MoMorad/iStock Unreleased via Getty Images

Investment Thesis

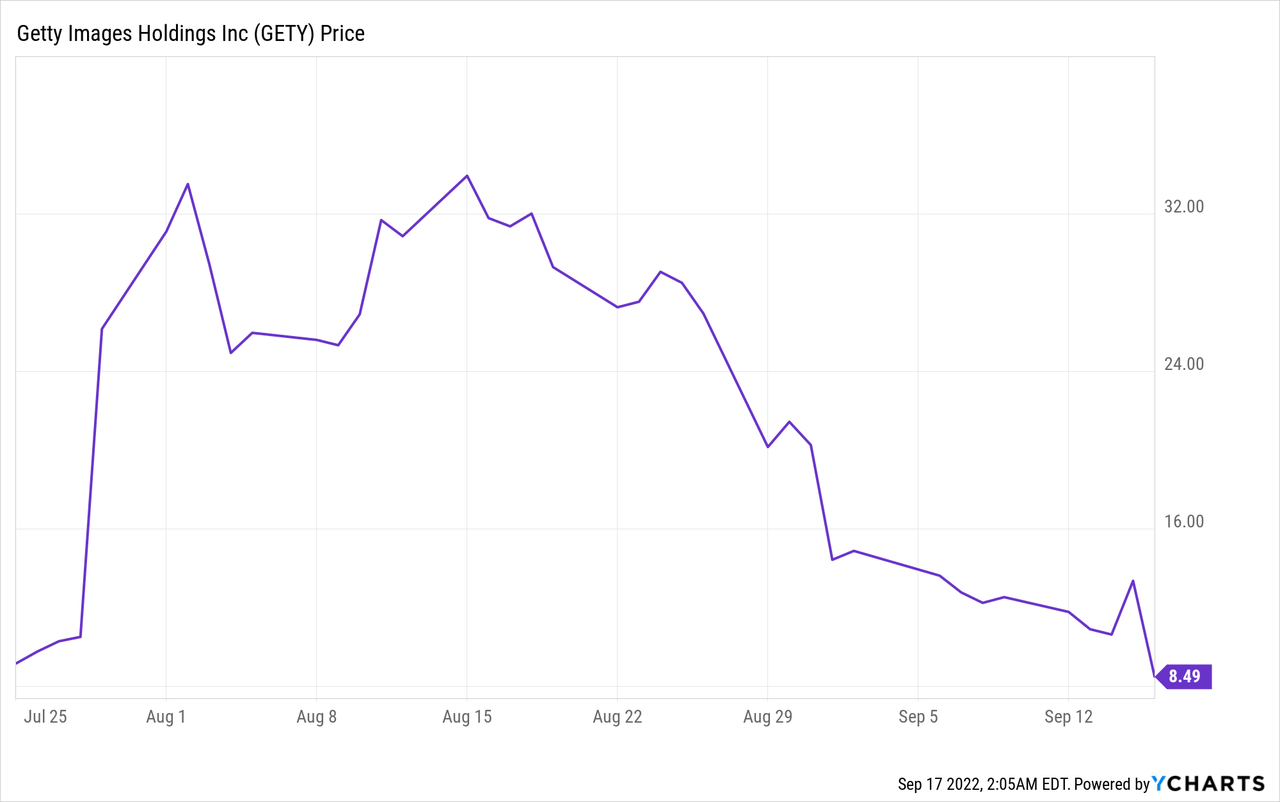

Getty Images (NYSE:GETY) went public earlier this year through a SPAC merger with CC Neuberger Principal Holdings II, raising up to $1.2 billion at a valuation of $4.8 billion. The company gained a lot of short interest since its IPO, which resulted in a subsequent short squeeze. The share price shot up almost 350% from $8.3 to $37.2 within two weeks but has been dropping since, now trading at $8.5. Getty Images has solid fundamentals with a growing recurring revenue base. It also has a strong moat thanks to its extensive content library. However, despite the significant drop, the current valuation remains very expensive when compared to peers. The growth rate has been slowing and it is also facing currency headwinds. Therefore I rate the company as a sell at the current price.

Overview

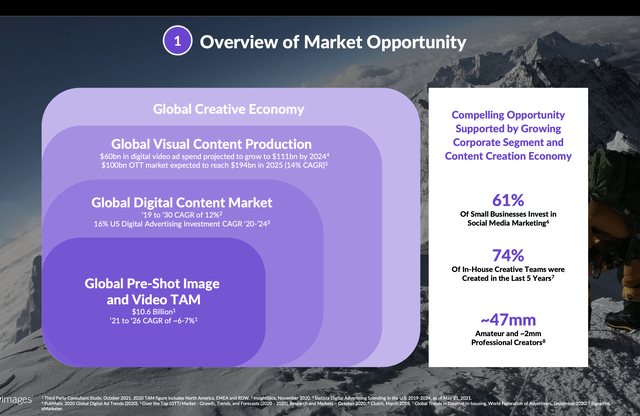

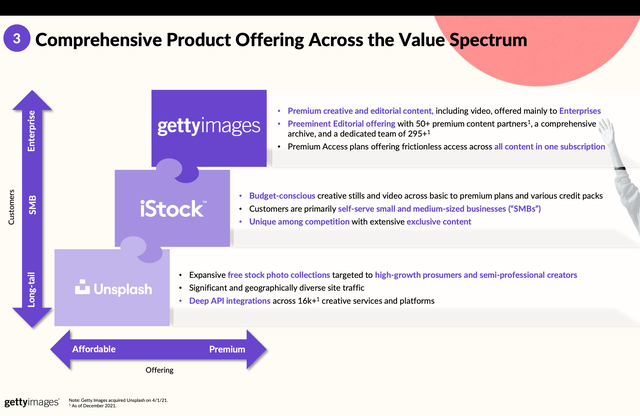

Getty Images is a leading global visual content marketplace offering consumers photos, illustrations, videos, and vectors. The company operates three platforms including Getty Images, iStock, and Unsplash. Getty Images mainly target enterprises with premium offerings, iStock provides affordable imagery for SMBs while Unsplash offers free images for mass consumers. Getty Images is benefiting from a large and growing TAM (total addressable market). According to the company, the TAM for global pre-shot image and video is estimated to be $10.6 billion with a CAGR (compounded annual growth rate) of 6%-7% from 2021 to 2026. The growth is attributed to the increase in digital advertising and marketing, and the growing content creation economy.

Why Getty Images?

Getty Images has a strong moat thanks to its ever-growing ecosystem. The company operates as a two-sided marketplace. It receives content from creators and offers it to consumers and enterprises through different platforms. It currently has around 300 content partners and over 450,000 contributors, with 80,000 of them being exclusive contributors. This allows Getty Images to have an extensive library with proprietary content that is hard to compete with. Unsplash for example has over 24 million monthly visits with 1.7 million searchable photos. It is basically impossible for new competitors to create such a huge content library in a short period of time.

Getty Images is also transforming from a licensing model to a hybrid model (subscription + license). It has introduced a bunch of new subscription products in the past few years, such as Premium Access in 2019. In 2015, the proportion of subscription revenue is only around 29%, but the number increased significantly to 46% in 2021. The management team is confident that the figure can hit 60% in the long run. The hybrid model is much more accretive for the company in my opinion as it provides a recurring revenue stream with high stability and visibility. The company is also seeing new monetization opportunities in the advertising space. It now offers native ads to advertisers like Microsoft (MSFT), Squarespace (SQSP), Mailchimp (INTU), and more.

Financials

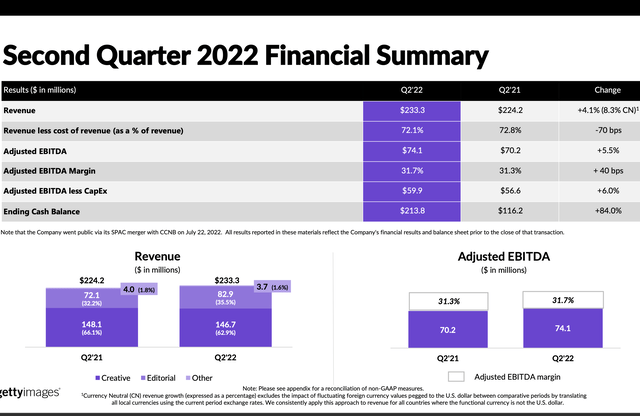

However, the solid fundamentals do not seem to be translating into its financials. Getty Images reported its second-quarter earnings last month and the growth rates are disappointing. The company reported revenue of $233.3 million, up 4.1% YoY (year over year) from $224.3 million. This represents a significant slowdown in growth rate compared to the 20.5% reported in the prior year. The creative segment amounted to $146.7 million, down 1% YoY, while the editorial segment amounted to $82.9 million, up 15% YoY.

The growth is largely driven by the increase in active annual subscribers, which was up 34.8% to 89 million. Purchasing customers and paid download volume also saw decent traction, up 12.6% and 9.4% respectively. The company continues to see good progress in its transition to the hybrid model. Subscription revenue as a percentage of total revenue grew from 44.3% to 48.2%.

The company continues to show strong profitability but bottom line growth also decelerated. Gross profit was $168.2 million compared to $163.3 million, up 3% YoY. The gross profit margin was down 70 basis points to 72.1%. Adjusted EBITDA increased 5.5% YoY from $70.1 million to $74.1 million. A much lower growth rate than the 11% posted a year ago. Adjusted EBITDA was 31.7%, up 40 basis points. Free cash flow dropped from $32.9 million to $16.8 million, representing a 48.9% decrease. The company’s balance sheet is also subpar. It ended the quarter with $214 million in cash and $1.73 billion in debt. While most of these are long-term debts and the company should have enough cash flow to cover the repayments, it will weigh on the company’s financial flexibility.

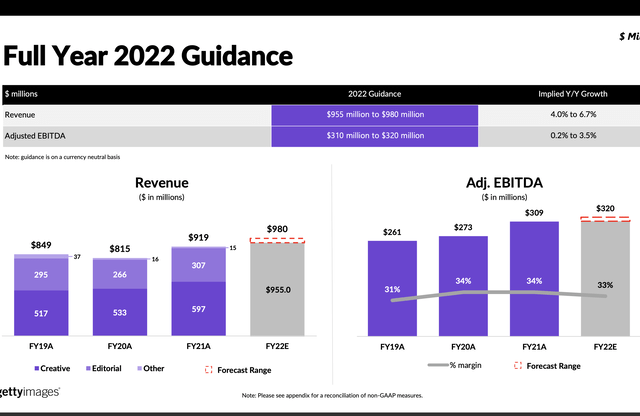

Getty Images expects growth to remain slow throughout the rest of the year. Revenue guidance of $955 million to $988 million represents a growth rate of 4.0% to 6.7%. While Adjusted EBITDA of $310 million to $320 million represents 0.2% to 3.5% growth.

The company is also currently facing substantial currency headwinds. Due to its strong global presence, the company is being negatively impacted by the strong dollar. During the third quarter, the total revenue and adjusted EBITDA took a hit of 4.2% and 6.1% due to unfavorable FX. If the dollar continues to spike, it is likely that the company’s financials will continue to be under significant pressure.

Valuation

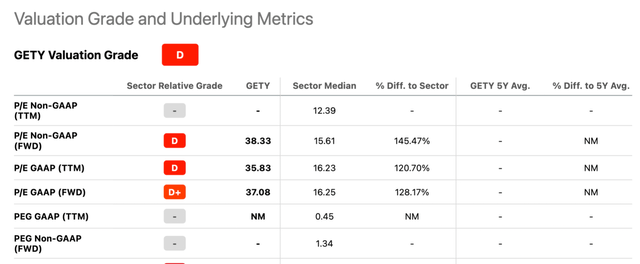

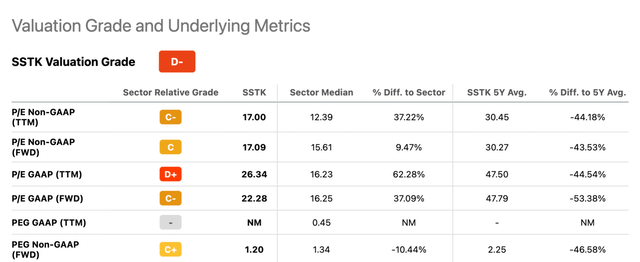

Despite the recent massive drop in share price, Getty Images is still trading at an fwd P/E ratio of around 37.1x. This is very expensive considering how low the growth rate has been. It is also trading at a significant premium compared to Shutterstock (SSTK), another leading imagery company. Shutterstock is currently trading at an fwd P/E ratio of only 22.3x, which represents a 39.9% discount compared to Getty Images. It also has a higher growth rate (9% vs 4%) with an extra dividend yield of 1.7%. Even high-quality mega caps like Microsoft and Google (GOOG) (GOOGL) are trading at a much lower valuation while growing revenue quicker, not to mention better prospects. In my opinion, there is no way Getty Images’ current valuation is justified, and a downward revision in multiples is highly likely.

Conclusion

In conclusion, I believe it is better for investors to stay away from Getty Images for now. Yes, the company does have a large TAM and a leading position with its two-sided marketplace, which gives it a strong moat. It is also transitioning to a hybrid model which will improve revenue visibility and stability moving forward. However, none of this seems to be translating to its recent financials. Revenue growth continues to decelerate and the guidance does not seem to indicate any kind of improvement. Financials are also likely to be under further pressure due to strong currency headwinds. Despite the recent drop, valuation is still way too expensive compared to peers and other companies. Therefore I rate the company as a sell.

Be the first to comment