Torsten Asmus

Thesis

GAMCO Global Gold, Natural Resources & Income Trust (NYSE:GGN) is an equity closed end fund. The vehicle holds mining and energy conglomerate shares, with a 15% sleeve allocated to short-term treasury bills. The vehicle has an unsupported 10% dividend yield, with the true portfolio cash flow closer to a 5% to 5.5% yield. In a year of record inflation like 2022 GGN has not been able to provide a palatable hedge, the fund being flat from a total return perspective. The reason behind this lack of a performance is the overweight allocation to gold mining equities, a sector which is down -20% year to date.

A savvy investor needs to keep in mind that the correlation between a commodity and commodity equities is not one-to-one. The best commodity exposures are obtained through funds composed of futures, while equity funds have other risk factors baked into their performance. As a stark example for this basis, we can have a closer look at two of GGN’s top holdings, namely Shell (SHEL) and Total (TTE). While oil is up more than 30% year to date (WTI that is), the two European Oil & Gas majors have an almost flat total return. The explanation lies with their write-downs in their substantial Russian holdings, and the regulatory and taxation environment in Europe. Substantially higher oil prices have not translated into an equally positive share performance.

Due to their global revenue stream, some of the other miners are now down on a year-to-date basis given the slowdown in China and their property sector crash. GGN runs exposures to global companies which have many risk factors composing their earnings and performance. We do not like this muddled vector composition, because it is hard to predict the performance. Even if an investor would have known that 2022 will be remembered as the year of record inflation, said investor would have not been able to profit via GGN. Looking at the fund’s historic performance, we can see a similarly spotty track record:

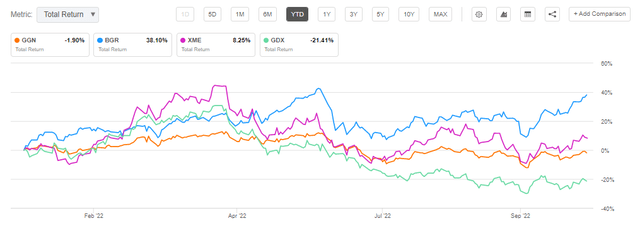

In the past decade, the fund has posted positive yearly performances in only 50% of the instances, and the correlations with distinct risk factors are a bit on the weak side. We prefer to take a cleaner view on Oil & Gas via specific CEFs or ETFs (we analyzed BlackRock Energy and Resources Trust (BGR) for example here) and we would parse out gold miners with global conglomerates via specific ETFs such as XME and GDX.

We are not fans of GGN or the fund’s unsupported dividend, and we cannot see how this CEF can be considered an inflation hedge after its flat performance in a year such as 2022.

Holdings

The fund can be decomposed in two large asset classes:

- Mining Companies

- Energy Companies

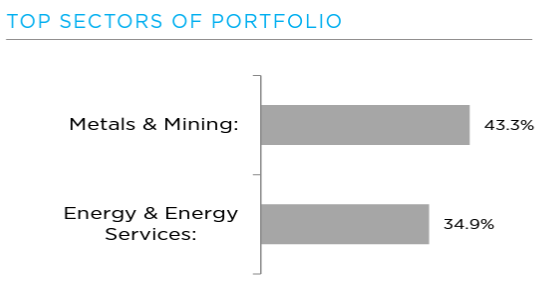

Top Sectors (Fund Fact Sheet)

An investor needs to keep in mind that the fund does not take positions in the actual commodities, but in the equities of mining and energy producing enterprises. The differences between the returns of the underlying commodity and the equity of a company can be substantial at times, especially when balance sheet issues arise or environmental factors such as ESG factors come into play.

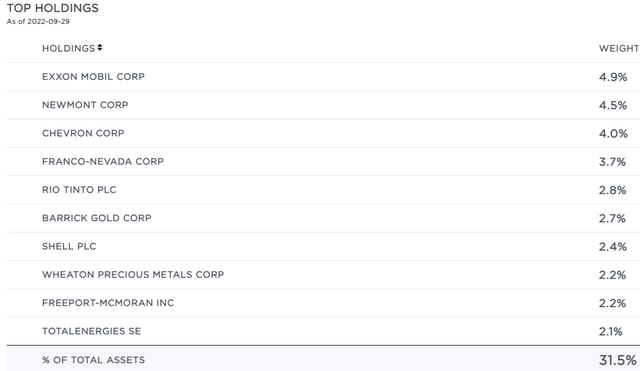

The current fund top holdings are:

Top Holdings (Fund Fact Sheet)

We can note that the list contains some of the largest global players in the mining industry such as Rio Tinto (RIO) and Freeport-McMoRan Inc. (FCX) alongside most of the global Oil & Gas majors.

An investor really needs to get behind the global enterprises and their impact on returns. For example, when one says Energy Company in 2022, the first thing that comes to mind is outperformance. It would be erroneous to think through that framework when it comes to the GGN portfolio. Why? Well, let us have a look:

Energy Equities YTD Total Return (Seeking Alpha)

We can see from the above graph that Exxon (XOM) and Chevron (CVX) have a stellar 2022, while Shell and Total are barely getting by. The reason behind this divergence is the fact that Shell and Total are European companies that used to have a substantial presence in Russia which had to be written down, and they’re subjecting to European windfall taxes and other regulatory issues associated with the old continent. Not all energy companies are created equal, and the American ones have put in a good performance in 2022, but not the European ones. GGN’s build thus is not geographically focused, and it will always encompass macro and political issues associated with the global conglomerates that are present in the portfolio.

Performance

Surprisingly for a fund that is supposed to be an inflation hedge, GGN has not performed well in 2022:

The CEF is basically flat in 2022, which in itself would be a decent performance, but when compared to other funds in the Energy and Mining sub-sectors GGN’s performance pales. When looking at the BlackRock Energy and Resources Trust, a CEF which we covered here, or the S&P Metals and Mining ETF (XME), we can see substantial positive performance in 2022. Why is GGN only flat? The answer lies in the fund being overweight gold mining companies. Gold miners are down -21% year to date, dragging the overall fund performance.

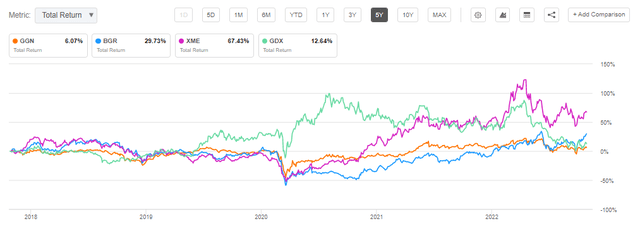

On a 5-year basis, GGN exposes the same flat performance:

The CEF has not done much for investors in the past years.

Premium/Discount to NAV

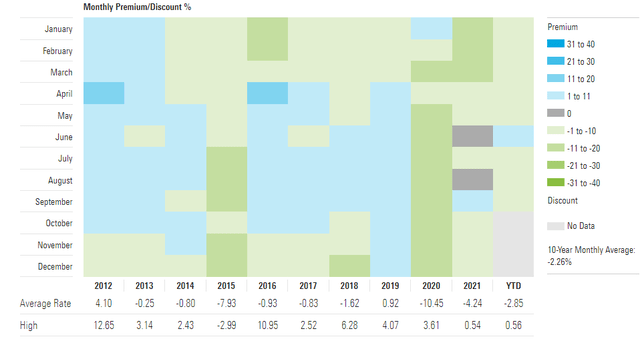

The CEF has usually traded at a discount to net asset value:

Premium/Discount to NAV (Morningstar)

Currently, the fund is trading with a -3% discount, and we expect this figure to persist. There is no outperformance to speak of for this CEF, so the market will rightfully keep trading the vehicle at a discount to net asset value.

Distribution

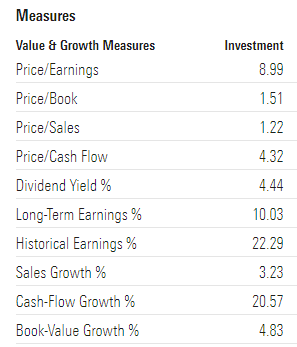

The fund currently exhibits a 10% yield, which is unsupported. The underlying portfolio generates a cash flow yield of around 4.4% only:

Portfolio Measures (Fund Fact Sheet)

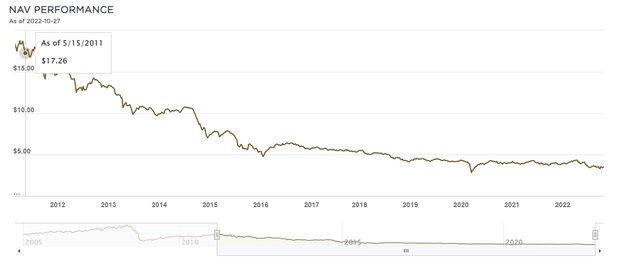

When we factor in the fund’s leverage, which stands at 14%, we get to a cash flow yield of around 5% to 5.5%. The rest is going to be ROC unless the fund is able to generate capital gains. We can see the heavy utilization of ROC for the fund via its substantial NAV erosion throughout time:

Conclusion

GGN is an equity CEF. The fund focuses on mining and energy equities, with overweight positions in global conglomerates. The CEF also utilizes a covered call options overlay strategy, which can cap the upside in market rallies while providing a buffer in down cycles. The vehicle is flat on a year-to-date basis from a performance standpoint, given its positioning in gold miners and European Oil & Gas majors. The fund has an unsupported 10% dividend yield, with the portfolio generating only around 5% to 5.5% dividend yields. In years like 2022 when there are no capital gains to be had from a portfolio standpoint, the fund ends up utilizing a substantial amount of ROC. We do not like how the vehicle has a multitude of risk vectors running its performance, and we prefer cleaner expressions of a market view via CEFs or ETFs such as BGR (energy), XLE (energy), XME (mining) or GDX (gold miners).

Be the first to comment