MarsBars

Having growth stocks in one’s portfolio can be fun when the times are good, but can be hard to bear after the music stops, especially when one is staring at unrealized losses and no dividend income to boot. Such may be the case with once high flying technology stocks like Meta Platforms (META) and Salesforce (CRM), that are now trading cheaply compared to where they were just a year ago.

That’s why it pays to have income stocks that literally work for you by generating a recurring income stream. This brings me to Gladstone Capital Corp. (NASDAQ:GLAD), which is one of a handful of BDCs that pay its investors a monthly income stream. In this article, I highlight whether the stock is a buy or hold at present, so let’s get started.

Why GLAD?

Gladstone Capital is a BDC that’s externally-managed by Gladstone Management Corp., with its namesake David Gladstone serving as Chairman of the company. It belongs to the Gladstone family of companies, including REITs Gladstone Land (LAND), Gladstone Commercial (GOOD), and BDC peer, Gladstone Investment (GAIN).

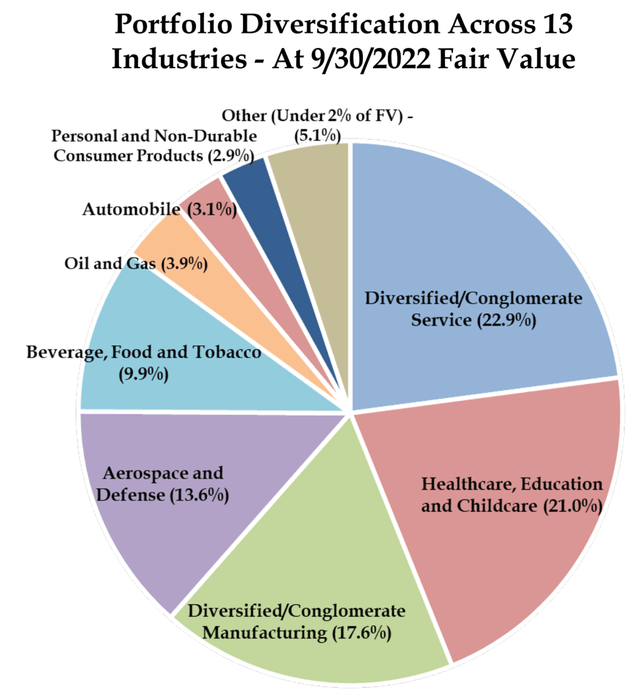

At present, GLAD carries a diverse portfolio of investments with a fair market value of $650 million across 52 companies. As shown below, most of GLAD’s portfolio is in the segments of business services, healthcare, education, manufacturing, and aerospace/defense.

GLAD Portfolio Industries (Investor Presentation)

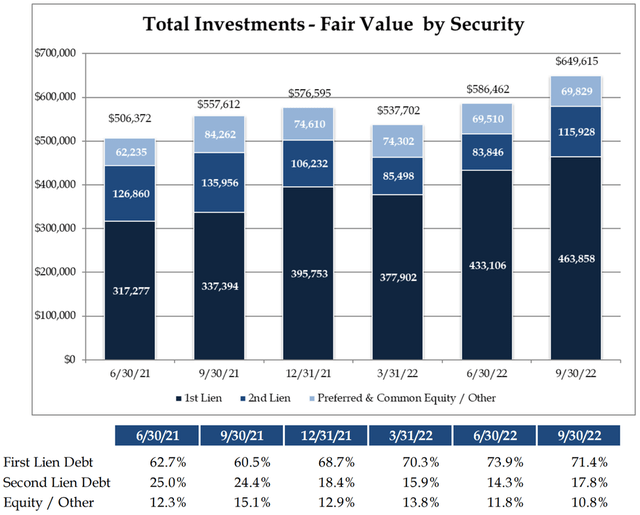

GLAD differs from its sibling BDC, GAIN, in that it has lower exposure to equity investments, and higher exposure to secured debt. This makes GLAD more like a traditional BDC with a more assured recurring income stream versus a private equity / BDC hybrid that GAIN more closely resembles.

As shown below, 89% of GLAD’s investment portfolio is comprised of secured debt (71% first lien, 18% second lien), with the remaining 11% comprised of equity upside potential to its net asset value.

GLAD Portfolio Mix (Investor Presentation)

GLAD is seeing encouraging growth in the current economic environment, as originations have outpaced portfolio exits and refinancing over the past year. This generated a net $92 million increase in total investments in the past four quarters. This is driven by strong PE sponsor demand for flexible, one-stop shop first lien / unitranche financing, which has lifted first lien debt from 61% of GLAD’s portfolio in the prior year period to 71% as of 9/30/22.

Meanwhile, GLAD is demonstrating stable book value, with NAV per share declining by just $0.04 sequentially during the quarter ended 9/30/22. It’s also seeing the benefit from rising rates, as 88.5% of its loan portfolio is subject to floating rate with minimum floors. This contributed towards net investment income growing by 8.6% sequentially to $0.22, and enabled GLAD to raise its monthly dividend to $0.07 with a 100% payout ratio. Encouragingly, management expects to be able to raise the distribution in the coming quarters, as noted below during the recent conference call:

With our floating rate investments exceeding our floating rate liabilities by approximately $400 million and the current floating rates on pace to be up about 125 basis points for the quarter, we would expect our net interest margin to be up in the range of $1.25 million this quarter. Based on the portfolio performance and as the net interest income is realized, we expect to be in a position to consider increase in the shareholder distributions in the coming quarters.

GLAD is also modestly leveraged with a debt to equity ratio of 1.1x, sitting well below the 2.0x regulatory limit, and is more or less on par with that of most other BDCs. Its portfolio companies also appear to be overly healthy, with 89% of them having a debt to EBITDA ratio of less than 3.5x.

While GLAD has many things going for it. My biggest hang-up is the valuation. At the current price of $10.49, GLAD is no longer cheap at the price to book value of 1.15x. As shown below, GLAD is now heading towards the high end of its valuation range over the past 5 years.

GLAD Price to Book (Seeking Alpha)

While this may be an acceptable valuation in a normal market, there are simply too many other enticing BDCs with higher yields. For example, Capital Southwest (CSWC), Hercules Capital (HTGC), and Horizon Technology Finance (HRZN), which also pays monthly, all provide higher yields than GLAD.

Investor Takeaway

While GLAD may be a solid performer, its yield is currently not as appealing on a relative basis, and its valuation is no longer cheap relative to its historical norms. This is considering higher yielding alternatives available in the BDC space right now. As such, I view GLAD as being a hold until its price gets closer to a 1.05x price to net asset value ratio.

Be the first to comment