dmphoto/E+ via Getty Images

A shareholder success story

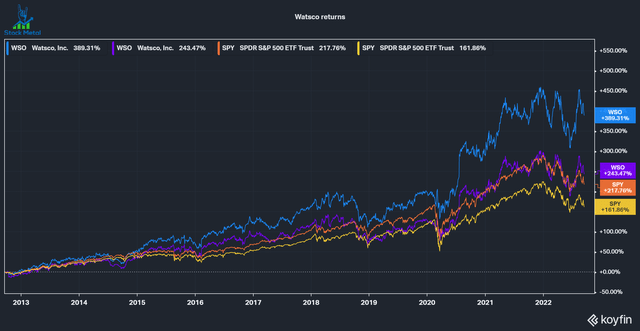

Watsco (NYSE:WSO) has been a great success for long-term investors, outperforming the S&P 500 considerably over the last 10 years. The company delivered a 243% increase in price and a total return of 389% due to its significant dividend.

Watsco continues to benefit from industry tailwinds, excellent management with skin in the game and a sound business model. In this article, I will explain why I added Watsco to my concentrated buy and hold portfolio at a 3% weighting.

Watsco 10 year returns (Koyfin)

The HVAC industry

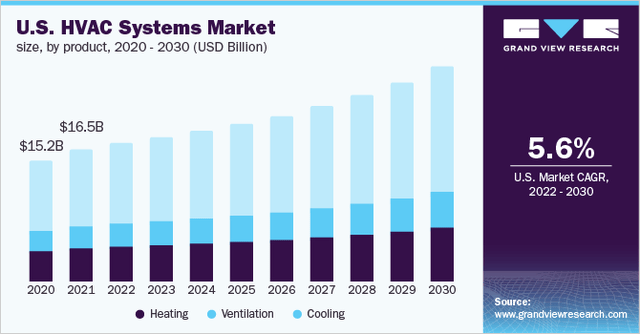

According to GrandViewResearch, the US HVAC (Heating, Ventilation and Air Cooling) industry is expected to grow at 5.6% a year to $26.9 billion by 2030. The bigger HVAC Service market is expected to grow to $35.7 billion by 2030, although growing at a slower pace.

US HVAC growth projection (grandviewresearch)

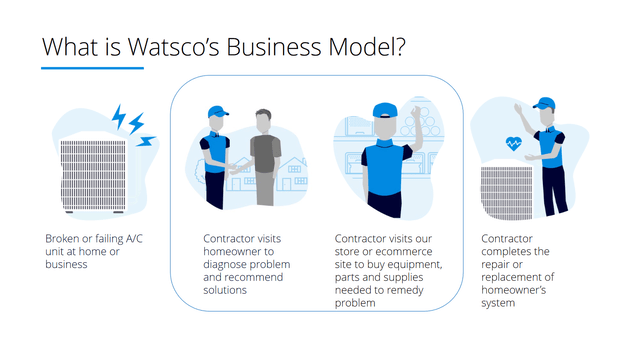

Watsco works as an intermediary between the HVAC manufacturers and the contractors. Through their large network of offline stores and their online e-commerce platform, they offer over 1500 SKUs (the largest product catalog in the US). In the picture below you can see Watsco’s Business model visualized. With over $6 billion in revenues (FY21) Watsco is roughly twice as large as the closest competitor in the HVAC service space, giving them scale advantages.

Watsco Business model (watsco investor presentation)

HVAC is an interesting industry with tailwinds and barriers to entry:

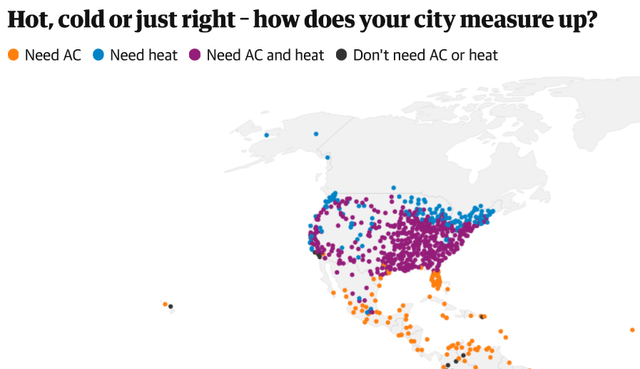

- HVACs are often a necessity and not a luxury item, as you can see in the map below.

- Because of the necessity and the rather infrequent purchasing frequency customers aren’t price sensitive, so higher prices can easily be passed on to the customer. New HVACs are purchased on average every 10 years but need frequent servicing. Annual shipments of new systems in the US are around 10 million and the majority are replacement units. The aging install base in the US is over 115 million units that will need servicing and replacements.

- HVACs need experts with technical expertise to install and service units and OEMs need to approve distributors, adding barriers to entry to the business model.

- HVAC benefits from regulatory pressures to install increasingly efficient and environmentally friendly units. In 2023 the minimum SEER standard that a newly sold unit can have will be increased, leading to new products being pushed with higher average prices. Distributors will be allowed to sell existing inventories, but can’t purchase new units under the minimum SEER level after 2023.

map of liveability with or without HVAC (the guardian)

Advantages through technology

A big reason for my investment case is that Watsco has continued to push into new technologies to leverage them to grow market share and customer relationships with its contractors.

Watsco technological edge (watsco investor relations)

The e-commerce opportunity

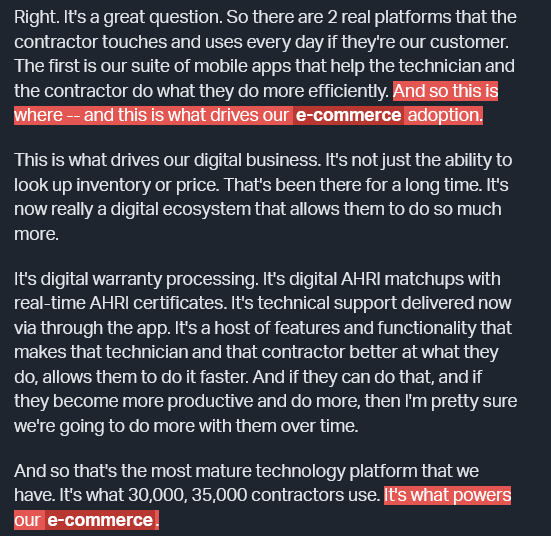

Watsco has invested heavily into its e-commerce capabilities over the last years, creating the leading marketplace of HVAC units and accessories with over 1 million SKUs digitalized on the platform. Besides a web platform, Watsco also offers apps that make it fast and easy for customers to compare prices on the go, for example, while selling to a customer. E-commerce is growing faster than offline sales and keeps growing to a bigger part of Watsco’s business, now accounting for 1/3 of sales and over $2 billion of revenue in the last 12 months.

E-commerce customers are reported to have a 70% lower attrition compared to offline customers, due to the unique experience Watsco can offer them that way. They also on average order 17% more line items compared to traditional orders. In the Q2 earnings call, it was mentioned that the main reason for this is that e-commerce customers buy more accessories compared to traditional sales.

Leveraging Inventory management

A large part of Watsco’s business is providing inventory to customers promptly wherever they are. Whether it is through offline or online channels, the product needs to be delivered fast and inventory shouldn’t build up. The company invested in inventory management systems to increase its oversight over the inventory and use data analytics to optimize its inventory. This can also increase revenue, if they can find out the mispricing of products in certain areas (this can be lower and higher pricing, depending on the region), according to the last earnings call. In the last year, Watsco had millions of costs just from moving products between locations to delivering orders. As they keep learning to use their data, they should realize incremental cost savings resulting in higher margins that way.

Marketing solutions to strengthen customer relationships

The last part of the technological advantage Watsco has is its additional services and solutions for customers. Their marketing solution On-Call-Air, according to the last earnings call, generated over $300 million in GMV after contractors leverage the solution to seal deals with customers. This is another reason why contractors want to stick with Watsco, the added services like digital warranty processing, compliance operations regarding digital AHRI matchups with real-time AHRI certificates and technical support through the app. The digitalized experience drives higher sales, lower costs and will drive up margins incrementally over the years.

Currently, margins are elevated due to Covid tailwinds, but management is confident that they will eventually reach a 15% EBIT margin (currently 11%, 5-year median of 8%) and keep their elevated 27% gross margin (5-year median of 24%) through the cost savings and increased revenues through their technological efforts.

Watsco at Jefferies Global Industrial Conference (Koyfin)

Valuation

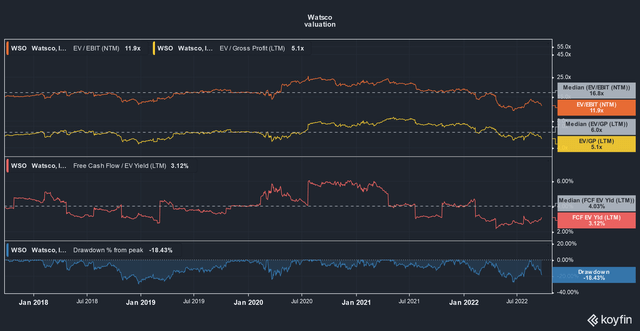

Because management is guiding for EBIT and gross margins I’ll look at those multiples as well to value the company. Watsco is significantly below its 5-year median EV/EBIT multiple of 16.8 times (almost 2 standard deviations lower) and also 1 standard deviation below its historic gross profit multiple of 6 times.

On a Free Cash Flow basis, the company is above its historic median, due to increased inventory levels leading into the transition to the higher SEER standard units. I expect the FCF yield to normalize again next year. The company has done better than the overall market with an 18% drawdown to its All-Time high.

Conclusion

Watsco is a strong compounder that will keep winning by investing where the competition is sleeping: Digitalization. Their efforts are already showing significant increases in sales, cost savings and are creating a moat by binding contractors to its superior infrastructure. I opened a position in Watsco this month (around 3%) and am looking to add further to my position as the market continues to fall.

Be the first to comment