Brandon Woyshnis/iStock Editorial via Getty Images

Investment Thesis

General Motors (NYSE:GM) has proved why it is one of the leading automotive producers globally, given the advanced material supply agreements, impressive projected output of 160 GWs from Ultium battery plants, and exemplary capital raises/ loans thus far.

With the accelerated EV investments, we are highly confident about GM’s 1M projected capacity by 2025, if not earlier, assuming the eventual recovery of macroeconomics and the global supply chain by 2024. Along with an aggressive projected YoY growth in wholesales by 30% and $90B annual EV revenue by 2030, GM is absolutely ready to go indeed. As a cherry on the top, 75% of its commodities will also be sourced from North America, due to the significant geopolitical implications from Russia and China.

The temporarily elevated sticker price for new and used auto sales would also improve GM’s margin ahead, given the limited market supply over the next few quarters. Thereby, speculatively balancing the $5B impact of rising inflation in FY2022 and aggressive investments into the EV segment through 2025.

GM Continues To Face Temporary Headwinds In Chips Supply

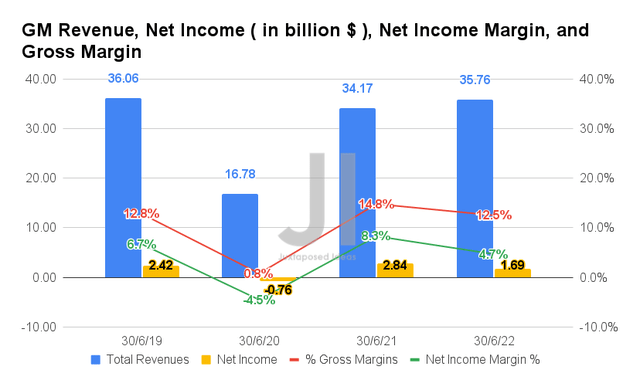

In FQ2’22, GM reported revenues of $35.76B and gross margins of 12.5%, representing an increase of 4.6% though a decrease of -2.3 percentage points YoY, respectively, partly attributed to rising inflation and global chip supply. The company also reported further headwinds to its profitability, with net incomes of $1.69B and net income margins of $4.7%, indicating a decline of -40.4% and -3.6 percentage points YoY, respectively.

However, it is essential to note that these declines are mostly attributed to the 95K vehicles worth approximately $5.7B (based on the Average Transaction Prices of $60K for trucks and SUVs ) produced in North America, being undelivered due to missing components. Thereby, pushing the unrecognized revenue, net income, and Free Cash Flow (FCF) generation to H2’22.

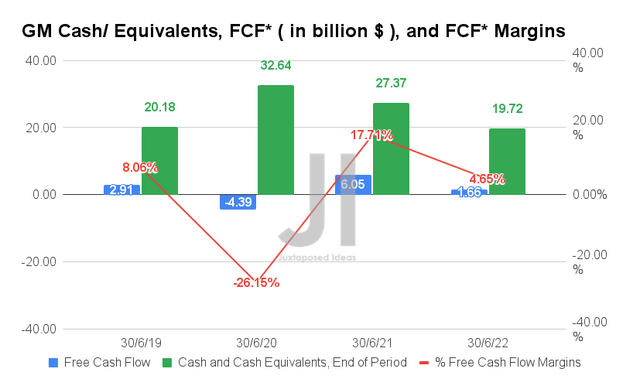

This global event has directly affected GM’s cash flow generation, with a FCF of $1.66B and a FCF margin of 4.65% in FQ2’22, representing a decline of -72.5% and -13.06 percentage points YoY, respectively. The elevated $2.1B of capital expenditure in the latest quarter has also partly contributed to its lower cash flow, compared to $1.5B in FQ2’21.

As a result, it is not surprising to see an impact on its cash and equivalents of $19.72B on its balance sheet in the latest quarter, compared to $27.37B in FQ2’21. However, we must also highlight that the sum remains robust for most of its EV expansion and growth plans worth $35B through 2025, given its robust adj. FY2021 FCF of $7.68B and the projected adj. FY2022 FCF of up to $9B.

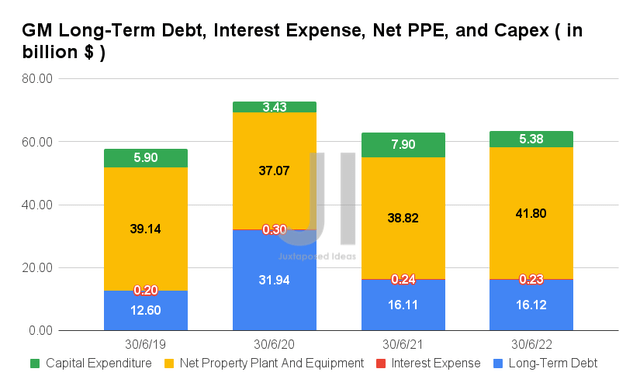

These rapid expansion plans have directly aided the growth in GM’s net PPE assets to $41.8B, representing an increase of 7.6% YoY, with a continued investment of $5.38B in capital expenditure in FQ2’22 (comprising $2.1B for properties ).

In the meantime, the company’s long-term debts of $16.12B and interest expenses of $0.23B in the latest quarter remain relatively stable, significantly aided by the new $1B notes due 2029, $1.25B notes due 2032, and $2.B loan from the US Department of Energy post FQ2’22 earnings call. Barring any additional leveraging, these capital raises would bring its debt levels to $20.87B in FQ3’22, further strengthening its balance sheet in a period of economic uncertainties ahead. CEO of GM, Mary Barra, said:

While demand remains strong, there are growing concerns about the economy to be sure. That’s why we are already taking proactive steps to manage costs and cash flows, including reducing some discretionary spending and limiting hiring to critical needs and positions that support growth. … We have a foundation of strong earnings and cash flow, an investment-grade credit rating, historically low pension obligation and outstanding vehicles, services and pricing. … All of this will help us continue to execute our growth strategy and insulate it from short-term market challenges. (Seeking Alpha)

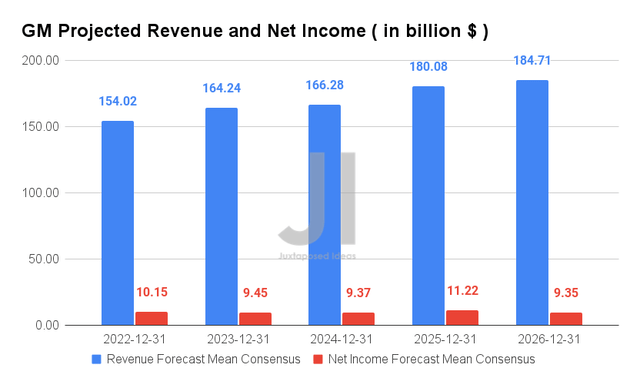

Mr. Market Has Confidently Upgraded GM’s Forward Profitability

Over the next five years, GM is expected to report revenue and net income growth at a CAGR of 7.78% and -1.34%, respectively. Though the top line numbers represent a notable decline in estimates by -4.2% since our previous analysis in July 2022, we must also highlight the impressive upgrade of 7.8% to its projected profitability through 2026. Thereby, pointing to its improved net income margins of 5.1% in FY2026, similar to FY2019’s level of 4.9%.

For FY2022, consensus estimates that GM will report revenues of $154.02B, net incomes of $10.15B, and net income margins of 6.5%, representing excellent Yoy growth of 21.2% and 1.3% though a decline of -1.4 percentage points, respectively. These were significantly bolstered by the management re-affirmed guidance in its recent FQ2’22 earnings call.

In the meantime, we encourage you to read our previous article on GM, which would help you better understand its position and market opportunities.

- General Motors Is Catching Up To Tesla (TSLA)

So, Is GM Stock A Buy, Sell, or Hold?

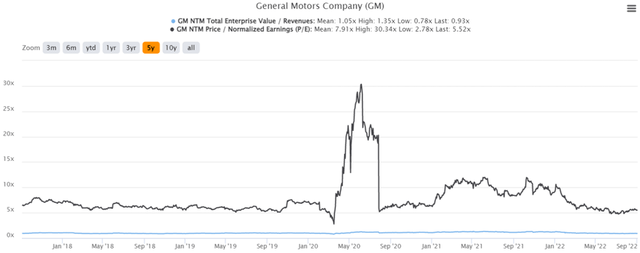

GM 5Y EV/Revenue and P/E Valuations

GM is currently trading at an EV/NTM Revenue of 0.93x and NTM P/E of 5.52x, lower than its 5Y mean of 1.05x and 7.91x, respectively. The stock is also trading at $38.47, down -42.7% from its 52 weeks high of $67.21, though at a premium of 26.8% from its 52 weeks low of $30.33.

GM 5Y Stock Price

It is evident that GM is riding on the bullish sentiments post Inflation Reduction Act, combined with the reinstatement of its quarterly dividends, $5B of share repurchase program, and its strengthened domestic battery supply chain with LG Chem, POSCO Chemical, and Livent Corporation (LTHM). The latter would definitely aid the company’s future sales, given the favorable $7.5K tax credit for its basic models of trucks, vans, and SUVs <$80K and cars <$55K.

The recent semi-destruction of mid-tier smartphones and PC may also pave the way for increased production and availability of automotive chips from GM’s domestic partners, such as Qualcomm (NASDAQ:QCOM) and ON Semiconductor (NASDAQ:ON) by H2’22. Thereby, potentially boosting the company’s delivery and top-line growth then. Assuming 1B production output by 2025, the EV segment would easily comprise an exemplary 15% of its global deliveries of 6.29M as of FY2021. Otherwise, a decent 10% based on GM’s maximum output of 10.01M in 2016.

Nonetheless, due to Powell’s hawkish commentary on aggressive interest rate hikes, consensus estimates have downgraded the GM stock’s price target from $53.17 in July 2022 to $45.43 at the time of writing, with the latter representing a minimal 18.09% upside from current prices. Combined with the fact that it is trading with a baked-in premium above its 50-day moving average of $35.84, we prefer to exercise caution for now. We may potentially see a more attractive entry point at the Fed’s upcoming meeting on 20 September, so interested investors would be well advised to wait for that dip before adding at the mid $30s.

Good luck to all.

Be the first to comment