izusek/E+ via Getty Images

Co-produced with Treading Softly

What would you do with an endless supply of money? Would you solve the world’s poverty issues? Would you buy the fanciest cars and fanciest houses and live like a real-world Tony Stark?

A popular mantra for dividend income investors is this:

Get rich, then get lost

This, in essence, means using the market to generate high levels of income, then go off and live the life you want to live. For some, that will be moving into the mountains or the woods, off-grid, lost to the hubbub of working life.

Have you ever taken a vacation in a cabin in the mountains? You can experience true silence, no cars, no people – except those you bring with you.

There are places in Tennessee where you can sit and see for miles and miles, only hearing the crackling of the fire you’ve made and millions of stars above at night.

For many, the ability to live in such a place is a pipedream, something they daydream about while stuck in their cubical or bedroom at-home office. Yet, the market offers an avenue to make this dream a reality or your version of it. The careful, diligent, and persistent income investor can create a portfolio with truly outstanding income-generating potential.

Today, I want to take a moment to suggest two securities that belong in that type of portfolio to help get your income ball rolling.

Pick #1: OXLC – Yield 12.9%

Be greedy when others are fearful. It’s a piece of great advice, at least when there isn’t a real danger. At High Dividend Opportunities, our goal is to sift through high yielding picks and separate those that are high yield because they are super high risk and those that are high yield because the market is overly fearful.

Oxford Lane Capital (OXLC) is one example of an opportunity that the market is overly fearful of. OXLC invests in “CLO equity” (collateralized loan obligations).

What is a CLO? It is a bundle of leveraged loans known as “Bank loans.” The manager manages a portfolio of the loans and sells off rights to the cash flow from the loans.

It starts with the manager accumulating a portfolio of loans. These are not loans to the business your friend’s nephew is starting up from his mother’s basement. They are loans to reputable companies that are often publicly traded and always have a public credit rating. These are typically B/B+ rated companies. These loans are “senior secured” loans that are at the top of the capital stack. They have priority over the equity, unsecured bonds, and even 2nd lien debt. If you’re reading a 10-Q or 10-K of a borrower, you will see it described as a “term loan.”

After setting up an attractive portfolio, the manager then looks to sell “tranches.” Institutional investors who are willing to pay a premium get to be first in line. When the underlying borrowers pay, the senior “A” level tranches get paid first, then the “B” tranches, etc. Since the investors buying the tranches are paying a premium, the result is that the amount being paid to the debt tranches is much lower than the amount that the borrowers are paying on their loans. This excess goes to the “equity” tranche, which is primarily held by the fund manager but may also be traded on the secondary market. These “equity” tranches are what OXLC buys.

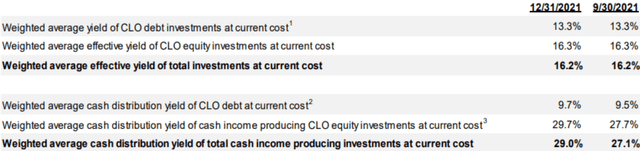

The cash flow coming from these positions is nothing less than amazing, as OXLC has benefitted from buying CLO equity positions at very low prices thanks to the COVID pandemic, combined with historically low default rates on leveraged loans. OXLC is receiving a cash yield of 29%! (Source: Investor Presentation Quarter Ended December 31, 2021)

Investor Presentation Quarter Ended December 31, 2021

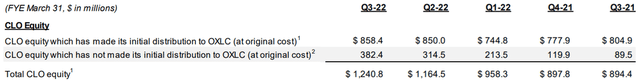

OXLC is raking in cash hand over fist, and core earnings provide dividend coverage of over 200%. The best part is that OXLC has already invested in new positions that are not yet paying. As of December, over 30% of OXLC’s holdings haven’t had to make their first payment.

Investor Presentation Quarter Ended December 31, 2021

Most of these positions ($358 million) are scheduled to make their first payment by June 2022. This will drive OXLC’s earnings even higher.

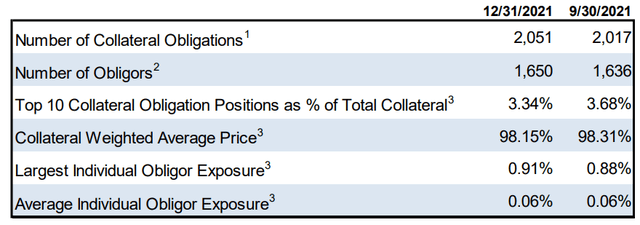

So what is the risk? The most significant risk for CLO equity positions is a spike in defaults. When a borrower doesn’t pay, the equity position absorbs the impact. OXLC is well protected from occasional defaults, with very diversified exposure to 2,051 loans to 1,650 borrowers. No single borrower accounts for more than 0.91% of OXLC’s assets.

Investor Presentation Quarter Ended December 31, 2021

Default rates have been near record lows and are expected to remain low, with Fitch projecting 1.5% for 2022 and 1.25-1.75% for 2023, noting that the fate of a handful of larger borrowers could result in a default rate below 1%. These low default rates mean that OXLC’s cash flow will remain higher than expectations.

We expect OXLC will continue to retain excess capital to reinvest in new opportunities. However, as a CEF, OXLC is required to distribute most of its taxable income, so a dividend raise is definitely on the table.

2022 will be a home-run year for OXLC, and we can collect an impressive 12.9% yield while we wait!

Pick #2: BRSP – Yield 8.4%

As investors, we are often reliant on the management of the companies we invest in. If your name is Carl Icahn, you can buy enough of a company to get a couple of Board seats and exercise significant influence over the management of a company. For those of us who aren’t billionaires, we get the opportunity to vote our shares, but in general, we don’t have enough influence to sway management. Sometimes management decides to go in a completely different direction than you prefer. It’s a harsh reality of investing that management doesn’t always share your goals.

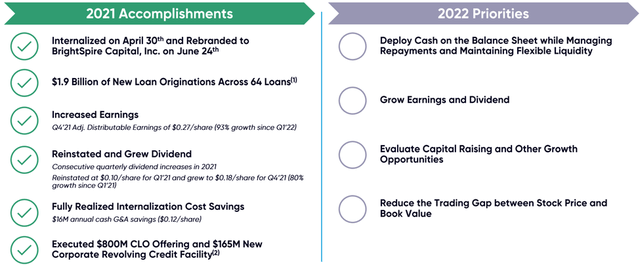

For this reason, I like companies that provide clear priorities, and I especially love when those priorities mesh with mine. BrightSpire Capital, Inc. (BRSP) didn’t consult with me when choosing a new ticker. Still, I’ll forgive an awkward ticker that tempts me to issue an apology whenever I’m talking to the HDO team if management’s priorities mesh with mine. (Source: Investor Presentation Q4 2021)

BRSP is a phoenix, rising from the ashes of Colony Credit Real Estate (CLNC). It has new management, an entirely new portfolio, got rid of its old external manager, reinstated its dividend, and raised it every quarter in 2021. It was a good year, both for capital appreciation and income growth.

In 2022, growing the dividend remains prominently on BRSP’s priority list. Words that were backed up by action when BRSP raised the dividend another 5.5% to $0.19/quarter in March.

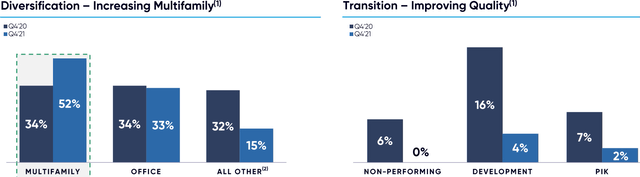

BRSP is a commercial mortgage REIT focusing on senior mortgages and multi-family. BRSP materially improved the quality of its portfolio in 2021.

Most notably, it got rid of its non-performing loans, dramatically reduced development loans which are higher risk, and loans that paid “PIK” (payment in kind), where interest is added to the loan principal instead of being paid in cash. These loans often have higher yields, but they come with greater risk. Developers walk away from a vacant property if they decide the deal doesn’t make financial sense. PIK is great only if the borrower can eventually pay the principal. Cash in hand is king, especially in a high inflation environment.

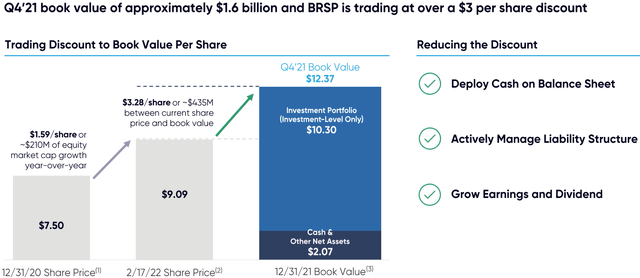

BRSP has been growing earnings consistently, with adjusted distributable earnings climbing from $0.20/share in Q4 2020 to $0.27/share in Q4 2021. BRSP continues to trade at a massive discount to book value, even though cash makes up over $2/share of its assets!

As 2022 goes on, BRSP will continue to deploy its cash on hand. They are generating higher earnings and supporting a higher dividend while maintaining a responsible approach. BRSP invests in floating-rate mortgages, so rising rates will drive cash flow even higher.

We love the whole commercial mREIT sector right now, and BRSP is hands down the best value at its current prices.

Conclusion

OXLC and BRSP offer you high yields right now and the outlook for growing dividends down the road. That’s an income investor’s dream opportunity. Even without dividend growth, both offer you income exceeding inflation now and allow you to compound your income month after month and quarter after quarter.

So what will you do with your income portfolio’s output once you retire? The sooner you get it generating income, the larger that income output will be. Are you 20 years old with only a few dollars to put aside? Get started and let that money earn you dividends for decades. You’ll be amazed at how quickly your income grows.

Ready for retirement today? With yields of 8-12%, you can take out what you need and have excess to reinvest and keep your income growing. There is no need to sell your shares and cannibalize your portfolio.

You are writing the foreword to your retirement journal now. How will it begin? Some of the greatest novels in history have powerful opening sentences, Will yours be “I got rich, then I got lost”?

Be the first to comment