Tempura/E+ via Getty Images

GIC Holds Steady

Global Industrial Company (NYSE:GIC), which operates in the industrial and MRO product sales in North America, focuses on territory sales management programs to build relationships. The private brand remains a critical focus because of its high-profit margin. The company’s end-to-end purchase, service, and digital and multi-channel sales help improve operating margin.

On the other hand, sales headwinds in Canada and commodity price inflation can mitigate a part of the expected profit gains. The demand side, too, remains uncertain given the evolving COVID situation. Although cash flows decreased in FY2021, normalization of inventory balances can reduce the pressure on working capital requirements. The stock is reasonably valued versus its peers. I do not see strong drivers that can move the stock in either direction. Still, investors might want to hold the stock in the short-to-medium term, given the recent dividend hike.

Marketing Activity And Strategies

One of the key strategies for GIC is to strengthen the private label and private brand strategy, which has a substantial margin benefit. Marketing initiatives are essential in an industry that deals directly with customers. The company focuses on territory sales management programs to build public sector and private market relationships. The private brand remains a critical focus because of the high-profit margin associated with the private segment. One important initiative undertaken by the company has been the Accelerating the Customer Experience (or ACE), which encompasses customers’ end-to-end purchase, service, and delivery experience. This works with the digital and multi-channel sales model for product category expansion in private brand products. The program aims to drive repeat orders and increases customers’ annual and average spending.

Input Cost Rise And Inventory Cost Management

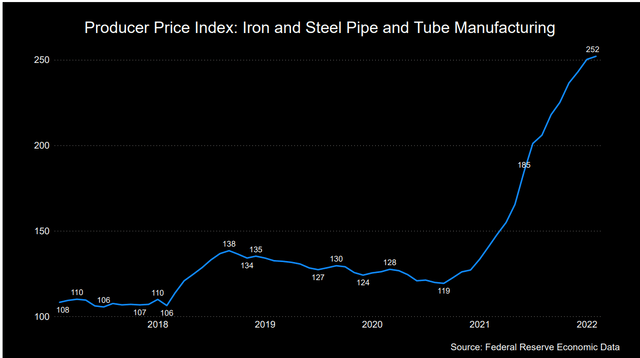

Simultaneously, it keeps broadening the product verticals and leveraging vendor relationships to keep costs down. GIC plans to improve operating profit margin through pricing analytics, higher-margin sourcing channels, and freight optimization. One of its benefits in late-2021 was using lower-cost inventory using the FIFO method. Since the commodity price inflation and wage inflation are eating away much of the profit gains, the above initiative would matter to balance out the cost hike and bring the margin back up. The Producer Price Index for iron & steel products has increased alarmingly (79% up) in the past year until February 2022. So, despite the better product and customer mix, I expect the margin growth to stay muted in the medium term.

Also, during Q4, the company’s SG&A costs went up due to increased marketing investments in product lines and other growth initiatives. For example, it recently started implementing advanced slotting techniques in its distribution centers. The process improvements will increase order processing speeds and enhance productivity. I expect various marketing initiatives to keep the SG&A costs high in 2022.

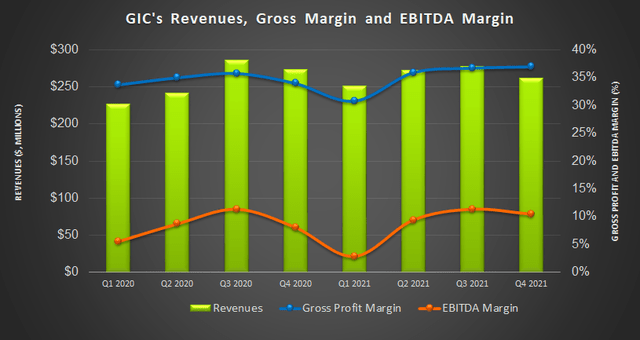

Q4 Drivers And Margin Analysis

The company’s revenues decreased by 5.6% in Q4 2021 compared to Q3. Much of the topline loss can be attributed to lower revenues from Canada following an adverse change in currency and lower PPE sales. The company’s US operation, however, witnessed moderate growth. Higher managed sales channels and e-commerce orders made up the bulk of the order growth in the past year until Q4. Open order book, however, has doubled over the past year. Despite that, the supply chain constraints led to increased variable selling expenses and delays in order fulfillment.

The company’s operating profit increased by 24% year-over-year. As I explained before in the article, the private brand offering improved sales mix and impacted price rationalization, leading to a favorable product margin. Lower FIFO inventory sell-through will continue to mitigate higher input costs in the short term.

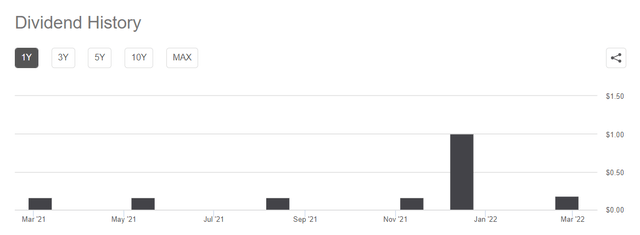

Cash Flows And Dividend

In FY2021, higher working capital requirements pushed GIC’s cash flow from operations (or CFO) lower (27% down) than a year ago. Increased inventory balances following higher freight cost and safety stock and in-transit inventory addition resulted in the CFO fall. So, free cash flow (or FCF) also declined in the past year. The management expects 2022 capex to be in the range of $7 million-$9 million, which is more than double compared to FY2021.

GIC does not have any long-term debt, which puts it in a much more advantageous position than its peers (FAST, MSM, and MRC) as of December 31, 2021. Its liquidity was $81 million as of December 31, 2021. In early 2022, the management increased the quarterly dividend. It currently pays an annual dividend of $0.72, which translates into a 2.24% dividend yield.

Linear Regression Based Forecast

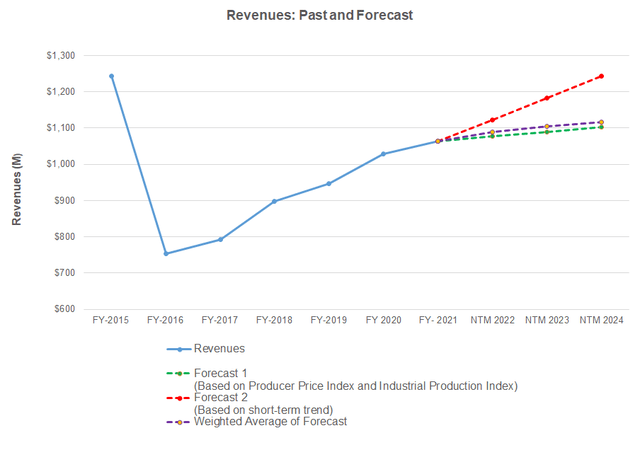

Author created, Seeking Alpha, and FRED Economic Research

Based on a regression equation between Producer Price Indices for iron & steel products, Industrial production Index, and GIC’s reported revenues for the past seven years and the previous four quarters, revenues can remain steady in the following three years.

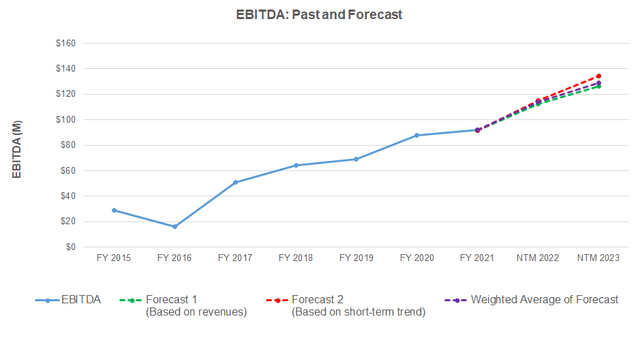

Author Created and Seeking Alpha

Based on a regression model using the average forecast revenues, I expect the company’s EBITDA to increase in the next 12 months (or NTM 2022) and will continue to grow at a more moderate rate in NTM 2023.

Target Price And Relative Valuation

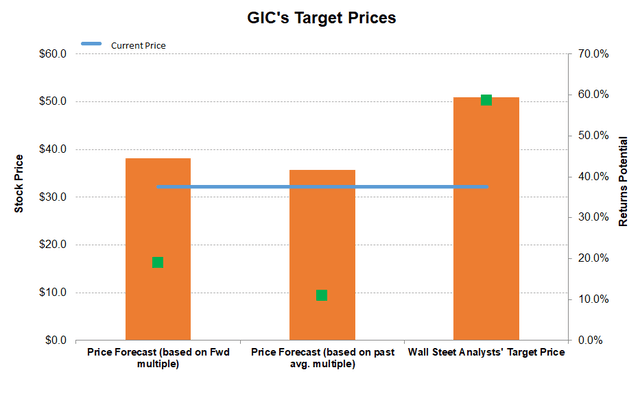

Author Created and Seeking Alpha

GIC’s returns potential (19% upside) using the forward EV/EBITDA multiple (12.6x) is lower (than Wall Street’s sell-side analyst expectations (59% upside) but higher than returns potential (11% upside) based on the past EV/EBITDA multiple.

The company’s EV/EBITDA multiple (14x) is lower than its peers’ (FAST, DNOW, and MRC) average. GIC’s forward EV/EBITDA multiple contraction is less steep than its peers’ EV/EBITDA contraction, typically resulting in a lower EV/EBITDA multiple compared to peers. So, the stock is reasonably valued on a relative basis.

What’s The Take On GIC?

GIC engages in the sale of industrial and MRO products. Since the market is typically fragmented, it focuses on territory sales management programs to build relationships. Therefore, branding, especially in the private segment, remains a key differentiator to earn a high-profit margin. The company’s end-to-end purchase, service, and digital and multi-channel sales help improve operating margin. In Q4, the company’s operating margin expanded.

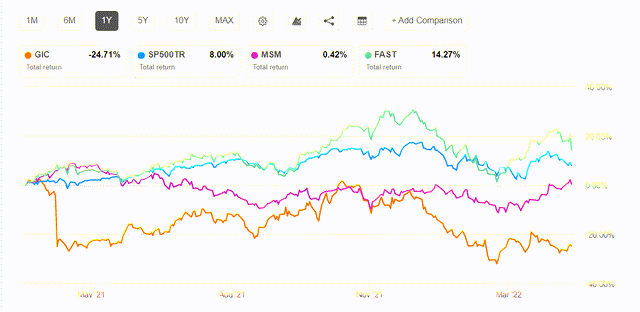

Commodity price inflation and wage inflation are eating away some of the profit gains, as evidenced by the higher producer price index. In Q4, the company witnessed a topline loss in Canada. Also, during FY2021, working capital requirements increased due to higher inventory balances because freight costs and safety stock, and in-transit inventory swelled. As cash flows fell, the stock underperformed the SPDR S&P 500 Trust ETF (SPY) in the past year. Nonetheless, given the relative valuation, I think the stock price will remain steady in the short-to-medium term.

Be the first to comment