Anchiy/E+ via Getty Images

Genius Sports (NYSE:GENI) is coming off a couple of challenging years, as its share price cratered from around $25 per share on May 24, 2021, to a low of $2.20 per share in early July 2022.

Starting in August 2022 the company’s shares started to make an upward move, trading in a range of $3.60 to about $4.80 before getting another push up to around the $5.50 per share level before pulling back to about $4.60 on November 9, 2022.

It appears to me, especially after the recent earnings report of the company, that it may have turned a corner and is positioned for a period of growth, albeit one that will probably prove to be choppy.

In this article, we’ll dig into some of the numbers and highlights of its earnings report, and why I think the company is likely to enter into a period of sustainable growth.

Latest earnings

Revenue in the third quarter was $78.7 million, up 14 percent year-over-year, beating by $1.47 million.

GAAP earnings per share was -$0.04, beating by $0.04.

Net loss in the quarter was $9.0 million, up 87 percent from last year in the same reporting period. The improvement was attributed to gains in profitability, a decrease in stock-based compensation, and a gain on FX. Adjusted EBITDA was $7.7 million, up from the $0.4 million loss in the third quarter of 2021.

For the nine-month period ended September 30, 2022, GENI generated revenue of $235.7 million, beating guidance of $231 million, and adjusted EBITDA of $13.1 million, beating guidance by $12.00 million.

At the end quarter GENI had a cash balance of about $150 million. Of that, $33 million was restricted. The company has stated in the past that restricted cash will be returned to the cash and cash equivalents line on the balance sheet over time.

By the end of fiscal 2022, GENI expects a cash and restricted cash balance in the range of $140 to $150 million. That could change based upon exchange rates in the last quarter.

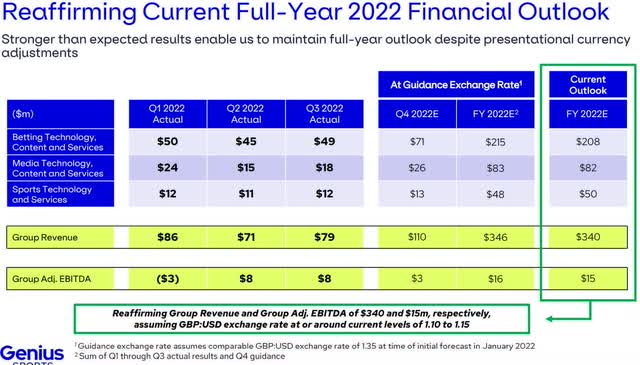

Concerning guidance, GENI expects to generate about $340 million in revenue and adjusted EBITDA of about $15 million for full year 2022. For 2023, the company guides for revenue to be in a range of $430 million to $440 million, with adjusted EBITDA of $40 million to $50 million.

The above numbers assume a GBP:USD exchange rate of about current levels of 1.10 to 1.15.

Performance by segments

Genius Sports, which touts itself as the “official data, technology and broadcast partner that powers the global ecosystem connecting sports, betting and media,” operates in three segments: Betting Technology, Media Technology, Content & Services, and Sports Technology & Services. We’ll look at their performance in the third quarter.

Betting Technology, Content & Services

Betting Technology, Content & Services is the largest unit of the company, and confirmed that by driving $49.2 million in revenue, up 13 percent year-over-year. The improvement came from an increase in new customer acquisitions, using more of its available content, and expanding its existing value-add services while offering new services.

Media Technology, Content & Services

Media Technology, Content & Services produced revenue of $17.9 million in the third quarter, up 29 percent from the third quarter of 2021.

A positive there was it was primarily driven by organic growth, as well as some new customer wins. Organic growth was driven by existing customers utilizing more of its programmatic advertising services.

Sports Technology & Services

Sports Technology & Services boosted revenue in the quarter to $11.6 million, up 6 percent on a constant currency basis. The key driver there was an increase in revenue from Second Spectrum.

GENI entered into new partnerships with 27 sportsbook customers, pointing to some significant improvement in its performance going forward.

The company also launched “new free-to-play games in partnership with NFL organizations.” That has significance in becoming stickier while attracting potential paying clients.

Conclusion

As mentioned earlier, GENI dropped to a 52-week low of $2.20 in early July, then started to rebound about a month later. Since the share price of GENI has doubled since July, the question needs to be considered as to whether or not a lot of expected growth is already priced in.

My thought is once the market digests the numbers, specifically concerning each segment, along with included guidance, I think there’s some decent upside for the company in 2023.

I like its momentum as it bounces off a weak performance that started a year ago in November 2021.

Even though the gaming sector as a whole has been out of favor in some cases, I believe money is increasingly rotating there from consumers wanting to enjoy experiences again after being locked down for a prolonged period of time.

What has yet to be determined is how deep and long the current recession is going to last, and how much disposable income consumers have. That in turn will determine how much capital GENI’s customers are willing to spend on its products and services.

I lean toward things loosening up some in the gaming industry, assuming nothing too drastic happens on the economic front. Under that scenario wallets will tighten up and shareholders will have to wait a little longer to get rewarded.

One final thing, I think the best way to easily and simply track the performance of GENI is to closely monitor its ‘Betting Technology, Content & Services’ unit. Since it easily accounted for more than 50 percent of revenue, how that unit performs will be how the company performs.

The other segments will of course add to its overall performance, but that is going to be the main driver for the foreseeable future.

Be the first to comment