gorodenkoff/iStock via Getty Images

Gentherm Incorporated (NASDAQ:THRM) is a global developer and manufacturer of innovative thermal management technologies that provide temperature control equipment to automotive and medical industries.

With a focus on providing high-quality climate comfort, battery thermal management, and thermal medical devices, the company offers innovative products at a competitive cost. Also, Gentherm has been investing in improving and creating new products for existing markets, which might drive revenue growth.

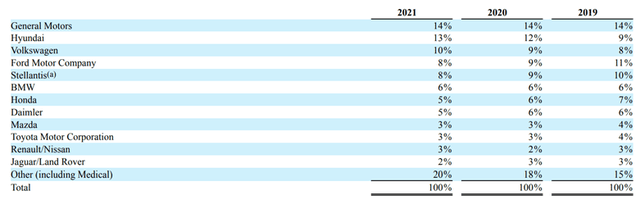

Customers (Annual report)

The company’s significant amount of revenue comes from the top five customers. Therefore, Gentherm might face considerable pricing pressure from these customers, and any significant fluctuations in their operating strategy might affect the company considerably.

Also, a significant percentage of revenue is primarily dependent on the number of vehicles produced and consumer demand for the automotive sector. Therefore, investors might see substantial fluctuations in the business with cyclical uptrends and downtrends in the automotive industry.

Over the period, the stock has given huge returns despite the reduction in earnings; the stock price has been rising consistently. Still, the stock has reached significantly higher valuations, which might not give any significant returns from this price. Although there is considerable opportunity for the business to grow, it might take a long time to attain high profitability again. Therefore, I assign a sell rating to the stock.

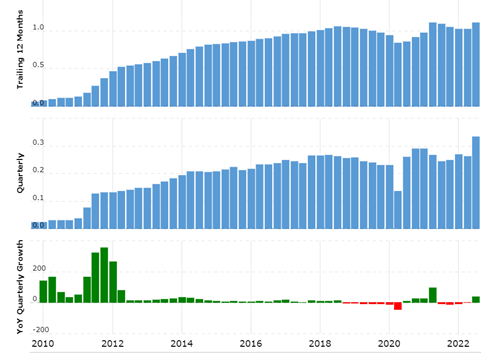

Historical Performance

Revenue growth (macrotrends.net)

Over the period, due to its significant cyclical operations, the company has seen substantial ups and downs. Still, Gentherm has emerged as a leader in the industry because of its strong business model. In the last ten years, revenue has increased from $554 million in 2012 to about $1 billion by 2021. Considerable growth in the revenue came before 2015 and from 2016 onwards, the revenue has been oscillating at the same levels.

Also, net profits have been volatile over the period and started dropping from 2016 onwards till 2020, but due to significantly higher volume sales and higher prices, in 2021 net profits increased sharply, reaching $94 million.

Despite huge fluctuations in the profit margins, the stock has increased more than four times from 2012 onwards, which has created significant value for the shareholders.

Furthermore, the debt levels have increased significantly to $234 million from $32 million last year, but the company has significant liquid assets. As a result, the company could manage its debt facilities efficiently.

A strong financial position along with strong cash flow history, resulted in huge value creation for shareholders, historically price to earnings ratio has been near 25 but due to the company’s strong future prospects, the ratio has increased to more than 34.

Strength in the business model

Although various factors can hamper the company’s performance, the business model is substantially strong and sound.

Strong financial condition

Despite working in an intensely competitive industry where the major customers put significant pricing pressure, the company managed to be profitable over a very long period, which shows that the business model is substantially robust.

Strong growth prospects

The management has been implementing various strategies, such as improving battery performance by maintaining temperature, increasing Personalized passenger comfort, and managing energy efficiency, which will further improve the business model. Its focus on battery performance might help improve the efficiency of electric vehicle batteries, which can lead to a significant rise in revenue and increased profitability.

Management’s focused approach

In 2018 and 2019, Management decided to exit non-Core Businesses and focus relentlessly on improving thermal regulatory devices. As a result, the company closed and sold various businesses, which were consuming significant cash, and invested the money to buy back the shares. A focused approach and strategic investments in research and product development might help the company bring innovative products, which can further strengthen the business model.

Also, the company has been focusing on developing cost-effective and innovative products. As a result, the company has received the first production vehicle award for climate sense on the 2024 model year electric vehicle with a global automaker.

Risk factors

As the company has various products that might be used in electric vehicles, which might lead to significant improvement in the business, multiple risks can affect the business model. Also, there are considerable uncertainties about its applications in electric vehicles. As the stock price has attained a very high valuation, negative sentiments about the product performance might significantly affect the stock price.

As the current situations, such as chip shortage, increased labor cost, and high inflation, are affecting profitability considerably, the company might face these issues for a much longer time; in such cases, the stock price might see a significant correction.

Although the company is leading the industry, due to the higher growth prospects, competitive pressure might increase in the upcoming years, as various companies such as Modine (NYSE:MOD) has been focusing on bringing innovative products to manage temperature, any increased competition or customer preference shift towards other tech products might hurt the future profitability.

Recent development

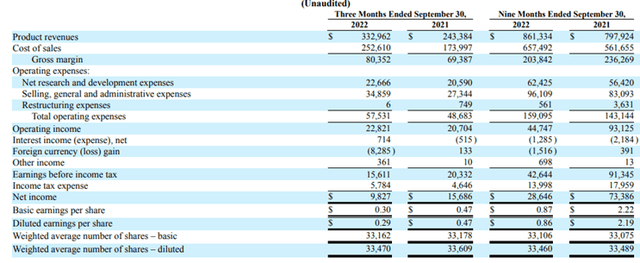

quarterly results (quarterly report)

In the recent quarter, revenue grew from $243 million same quarter last year to about $332 million and outperformed actual light vehicle production. But due to higher sales costs and losses on foreign exchange, the profitability remained subdued.

Demand for the thermal comforts solution in the EV market has been strong, and launched automotive solutions on 18 different vehicles across 12 OEMs, including global auto leaders such as BMW, Mercedes Benz, and General Motors, resulting in a significant gain in the market share over the past few quarters.

The company is financially strong and has been gaining market share. Also, prospects for the business regarding its application in electric vehicles are significantly compelling. But the company’s current valuation looks pretty high, and there might come various uncertainties about its future prospects, such as increasing competition which might affect profitability severely.

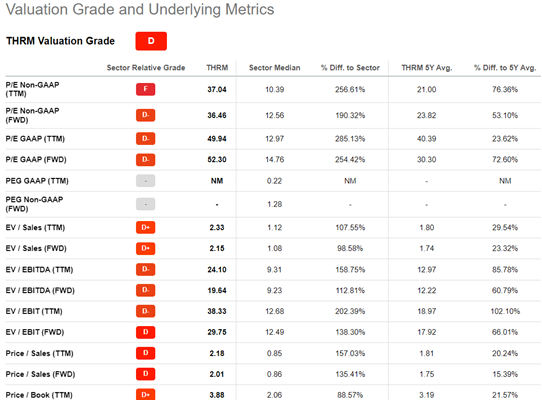

Valuation Metrics (Seeking alpha)

Currently, the stock has been trading for more than $2.5 billion, which gives it a price-to-earnings ratio of more than 25 if we compare it to the 2021 multi-year high earnings of $95 million. Also, as per the valuation current valuation metrics, the stock price seems substantially high.

Also, in the last nine months, profitability has decreased significantly to just $28 million, which seems considerably lower than 2021 earnings.

Based on the facts mentioned above, it seems that the stock has become significantly overvalued and may not give desirable Returns to the shareholders. Therefore, I assign a sell rating to the stock.

Be the first to comment