alvarez/E+ via Getty Images

The S&P Global Sector PMI™ revealed that Automobiles & Auto Parts sector output contracted worldwide for a second successive month amid the sharpest reduction in new orders since the COVID-19 pandemic and renewed supply disruptions linked to the pandemic and Russia-Ukraine war. There were mixed trends by regions, Europe and Asia were the hardest hit, with the latter seeing output falling at a sharper rate in May. That said, a key component of automobiles production – semiconductors – continued to see its short supply situation show signs of easing in May, according to PMI data, which may bode well for the wider autos sector going forward.

Global Sector PMI shows auto sector output in contraction in May

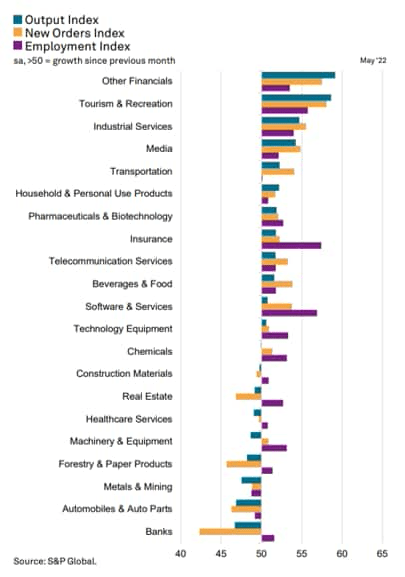

The S&P Global Sector PMI™ indices are compiled from responses to questionnaires sent to purchasing managers in S&P Global’s PMI survey panels, covering over 27,000 private sector companies in more than 40 countries. The Sector PMI tracks eight broad sectors – Basic Materials, Consumer Goods, Consumer Services, Financials, Healthcare, Industrials, Technology and Telecommunication Services – and 21 sub-sectors on a monthly basis.

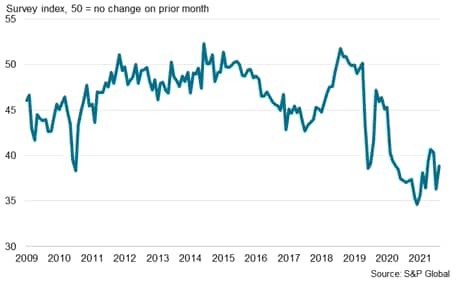

The latest May survey signalled that while most categories saw business activity improve in May, a number of sectors remained under pressure amid weak demand, supply shortages and steep prices. Many of these sectors were concentrated in the manufacturing sector, with the likes of the Automobile & Auto Parts sector ranking amongst the worst performers. May also marked the second consecutive month in which the Automobiles & Auto Parts sector saw output fall, dragging the headline PMI for the sector into contraction territory for the first time since July 2020.

Asia auto sector output declines at a faster rate in May

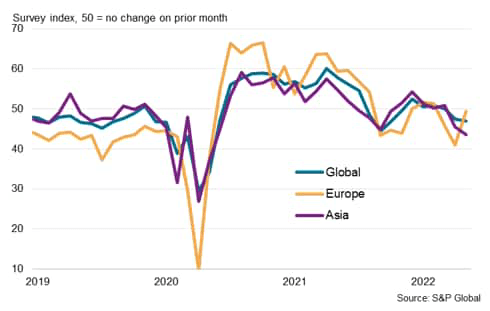

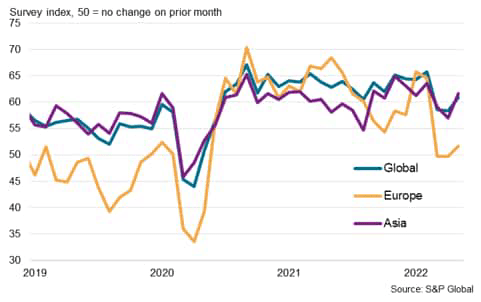

The rate at which the Global Automobile & Auto Parts sector declined was the fastest since October 2021. Mixed trends were observed across the continents tracked with the contraction of Europe Automobile & Auto Parts sector output easing markedly while Asia’s Automobiles & Auto Parts output contraction accelerated to the fastest pace since initial months of the COVID-19 pandemic. The sector was also the worst performing in the Asia region in May.

Automobile & Auto Parts sector PMI output

A challenging supply chain situation continued to plague the auto sector in May, with Greater China and surrounding regions, including Japan and Korea, continuing to see production impacted by COVID-19 lockdowns while the Russia-Ukraine conflict also played a part (See ” May 2022 production forecast sees variations from region to region“, 16 May 2022). As such, it perhaps little surprise to find Asia’s production being the one to pose a drag on the overall global picture.

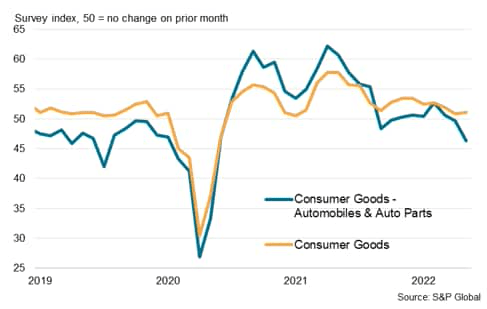

Global consumer goods demand waver as spending shift towards services

Leading to the poor Automobiles & Auto Parts sector output performance had also been the weakness in demand recorded in May. Automobiles & Auto Parts new orders fell at the fastest rate since May 2020, which was at the heights of when the COVID-19 pandemic first broke out.

This was set against a backdrop whereby overall Global Consumer Goods new orders growth had been tapering into 2022 with supply chain issues, rising costs and a shift in spending towards services underpinning the trend.

Consumer Goods PMI new orders indices

Automotive sector supply issues continue to outweigh demand decline

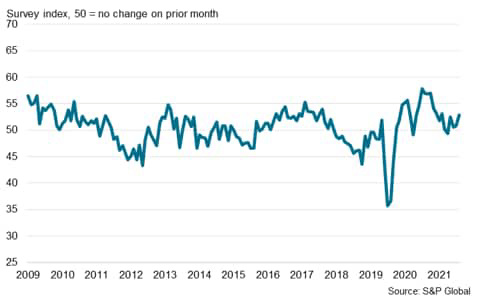

Despite a deterioration in demand conditions for automobiles, and correspondingly auto parts, it must be highlighted that backlogged work continued to build in the Global Automobiles & Auto Parts sector midway into the second quarter. The PMI’s Backlogs of Work Index has now indicated a fourth successive month in which work outstanding rose, overlapping the two-month contraction of new orders. In fact, the rate at which backlogged work accumulated accelerated in May even as new orders fell sharply, indicating more severe supply side bottlenecks.

Global Automobile & Auto Parts sector PMI backlogs

Assessing the Suppliers’ Delivery Times index, vendor performance continued to deteriorate within the Global Automobiles & Auto Parts sector. Even though the rate at which lead times lengthened declined from April, it remained indicative of widespread delays when compared to the survey history, and is nowhere near the rate when things first recovered from the COVID-19 pandemic hit in 2020.

Global Automobile & Auto Parts sector PMI suppliers’ delivery times

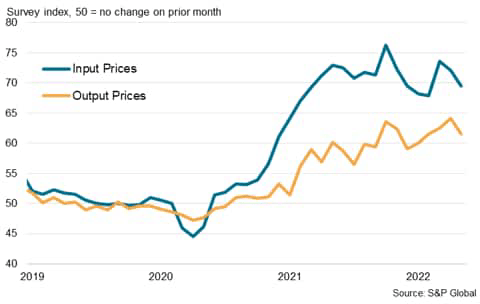

Auto sector price pressures ease marginally in May

As a result of the supply issues on hand, price pressures also remained severe in May. That said, there had likewise been some early signs of easings across both input costs and output price inflation in May in the Global Automobiles & Auto Parts sector.

By geography, Europe’s Automobiles & Auto Parts sector saw both input cost and output price inflation decline from the April record rates. Input prices nevertheless rose at the sharpest pace amongst the various European business sectors tracked for a second month in a row. Over in Asia, price pressures also showed signs of easing with input costs and output prices exhibiting much slower rates of growth compared to their western counterpart.

Automobile & Auto Parts sector PMI price indices

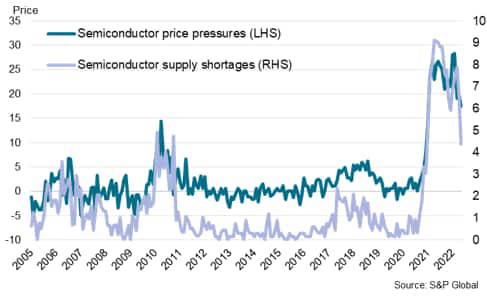

Semiconductor shortage broadly show further signs of easing in May

Deep diving into the performance of semiconductor supply and pricing situation, given the impact that this key component has on automotive production, we find that semiconductor shortages showed further signs of easing globally. This was according to our S&P Global PMI™ Commodity Price and Supply Indicators which track the development of price pressures and supply shortages each month for at least 20 items using responses gathered from the S&P Global Manufacturing PMI survey.

Global Commodity Price & Supply Pressures: Semiconductors

Following our update last month where the Commodity Price and Supply Indicators signalled that the semiconductor shortage displayed signs of peaking, the latest May data had only further confirmed the trend, boding well for the wider automotive sector.

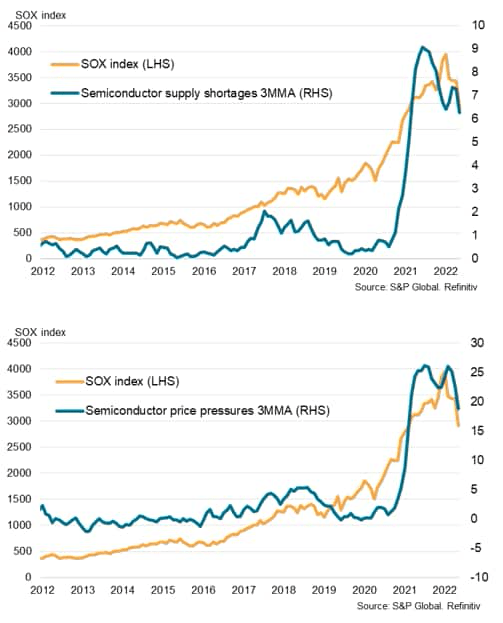

In turn for the Philadelphia semiconductor index (SOX index), which we find the PMI gauges correlating with, there are indications that further SOX declines may ensue. This was as the semiconductor price pressure and supply shortages indices both pulled lower in May to the lowest readings since early 2021.

Global semiconductor supply shortages and price pressures vs. SOX index

Automotive sector outlook

Despite the Global Automobiles & Auto Parts PMI slipping into contraction for the first time in almost two years, weighed by the sharpest new orders contraction since the COVID-19 pandemic, sentiment improved globally amongst auto and auto parts makers in May. This was also the case in both Europe and even Asia despite the onslaught of supply woes gripping the sector.

Automobile & Auto Parts sector PMI future output

It is perhaps with little doubt that uncertainties persist both on the demand and supply side amid a slowdown in global growth expected and with the Ukraine war and mainland China’s COVID-19 disruptions persisting. That said, the green shoots seen here from improving business confidence amongst auto and auto parts makers to easing semiconductor industry constrains may offer some semblance of hope for improvements moving forward.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment