tolgart/E+ via Getty Images

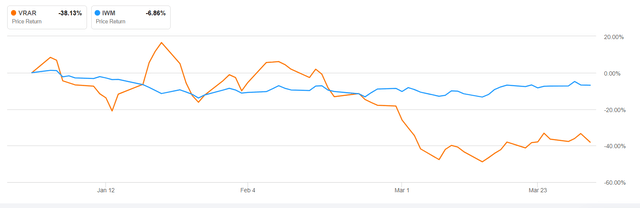

Market conditions haven’t been too kind to The Glimpse Group (NASDAQ:VRAR), with shares hitting all-time lows of $5 a share before bouncing back above $6 where it sits today. These prices reflect a mass misunderstanding from the market, reinforced by worsening sentiment which has destroyed confidence in microcaps over the last few months.

However, even as the market has started to experience a relief rally, Glimpse has not seen the benefits of this. Considering the fact, in my opinion, Glimpse remains one of the most attractive microcap plays out there, this lack of movement appears misplaced. With Glimpse, you have a company that has an exceptional balance sheet, a strong moat, impressive revenue growth and a huge Total Addressable Market. This is all the making for a great Microcap story, allowing shareholders to realize extremely lucrative returns. I believe a $21 price target is achievable over the next year and I set out why in this article.

VRAR vs iShares Russell 2000 ETF (SA)

A huge Metaverse exposure opportunity

Metaverse Madness! Most, if not all readers will have heard of the ‘phenomenon’ over the last few months after Meta (FB), made its huge move into the market, leading to its renaming. Investors all across the world are scouring the public markets (and private) to get exposure to the fast-growing market. BlackRock (BLK), the world’s largest fund manager, has already announced it will venture into investing in the Metaverse. Bloomberg estimated the Metaverse opportunity to be an $800 billion market opportunity, Citi (C) sees the TAM between $8 and $13 trillion.

However, as always, as investors look for ways to play this theme, they overlook microcaps. Of course, due to their relatively small size and low liquidity, investing in small caps can create extreme risk, especially when that company is attempting to take on the unknown and there isn’t much history of operating performance. However, that is the bread and butter of risk-prone investors, where the diamond amid the rough can be found. What if I said there was a micro-cap Metaverse play with a forward EV/sales multiple of 6.4, anticipated to grow at 100% and is currently sitting on a cash pile of $20 million? Glimpse Group offers that.

The Forward EV/Sales multiple above is based on the fact I have booked Glimpse’s recent acquisition of S5D as a liability obligation, even though only $4 million cash (and $4 million in stock) has been paid at this point. In reality, that obligation will only lead to an outflow if revenue milestones are met, meaning that the Forward EV/sales multiple would contract further by the time the obligation is realized.

The roll-out strategy in a fragmented market

What remains so appealing about Glimpse is the shape of the market it’s currently trying to tackle. This market is incredibly fragmented and undiscovered at this point in time. It’s clear that so many companies want to make inroads into the Metaverse and the impact it may have on the future of the Web. However, they need support and guidance; Glimpse is here to provide that through its services. For Glimpse’s positioning alone and mass diversification across numerous different subsidiaries, it’s worth taking a punt at a minimum on the name.

What’s really needed in this market is scale; Glimpse has that scale. This has been achieved due to the recent acquisition of S5D, which already has a large client base and $5 million revenue run rate. Bringing that company into the ecosystem and allowing it to provide and receive information and support from other VR/AR companies in this early-stage fragmented market has significant ramifications for Glimpse’s ability to tackle the unknown. This is a sector where the capabilities aren’t understood at this time, there hasn’t been a huge amount of ‘Metaverse software building’. Yet Glimpse obtained and holds that valuable first-mover advantage.

Setting a $25 price target

Not too long ago, Glimpse Group breached $20 on the back of the Metaverse hype and vastly improving sentiment towards the company as it started to gain traction. Today, Glimpse’s share price has fallen off a cliff, as the broader market and small caps have tumbled. This represents a complete detachment from the core developments of Glimpse’s underlying business and presents shareholders with a significant opportunity.

After Glimpse’s immediate jump, the company shrewdly raised a colossal $25 million through equity offering at $14.68 a share. While a discount then, this represents a 138% premium to today’s price! There were also 750,000 shares purchasable through warrants with the offering; however, the exercise price is $10.

This raise has essentially shored up the company’s balance sheet for these uncertain times. There is great justification for the market to be concerned about small caps across the board, as they continually rely on equity and debt raises to fund loss-making operations. However, this thesis isn’t applicable to Glimpse which sits on a $20 million cash pile, burning circa $2.3 million a quarter. This fall is irrational.

Based on today’s outstanding share count, if Glimpse was to trade at $21, that would infer an mcap of $264 million and a forward (FY22) EV/sales multiple of 22 based on analyst expectations. This is certainly very expensive but under more healthy market conditions, very achievable. This is because:

- I believe analyst forecasts are conservative. Considering historic growth, Glimpse’s unbelievably small base – the company can very rapidly scale revenues and bring down that valuation. Glimpse has a perfect combination of small size, big opportunity, but also greater scale than the majority of its peers.

- Significant further accretive acquisition opportunities within the VR/AR space.

- Big partnership possibilities that can provide massive scaling opportunities ($1 million master services agreement proved that).

- International opportunities, Glimpse has already started to launch its international operations in Turkey and Israel.

Considering the above, I believe it’s reasonable to argue Glimpse will grow far quicker than the market expects in the back half of this year. Glimpse is expected to deliver 100% revenue growth next year, meaning next year Fwd EV/sales multiple is around 3x – ludicrously cheap for a company that is forecasted to deliver 100% revenue growth and sits on 57% gross margins.

The realization of the above factors over the coming quarters will provide the catalyst for the reprice in my opinion. Drawing sector comparisons to the likes of Vuzix (VUZI) shows a stark mispricing. Vuzix is expecting revenues of $17 million for FY22, yet has a market capitalization of $418 million. The company also expects to grow at a relatively slower pace the year after, meaning NTM EV/sales multiple is 16x compared to Glimpse’s 3x.

Risks

A lot of my thesis is hinged upon the fact that the market stays in a relatively healthy condition and that a recession doesn’t precede. Recession risks are very real as the fed plans for excessive rate hikes moving forward in order to get a grip on inflation which is ripping through the US right now. In this case, small caps and in particular high growth, unprofitable small caps will most likely see further downward pressure. The general macro factors that may actually affect Glimpse’s underlying business (inflation) aren’t as significant due to the large cash pile; however, the market probably won’t consider it because it’s incredibly irrational and broad market sell-offs will ensue.

Other risks are further capital raises. The board from the start said it wants to pursue roll-up acquisition strategies. That will be achieved through raising additional capital. I do not believe they would do it at these prices. On future spikes, there may be opportunities to raise additional capital that management will take.

Conclusion

Glimpse offers a compelling risk/reward play for both the near and long term. Over the near term, you have a company that will immediately benefit from accretive acquisition and Metaverse-related market sentiment improvements. You also have the material benefit of entering shares at a 58% discount from the latest offering, which has resulted in a significantly bolstered balance sheet. Over the long term, there are huge secular tailwinds and growth opportunities covering numerous industries, many of which Glimpse has already started to enter as it utilizes its ‘broad umbrella’ approach thanks to its diversified range of subsidiaries.

Glimpse is significantly undervalued to me right now with a strong asymmetric reward, I believe a $21 price target is very achievable.

Be the first to comment