Wolterk

General Mills – An Intro

General Mills, Inc. (NYSE:GIS) stock jumped almost 6% after the announcement of the company’s first-quarter fiscal 2023 earnings. The post-earnings spike came as a result of organic net sales growth of 10% coupled with adjusted operating profit growth of 8% and adjusted diluted EPS growth of 13% for the quarter. This momentum led management to raise its full-year fiscal 2023 outlook which the market was obviously encouraged by considering we are only 3 months into the present fiscal year. Furthermore, guidance was increased not only for top-line sales but also for operating profit and earnings per share respectively.

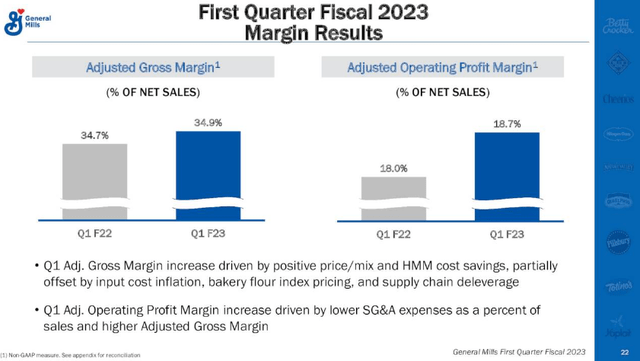

Suffice it to say, with earnings now growing faster than sales due to rising margins as we see below, this is bullish news indeed if these trends can continue over time. HMM cost savings as well as an improved price/mix breakdown drove adjusted gross margin higher in the quarter. Management played down to an extent how impressive the gross margin print was citing the risk of extended supply chain disruptions going forward. In saying this, however, it is clear that General Mills has been able to take advantage of renewed demand on the “in-at-home” front whilst also decreasing costs on the back end.

This is precisely what the market wanted to see especially in this present inflationary environment. The reason being is that as long as margins can remain elevated, GIS will continue to be able to aggressively accelerate investment in its business as well as reward shareholders to boot. Operating cash flow increased by $19 million in Q1 and balance sheet equity continues to go from strength to strength. The CEO said the following which again demonstrates that the wind is certainly in General Mills’ sails at present.

General Mills is executing its Accelerate strategy to drive sustainable, profitable growth and top-tier shareholder returns over the long term. The strategy focuses on four pillars to create competitive advantages and win: boldly building brands, relentlessly innovating, unleashing scale, and standing for good. The company is prioritizing its core markets, global platforms, and local gem brands that have the best prospects for profitable growth and is committed to reshaping its portfolio with strategic acquisitions and divestitures to further enhance its growth profile.

GFI Margins Report Q1 Fiscal 2023 (Company Website)

The three core areas to confirm the momentum are the company’s profitability trends, GIS’s technicals, and the stock’s valuation. Encouraging trends in these areas usually means rising prices will come sooner rather than later.

Profitability

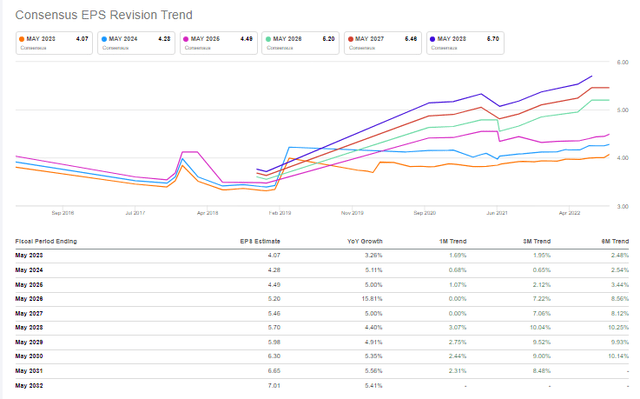

We touched already on the company’s rising margins and how this trend will facilitate accelerated investment going forward. Furthermore, earnings revisions continue to rise with the present 3.26% expected growth rate in fiscal 2023 ($4.07 EPS expected) most likely to increase in the quarters to come. We state this because forward expectations continue to accelerate as the annual estimate is up approximately 1.7% over the past 30 days alone. Furthermore, with a solid interest coverage ratio of 8.6 and a cash dividend payout ratio of 45.3%, as long as trading conditions cooperate on the supply side, there are no significant impediments that should stall earnings growth here.

General Mills EPS Consensus Estimates (Seeking Alpha)

Technicals

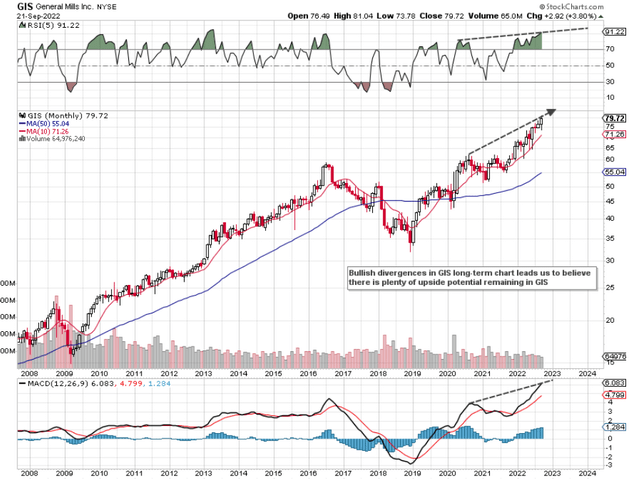

If we go to the long-term chart of GIS, we see that despite the fact that shares have been on a tear over the past few years, we still do not have any bearish divergences of significance to speak of. Both the stock’s RSI and MACD long-term indicators remain in bullish mode. Short interest (2.2%) continues to come down and the turning up of the 50-month moving average is significant in our eyes. Furthermore the recent breakout to higher highs and the fact that a trend in motion is much more likely to continue than reverse should bring trend followers into this play before long.

GIS Stock Valuation

Given how shares of GIS look heavily overbought on the long-term chart, many may assume that shares are too expensive at present. However, if the present bullish trends continue, we would not be surprised if General Mills’ fiscal 2023 GAAP earnings multiple of 19.6 continues to come down meaningfully. Furthermore, the company’s excellent profitability has to be taken into account when trying to value this company. The present net profit per employee ($83k) has soared over the past few years (5-year average of $58k) and really demonstrates how GIS has transformed for the better in recent times. Suffice it to say, It is not General Mills’ fault that the market continues to love this stock.

Conclusion

To sum up, the earnings and sales beat as well as the guidance hike which General Mills reported in its first fiscal quarter of 2023 powered shares forward by almost 6%. We would expect more gains to come here as the company continues to take advantage of higher inflation as customers look for more value offerings. We look forward to continued coverage.

Be the first to comment