HuyNguyenSG/iStock Editorial via Getty Images

There’s been a lot of talk about General Electric’s (NYSE:GE) trajectory from an ‘everything’ powerhouse through selling off its businesses piece by piece, aiming to slim down and eventually break into 3 separate companies: aviation, healthcare and energy.

I’ve discussed these 3 segments last year and why the overall growth and ownership structure will allow investors to enjoy the best of both worlds. However, the GE that will stay GE is going to focus almost exclusively on aviation and although healthcare and energy are fast growing business segments – aviation, I believe, can be the grandest for long term investors.

This is due to the 2 tiers of the investment thesis – short term and long term, and each present a solid independent investment opportunity.

Short Term – Jets, Jets, Jets

As we come out of the COVID-19 pandemic, we’re seeing a continued increase in the demand for airlines to renew a good portion of their fleets by using the money they’ve got to get more fuel efficient jets which can in turn attract more passengers through cheaper rates and better onboard services.

This is compounded by the continued emergence of low cost airlines all across the world, which are growing at some of the fastest rates we’ve seen airlines grow in decades, like Spirit Airlines (SAVE), Frontier Airlines (FRNT) and more. These airlines are not necessarily simply taking away business from major airlines, which still rely heavily on business travel, but are attracting individuals who won’t be taking these flights if the only alternative was a ticket which costs 5x to 10x as much.

This boost in airline spending on renewing or expanding their fleets is increasing demand for GE’s engines, which are on most of the planes made by Boeing (BA) and Airbus (OTCPK:EADSY). This is set to increase the short term growth for the company as we emerge from the pandemic and supply chain woes decrease and companies like Boeing and Airbus are able to deliver new planes.

In Between – Supersonic Adventures and 3D Printing

While we enjoy the increased demand for the company’s engines, there are a few other factors which will aid growth while we wait for the longer term factors to materialize.

GE additive uses 3D printing technologies to more efficiently manufacture various parts for both aviation and aerospace – a fast growing market which is already seeing demand spike as more and more companies are looking for more efficient ways to manufacture parts without the hassle of large manufacturing plants. This is also going to be a fast growing market in the aerospace industry as the ability to lift up a 3D printer into space means that it can take 1 trip and print various products up in space rather than manufacture them on the ground and then take multiple trips to get them into space.

Another fascinating growth opportunity is the recent talk about the return of supersonic flight. While the same hurdles remain, like the inability to fly over land when going supersonic, with the technological advancements in the area there may come a time in the not too distant future when we’ll see the return of the short hour flights from New York to London and other continents.

Long Term – Space, Space, Space

The far more interesting element of the company’s future growth prospects lies in outer space exploration. This is because they are already a global leader in all things aero and they have multiple projects manufacturing efficient jets, rockets and various parts for aerospace – from stratosphere flight to space.

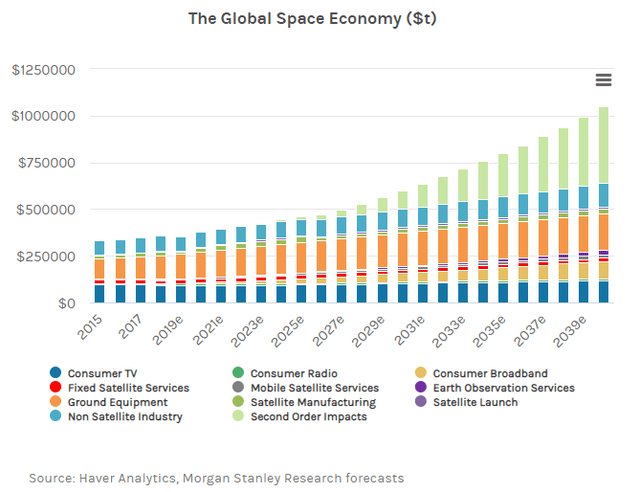

Morgan Stanley Space Economy Report

As we can see, according to Morgan Stanley, the space exploration industry is projected to reach about $1 trillion in revenues by 2040, driven by lower costs of entry and launches as well as a wider array of companies exploring various methods of achieving space flight and exploration.

This means that beyond current expectations for the company, they are set to be a major part of this fast-growing industry for quite a long time and have the potential to be a major benefactor from the increase in spending by both private and public entities.

Current Expectations to Likely Outperformance

Currently, the company is projected to grow both sales and net income at quite the fast pace after it shed off a lot of its slower or negatively growing businesses. Here are those numbers:

Sales growth is projected to accelerate as acquisitions and increased demand continues to drive the company’s orders.

| 2023 | 2024 | 2025 | 2026 | |

| Revenue | $75.2 billion | $81.4 billion | $86.0 billion | $95.5 billion |

| Growth | +1.30% | +8.33% | +5.63% | +11.1% |

(Source: Seeking Alpha Analyst Projections Aggregator)

As we can see, the company is set to enjoy a boost to sales as aviation becomes the sole business segment. But the more interesting thing is how the company’s recent efforts to lower expenses and increase their gross margins is projecting onto their net income, which has been soaring.

| 2023 | 2024 | 2025 | 2026 | |

| EPS | $2.76 | $4.68 | $6.14 | $8.07 |

| Growth | +30.4% | +69.3% | +31.1% | +31.5% |

(Source: Seeking Alpha Analyst Projections Aggregator)

Increased Margins & Lower Debt

The company has been enjoying overall better gross profit margins as technological advances has aided cost savings on the manufacturing process, as well as the natural increase as they no longer report business segment which have a low gross margin.

On top of the increase in overall gross margin, the company has been doing 2 things to lower overall expenses:

Lower SG&A: Selling, general & administrative expenses have been heading lower as the company breaks up and sells underperforming assets and segments and focused on their more profitable ones. The Aviation segment is set to have lower overall costs since so much of the process is automated, unlike the company’s former business segments which took a lot of human resources.

Lower debt, which the company has been both selling off alongside their respective business segment, as well as using the cash infusion from asset sales to pay down their debt. After holding a mind boggling $245 billion in long term debt about a decade ago, they are paying off or spinning off huge amount of long term debt, going from around $100 billion in the beginning of 2018 to just over $27 billion as of their latest report. (Source: GE Balance Sheet).

The lower debt not only means the company’s valuation is aided by deleveraging, but also that the company’s interest expense liability is heading down as well, even as interest rates are heading up. After paying just shy of $3 billion in interest expense for 2019, the company is now expected to pay roughly half of that at about $1.6 billion, which is cold hard cash they can use for acquisitions to drive short and long term revenue growth. (Source: GE Income Statement).

These factors are very encouraging and I believe will be major driver for the company to outperform the aforementioned, current analyst projections.

Investment Conclusion

Investors who are looking for exposure to the aviation market but don’t want to rely on airlines and other companies which have a volatile expense environment with fuel prices and low cost airlines emerging on the scene can explore an investment in GE as they remain a leading manufacturer of jet engines, which they supply to most major airline manufacturers and defense contractors.

But for investors who want exposure to the broader aerospace industry without trying to guess which company will be the first or the winner, GE is also a good long term play, I believe. This is because they continue to be industry leaders in manufacturing and providing tools and rocket systems for both private and government entities leading the space race 2.0.

Overall, with their focus on lowering debt and using acquisitions to fuel growth, I am bullish on the company’s medium term prospects and am highly bullish on their long term, 10-15 year prospects.

Be the first to comment