courtneyk

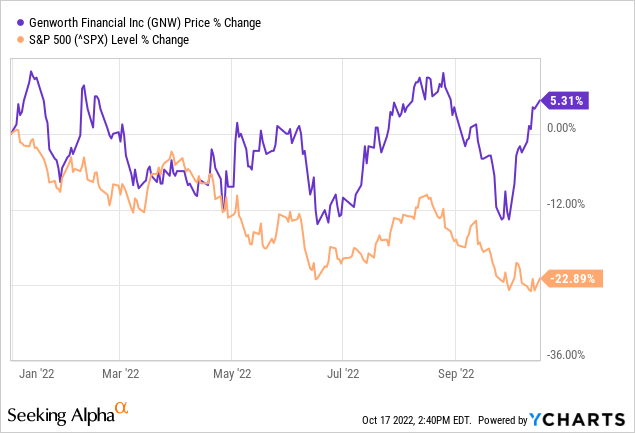

Genworth Financial, Inc. (NYSE:GNW) has been relatively resilient in an otherwise abysmal equity market. The stock is up over 5% YTD compared to down 23% for the S&P500:

Whether Genworth’s strength continues depends on several factors expected to unfold through the remainder of ’22 and ’23. Below is a summary of items investors should be looking for in the company’s Q3 earnings on November 1st.

Enact dividends

Probably the most important item on the agenda is Enact Holdings, Inc.’s (ACT) performance and the likelihood of future dividends. At the moment, Genworth primarily relies on dividends from its ~81.6% equity stake in Enact to service debt, fund growth initiatives, and return cash to shareholders (Genworth Holding is also receiving capital via cash tax payments, however, those are expected to run out in ’23). It is imperative dividends from Enact continue to flow until Genworth develops other cash flow streams.

Despite the recent slowdown in mortgage originations, it is anticipated that Enact will continue to deliver on its regular quarterly dividend as well as the previously guided special dividend sometime in Q4. Although it is not expected, it would not be surprising considering the challenging macro-environment if management reduces the special dividend from the ~$200m discussed in Enact’s Q2’22 earnings call.

Share repurchase program

With all ’24 senior notes retired, Genworth can turn the company’s free cash towards its $350m share repurchase plan. Announced in May, Genworth has purchased at least $30m worth of shares under the authorization, leaving ~$320 untapped. It is, however, unclear whether the company will have enough cash available at the holding company through year-end to exhaust the authorization while maintaining a 2x interest cash buffer on the balance sheet. Therefore, this is something to monitor closely.

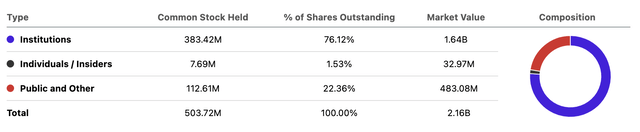

The share buyback program should benefit long-term investors by reducing the oversupply of Genworth’s shares in the market. As of July 27th, there were ~503.7m Genworth S/O. The excessive amount of shares in the market along with Genworth’s penny stock status has made it a haven for speculators and day traders. Presently, over 22% of Genworth’s shares are held by retail investors (Public and Other):

Conversely, only ~76% of Genworth shares are controlled by institutions compared to ~93% among peers:

Seeking Alpha – GNW – Peers (Customized)

As the company buys back shares in the market, it is anticipated that not only will long-term investors benefit from a rising share price, but also from reduced volatility.

MYRAP

Progress on Genworth’s Multi-Year Rate Action Plan is something to keep a close eye on in the coming quarters. This is because, while the company and market assign nil value to the life business, as management continues to narrow the deficit between LTC premium and future liabilities, residual value could become realizable. As of June 30, the company has achieved $20.7b in rate increases or benefit reductions towards its $28.7b goal. Through 1H’22 alone, Genworth received $1.1b in approvals on a net present value basis.

In Q3, investors should expect to see a positive impact from the PCS I and PCS II legal settlements, in addition to incremental premium increases allowed by state regulators. Moreover, starting in ’23, Genworth will likely (at least temporarily) experience an acceleration towards reaching its breakeven goal under MYRAP as the company implements the Choice II legal settlement affecting over $1b of annual premiums (Choice II is Genworth’s largest legacy LTC block). However, keep in mind the goal is subject to change as it is based on current assumptions that may differ in the future.

Global Care Solutions

Long-term investors stand to benefit tremendously if Genworth is successful in standing up its growth initiatives under the umbrella of Global Care Solutions (“GCS”). Presently, GCS consists of CareScout – Genworth’s services & advisory business. There is also discussion of launching new LTC products through GCS, but those plans appear to have been postponed due to poor economics.

At this point, little has been disclosed about CareScout’s offerings or pricing, although the company’s website states that its first product will be available sometime in 2023. Genworth recently announced the addition of Timothy Peck, a Harvard-educated medical doctor and entrepreneur, to head up GCS.

Investors should expect to receive more details about the initiative in the Q3 report, but at this point, it is unlikely GCS will have a material impact on Genworth’s stock.

Genworth’s investment portfolio

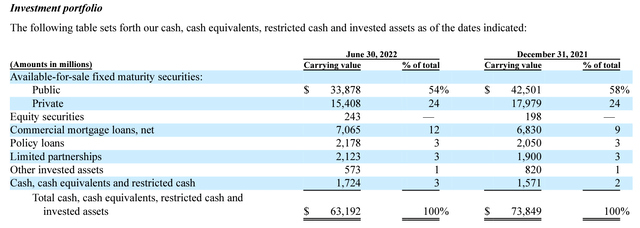

As of June 30, Genworth had $63.2b in cash and investments in its portfolio:

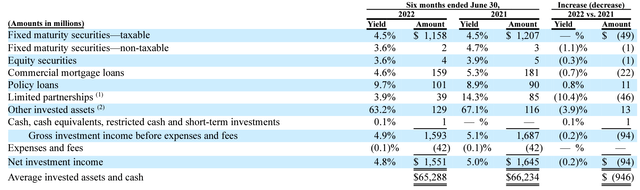

Between December 31, 2021 and June 30, the carrying value of Genworth’s investment portfolio declined by $10.7b due, in part, to falling fixed securities prices. This trend is expected to continue through 2H. However, portfolio yields should fare better in 2H, with the cost of borrowing rising as the Fed continues to fight inflation with rate increases. Genworth reported a 4.8% investment yield in Q2 through 1H’22 compared to 5.0% in the same year-ago period:

Any sign of increasing yields a likely to be received favorably by investors and could possibly lift market sentiment. After all, a better return will inevitably help Genworth achieve breakeven in its life business.

LDTI accounting standard impact

It would be productive for investors to get an update on the implementation of ASU 2018-12, or LDTI. Genworth is expected to see a material decrease in the company’s book value as a result of the new accounting rule; although, more importantly, it will not have an impact on the economic value of Genworth. It would be beneficial to get a sense of where Genworth expects book value to fall after LDTI is fully implemented in Q1’23.

AXA litigation

Last but not least, an update on the AXA v. Santander litigation would be helpful. This is because Genworth will potentially receive a substantial windfall in the event AXA succeeds in its lawsuit against Santander over the mis-selling of past insurance policies. In July, the court ruled to allow AXA to argue its claims resulting in over $800m in damages at trial. Therefore, any update on how the litigation is proceeding could be beneficial for investors.

Valuation

Valuation for Genworth has not changed from the previously provided ~$5.20/sh. The stock remains a Buy.

Be the first to comment