Jonathan Kitchen

It’s been about 3 ½ months since I put out my “avoid” piece on Gentex Corporation (NASDAQ:GNTX), and in that time the shares are down about 4.7% against a loss of ~3.9% for the S&P 500. The company has reported earnings since, so I thought I’d review the name yet again. After all, a stock trading at $28 is a slightly less risky investment than when the same stock is trading at $29.60. I’ll make the determination by looking at the updated financial history here, and by looking at the stock as a thing distinct from the underlying business. Finally, right on cue, I bragged in my previous missive on this name about the premia I’d earned selling puts, but I couldn’t sell puts 3 ½ months ago as I considered the premia for reasonable strike prices to be too thin. Now that the shares have fallen in price, it’s time to revisit this and determine whether we can make a decent return by selling puts.

We’re all busy, and many of us spend a great deal of time searching for ways to save time. If you’re such a person, you’re in luck, because I’m about to offer you my handy “thesis statement” paragraph. It’s here where I offer up the gist of my thinking in a convenient, single-paragraph package. I think this stock remains dead money for the moment. The shares are more expensive now than they were when last I reviewed the name, in spite of the fact that the company is far less profitable now than it was in 2021 or 2019. In my previous missive, I pointed out that an investment in a 10-year Treasury Note would produce greater cash flows at arguably less risk, and nothing’s changed to convince me otherwise. Finally, while I made some decent returns selling puts previously, that route is no longer available in my view, as the premia on offer are too thin to justify the effort. I think we have to sit around and wait for the inevitable price drop before getting excited. I’d be very happy to buy this name, but it’d need to be trading about 29% cheaper than it currently is before I do so.

Financial Snapshot

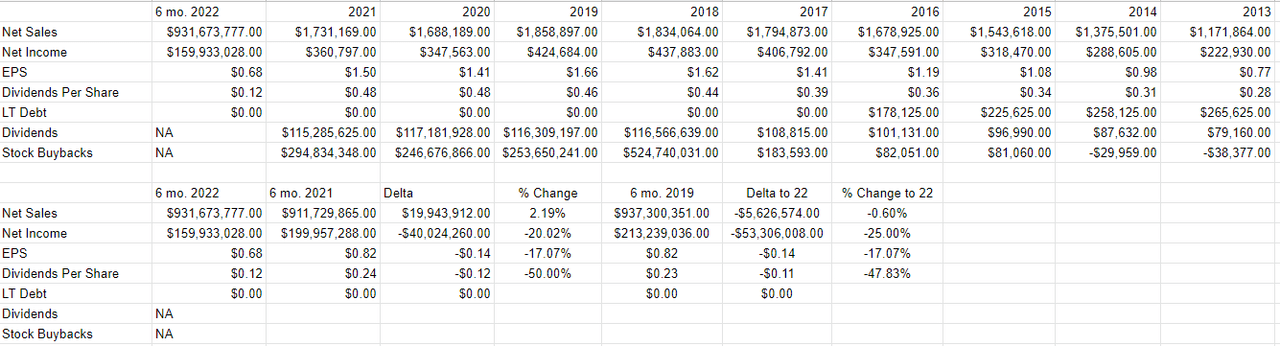

The financial performance for the first half of this year has been poor in my view. Although sales are up slightly relative to the same period in 2021, net income is down significantly. Specifically, revenue is up by about 2.2%, while net income is off by $40 million, or 20%. This is a consequence of the fact that growth in Engineering and SG&A expenses swamped the 2% uptick in sales, with the former up by 14%, and the latter up by over 23%. If your instinct is to find refuge in the idea that 2021 was a particularly good year, making comparisons to that period particularly challenging, allow me to destroy that refuge. For instance, results are even worse in 2022 when compared to the same period in 2019. Sales in 2022 were actually lower slightly (down .6%) and net income is fully 25% lower now than it was then. The same story emerges when comparing 2019 to 2022. Engineering expenses are now about 15% higher than they were, and SG&A expenses are about 36% higher than in 2019.

One obvious bright spot is the capital structure. There is virtually no debt here, which obviously reduces the level of risk dramatically. Finally, as the company stated, the dividend will “grow roughly in line with net income growth“, I think it would be wise for investors in this company to buy only if they’re comfortable with the current yield. The dividend has remained flat for the better part of three years, and I expect this to continue. That said, the capital structure is rock solid, implying that the dividend is quite secure, and for that reason, I’d be very happy to buy in at the right price.

Gentex Financials (Gentex investor relations)

The Stock

You may wonder why my social life is in the miserable state it’s in. I’m about to offer you an insight into one of the many reasons. I repeat myself. Often. With that out of the way, prepare for some more repetition when I write to you that I think the business and the stock are quite distinct from each other. Here’s what I mean. Every business buys a number of inputs, performs value-adding activities on them and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. It’s also possible that the stock’s movements relate to the crowd’s view about “the market” in general, and have very little to do with what’s going on at the company. So, in some sense, the stock is “doubly buffeted” by the crowds’ rapidly changing views about a given company, and the crowd’s rapidly changing views about the overall stock market, the overall economy, etc.

This can be as tiresome as having a friend who either constantly brags, constantly repeats himself, or much worse, both. After all, if the stock’s price is really only the present value of all future cash flows (it is), then it shouldn’t bounce around in price so much. While this is tiresome, it’s also potentially profitable, because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Excessively low expectations correlate with strong future gains.

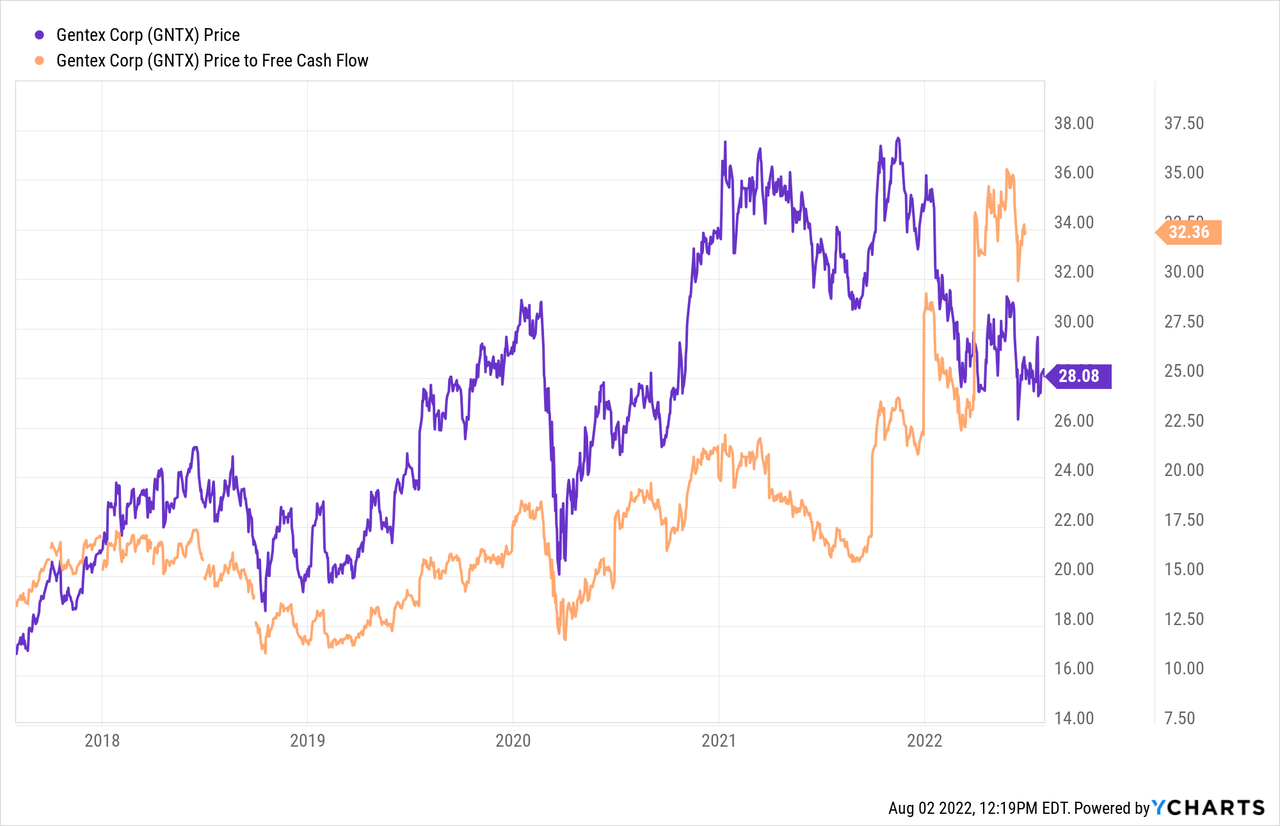

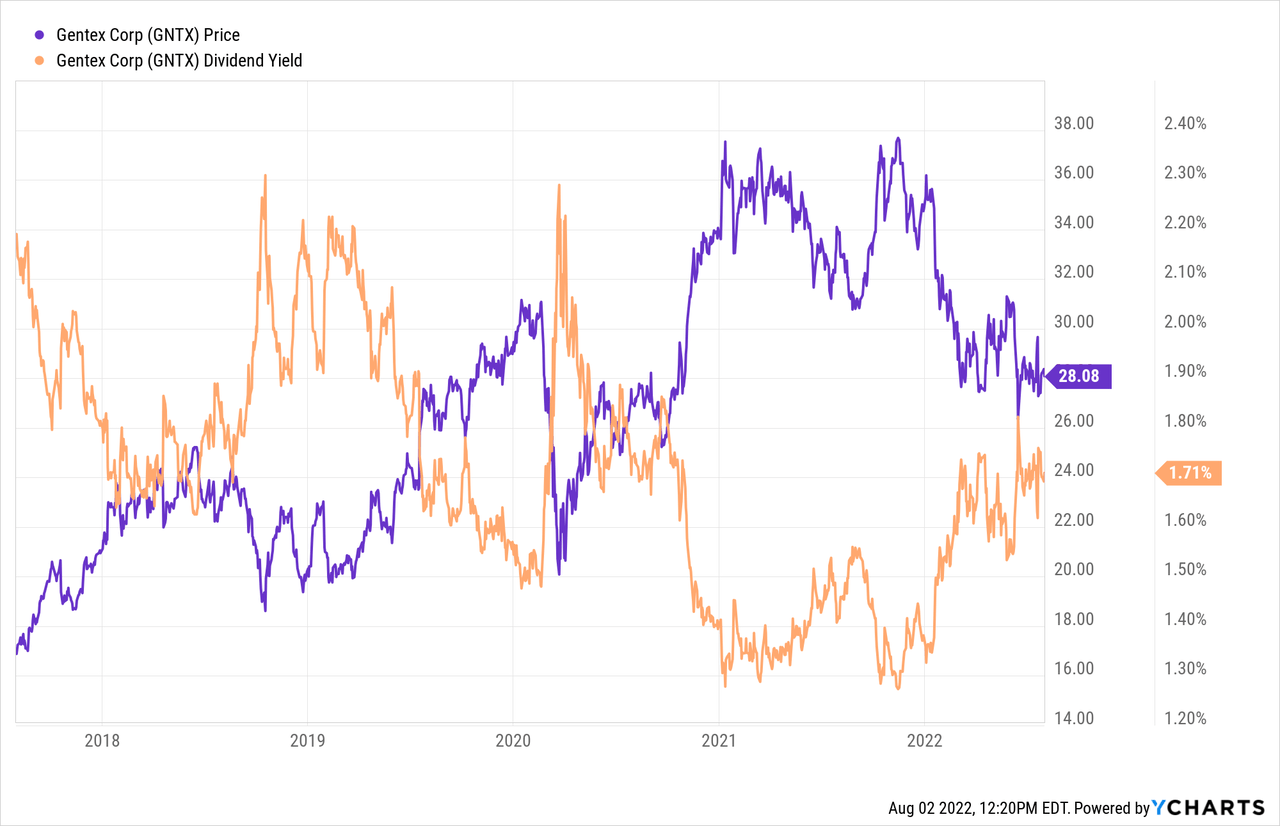

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Previously, I decided to continue to avoid the shares because they were trading at a price to free cash flow of ~24.5 times and sported a paltry dividend yield of about 1.6%. Zoom forward in time and the shares are much more expensive, and the dividend yield has barely budged higher, per the following:

The fact that investors are paying more and getting basically the same yield is not a great sign in my view. It’s enough to cause me to continue to eschew the shares. Before I get excited here, I need to see financial performance improve relative to 2019, and or for the shares to become much more attractively priced.

Options Update

My regulars know that I love to write deep out-of-the-money put options on decent companies because I think these create “win-win” trades. If the shares remain above the strike, I collect the premia. If the shares drop in price, I’ll be obliged to buy, but will do so at a price that I find attractive. When it comes to Gentex, I previously did well, selling 10 December Gentex puts with a strike of $20 for $.70 each. These expired worthless, which boosted my overall return on this name nicely. It’s time to look into this again. Is it possible to earn some money while we wait for the shares to fall to a more reasonable level?

I’d be willing to buy these shares if the yield reaches ~2.4%, which works out to a price of about $20 per share. This is a reasonable level for a company with a history of not growing the dividend, in my view. The problem for me is that the premia on offer are quite thin at the moment. For instance, the December puts with a strike of $20 are bid at $.10. This isn’t worth it in my estimation, and for that reason, I’ve got to sit and wait around for shares to drop to a more reasonable level before buying.

Conclusion

In my previous missive, I didn’t see enough value for the price, and nothing’s really happened to change my view in my estimation. The shares are more expensive in spite of the fact that the company has performed materially worse in 2022 than it did in 2019. The yield is barely higher, so investors are paying much more and getting about the same. That’s never a great combination in my estimation. Additionally, while I’ve done well with options in the past, there’s not much on offer at the moment, so I must continue to simply sit and wait for valuations to return to something like “reasonable” before getting excited. To be clear, I’d be comfortable buying at the right price. The problem is that we’re about 29% over reasonable at the moment, in my view.

Be the first to comment