Andrii Dodonov/iStock via Getty Images

Investment Thesis

Gladstone Investment (NASDAQ:GAIN) reported strong Q1 results (three months ended June), echoing a resilient portfolio despite macroeconomic challenges. Shares are up 17% from March 2022 lows, backed by improving business sentiment and active U.S. middle market, providing an accommodative backdrop to its strategy heavily reliant on capital gains to cover dividend distribution.

A relatively low yield offsets the luxury of monthly dividends, currently yielding 5.6% annually, pushed down by a high share price trading at a premium to Net Asset Value (“NAV”). This mirrors shareholder confidence in GAIN’s ability to generate capital gains on its equity investments, currently standing at 26% of the total portfolio, one of the highest in the business development company (“BDC”) sector.

Revenue Trends

On Thursday, investors were quick to brush off a 20% year-over-year (“YoY”) decline in net interest income “NII.” This was attributed to last year’s extraordinary revenue distorting YoY comparison after GAIN received past interest due from a previously-defaulting company in Q1 last year. After adjusting for this technical discrepancy, interest income shows a slight decrease, aligning with a small reduction in interest-bearing assets under management (“AUM”), primarily due to a portfolio company recently defaulting on interest payments.

|

Millions USD |

Total NII |

Past due interest paid |

Adjusted NII |

Interest-bearing AUM |

|

Q1 2022 |

$12.7 |

$ 0 |

$12.7 |

$431 |

|

Q1 2021 |

$15.9 |

$2.3 |

13.6 |

$466 |

From a business model perspective, I believe that GAIN’s portfolio is as strong as a lower U.S. Middle Market private credit firm could be. The company has often succeeded in turning around troubled companies, such as B+T Communications, PSI Plastics, and The Maids International. The company utilizes a long-term investment approach, giving it time to work with the management teams of its portfolio companies, and inject more cash if need be. This strategy has shielded it from high realized losses experienced by its peers.

As of June 2022, 16% of the portfolio at cost was on default, spanning three companies; J.R. Hobbs, Mountain Corporation, and SFEG Holdings. Things are looking better for SFEG than J.R Hobbs and Mountain Corp, who have been on default for over two years. However, even if these companies go under, GAIN has equity exposure to many companies that are just doing fine. These include Horizon Facilities, Nocturne Villa Rentals, Brunswick Bowling, and Council Press. These companies together contributed $30 million in capital gains during the quarter, compensating for any realized losses that might occur.

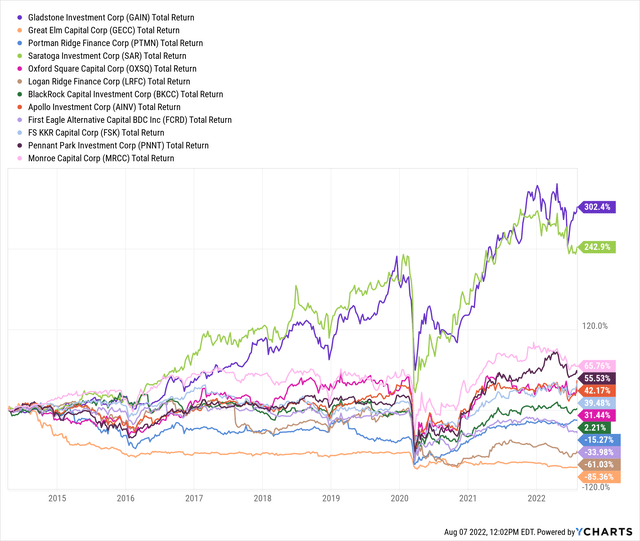

GAIN Total Return Level ( Data by YCharts)

During the quarter, GAIN also benefitted from increased dividend distribution from its equity holdings, adding $1.6 million this quarter, compared to zero dividends in the same period last year, another sign of improving fundamentals. The company also recorded a $5 million success fee; the provisional income attached to its debt securities in case of portfolio company change of control, demonstrating that activity in the U.S. middle market remains strong, albeit at a slower rate than its peak in 2021. Despite the recent monetary tightening, interest rates remain historically low, offering an accommodative backdrop as investors continue seeking yield in the private credit space.

Secret of Success: Management’s Integrity

BDC regulatory framework suffers from systematic flaws that make it challenging to preserve capital. Companies registered as BDCs must distribute 90% of their investment income, net of capital depreciation, making it challenging to recover capital losses from bankruptcies. These dynamics are exacerbated by excessive risk-taking, driven by the conflict of interest between management receiving compensation based on the fund’s size and shareholders seeking consistent income and capital preservation. This flawed regulatory framework is why 80% of BDCs have lost per share NAV value since inception.

GAIN has been immune from these dynamics for two reasons. First is management’s integrity, which puts shareholders’ interests above its own. Unlike its peers, GAIN has been prudent in raising capital despite its low leverage, opting to preserve dry powder to support its portfolio companies when in need, in line with its long-term activist approach towards lending. It could quickly raise equity capital to expand assets under management (“AUM”) and management’s pay.

Still, it remains conservative in raising equity capital instead of increasing AUM and management’s pay, unlike most BDCs continuously diluting shareholders’ equity. Management’s approach towards capital raising mirrors integrity, offsetting systematic flaws of the BDC regulatory framework and conflict of interest inherent in the external-management structure.

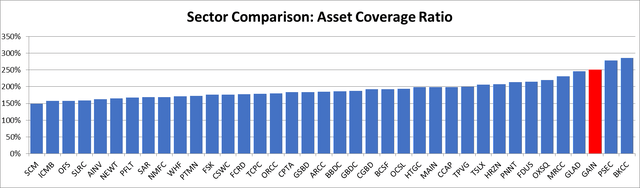

Asset Coverage Ratio (SEC Filings)

However, multiple issues are overshadowing the quantitative measurement of performance. First comes transparency. Unlike many of its peers, GAIN doesn’t distribute interest coverage figures of its portfolio, a critical metric of portfolio performance. Second, the company doesn’t incorporate credit spreads in valuing its portfolio. For example, during the early days of the pandemic, when uncertainty was at its peak, management kept the fair value of its investments unchanged, highlighting discrepancies between public and private market valuation methods.

Summary

It is an exciting time to gain exposure to the BDC sector, especially for well-managed companies such as GAIN. Despite risks inherent in investing in small and medium enterprises, the risk premiums are attractive, especially in the current low yield environment, despite recent monetary tightening. Activity in the U.S. Middle Market remains strong, a message communicated by the many BDCs reporting results for the three months ended June, contrary to economists’ dim predictions and challenging macroeconomic trends that sent the sector’s shares low.

Be the first to comment