franckreporter

Genuine Parts (NYSE:GPC) has outperformed the broad market by an impressive margin this year. To be sure, while the S&P 500 has plunged 22% this year, Genuine Parts has rallied 14%. The striking outperformance of Genuine Parts has resulted from its resilience to recessions and high inflation, as the company has proved capable of passing its increased costs to its customers. Its immunity to the perfect storm created by 40-year high inflation and the increasing risk of an imminent recession may entice some investors to purchase this high-quality Dividend King. However, as the stock is trading at a nearly 10-year high price-to-earnings ratio of 19.8, investors should wait for a better entry point.

Business overview

Genuine Parts distributes replacement parts for all the types of vehicles, including electric vehicles, as well as industrial parts and materials. It is present in more than 3,000 locations in North America, Europe, Australia and New Zealand.

Due to the unprecedented fiscal stimulus packages offered by most governments in response to the pandemic and the ongoing war in Ukraine, inflation has skyrocketed to a 40-year high this year. Consequently, most companies have incurred a steep increase in their costs, and thus they have seen their profit margins shrink considerably. Even rock-solid retailers, such as Walmart (WMT) and Target (TGT), have incurred a great contraction of their margins this year. The decrease of profit margins of most companies is a major reason behind the ongoing bear market of the S&P 500.

Genuine Parts is a bright exception, as it has proved capable of passing its increased costs to its customers. In the most recent quarter, the company grew its revenue 17% over the prior year’s quarter thanks to 11.5% comparable sales growth and 8.8% growth from acquisitions, partly offset by currency losses. In other words, the auto parts retailer proved immune to the drastic budget tightening of consumers, which has resulted from the surge of inflation.

In addition, Genuine Parts expanded its profit margin from 9.2% to 9.8%, and thus it grew its earnings per share by 26% over the prior year’s quarter, from $1.74 to $2.20, thus exceeding the analysts’ consensus by $0.17. The company posted all-time high revenue and earnings per share in the second quarter. In addition, it was the ninth consecutive quarter in which Genuine Parts exceeded the analysts’ estimates by a wide margin. This is a testament to the strength of the business model of the company and its sustained business momentum.

Even better, despite the pronounced slowdown of global economy, Genuine Parts raised its guidance for the full year. It raised its guidance for revenue growth from 10%-12% to 12%-14%, mostly thanks to strong momentum in industrial parts, and improved its outlook for growth of earnings per share from 11%-14% to 13%-15%. Notably, management improved its outlook despite its expectations for greater currency losses (3.0% vs. 1.5%-2.0% previously).

The sustained business performance of Genuine Parts should be attributed to its solid execution, but also to some industry tailwinds. There is a continued increase in the total miles driven and the average age of vehicles. There is also limited new car inventory due to unprecedented supply chain disruptions, and thus the prices of used cars have greatly increased. All these factors have resulted in more frequent replacement of spare parts, and thus they provide a strong tailwind to the business of Genuine Parts.

Investors should also note that Genuine Parts has exhibited a consistent growth record throughout the last decade. The company has grown its adjusted earnings per share in 8 of the last 10 years, at a 6.8% average annual rate. A significant part of this growth has come from a long series of acquisitions of smaller companies. Management recently stated that it continues to explore a healthy pipeline of potential acquisitions.

Overall, one can reasonably expect Genuine Parts to continue growing its earnings per share by approximately 7% per year on average in the upcoming years. Analysts agree with this view, as they expect the auto parts retailer to grow its earnings per share by 7% per year in 2023-2024.

Valuation

Genuine Parts has outperformed the broad market by an impressive margin over the last 12 months. During this period, the stock has rallied 27% whereas the S&P 500 has shed 14%. As a result, Genuine Parts has rallied to new all-time highs and is currently trading at a nearly 10-year high price-to-earnings ratio of 19.8. This earnings multiple is higher than the 10-year average of 18.2 of the stock.

More importantly, the stock traded with an average price-to-earnings ratio of 18.2 during a decade with depressed interest rates. Now that interest rates have surged to 15-year highs, most stocks have incurred a compression of their valuation levels, as the present value of their future cash flows has significantly decreased. To cut a long story short, the market has already appreciated the virtues of Genuine Parts, which has proved exceptionally resilient in the highly inflationary environment prevailing right now.

On the other hand, Genuine Parts is currently trading at 17.3 times its expected earnings in 2024. In other words, as long as the company remains in its reliable growth trajectory, its growth will gradually offset the headwind from the current premium valuation of the stock. Overall, Genuine Parts appears to be fairly valued right now.

Dividend

Genuine Parts has raised its dividend for 66 consecutive years, and hence it is a Dividend King. There are only 45 Dividend Kings in the investing universe, and hence the accomplishment of Genuine Parts is exceptional. Moreover, the company has a healthy payout ratio of 45% and a solid balance sheet, with interest expense consuming only 4% of operating income. Furthermore, its net debt (as per Buffett, net debt = total liabilities – cash – receivables) currently stands at $9.8 billion. This amount is only 45% of the market capitalization of the stock and 9 times its annual earnings, and hence, it is certainly manageable. Thanks to all these facts and its reliable growth trajectory, Genuine Parts is likely to continue raising its dividend for many more years.

Genuine Parts has grown its dividend by 6.1% per year on average over the last decade and by 5.5% per year on average over the last five years. As the company is expected to grow its earnings per share by about 7% per year in the upcoming years, it is likely to continue raising its dividend by 5%-6% per year.

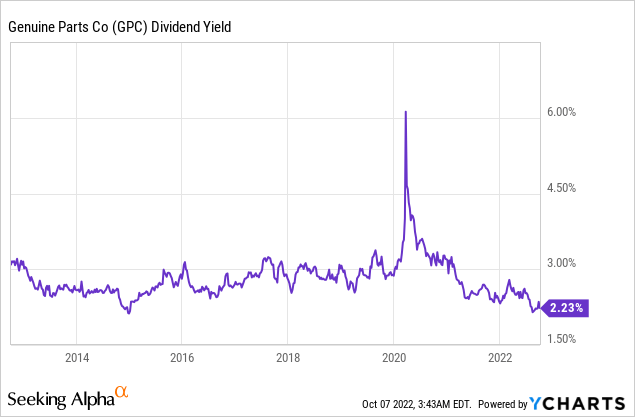

On the other hand, due to its rally, the stock is currently offering a 10-year low dividend yield of 2.3%.

Therefore, it is not attractive from an income perspective, especially given the current inflation rate of 8%. The 10-year low dividend yield may also be a signal that investors should wait for a more opportune entry point.

Final thoughts

Genuine Parts has offered a safe haven to its shareholders in the ongoing bear market, as the stock has proved immune to the inflationary environment that has prevailed this year. However, the investing community has already appreciated the resilience of this high-quality Dividend King and has rewarded the stock with a 27% rally in the last 12 months, to a new all-time high.

Given the nearly 10-year high valuation level and the 10-year low dividend yield of the stock, investors should wait for a better entry point, probably around the technical support of $140. On the other hand, in the long run, the consistent growth of Genuine Parts is likely to largely offset the headwind from its current premium valuation.

Be the first to comment