ASML corporation office in Silicon Valley Michael Vi

ASML Holding (NASDAQ:ASML) is one of the world’s most influential companies. It’s not a household name, but it’s arguably more important than many companies that are. The company is the only one in the world that makes extreme ultraviolet (“EUV”) lithography systems, which are crucial in building the world’s fastest computer chips. So, companies that design and manufacture chips have no choice but to use ASML’s products. Other companies sell lithography equipment, but are not yet able to produce EUV machines, meaning that ASML has the market cornered on the most advanced equipment.

It’s not a foregone conclusion that ASML’s monopoly will last forever. Some experts believe that rivals will catch up by 2025. China is offering generous incentives for Chinese companies that can build semiconductor equipment. At least one Chinese firm, Semiconductor Manufacturing International, can build 7nm chips, but they aren’t yet capable of EUV lithography.

So, ASML’s competitive position is incredibly strong right now. Perhaps the strongest in the semiconductor industry. In a recent article, I highlighted Taiwan Semiconductor (TSM) as a good company, owing to its majority market share in semiconductor manufacturing. TSM is indeed a great company, but in terms of raw competitive position, it can’t hold a candle to ASML, which literally has no competitors at the high end of its product range!

In economics, monopolies are described as having higher profits than other firms, because their lack of competition gives them pricing power. They are described as having positive economic profits (profits after accounting for opportunity cost), unlike firms in perfect competition, which are only profitable temporarily, and even then, only in terms of accounting profits.

ASML’s recent financial performance is perfectly consistent with the description of a monopoly. In its most recent quarter, ASML delivered:

-

$5.77 billion in sales, up 6.3% from the second quarter.

-

$8.9 billion in gross bookings, up 5.4%.

-

$2.99 billion in gross profit, up 12%.

-

$1.7 billion in net income, up 20%.

-

$4.29 in diluted EPS, up 21.1%.

It was a night and day difference compared to other semiconductor companies. In the same quarter when NVIDIA (NVDA) saw its sales decline 17%, and when Micron (MU) guided for a large decline in earnings, ASML delivered positive growth and guided for even more of it! Clearly this company’s strong competitive landscape was reflected in its financials. In this article I will make the case that ASML is a solid stock because, although it is expensive, it has a strong enough market position to command a premium price tag.

Competitive Landscape

ASML is a company whose main claim to fame is its competitive position. In this article I will take a look at the finer points of how ASML’s technologies stack up compared to those of the competition.

ASML vs SMEE

Shanghai Micro Electronics is perhaps ASML’s best known competitor. You might wonder why I’m describing anybody as an ASML competitor when I just described it as a monopoly a minute ago. The monopoly referred to is in the EUV lithography equipment subset of the lithography market, not the lithography market as a whole. China’s SMEE does have advanced Lithography capabilities, and they have been used to manufacture 7nm chips.

So, how do SMEE’s machines compare to ASML’s?

We can start by looking at the most advanced systems each company offers.

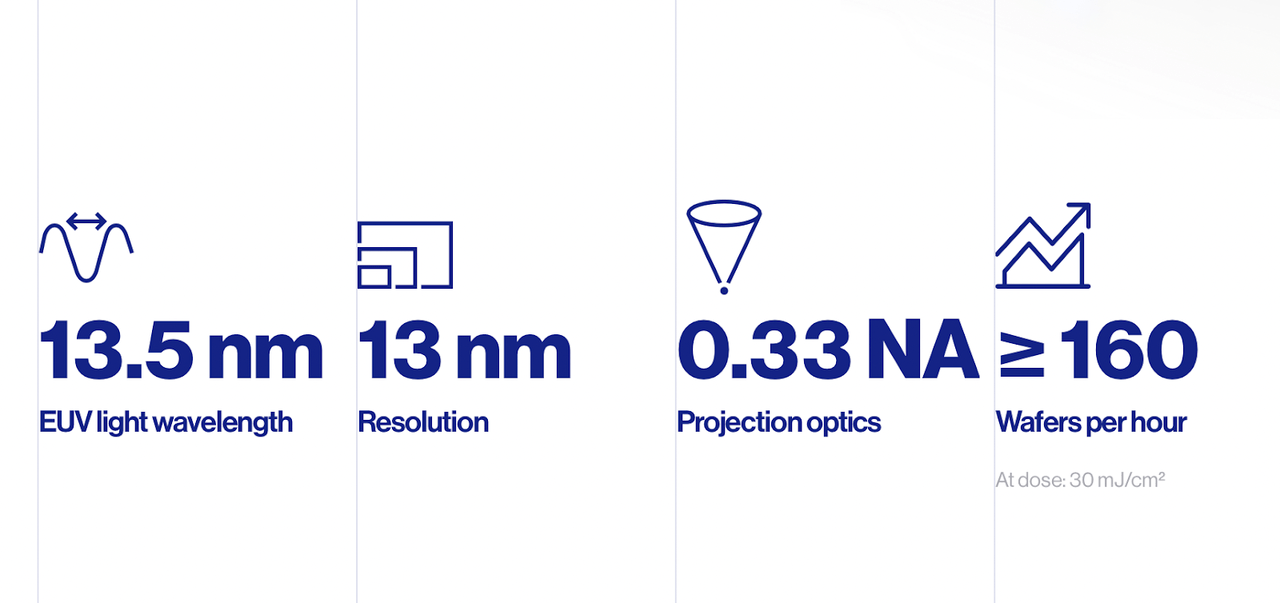

ASML’s most advanced lithography system is the Twinscan NXE:3600D. It uses a 13.5nm wavelength, which is almost x-ray range. It supports 3nm logic nodes. It has 0.33 projection optics and can do more than 160 wafers per hour. It was used to develop advanced chips including Apple’s (AAPL) M2, which features 5nm technology.

Next up we have SMEE. Its most advanced machine is the 600 series stepper, which has a 90nm resolution. This is nowhere near as small as ASML’s highest resolution, but another Chinese company is producing 7nm chips without access to ASML’s EUV machines. China made the jump from 14nm to 7nm faster than any other country, though it’s still well behind Taiwan Semiconductor, which is shipping 5nm chips (for example Apple’s M2) and working on 3nm, 2nm and beyond.

SMEE specs (SMEE)

ASML specs (ASML)

ASML vs Nikon

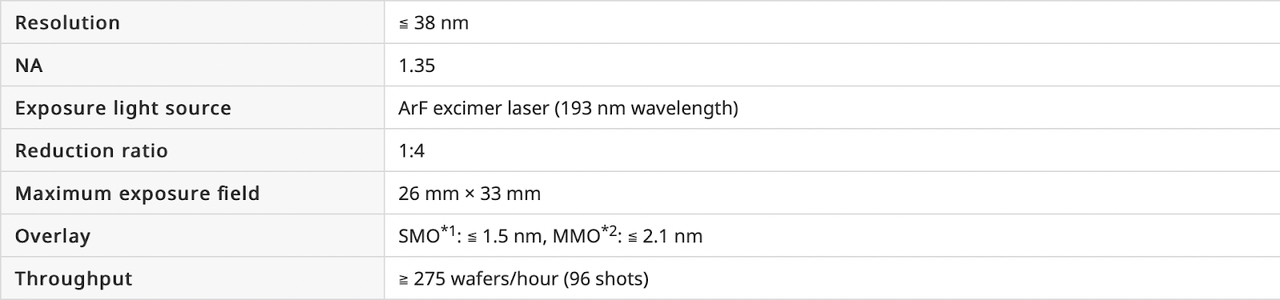

It’s also worth mentioning Nikon’s (OTCPK:NINOY) offerings. Nikon makes a machine called the NSR S-365E which has a 38nm resolution. That is higher than SMEE’s best machine but not quite as good as ASML’s EUV lithography systems. On the whole, a look at SMEE and NINOY’s offerings suggests that ASML’s market position in EUV lithography is rock solid.

Nikon specs (Nikon)

Valuation

Having looked at ASML’s competitive position, we can move on to its valuation. This is the least flatting part of the analysis for ASML, because its stock is rather expensive. However, when a company has a literal monopoly, higher multiples are justified.

According to Seeking Alpha Quant, ASML trades at the following multiples:

-

Adjusted P/E: 42.

-

GAAP P/E: 44.

-

PEG: 1.72.

-

Price/sales: 12.75.

-

Price/operating cash flow: 25.

These are all extremely high multiples. In 2022, we’ve seen tech stocks fall in price, which has resulted in their multiples coming down, but ASML still trades at a steep valuation, scoring an ‘F’ on valuation in Seeking Alpha’s quant system.

However, you need to consider the fact that this company has a truly remarkable market position. When a company has a monopoly, that gives it the ability to charge high prices without sacrificing volume. ASML’s machines cost hundreds of millions of dollars. The next one set to come out, with an 8nm resolution, will cost $300 million. Despite this, ASML’s net bookings increased in the most recent quarter. As long as companies are competing to make faster and better chips, they will need ASML’s machines. So, ASML tends to have high margins, and consistent growth even in market conditions that are bad for other semi names.

This fact is significant when doing a discounted cash flow (“DCF”) valuation on ASML. Normally, when you value a stock this way, you need to assume that growth will slow down eventually (say, after 5 years), because it isn’t conservative or prudent to assume that high growth will continue forever. However, in ASML’s case, the competitive position argues that the company will continue to grow as long as the industry does. So we can reasonably forecast that ASML’s revenues and cash flows will continue to grow at a decent pace.

In the most recent quarter, ASML had $20.56 in free cash flow per share. That figure has grown by 164% CAGR over three years, 42% CAGR over five years, and 18% CAGR over 10 years. Let’s assume that the slowest of these growth rates is about what the five-year future growth rate will look like. Let’s also assume that it slows down even further to 5% in the foreseeable future after that. At an 8% discount rate, that gives us a price target of $1,255.

Now, the discounted cash flow model above is a little less conservative than the ones I’ve used in past articles on other stocks. Usually I assume only five years of growth and none after that. I also usually assume extreme growth deceleration, in order to avoid excessively rosy forecasts. In ASML’s case, more optimistic forecasts are warranted. It’s a monopoly in EUV lithography, it has enormous pricing power, and it recently guided for positive growth in a period when chip makers expected declining earnings. Finally, its potential competitors aren’t expected to catch up until 2025. It is reasonable to expect this company to keep growing at a steady clip.

Risks and Challenges

As I’ve shown, ASML has an incredible competitive position. That merits a premium price, but not an infinite price. There are valuation related risks that investors will want to keep in mind here, including:

-

Rising interest rates. Rising interest rates make growth less valuable in a discounted cash flow model. In such a model, you divide each cash flow by one plus the discount rate, all to the power of years elapsed. The higher the discount rate, the less the cash flow is worth. ASML’s monopoly position definitely gives it a reasonable path to future growth but rising interest rates make future growth less valuable. It’s a mathematical fact.

-

Supply chain issues. ASML sources parts from thousands of individual suppliers. This fact, along with the company’s patents and complex processes, makes for a wide moat. However, it’s also a potential problem. If one of ASML’s foreign suppliers gets caught up in a trade war or an export ban, then ASML will have to look elsewhere. That could lead to shipping delays and other issues that impact revenue.

-

Competitors catching up. As I mentioned earlier, ASML has no competitors in EUV lithography. It does, however, have competitors in lithography in general. These competitors are working to catch up with ASML’s EUV technology. Industry forecasts see Nikon and SMEE getting there in 2025. Perhaps ASML’s monopoly won’t last all that long, though if the other two companies do catch up, EUV will be an industry with only 3 players, which is not too competitive.

The Bottom Line

The bottom line on ASML is that it’s an incredible company. It has the widest moat I’ve ever seen, it has pricing power, and it is growing faster than its industry. This is all very impressive, but do remember that the stock is quite pricey. As a value investor, I’d like to see the multiples come down before I’d buy. Those who are less value-oriented might benefit by taking a small starter position now, and buying in size if the stock gets cheaper.

Be the first to comment