Eoneren

Gladstone Investment (NASDAQ:GAIN) increased its monthly distribution from $0.075 to $0.08 per share last week and declared a special distribution of $0.12 per share to be paid in the fourth quarter.

The business development company’s dividend is covered by adjusted net investment income, and the stock has begun to trade at a larger discount to net asset value in recent weeks.

Gladstone Investment, in my opinion, is an appealing income investment for investors seeking recurring dividend income and a higher margin of safety.

Recent Dividend Increases

Gladstone Investment is one of those business development companies that pays its distribution on a monthly basis, and the company recently announced that it would increase its distribution from $0.075 per share per month to $0.08 per share per month, a 6.7% increase.

In addition, Gladstone Investment announced the payment of a $0.12 per share special dividend on December 15, 2022.

Gladstone Investment’s forward dividend yield is 8.8%. Investors can secure a 7.8% dividend yield, which is covered by the BDC’s adjusted net investment income, excluding the special dividend.

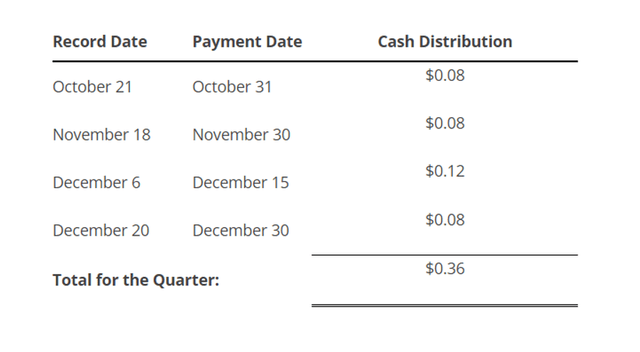

Gladstone Investment distributes a monthly dividend at the end of each month. The payment schedule for fourth-quarter monthly dividends and the special dividend is shown below.

Cash Distribution (Gladstone Investment Corp)

Dividend Covered By Net Investment Income

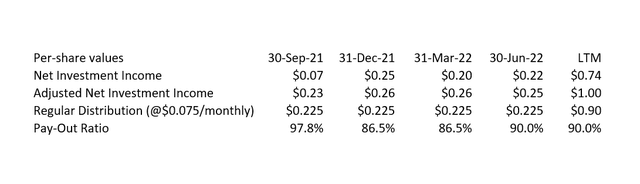

Gladstone Investment covered its dividend with adjusted net investment income in the second quarter, and the BDC is likely to cover its dividend with NII in the third quarter as well, given the low pay-out ratio over the last year.

Gladstone Investment’s adjusted net investment income accounts for the payment of a capital incentive fee to the external manager, which cost the company $0.065 per share per quarter over the previous year.

Gladstone Investment’s pay-out ratio (based on adjusted NII) was 90% in the second quarter and 90% over the previous twelve months, indicating that the company could afford to increase its monthly dividend. In order to distribute excess portfolio income, the BDC pays special dividends.

I am not concerned about Gladstone Investment’s dividend coverage because the current pay-out ratios are so low.

Pay-Out Ratio (Author Created Table Using Gladstone Investment’s Disclosures)

Equity Exposure Might Be Considered A Risk

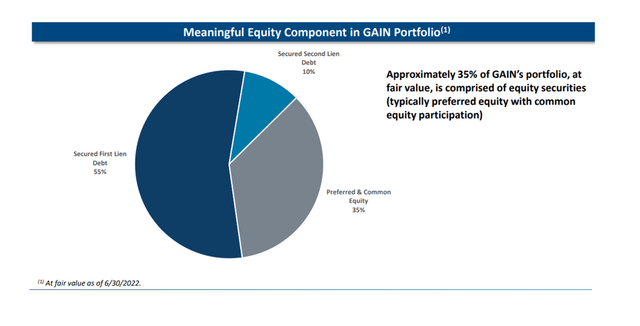

Gladstone Investment has a less diverse portfolio than other business development firms due to its exposure to equity investments.

Approximately 35% of the BDC’s portfolio is invested in equity securities, giving the BDC more risk but also more upside potential than comparable BDC companies.

Gladstone Investment, on the other hand, has a track record of successfully exiting equity investments at high multiples.

The majority of the BDC’s investments (65%) are still in secured first and second liens.

Equity Securities (Gladstone Investment Corp)

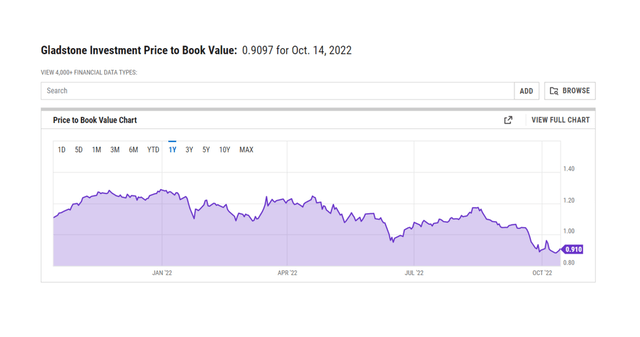

Now Trading At A Discount To Net Asset Value

Gladstone Investment’s stock is currently trading at a 9% discount to its net asset value of $13.44 per share in 2Q-22. The discount resulted from a sharp selloff in the BDC sector in response to high inflation rates and the central bank’s 75-basis-point interest rate increase in September.

Gladstone Investment’s discount valuation implies a higher margin of safety for investors, which is unwarranted given that the business development company recently increased its monthly distributions.

Why Gladstone Investment Could See A Lower Stock Price

Gladstone Investment and other business development firms may experience negative book value growth if portfolio quality deteriorates.

According to J.P. Morgan chairman Jamie Dimon, the U.S. economy is on the verge of entering a deeper recession in 2023, which could create headwinds for Gladstone Investment’s portfolio.

Gladstone Investment is also more exposed to equity investments than the average BDC, making it a higher risk investment option for passive income investors.

My Conclusion

Gladstone Investment is currently offering an 8.8% dividend yield (including special dividends), and its stock is trading at a 9% discount to net asset value.

Despite the fact that Gladstone Investment is riskier than the average BDC due to its exposure to equity securities, I believe the discounted valuation provides a higher margin of safety for passive income investors.

Gladstone’s appeal as a passive income investment has grown significantly as a result of the increase in monthly distribution and the announcement of a special dividend.

Be the first to comment