sankai/iStock via Getty Images

Ginkgo Bioworks’ (NYSE:DNA) stock price has collapsed over the past 12 months, despite the underlying business performing relatively well. This decline is largely due to macro factors and a shift in sentiment, with the biotech sector also falling significantly over the same period. This is not necessarily an attractive entry point though, as there is a large amount of risk in the synthetic biology industry and Ginkgo’s business model.

Ginkgo is engaged in business model innovation, as much as they are involved in technological innovation. For Gingko, the organism is the product, rather than lab services or a molecule. Ginkgo is not the first company to pursue this approach though, as Amyris (AMRS) and Zymergen (ZY) were both positioned as horizontal platforms in the past. Both of these companies ran into issues with high costs, an inability to capture sufficient value and the relatively small size of the market.

Past failures may not be relevant to Gingko though as the synthetic biology industry is maturing, increasing demand for strain engineering. Technology relevant to synthetic biology has also improved in recent years, dramatically increasing the capabilities of companies like Ginkgo. Ginkgo is also operating at a much larger scale than other companies have in the past, which could enable success.

Horizontal versus Vertical Integration

There are fundamental reasons for pursuing a horizontal versus a vertical integration strategy which often get overlook. Investors and managers frequently get swept up in the prevailing paradigm, like the current dominance of information technology businesses, which are often positioned as horizontal platforms. In comparison, previous eras saw a focus on vertical integration (Ford (F)) and diversifying revenue through a conglomerate structure (General Electric (GE)). None of these structures is inherently superior though, as the best structure for any business is dependent on the industry and the industry’s maturity.

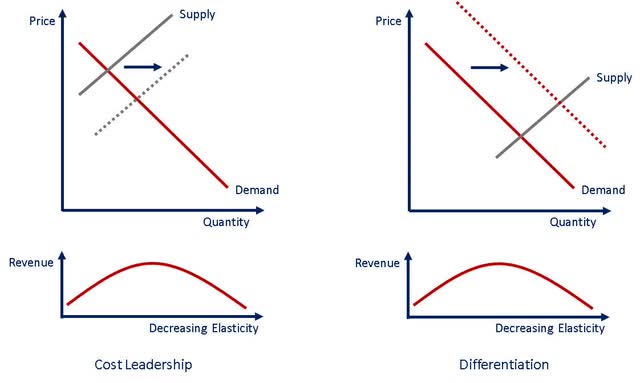

In the early stages of an industry, costs are generally high and as a result demand is elastic. In this scenario, businesses are often well served by pursuing a price leadership strategy, as lower prices lead to increased demand and increased industry revenue. Firms can often significantly improve unit costs through experience and economies of scale, but these types of gains become increasingly difficult to achieve over time. As the industry matures, demand will become inelastic as needs are satiated. Continuing to pursue a price leadership strategy at this point decreases industry revenue and destroys value. While a price leadership strategy may no longer be viable, the increase in industry size and complexity opens other opportunities. Firms can choose to specialize in a particular segment of the value chain, which may not have provided sufficient scale in the past. There may also be complex steps in the value chain which a specialist firm can dominate. Firms should begin pursuing a differentiation strategy when demand becomes inelastic, so that they can continue to increase revenue.

Figure 1: Cost Leadership versus Differentiation (source: Created by author)

Henry Ford understood that at the right price point the automobile would become a mass market product and pursued cost leadership through deep vertical integration. This led to Ford dominating the US automobile market in the early years, until the willingness of consumers to pay began to exceed the cost of the Model T. At this point, General Motors (GM) was able to gain market share by offering a portfolio of higher quality vehicles.

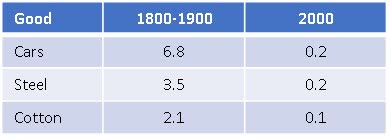

Table 1: Example Price Elasticities of Demand (source: Created by author)

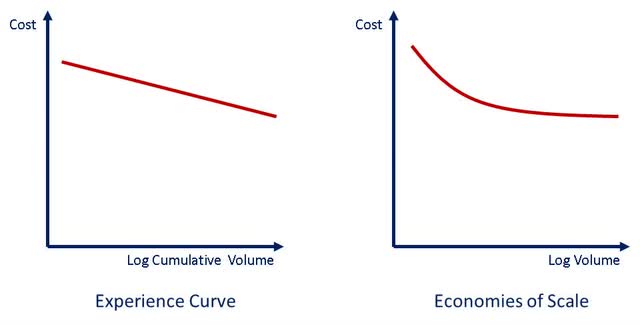

Ginkgo is driving cost declines through economies of scale and the experience curve. The extent to which this opens up the market for synthetic biology lab services is uncertain though. It is questionable whether strain engineering is currently the real bottleneck in the synthetic biology industry given the difficulties involved in scaling up production. To achieve success, the synthetic biology industry must drive down the cost of end products and vertical integration is often the best way of doing this in a nascent industry.

Figure 2: Cost Benefits of Scale (source: Created by author)

Vertical integration can also help resolve the cold start problem in embryonic industries, where production costs are high and as a result demand is low. Insufficient demand in a nascent industry is problematic because productivity growth is often dependent on production volumes. When this is the case, businesses will often try to bootstrap demand (introducing complimentary goods, consuming the product internally). Examples of this include:

- Standard oil providing lamps to China to spur demand for kerosene

- Twist Bioscience (TWST) is developing antibody therapies to increase demand for synthetic DNA

- Schrodinger (SDGR) is developing drugs to increase demand for modeling software

While Ginkgo has received criticism for related party transactions, these should really be viewed as an attempt to bootstrap demand. These businesses will ultimately succeed or fail on their own merits, which will help to validate or invalidate Ginkgo’s platform.

A horizontal integration strategy generally becomes more attractive as an industry matures for a number of reasons. For example, it may become more difficult for a vertically integrated firm to remain competitive as an industry becomes more complex. This may be due to the technology involved in production becoming more complex or because the market becomes fragmented as firms begin to pursue differentiation. As an industry grows, the increased volumes also make it more viable for firms to specialize in particular niches.

Gingko has copied AWS’ strategy of providing a horizontal platform that enables other businesses. AWS is an incredible business and this type of strategy may eventually work in synthetic biology, but Ginkgo has ignored the development stage of the industry. AWS was not launched during the birth of the computing industry in the 1950s-1970s and if it had been it would have been a complete failure. AWS came about after many decades of development, where the industry value chain became fragmented and specialists like Intel (INTC), Microsoft (MSFT), Compaq and Oracle (ORCL) succeeded in their niche. The industry value chain was initially highly vertically integrated, with IBM (IBM) dominating from end-to-end. The synthetic biology industry is still nascent and is yet to really solve fundamental issues like commercial fermentation at scale. Rather than try to solve these problems themselves, Ginkgo has chosen to leave this to poorly resourced customers.

It should also be noted that cloud computing and app stores are platforms where developers build applications which customers use. The companies operating the platform benefit from this activity. This is very different to how Ginkgo’s “platform” functions. Customers bring a project to Ginkgo and Ginkgo engineers an organism for them, which is typical of a service business. The platform analogy relies on Ginkgo being able to reuse code across projects.

It should be noted that it is difficult to make generalizations about synthetic biology due to the diversity of potential end markets. The optimal strategy for commercially producing a pharmaceutical product worth thousands of dollars per gram may be very different from producing something like biofuels. The relative importance of strain engineering, fermentation scale-up and downstream processing will vary from product to product, and as such, so should a company’s strategy.

Where there are naturally occurring alternative sources of a particular product, like extracts from plants, synthetic biology must be competitive on cost and quality. Plant breeding efforts continue in areas like cannabinoids and steviol glycosides, to try and increase the yield of more valuable minor products. One of the first products targeted with synthetic biology was artemisinin, the success of which was limited in part by the fact that artemisia breeding efforts led to an increased yield of artemisinin from the plant and hence lower costs.

Ginkgo appears to have recognized many of these issues and are focusing on programs where they are more likely to succeed. This includes:

- Trying to avoid competing with existing production

- Focusing on areas that are less price sensitive

- Focusing on areas where scale-up is less important

AWS and Infinite Demand

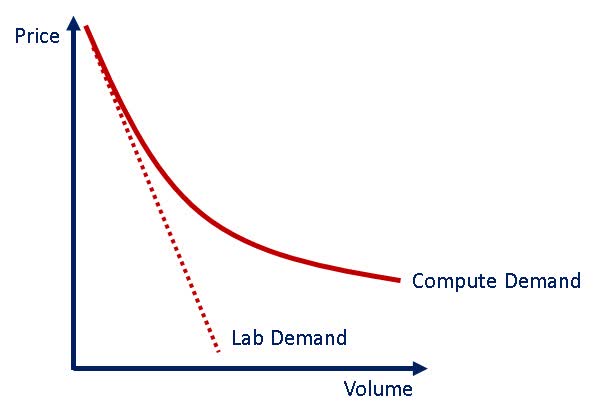

Ginkgo often compare their business to AWS, but this is questionable given the fact that demand for compute and storage has remained elastic, even as costs have declined over orders of magnitude. Companies like Intel have achieved growth over an extremely long period of time as demand has never been satiated, despite massive productivity gains. If Ginkgo are able to continue driving lab costs down, it is not clear that demand will remain elastic, which may mean that at some point revenue growth stalls. It could be argued that this is a likely scenario as synthetic biology is used to produce physical products and there will be a limit on the demand for these products.

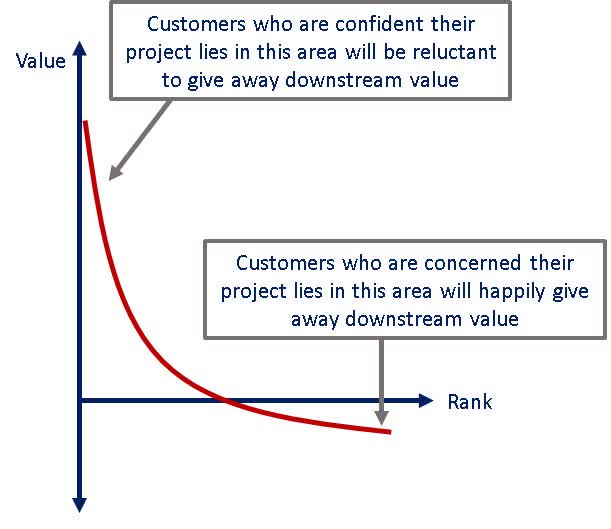

Figure 3: Potential Demand Curve for Biotech Lab Services (source: Created by author)

Value Capture

The hype around Ginkgo’s business primarily stems from their goal of capturing downstream value in each project. Ginkgo aims to operate the foundry near breakeven, with foundry services providing a predictable revenue stream that is independent of the success of partner commercialization efforts. Upside is then expected to come in the form of royalties, equity and milestones. Ginkgo must be able to capture part of the downstream value created to realize this vision though.

If Ginkgo’s value proposition simply ends up being that they can engineer organisms at a lower cost than competitors, their platform will capture little of the value it creates. Customers will not give away large shares of downstream value just to modestly lower R&D costs, particularly if they expect a large amount of product revenue. To realize the vision of Ginkgo’s founders, Ginkgo must be able to perform R&D services that go beyond the capabilities of competitors. If Ginkgo are able to produce products that no one else can, then they are likely to realize a significant share of the downstream value created.

Ginkgo’s business model also potentially introduces an issue with adverse selection. If Ginkgo is willing to perform lab services at a breakeven price in order to try and capture downstream value, customers who are less confident in the prospects of their business could be more likely to utilize the platform. In comparison, a business that is highly confident of success may be more willing to bear higher development costs in order to ensure they retain all of the downstream value. Given Ginkgo’s focus on royalties and equity stakes, attracting the right partners and negotiating contracts that align incentives is extremely important.

Figure 4: Potential Adverse Selection (source: Created by author)

When accepting equity in lieu of royalties, Ginkgo typically takes 30%+ stakes in newly formed companies.

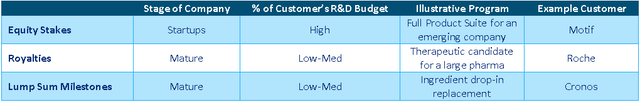

Table 2: Illustrative Structure of Downstream Value Share (source: Ginkgo Bioworks)

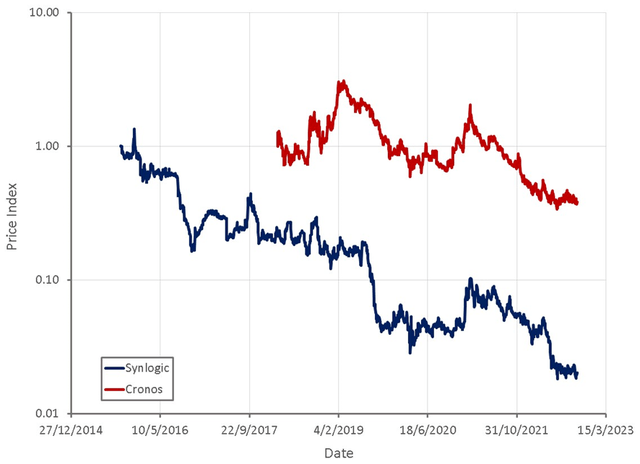

Even if Ginkgo has the bargaining power to negotiate attractive contracts, their programs must still achieve commercial success, which is not a given. There is the question of product-market fit and scale-up is often difficult. Synlogic (SYBX) and Cronos (CRON) are two clear examples where Ginkgo’s equity stakes have declined in value significantly since partnerships were agreed to. That is not to say that ultimately the stock of these companies won’t turnaround, but the valuation at which Ginkgo receives equity stakes, the amount of equity received and the future performance of partners are all critical.

Figure 5: Synlogic and Cronos Share Price Performance (source: Created by author using data from Yahoo Finance)

Cronos

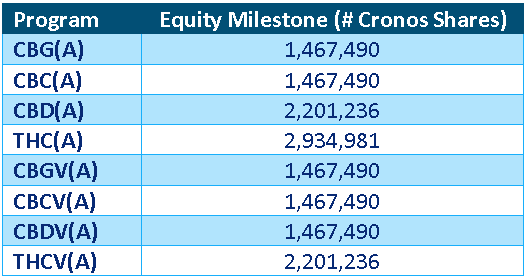

Ginkgo is developing organisms to produce cannabinoids for Cronos. There are 8 target cannabinoids in the partnership which will be produced by yeast via fermentation at costs below 1,000 USD per kg. Cronos will have the exclusive right to use and commercialize the key patented intellectual property related to the production of the target cannabinoids perpetually and globally. Ginkgo were expecting 20 million USD in foundry revenue over the life of the program, with an additional 44 million USD in equity milestones at Cronos’ current share price.

Table 3: Downstream Value from Cronos Program (source: Created by author using data from Ginkgo)

While cannabinoids have been touted as a success for Ginkgo, there are some questions. Cronos Group recently licensed foundational biosynthesis IP from Aurora and 22nd Century Group. It is a non-exclusive license which is intended to assist in the advancement of R&D on the biosynthesis of cannabinoids. Cronos stated that the license would help them to increase speed and efficiency in their commercialization efforts, indicating the process developed by Ginkgo was not cost-effective.

Aurora discovered key genes within the cannabinoid biosynthesis pathway and this has created an IP roadblock to efficient production. Companies must either license the IP or try and engineer their way around it, something that Ginkgo has apparently failed to do. Aurora and 22nd Century Group continue to enforce their IP against infringing parties, as well as to actively explore commercial development opportunities. Aurora and 22nd Century also continue to work on plant breeding to bring more consistent and higher yields to the hemp and cannabis industry.

Synlogic

Synlogic is developing biotic therapeutics to treat metabolic diseases and IBD. Their most mature product breaks down phenylalanine in Phenylketonuria patients. The program has shown positive results in phase II, breaking down phenylalanine in the GI of patients. Synlogic is now hoping to translate those results into reduced phenylalanine in the blood. Despite Ginkgo’s partnership with Synlogic, the strain used in the clinical trials was developed internally and in collaboration with enEvolv (acquired by Zymergen). Ginkgo’s strain did not meet Synlogic’s criteria to advance into clinical trials.

Competitive Advantage

Gingko’s competitive advantage is also uncertain at this point in time. In theory it is supposed to be based on data, with Ginkgo’s advantage growing over time. Rapid improvement in tools mean that a new entrant into the market is not necessarily that far behind Ginkgo though. What can be achieved with current technology would have been impossible only a short-time ago. Similarly, what will be possible in a few years’ time will likely greatly exceed current capabilities. Ginkgo also relies heavily on third-party technology, which lowers barriers to entry.

There seems to be an insistence that synthetic biology is essentially a computer science problem and that with enough data anything will be possible. Even if this is the case and data does provide a sustainable competitive advantage, it begs the question of why should Ginkgo be expected to dominate this market. If synthetic biology is largely a computer science problem, given the size of the opportunity it would make sense for companies like Google (GOOG) (GOOGL) and Microsoft to leverage their financial resources and expertise to enter the market. Having only invested a few billion dollars in their platform, Ginkgo’s lead is far from insurmountable.

Scale Up

While laboratory capabilities are improving, scale-up remains problematic and in many ways, is the biggest hurdle for synthetic biology. Many first-generation synthetic biology companies failed because they focused on relatively low value end products that could not be produced at a competitive price point at scale. Companies continue to grapple with these types of issues even today.

There is a range of intellectual property and process knowledge relating to scaling-up production and at this stage it is not clear that the industry is mature enough to simply hand off manufacturing to CMOs.

At the end of a program, Ginkgo’s customers receive the engineered organism along with a plan for manufacturing and downstream processing. This raises questions about how well strains initially perform at scale, how much ongoing assistance Ginkgo provides to customers to help them continue lowering production costs and what happens in the event that there are manufacturing issues.

A successful project requires collaboration between the fermentation team and strain engineers, which becomes more difficult if these teams reside within different organizations. Fermentation teams need an understanding of the organism’s physiology within the process to know how to optimize fermentation, and strain engineers need feedback from the fermentation team about the process so that they know what genetic changes to make to improve strain performance.

Fermentation conditions vary dramatically between lab, pilot and commercial scale production. Strain engineering is conducted at lab scale though, meaning that companies must be accurately able to extrapolate performance from lab data. This is not necessarily a straight forward process and requires experience.

Because larger fermenters have gradients in conditions, modeling and testing conditions at small scale can help alleviate challenges at larger scale, which are bound to come up. However, many companies find it difficult to do enough testing without the proper resources, such as bioreactor capacity or staff bandwidth. Ginkgo Bioworks utilizes Culture Biosciences to run bioreactor experiments to compare performance in a simulated production environment. Through repeated testing with different strains and processes, the data from Culture has consistently shown similar performance at other scales. For all key bioprocess variables like cellular metabolism, biomass growth, and product titer, similar results are observed between bioreactor runs done at Culture and in-house bench-scale reactors, pilot-scale, and production scale reactors.

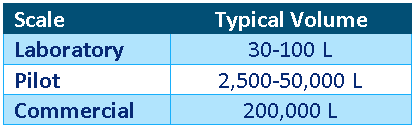

Table 4: Typical Scale-Up Volumes (source: Created by author)

Other problems that become more important when fermenting at large scale include:

- Strain stability

- Production of off-target products which lower yields and can retard the fermentation process

- Production of impurities, particularly ones that are difficult to isolate during downstream processing

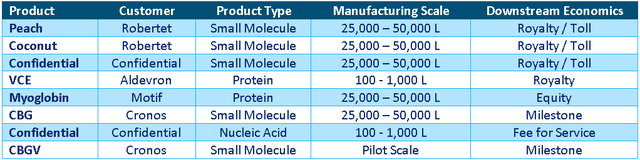

Gingko has demonstrated the ability to produce a range of products, although the economics of doing so remain unclear. Ginkgo’s engineering of yeast cells has already led to commercial production of three fragrance molecules. Robertet is manufacturing gamma-decalactone (strong peach scent) and massoia lactone (flavoring). Ginkgo has also highlighted commercial production of a number of other products at significant scale.

Table 5: Ginkgo Products in Commercial Production (source: Created by author using data from Ginkgo Bioworks)

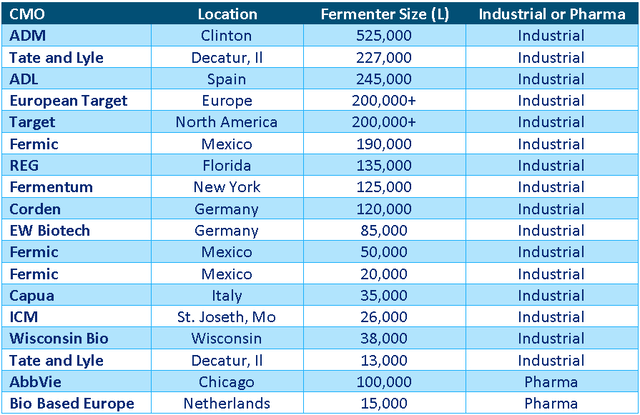

There is also a question about global production capacity and the ability of CMOs to keep up with potential demand. Ginkgo alone plans to have approximately 500 new programs per year within the next few years. In the vicinity of 16.5 million liters of fermentation capacity is available in the pharmaceutical industry, with approximately 62% of this dedicated to mammalian cell culture.

Fermentation capacity is another problem that is related to the target product. A company producing a high-value molecule in small quantities is unlikely to have problems obtaining access to a suitable fermentation facility, and cost is unlikely to be an issue. Companies producing relatively low value molecules in large quantities will need access to large facilities with access to low cost feedstock and energy. They will also be sensitive to CMO pricing, and it may not be commercially to bid for capacity when the market is tight.

Table 6: Example CMO Facilities (source: Created by author)

Conclusion

Ginkgo is a company with enormous potential, but there are large uncertainties around many aspects of their business. If Biosecurity revenue dries up going forward and meaningful downstream value isn’t realized in the near term, investors may begin to lose patience. Obstacles facing Ginkgo include scaling production, related-party revenue concentration, business model uncertainty and manufacturing bottlenecks.

Ginkgo is more likely to have success in areas where strain engineering is difficult and scale-up of production is less important. Ginkgo appears to be gravitating towards these areas, with an increasing number of pharma & biotech and agriculture programs. There are also signs that Ginkgo is becoming more vertically integrated in some areas to help products reach the market, as indicated by their collaboration with Bayer (OTCPK:BAYRY).

Be the first to comment