sturti/E+ via Getty Images

Article Thesis

Medical Properties Trust (NYSE:MPW) has reported its third-quarter earnings results on Thursday. The company continues to generate solid funds from operations that cover the dividend, and through several avenues, MPW is tackling its debt load. With shares trading at a very inexpensive valuation and offering a hefty dividend yield, shares have considerable potential going forward, as long as execution is good.

What Happened?

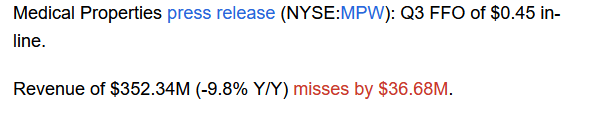

Medical Properties reported its third-quarter results, with the headline numbers being shown here:

Seeking Alpha

Revenues missed estimates widely, by around 10%. Meanwhile, MPW reported in-line funds from operations, making this a not very compelling report at first sight. But when we delve into the details, we see that there are some positives in the report, and MPW had been priced for a disaster anyways, thus I do not see MPW’s earnings report as a major issue, even though the company underperformed analyst expectations. The market seems to agree that this report was not a disaster despite the revenue miss, as MPW is relatively flat at the time of writing.

Medical Properties Trust’s Underlying Progress Is Solid

Revenue being down is not too surprising, I believe, as the company sold some assets over the last year, resulting in a smaller base from which the company was able to generate rent proceeds. It is surprising that most Wall Street analysts had not accounted for that and were looking for a much higher revenue number. But MPW not only saw its revenue decline due to changes in its asset portfolio, its expenses headed down as well. That’s not too surprising, as interest expenses and depreciation expenses decline when parts of the asset portfolio are sold and when the proceeds are used to pay down some debt.

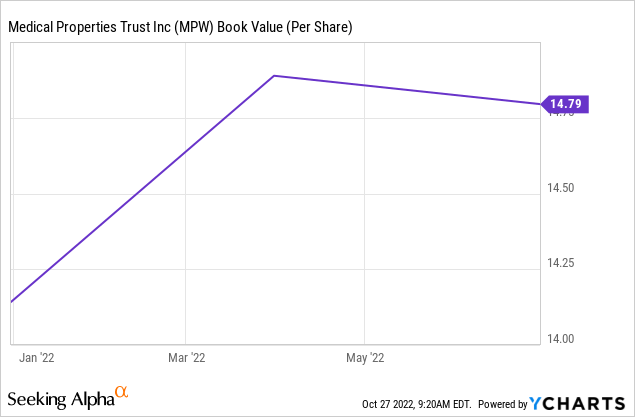

Medical Properties recorded some gains on the sale of assets. These gains are not recurring, thus they do not lift MPW’s earnings power in the long run. Backing them out in calculating MPW’s underlying cash flow thus makes sense. Nevertheless, it’s good that MPW’s assets are being sold at higher prices than their GAAP accounting value, as this suggests that Medical Properties’ book value is an overly conservative estimate of the underlying value of what the REIT owns.

With book value in the $15 range, and with that book value likely underappreciating the true market value of MPW’s assets, investors can feel some confidence that the current share price of $11 is already way below the value of what the company owns today. Debt is already accounted for in book value, thus this is a (likely too conservative) estimate of what shareholders could receive if the company were to sell its assets, pay down its debt, and return the proceeds to the company’s owners. In that regard, it also makes a lot of sense for the company to pursue buybacks (more on those later), as buying back shares below underlying value increases shareholder value over time.

MPW’s shares have performed pretty badly in recent months, with its debt load and (perceived) problems at Steward being the main culprits. Medical Properties has been targeting the debt issue this year, and debt is down from $11.3 billion at the beginning of the year to $9.5 billion as of the end of the third quarter. That makes for a debt reduction of $1.8 billion in nine months, or more than 15% in less than a year. And it looks like debt levels will continue to drop meaningfully going forward, as the company already has some deals in place. In its earnings release, the company states:

In addition, as previously announced, the Company expects to receive more than $650 million in proceeds in 2023 from other binding agreements. Forecasted proceeds from these transactions and any other potential dispositions, loan repayments and/or joint venture transactions are expected to fund debt reduction, potential stock repurchases and selective investments.

Not necessarily all of that will be used for debt reduction, but it seems likely that a significant portion of those future cash proceeds will be used for that. On top of that, the company will also continue to generate cash from its operations in both the remainder of the current year and in 2023. On top of that, MPW could forge other deals for additional asset sales in 2023. I thus think that debt reduction to $9 billion or below is only a matter of time, as that would only require $500 million in additional debt repayments — considering that MPW has done more than that per quarter in 2022 so far, that shouldn’t be a hard task for the company.

Apart from debt, another key worry is the situation at Steward, and, to a lesser extent, at some other tenants. MPW is exposed to Steward as it is a major tenant, and also because MPW has made loans to Steward on top of its rent exposure. Medical Properties has stated in the past that they believe that Steward will become free cash flow positive towards the end of the current year, which would be a major step for it to become a safer tenant. MPW stated the following in its earnings release (linked above):

During the third quarter, Steward completed the accelerated repayment of amounts due related to approximately $450 million in COVID-related advances and collected approximately $70 million of past due reimbursements under the Texas Medicaid program. With these cash drains now in the past, positive revenue trends, significant declines in contract labor utilization and anticipated annual savings resulting from adjustments to Steward’s cost structure are expected to result in positive and sustainable free cash flow.

This sounds positive and is in line with what MPW has stated in the past about Steward’s improving capacity to pay rent and to pay back loans. Some might argue that MPW management could be interested in painting a rosy picture, but I believe that what management has stated here will prove true, as the environment for hospitals is improving thanks to more elective procedures following the pandemic, and since it looks like Steward has indeed made considerable progress over the last couple of quarters. MPW investors don’t need Steward to do exceptionally well at all — in theory, Steward breaking even and not losing cash is completely sufficient for MPW and MPW’s owners.

Medical Properties’ statements regarding 2023 look positive so far as well. The company believes that contracted rent escalators, some of them CPI-linked, will result in a mid-single-digit growth rate in same-property rents next year. A ~5% revenue increase, all else equal, is a positive outcome for a company as inexpensive as MPW, especially since a considerable amount of that additional revenue should flow through to the company’s bottom line, as expenses are mostly fixed. Due to the impact of asset sales, company-wide revenue will likely grow less next year (or possibly decline, depending on how many assets exactly the company will be selling). But since those asset sales are reducing MPW’s debt and therefore its interest expenses, profits shouldn’t be impacted much.

For the current year, MPW forecasts funds from operations of $1.80 to $1.82 per share. That’s slightly more than what MPW had been forecasting in the past, as the previous range was $1.78 to $1.82 per share. Guidance increases naturally always are a positive sign — the company is not overpromising, and seems to be executing better than previously thought.

Due to the impact of straight-line rent, MPW’s adjusted FFO is meaningfully different from its normalized FFO, but even its adjusted FFO is high enough to cover the current dividend. During the third quarter, AFFO covered the dividend at a rate of 1.24, meaning the dividend, which currently yields 10.5%, is looking sustainable for now — potentially making MPW highly attractive for income seekers that want a high dividend yield.

With its recently-announced $500 million buyback program, MPW has an additional way to return cash to its owners. $500 million in buybacks could reduce MPW’s share count by more than 7%, which would provide a meaningful boost to FFO per share and which would make the dividend more secure, as total dividend payments in future years would be lower, even with the per-share dividend being kept stable. As noted above, buybacks also would further increase MPW’s book value per share as shares trade at a meaningful discount to said book value today.

Takeaway

There are some uncertainties when it comes to investing in Medical Properties. The Steward situation has not been fully cleared up yet, but it looks like things are improving. With growing same-property rents, declining debt levels, the just-increased FFO guidance, and reasonable dividend coverage, MPW looks attractive, however, despite Steward-related uncertainties.

With shares trading at a very inexpensive 6x FFO and at a clear discount to book value — which understates the market value of MPW’s properties — I think MPW has merit as an income and total return pick.

Be the first to comment