Thomas Barwick

Global Business Travel Group Overview

This post serves as an update to my coverage in October.

Global Business Travel Group, Inc. (NYSE:GBTG) continues to be attractive. As long as GBTG reaps the benefits of business travel recovery and hits guidance, I think the market will eventually recognize its true value. In the near future, it should be able to keep up revenue growth at or above industry averages, and its margins should grow thanks to high incremental margins.

Performance Review Since My Previous Coverage

Since my initial post, the share price of GBTG has fallen 7.7%. Given the broader macro headwinds, I see this as short-term share price volatility.

Q3 earnings review

GBTG’s Q3 earnings results were mostly in line with my expectations and continued the recovery momentum seen in the first half. Total quarterly revenue was $488 million, or about 72% of PF recovery, while total quarterly transaction value (TTV) was $6.6 billion, or about 69% of PF recovery. Still, the TTV beat is mostly due to the strength of unit prices, and the total transaction count recovery came in at 71%, which was slightly below what most people expected. This demonstrates that the recovery as a whole is sluggish, which I attribute primarily to the underperformance of European markets. GBTG also reported an EBITDA for the quarter of $41 million, which is a margin of 8.4 percent and is higher than analysts had predicted. There was also encouraging expansion in the company’s SME segment, where the company gained market share and saw an increase in overall SME business in Q3. In my opinion, this is going to be a major factor in GBTG’s future expansion.

However, it appears that the broader macro headwinds in 2023 could slow the overall recovery progress, despite the positive momentum coming out of the quarter. GBTG maintained its FY22 revenue and earnings guidance of $1.80-$1.85 billion and $90-$100 million, respectively, but lowered its full-year revenue recovery expectation for the coming year from 85% to the high 70%s.

Recovery in the Asia-Pacific Region could be critical for GBTG’s growth prospects

Cross-border business travel is rebounding as a result of the removal and ongoing relaxation of COVID-related entry restriction regulations in several key economies around the world during the quarter, releasing previously unavailable demand and bolstering GBTG’s top-line growth. Despite significant growth in the Asia-Pacific region (“APAC”) and a slight decline in EMEA (Europe, Middle East, Africa), the company’s most recent data show that recovery is slowing. Q3 saw only 2 points of sequential transaction recovery improvement, compared to the previous quarter’s 23 points (71% vs. 69%).

I believe the APAC rebound could offset some of the difficulties that European markets are experiencing. While North America is currently GBTG’s most profitable market, I’d like to point out that the APAC region’s faster recovery may actually become dilutive to the company’s total margin due to APAC’s faster expansion than North America and Europe.

GBTG growth shines in the small and medium-sized business segment

One of the primary growth catalysts for GBTG to outrun the recovery of the broader business travel industry is the SME (small and medium-sized) segment, which showed some impressive growth during the last quarter. Through the end of October 2022, the total value of PF LTM SME new wins was $2.5 billion, with unmanaged SME accounting for 25% of that total. The SME segment’s overall recovery trajectory has been outpacing that of the Global Multi-National (GMN) segment. Personally, I see the largest potential for GBT’s expansion in the unmanaged SME sector.

GBTG has high fixed costs that weigh on performance

In comparison to the earlier 85% revenue recovery expectation for 2023, the business cut the total revenue outlook for the next year to the high 70s% recovery vs. PF 2019 levels, showing a nearly 10-point reduction in recovery estimate.

Approximately 70% of GBTG’s total operating expense is tied down to personnel-related costs, rendering the company less agile in a more tough climate due to its predominantly fixed cost structure. Should the sales estimate go down, which I believe was motivated in part by the lack of visibility into the macro situation in 2023, materialize next year, the route to a full recovery of PF EBITDA margin might certainly become more challenging. However, the company has mentioned cost-cutting strategies for 2023 headcount growth that may assist control the growth of its cost base and prevent further margin erosion.

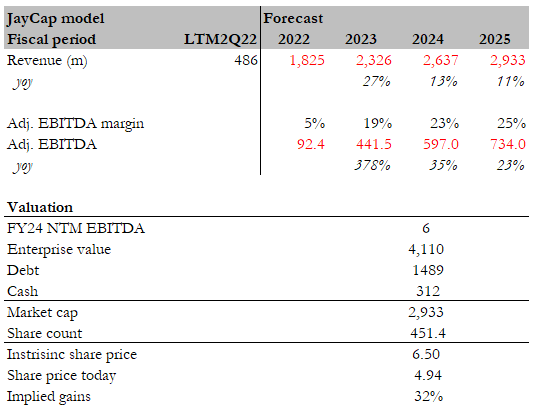

GBTG model update since October

My model has been updated to more accurately represent revenue for FY22 in light of the FY23 travel recovery guide down, and an increase in valuation from 6x to 7x (where it is trading at today). My belief remains that travel will eventually recover and that GBTG will benefit as a result. I continue to believe that GBTG is undervalued, and I believe that investors can profit from this mispricing.

In light of my new assumptions, I believe that the GBTG upside remains appealing, with a potential upside of 32% from the current share price.

Author’s estimates

Conclusion

I continue to believe that Global Business Travel Group, Inc. is currently undervalued and that patient investors could profit from purchasing the stock in the long run. Despite the bleak outlook for 2023, I am encouraged by GBTG’s healthy growth in consolidating the SME market, which is a long-term growth driver for Global Business Travel Group, Inc.

Be the first to comment