AlbertPego/iStock via Getty Images

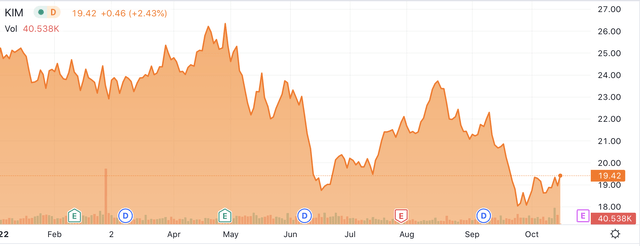

Alongside other real estate exposed stocks, shares of Kimco Realty (NYSE:KIM) have fallen over the past five months as rising interest rates weigh on valuations. With shares now down over 20%, there is now an interesting entry point into the stock as it continues its post-COVID recovery with funds from operation (FFO) set to pass its pre-COVID level this year.

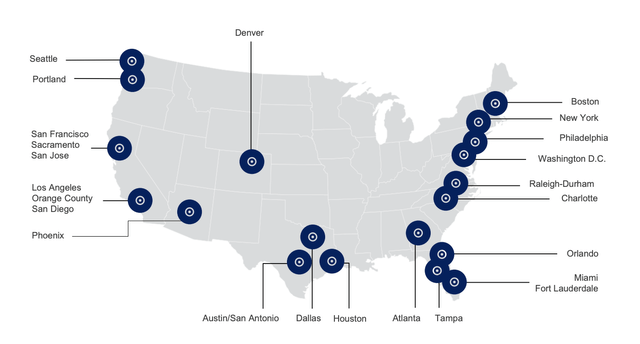

Kimco operates outdoor shopping centers, and 80% have a grocery store as the anchor tenant. The remainder of its business is mixed-use, or locations where there is multifamily atop of retail locations. It primarily operates along the coasts, with a presence in Texas and Arizona as well. Its top five markets are Washington DC, New York, Los Angeles, Houston, and Miami/Fort Lauderdale. Given its geographic location and mix of stores, its customers tend to have a higher income than the national average.

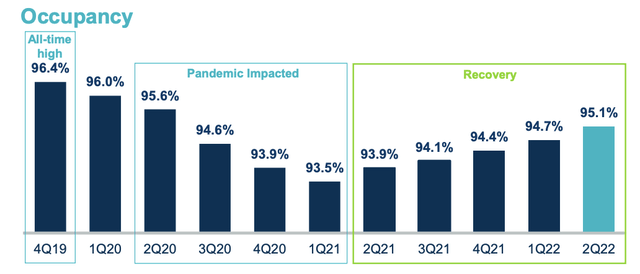

The company was hit hard by the COVID-19 pandemic as lockdowns led to store closures, and wary customers simply went out to shop less. As you can see below, its occupancy steadily fell in the aftermath of the pandemic to about 93.5%, but it has since gradually risen back to 95.1%. The fact grocery stores are its primary anchor helped to insulate results somewhat, and its contract leases have on average a 5-6 year remaining term, which also helps to mute volatility in occupancy and rental rates, though the company also faced forbearance and rent deferrals from store closures, which have largely normalized.

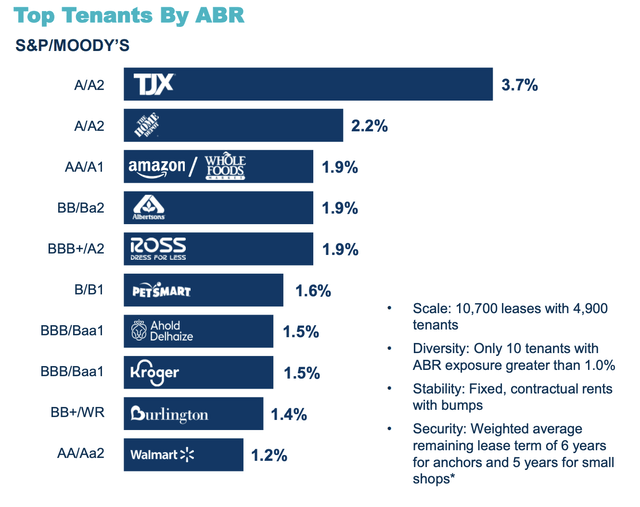

It is also important to note that Kimco has a diversified mix of high-quality tenants. Unsurprisingly, five of its top ten customers are grocery chains with the remainder being large retailers like Home Depot (HD) or TJ Maxx (TJX). With retailers increasingly using stores as part of their e-commerce platform, whether as a pick-up point for customers or holder of inventory for last-mile delivery, these open-air shopping centers are in my view a viable long-term asset class.

With occupancy rising, we are seeing the company perform well. In Kimco’s second quarter, funds from operation rose 17.6% to $0.40. Rental rates are up 4.8% over the past year to $19.31 and 7.5% above the pre-COVID level. Same-site net operating rose 3.4% Anchor occupancy is a particularly strong 97.6%.

Over time, the company targets 3-5% AFFO growth and 6-6.5x EBITDA. It is on track to do that, and it has brought leverage down to 6.4x this year. To bring down leverage since 2020, the company has been retaining some cash flow. This year, it plans to spend $450 million on cap-ex including $100 million of net acquisitions. This will leave the Kimco with $200 million in free cash flow after dividends.

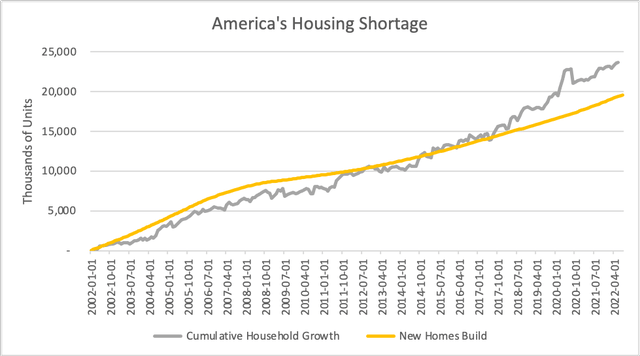

With this capital spending, Kimco aims to get its grocery-anchored share of rent to 85% while also expanding its residential unit count to about 12,000 from its previous 10,000 goal. I think adding the multifamily exposure will be accretive to the business as its leases are shorter (typically 1-year vs 5-10 years for a commercial lease), which will allow rental rates to move more quickly. Additionally, based on my calculations, we have built at least 3 million too few housing units over the past twenty years. This tight supply should support elevated rental rates to persist for the foreseeable future.

my own calculation

Given the bearishness around retail, it is also worth noting that retail construction is down about 56%. That lack of supply should support Kimco’s pricing power. Traffic at its centers is up 10% from last year and in-line with pre-pandemic levels. Outdoor grocery centers have very different dynamics than malls, and these results reflect that. Consequently, alongside Q2 results, management raised full-year AFFO guidance to $1.54-$1.57 from $1.50-$1.53

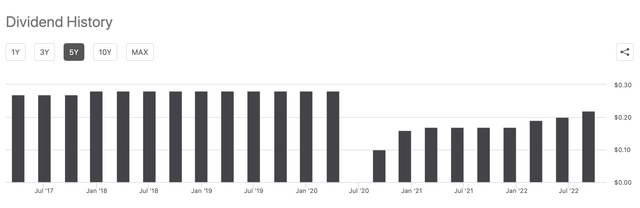

This is significant as AFFO, which is a key metric to determine how much in dividends can be paid out, is now solidly above its pre-pandemic results. In 2019, adjusted FFO was $1.47. Back in 2019, it paid a $0.28 quarterly dividend, which it had to cut as the pandemic hit. Management has raised its dividend in three consecutive quarters, but at $0.22, there is still room for growth.

With leverage inside the targeted range and 99.7% of consolidated debt fixed rate, KIM is well positioned to continue to raise its dividend. When the company reports third quarter earnings on October 27th, I see a strong possibility of another increase. Moreover, on Friday, Kimco sold $300 million in Albertsons (ACI) stock, following its announced acquisition by Kroger (KR). It still has 28.3 million shares that have a seven-month lock-up. At the $34.1 purchase price, the remaining shares are worth nearly $1 billion. Given the gain on sale, KIM will likely declare an additional special dividend this year.

Given Kimco’s market cap of $11.7 billion the value of these shares provide management with material flexibility, to pay special dividends, retire debt, or accelerate its acquisition of mixed-use properties. At today’s dividend, shares have a 4.64% yield and trade just about 13x AFFO. With AFFO above 2019 levels and rising as occupancy continues to rebound, I expect its payout to reach at least $0.25 next year, providing a 6% yield. With a strong asset mix, one-time windfall, and normalized balance sheet, KIM is poised for ongoing dividend growth that makes shares attractive for income investors.

Be the first to comment