buzbuzzer/E+ via Getty Images

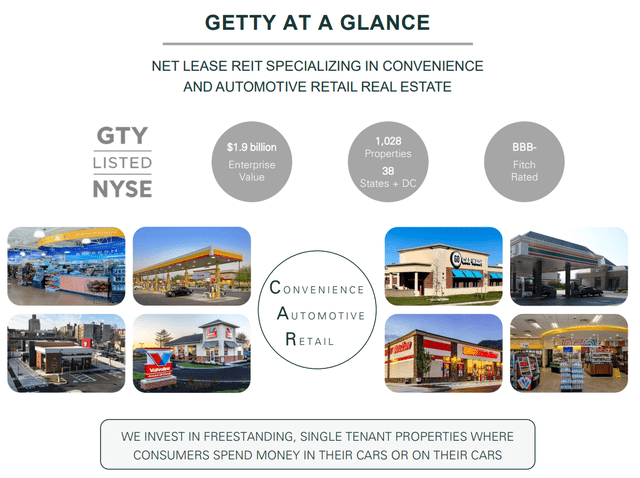

Getty Realty Corp. (NYSE:GTY) owns and leases a portfolio of over 1,000 gas stations and convenience store-type retail properties. The attraction of the stock is a compelling 5.7% dividend yield within a segment of real estate recognized for steady cash flows and high-quality tenants that have proven to be resilient over various market cycles. That said, while the current fuel prices near record levels mean consumers are paying more at the pump, the setup isn’t necessarily a windfall for the underlying operators or Getty Realty.

The challenge is that gas stations typically make the bulk of their profits through secondary services like an attached car wash or convenience store sales. The thought is that the high inflationary environment and headwinds toward consumer spending end up pressuring the near-term outlook. Indeed, shares of GTY are down by 10% this year suggesting poor sentiment and greater uncertainty. We believe the stock warrants some caution with downside risks.

source: company IR

Getty Realty Financials Recap

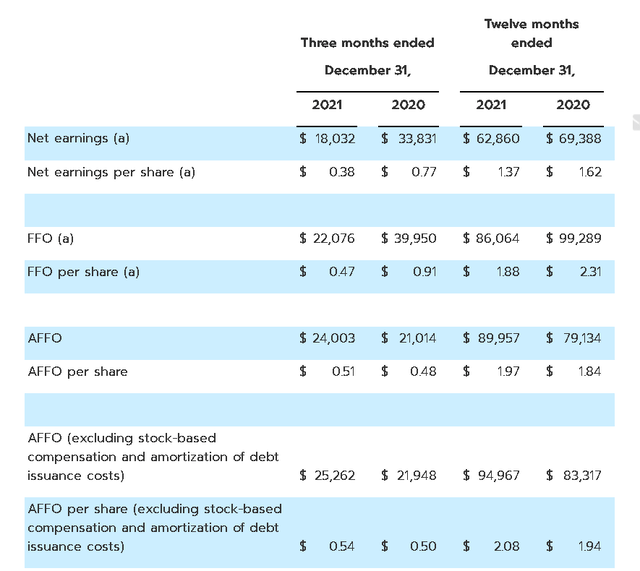

Getty Realty reported its Q4 results back in early February capping off a strong year for the company defined by the post-pandemic recovery. 2021 revenue from rental properties reached $154 million, up 6.4% year-over-year.

On a GAAP basis, a 16% increase in general and administrative expenses at the corporate level along with higher charges related to environmental litigation fees led to EPS of $1.37, down from $1.62 in 2020. Nevertheless, the earnings metric of adjusted funds from operation (AFFO) excluding stock-based compensation and amortization of debt at $2.08 climbed 7% year over year.

source: company IR

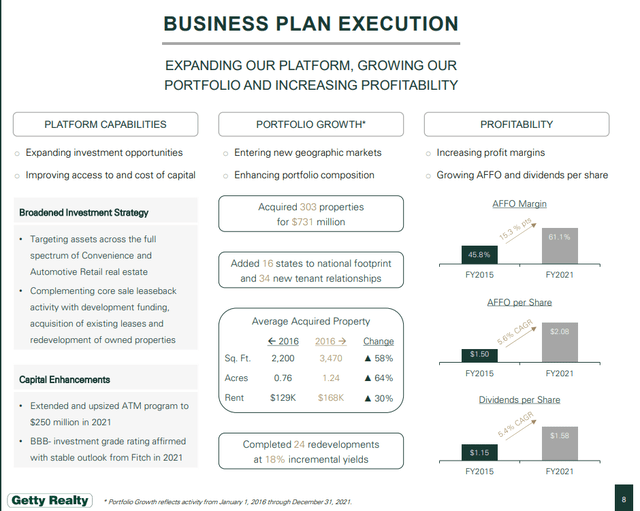

The company invested $200 million across 100 properties including the acquisition of 25 convenience stores, 17 car washes, 54 auto service centers, and one drive-thru quick-service restaurant. On this point, the company has been active with deals over the last several years as part of its growth strategy, acquiring 303 properties for $707 million since 2016. AFFO has climbed at a compound annual growth rate of 5.6% since the fiscal year 2015 while the company has increased its dividend by a similar amount to the current annualized rate of $1.58.

source: company IR

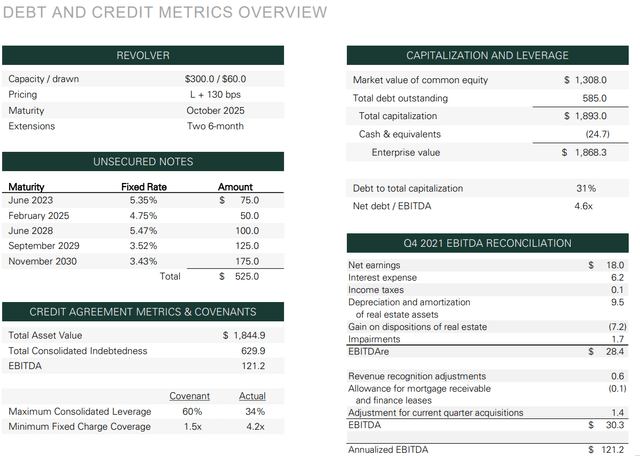

On the other hand, while Getty maintains an overall solid balance sheet with ample liquidity, a lot of its growth has been debt-driven. The REIT ended the year with $27 million in cash and equivalents against $585 million with a reported net debt to an EBITDA leverage ratio of 4.6x. This metric is set to increase considering Getty announced an additional private placement of $225 million in notes after the quarter-end that will be reflected in the Q1 balance sheet.

There is a thought that climbing interest rates may limit additional debt issuances in the near term with an eye on maintaining the company’s investment-grade credit rating currently at (BBB-). For the year ahead, management is guiding for AFFO in a range between $2.08 to $2.10, essentially flat compared to 2021.

source: company IR

GTY Stock Price Forecast

Getty Realty is a unique REIT offering investors exposure to gas stations and the convenience store business model. Still, it’s a segment that has been stagnant over the last few decades beyond Getty’s efforts at growth through acquisitions. Gas stations on the fuel side are recognized as being a low-margin business, often facing intense competition to keep the price per gallon as low as possible compared to what may be a competitor across the street. The real business is when those customers enter the convenience store to buy snacks and general merchandise which is more profitable.

We mentioned the near-term headwinds toward consumer spending. Simply put, drivers filling up their cars today at record prices are likely going to be hesitant on splurging on extra services like a premium car wash. Separately, the operators are also getting hit by higher costs including labor shortages and wages.

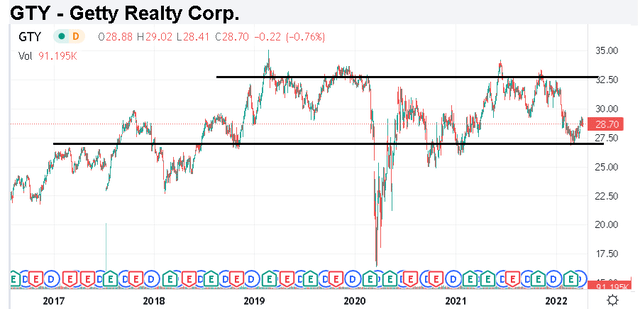

As it relates to Getty, the point here is to say that it doesn’t seem like great momentum to be investing in this segment. We can argue that even the deals the company made in 2021 were likely at stretched valuations. Looking at the stock price chart, outside of the early pandemic crash, GTY has been stuck trading around $30 per share for the last several years. It’s hard to get bullish here with a call for the stock to break out.

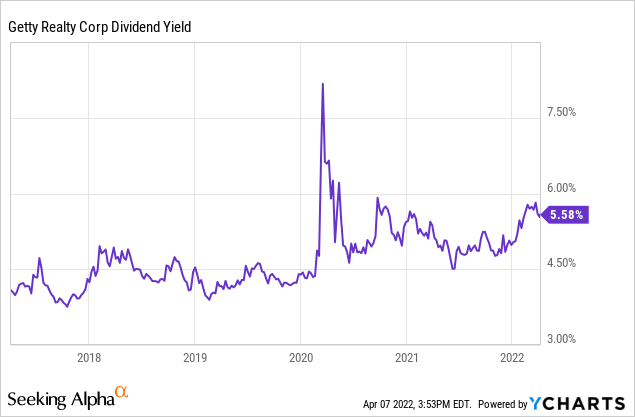

Seeking Alpha

The silver lining goes back to GTY’s 5.6% dividend yield. For income-focused investors, the stock could be a good option as a high-yield bond alternative. Outside of a complete real estate market crash or apocalyptic recessionary event, we believe the dividend is safe through underlying cash flows.

To be clear, there are plenty of risks. Higher interest rates including the 10-Year Treasury approaching 3%, may end up limiting the appeal of all high-yield stocks. Compared to strong rent increases seen in recent years, the expectation is that the climb in real estate prices going forward at least moderates.

Finally, we note that GTY’s price to FFO near 15x does not stand out as cheap among other retail REITs. The benchmark for the industry here would be Realty Income (O) which trades at 18x by the same metric. There is a case to be made that O deserves a larger premium given its larger scale and more diversified operation that has delivered stronger growth.

Final Thoughts

We rate GTY as a hold, viewing the stock at near fair value with a price target for the year ahead at $30.00. We balance a recognition of the underlying strength in the business against what we view as macro headwinds that may keep shares volatile. Overall, GTY is an interesting high-yield name, but we sense their other opportunities that offer a better combination of value and growth. Tactically, we would be open to taking a more bullish position on any correction below $26.00 which would improve the reward to risk setup.

Be the first to comment