. The yen has continued to weaken as a result and, while it is very cheap by most measures of fair value, until the BOJ changes its tune, additional weakness is more likely than is strength.

We continue to expect the BOJ eventually to move in the same direction as other central banks and to tweak its yield-curve control policy in the coming months. That should open the door for modest rate hikes next year, though the BOJ is likely to lag far behind its global peers in the pace and magnitude of tightening policy.

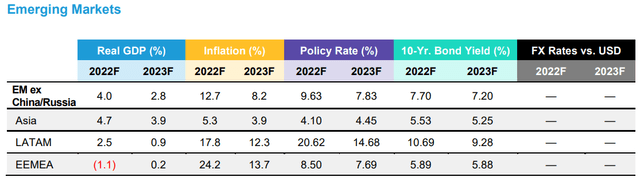

Outlook

- Emerging Markets (EM) remain under pressure due to the rising cost of capital, the drainage of global liquidity, and multiple external headwinds.

- EM assets might already be discounting much of the adverse cyclical and structural shifts, but the challenging global growth outlook and EM fundamental fragility still argue for caution in the near term.

Risk Factors

- The war in Ukraine is perhaps the riskiest known unknown.

- China’s growth trajectory and growth composition also hold risks for EM.

Overview

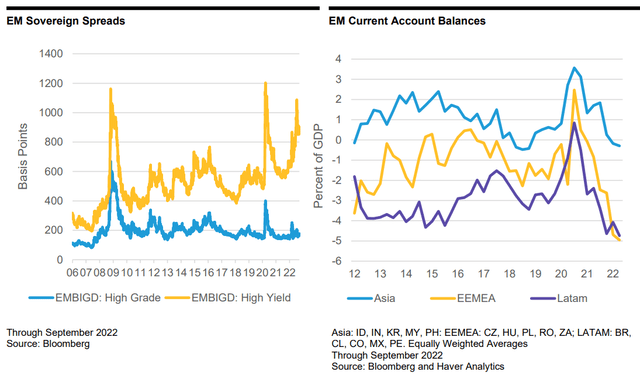

Emerging Markets (EM) remain under pressure due to the rising cost of capital, the drainage of global liquidity, and multiple external headwinds, ranging from the adverse effects of the war in Ukraine to economic underperformance in China. We think that many of these global macro pressure points could remain in place over the next 6–12 months.

Add persistent US-dollar strength to the equation, and it becomes even more difficult to see relief for EM asset prices in the near term. The final quarter of the year could remain bumpy as developed-market central banks move toward their terminal policy rates.

But with the slowdown in global growth in train and more disinflationary signals appearing, it might not be long before central banks pause their hiking cycles. In EM, quite a few central banks seem to be either at (Brazil) or very close to pausing (Chile, Colombia, Czech Republic, Hungary and Poland).

The gloomy global growth outlook could still hinder the speed and magnitude of any potential recovery in EM asset prices, and new shocks might shift prices into an even weaker range. But we think EM assets might already be discounting much of the adverse cyclical dynamics that are in train, and potentially also the adverse structural shifts that have been triggered by the pandemic and the war in Ukraine.

The war in Ukraine is perhaps the riskiest known unknown. Despite an initial focus on the South, the Ukrainian military made sudden advances in Eastern Ukraine recently, claiming back significant areas from Russian occupying forces. It highlights the increasing capability of the Ukrainian military (recently supplied with more US equipment), as well as potential supply and morale problems among Russian troops. Ukrainian military success increases tail risks of an escalation of the conflict by Russia.

China’s growth trajectory and growth composition also hold risks for EM. This year’s economic underperformance in China can largely be ascribed to its pandemic policies and weakness in the housing market. These headwinds might fade next year, but even if economic growth in China accelerated to a 5%–6% range, the pass-through to EM growth is likely to remain in structural decline.

Fiscal and external balances have improved over the past two years in some larger EMs, as the withdrawal of pandemic stimulus, and higher tax receipts from both rebounding growth and high inflation, have reduced vulnerabilities. But many frontier EMs continue to struggle to regain their footing, despite some also benefiting from rising commodity prices.

This has contributed to significant divergences in sovereign spreads with idiosyncratic drivers becoming more dominant in the weaker end of the credit spectrum. Even larger EMs have seen an unwinding of the external buffers that facilitated fiscal consolidation. So, while we think that EM assets might already be discounting much of the adverse cyclical and structural shifts, the challenging global growth outlook and fundamental fragility in the EM space still argue for caution in the near term, in our view.

Investment Risks to ConsiderThe value of an investment can go down as well as up and investors may not get back the full amount they invested. Past performance does not guarantee future results. Important Information Note to All Readers: The information contained here reflects the views of AllianceBernstein L.P. or its affiliates and sources it believes are reliable as of the date of this publication. AllianceBernstein L.P. makes no representations or warranties concerning the accuracy of any data. There is no guarantee that any projection, forecast or opinion in this material will be realized. Past performance does not guarantee future results. The views expressed here may change at any time after the date of this publication. This document is for informational purposes only and does not constitute investment advice. AllianceBernstein L.P. does not provide tax, legal or accounting advice. It does not take an investor’s personal investment objectives or financial situation into account; investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service sponsored by AB or its affiliates. Note to Canadian Readers: This publication has been provided by AB Canada, Inc. or Sanford C. Bernstein & Co., LLC and is for general information purposes only. It should not be construed as advice as to the investing in or the buying or selling of securities, or as an activity in furtherance of a trade in securities. Neither AB Institutional Investments nor AB L.P. provides investment advice or deals in securities in Canada. Note to European Readers: This information is issued by AllianceBernstein Limited, a company registered in England under company number 2551144. AllianceBernstein Limited is authorised and regulated in the UK by the Financial Conduct Authority (FCA -Reference Number 147956). Note to Readers in Japan: This document has been provided by AllianceBernstein Japan Ltd. AllianceBernstein Japan Ltd. is a registered investment-management company (registration number: Kanto Local Financial Bureau no. 303). It is also a member of the Japan Investment Advisers Association; the Investment Trusts Association, Japan; the Japan Securities Dealers Association; and the Type II Financial Instruments Firms Association. The product/service may not be offered or sold in Japan; this document is not made to solicit investment. Note to Australian Readers: This document has been issued by AllianceBernstein Australia Limited (ABN 53 095 022 718 and AFSL 230698). Information in this document is intended only for persons who qualify as “wholesale clients,” as defined in the Corporations Act 2001 (Cth of Australia), and should not be construed as advice. Note to Singapore Readers: This document has been issued by AllianceBernstein (Singapore) Ltd. (“ABSL”, Company Registration No. 199703364C). AllianceBernstein (Luxembourg) S.à r.l. is the management company of the portfolio and has appointed ABSL as its agent for service of process and as its Singapore representative. AllianceBernstein (Singapore) Ltd. is regulated by the Monetary Authority of Singapore. This advertisement has not been reviewed by the Monetary Authority of Singapore. Note to Hong Kong Readers: This document is issued in Hong Kong by AllianceBernstein Hong Kong Limited (聯博香港有限公司), a licensed entity regulated by the Hong Kong Securities and Futures Commission. This document has not been reviewed by the Hong Kong Securities and Futures Commission. Note to Readers in Vietnam, the Philippines, Brunei, Thailand, Indonesia, China, Taiwan and India: This document is provided solely for the informational purposes of institutional investors and is not investment advice, nor is it intended to be an offer or solicitation, and does not pertain to the specific investment objectives, financial situation or particular needs of any person to whom it is sent. This document is not an advertisement and is not intended for public use or additional distribution. AB is not licensed to, and does not purport to, conduct any business or offer any services in any of the above countries. Note to Readers in Malaysia: Nothing in this document should be construed as an invitation or offer to subscribe to or purchase any securities, nor is it an offering of fund-management services, advice, analysis or a report concerning securities. AB is not licensed to, and does not purport to, conduct any business or offer any services in Malaysia. Without prejudice to the generality of the foregoing, AB does not hold a capital-markets services license under the Capital Markets & Services Act 2007 of Malaysia, and does not, nor does it purport to, deal in securities, trade in futures contracts, manage funds, offer corporate finance or investment advice, or provide financial-planning services in Malaysia. Important Note For UK and EU Readers: For Professional Client or Investment Professional use only. Not for inspection by distribution or quotation to, the general public. The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P. www.AllianceBernstein.com © 2022 AllianceBernstein L.P. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment