Justin Sullivan/Getty Images News

Gilead Sciences (NASDAQ:GILD) has long been a leader in HIV/AIDS therapies as well as other anti-viral therapies. This last year it has seen a bolus of revenue and profits from its Covid therapy. Over the past decade it has also become a major competitor in cancer therapies. It is highly profitable and pays a hefty dividend. With a great combination of both future potential profit growth and the current dividend, it is a solid Buy for investors who can tolerate the pharmaceutical risk model where new therapies need to be developed more quickly than older therapies as their patents expire. Its stock can be bought cheaply at present because the company and analysts expect a decline in Covid therapy sales, leading to a year/year decline in revenue for 2022.

Therapy Overview

Gilead’s early success was in treating HIV infections. It later expanded into other antivirals and cardiovascular indications. Most recently it has concentrated on cancer and inflammatory disease. Beyond this overview a look at the Gilead commercial medicines list may help to get a grip on the investment value of the company.

Gilead’s HIV antiviral medicines have evolved over time, becoming considerably more effective and safer. The pipeline of potential new HIV therapies is also strong. Currently the best-selling Gilead HIV medicine is Biktarvy. It had sales of $2.53 billion in Q4 2021. Older HIV drugs like Descovy, Genvoya and Odefsey also generate substantial revenue, but are mostly declining y/y.

Other Gilead antivirals include Veklury (remdesivir) for Covid-19. Of its several Hepatitis C medicines, Epclusa (Sofosbuvir + Velpatasvir) is the best seller with $307 million in revenue in Q4 2022. For Hepatitis B Vemlidy is currently the leader, with $224 million in Q4 sales. The takeaway is that Gilead has a very strong anti-viral franchise that produces substantial revenue, cash flow, and profit.

The cardiovascular franchise currently consists of Letairis and Ranexa which had Q4 revenues of $46 million and $5 million, respectively. Letairis is now subject to generic competition, so it will continue to see its revenue decline. Gilead has no cardiovascular pipeline as it has decided to focus on cancer.

The inflammatory and fibrotic disease pipeline has not been a big winner yet. Two older, small revenue drugs in this category are Cayston and Tamiflu. The newly approved drug is Filgotinib for Crohn’s disease, developed by Galapagos. Revenue from that was not broken out.

Last but not least, we have the cancer therapies. These largely come out of the Kite Pharma acquisition of 2017 and the Immunomedics acquisition of 2020. However, prior to those acquisitions Gilead received FDA approval for Zydelig (Idelalisib) for treating leukemias and lymphomas. A kinase inhibitor, the drug has side effects that discourage its use and in Q4 2021 its sales had declined to $12 million. Newer entries are currently more successful, with Yescarta generating $182 million (up 41% y/y) in Q4; Tecartus $57 million (up 68%); and Trodelvy $118 million (up 141%). Trodelvy was acquired with Immunomedics.

Because of the current rapid growth in cancer drug revenue and the pipeline for label expansions and new therapies (see below), I see Gilead becoming a major player in cancer therapies. Cancer is a tricky disease, and the road could be rocky, but by the end of the decade cancer therapy revenue could hit one-third of total revenue by 2030, according to management. I would also expect small, innovative cancer companies to be high on the list of Gilead’s acquisition targets.

Q4 2022 Results

What did all that biotech, pharmaceutical genius amount to in dollars? The latest Gilead Q4 2022 results showed revenue was down 2% y/y. For predicting future value it is important to understand the dynamics of that stagnation. The newer drugs, notably HIV drug Biktarvy (up 22% y/y) and the three cancer drugs came on strong. Declines continued in the older HIV drugs and in Hepatitis C therapies. Most notably, the Covid 19 therapy, Veklury, saw a 30% y/y decline to $1.36 billion.

Cash flow from operations was an astonishing $3.20 billion, and free cash flow was $3.05 billion. That led to cash and equivalents ending at $7.83 billion, up about $1 billion over the prior quarter. Gilead used $894 million of cash flow to pay out dividends and about $1 billion to pay down debt. But long-term liabilities were a whopping $35 billion. That debt had been largely used to make acquisitions.

GAAP net income was $382 million, down 75% y/y. That was hit by part of a $1.25 billion legal settlement charge and a charge of $625 million to opt-in to a collaborations with Arcus Biosciences (RCUS). Strip out one-time charges and non-cash items and non-GAAP net income came to $866 million, still down from year-earlier, when Veklury generated almost $2 billion in revenue. EPS came to $0.30 GAAP and $0.69 non-GAAP.

Potential 2022 Catalysts

A couple of catalysts for Gilead were announced recently. On March 7 Gilead announced Trodelvy for late-line HR+/HER2- breast cancer met its primary endpoint, PFS (progression free survival). The Phase 3 study was of patients who had two to four prior lines of chemotherapy, i.e., very sick, advanced patients. The control group was given the physician’s choice of chemotherapy. While the exact results will not be released until they can be presented in a medical conference, the target was a 30% reduction in the risk of disease progression or death and was powered to detect a statistically significant difference of at least 0.9 months in median PFS. Secondary endpoints included overall survival, duration of response, clinical benefit rate and overall response rate as well as assessment of safety and tolerability and quality of life measures. The stock dropped on the news when Barclays analysts trimmed their price target for Gilead, arguing meeting the PFS endpoint would be insufficient for FDA approval. Since the definite PFS and OS data was not released, I would take that analysis as purely speculative.

On April 1 the CAR T-cell therapy Yescarta received FDA approval for expanding its label to include adult patients with large B-cell lymphoma that is refractory to first-line chemoimmunotherapy or that relapses within 12 months of first-line chemoimmunotherapy. The approved results were from the ZUMA-7 trial, which continues to monitor patients in additional indications. Given the approval we can expect Yescarta sales to continue to ramp rapidly.

Gilead expects three more Trodelvy readouts in the first half of 2022 and then another two in the second half. Yescarta is slated for a European decision in R/R follicular lymphoma in 1H, then a second-line LBCL decision in 2H. Domvanalimab, Etrumadenant, and Quemliclustat, all Arcus Biosciences cancer assets, are due for Phase 2 readouts in 2H 2022. Hepcludex is a hepatitis D antiviral with an expected FDA decision expected in 2H 2022.

While trial results sometimes disappoint, it looks like 2022 will be a rich year for possible positive data results. That would increase investor perceptions of potential long-term revenue and profits. Beyond 2022 the Gilead pipeline includes a large number of potential antiviral, anti-inflammatory, and cancer treatments in clinical trials. It is simply too big to cover here, so I refer you to the Gilead pipeline page.

Dividend

At the Q4 2022 conference on February 1, 2022, the dividend was raised $0.02 per share to $0.73 per share per quarter. It was paid on March 30 to shareholders of record as of March 15, 2022. At the closing price of $60.27 on April 4 that works out to a yield of 4.8%.

2022 Guidance

Guidance given for the full year 2022 is product sales between $23.8 billion and $24.3 billion. That includes total Veklury sales of approximately $2.0 billion, primarily reflecting the Q1 surge in COVID-19 related hospitalizations, but also an expected decline in hospitalization rates over the remainder of 2022. GAAP EPS is expected between $4.70 and $5.20. Non-GAAP EPS is expected between $6.20 and $6.70. At mid-range for non-GAAP EPS of $6.45 and the closing 4/4/2022 price of $60.27, the P/E would be 9.3.

Conclusion

Although with the end of the Covid pandemic in the United States we can expect Veklury sales to decrease rapidly (after Q1), most analysts and investors have already taken that into account, which is why the current P/E ratio of about 12 is so low. Earnings are also highly likely to take a dip as Veklury sales decline. But earnings will continue to support the dividend and pay down debt. Longer term I see revenue ramping up, particularly from the cancer therapy part of the portfolio. When the comps start leaving out the Veklury bolus, investor sentiment should become more positive, provided the cancer portfolio is performing well.

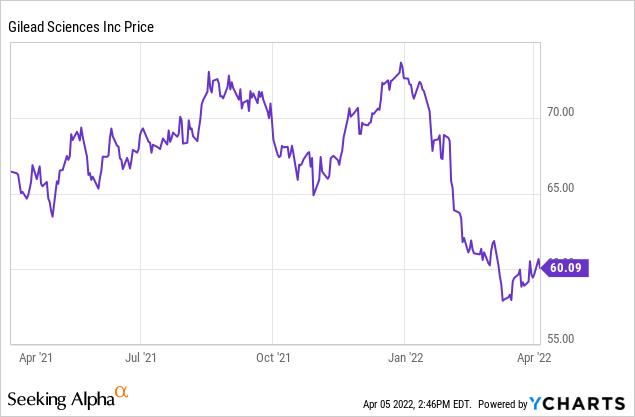

The 52-week high for Gilead is $74.12. I see no reason why Gilead cannot return to that vicinity and break through it if cancer therapy revenue continues to ramp rapidly. There will be a lot of data from clinical trials in 2022; positive data would be supportive. The price of the stock tends to be volatile, rising and falling every time the results of a drug trial or an FDA decision is reported. What is stable is the dividend rate. I generally reinvest dividends in much riskier, small cap biotech stocks with promising potential therapies. Check out my other Seeking Alpha articles to learn about my favorites.

Be the first to comment