Denis_Vermenko

Dividend investors have plenty to cheer about these days. For those with dry powder on hand, there’s no shortage of opportunities in the current market. While some may choose to play it safe with treasury bonds, I believe REITs, BDCs, and MLPs offer great risk-adjusted returns over the long-run, and those seeking income can lock in high yields today.

This brings me to the very high yielding Gladstone Commercial Corp. (NASDAQ:GOOD), which is now trading at levels that were unimaginable just a few short months ago. This article highlights why the recent material drop in GOOD presents a bargain opportunity, so let’s get started.

Why GOOD?

Gladstone Commercial is an externally-managed REIT that focuses on acquiring, owning, and operating net leased industrial and office properties throughout the United States. It’s led by CEO David Gladstone, who has been with the company since inception nearly 2 decades ago. Today, it owns 136 properties that are diversified across 112 tenants in 19 different industries and 27 states.

GOOD benefits from its diverse tenant base, leased to leading well-recognized companies with long-weighted average remaining lease term of 7.1 years. Towers Watson, General Motors (GM), Verizon (VZ), and Automatic Data Processing (ADP) make up 4 of GOOD’s top 5 tenants and comprise 11% of its annual straight line rent.

Importantly, GOOD enjoys strong rent collection of 100%, and a high leased rate of 97.3% as of the end of June, representing a sequential 30 basis points improvement from the prior quarter. Management has also been able to source properties at attractive cap rates, including 5 fully-occupied industrial properties for an aggregate $38 million at a weighted average cap rate of 6.6%.

Looking forward, GOOD has a fairly clear line of sight, as it only has 3% of its annual rent expiring through the end of this year. Moreover, management is making moves to reposition the portfolio away from office and more towards industrial. Since 2019, GOOD’s industrial allocation has greatly increased from 32% to 52%.

Headwinds to GOOD include supply chain constraints and inflation, which has weighed on its construction pipeline, and the office segment continues to be challenged. These points were noted by management during the recent conference call:

The construction pipeline increased dramatically to 613 million square feet in the second quarter, up roughly 12.5% from Q1. Supply chain labor and inflationary pressures have delayed development schedules contributing to the record high construction pipeline. The industrial market is expected to remain robust. The office market has continued to evolve and gradually recover from the pandemic. However, Cushman & Wakefield references that office absorption has continued to be negative.

Nonetheless, I view these concerns as being more transitory in nature, and demand for industrial properties continue to outpace deliveries. As such, the silver lining for GOOD is that should continue to see strong demand for its existing properties.

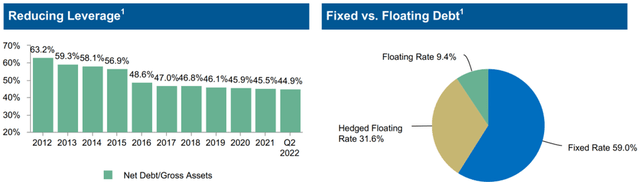

Furthermore, GOOD maintains a strong balance sheet with a net debt to gross assets ratio of 44.9%. Moreover, creditors appear to rather warm towards GOOD, as reflected by the $20 million in mortgage debt that was recently issued to the company at an attractive 3.7% interest rate, enabling it to repay a higher rate mortgage with a 6.1% rate. As shown below, GOOD is somewhat protected from rising rates given that well over half of its debt is fixed rate, and it’s made steady progress in reducing its leverage every year for the past decade.

GOOD Leverage (Investor Presentation)

What’s great for income investors is that GOOD pays a monthly dividend that’s never been reduced since payments began in 2004. This enables dividend investors to match their income streams with their recurring monthly expenses. While GOOD’s payout ratio of 96% is on the high end, this is nothing out of the ordinary as it’s known for paying out most of its cash flows to shareholders, and relying on capital markets for growth.

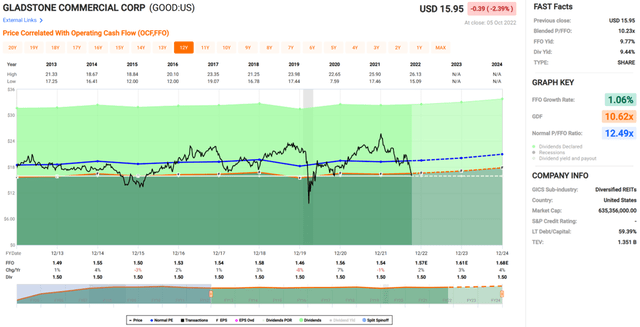

Lastly, at the current price of $15.64, GOOD trades at a very attractive forward P/FFO of 10.0, sitting well below its normal P/FFO of 12.5 over the past decade. Sell side analysts have a consensus Buy rating on GOOD with an average price target of $23. This, combined with GOOD’s 9.6% dividend yield, translates to potentially very strong returns.

Investor Takeaway

Gladstone Commercial continues to make meaningful progress towards its transition to industrial properties. It has strong operating fundamentals, and its strong balance sheet provides it with the flexibility to continue growing through acquisitions. At the current price, GOOD offers very attractive risk-adjusted return potential. As such, I find GOOD to be a great bargain buy on the recent drop.

Be the first to comment