elena_larina

Investment Thesis

The share prices for Genco Shipping (NYSE:GNK) and other dry-bulk marine shippers are volatile and the dramatic changes in the Baltic Dry index show why. I think GNK’s stock price will appreciate based on developments in Dry Bulk shipping supply and demand plus marine fuel costs. Even if GNK’s stock price only moves from $14.18 to $15 by May 19th, a 44.5% potential annualized return is possible including covered call premium and dividends.

Genco Shipping

Genco Shipping is a provider of international seaborne dry-bulk transportation services. They transport iron ore, coal, grain, steel products, and other dry-bulk cargoes along worldwide shipping routes. GNK wholly owns a modern and diverse fleet of Capesize, Ultramax, and Supramax dry-bulk vessels that provide an essential link in international trade.

GNK is focused on corporate governance and rated #1 in the Webber Research 2021 ESG (Environmental, Social, and Governance) scorecard. They expanded in the Ultramax sector with nine acquisitions since Dec 2020.

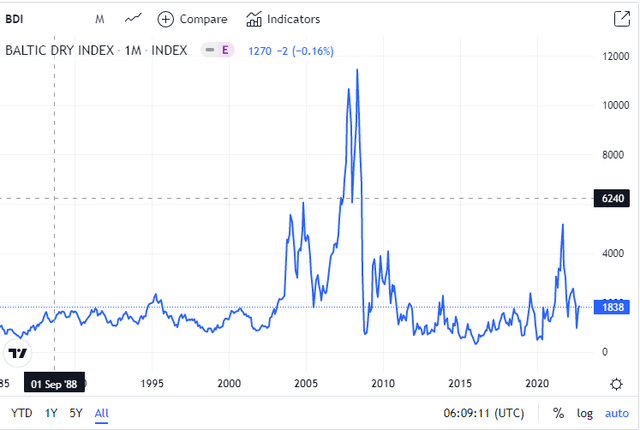

The Baltic Dry index

The Baltic Dry index tracks dry-bulk shipping rates for about 24 global routes. The index went as low as 400 points in May 2020 to a high of 5,500 in September 2021.

The dramatic change in the index shows why dry-bulk shippers have experienced both boom and bust.

tradingeconomics.com/commodity/baltic

Earnings per Share for Dry Bulk Shippers are Volatile

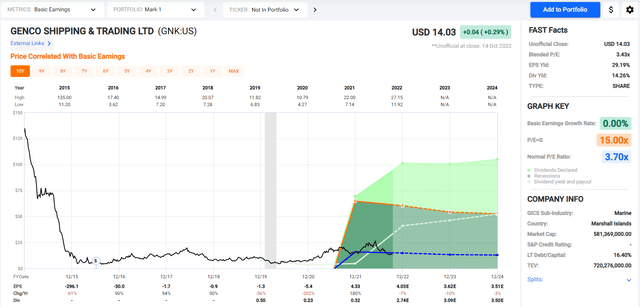

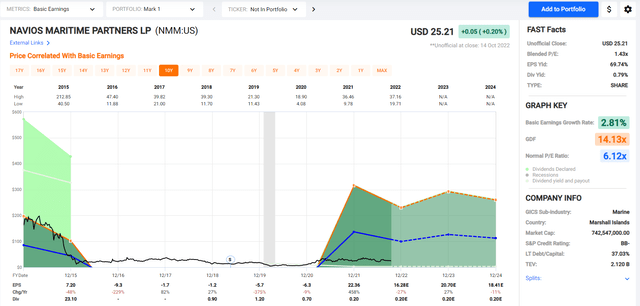

The black line shows GNK’s stock price for the past decade. Look at the chart of numbers below the graph to see that GNK had negative earnings per share from 2015 to 2020. They earned $4.33 in 2021, and EPS is forecasted to fall slowly each year to $3.51 in 2024. Some poor investors paid $135 per share starting in 2015.

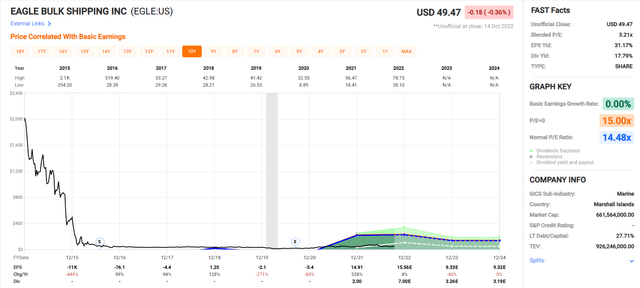

The basic story is not much different for fellow maritime shippers Eagle Bulk (EGLE) and Navios Maritime (NMM).

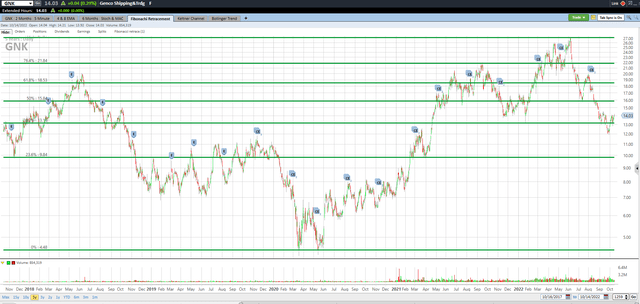

I’ve added the green Fibonacci lines using the high and low of the past five years for GNK. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where GNK may be going. GNK may touch the $13.16 38.2% Fibonacci retracement level again or even go lower. However, I believe that GNK will trade above $15 by May for the reasons in this article.

Developments in Dry Bulk Shipping Supply and Demand

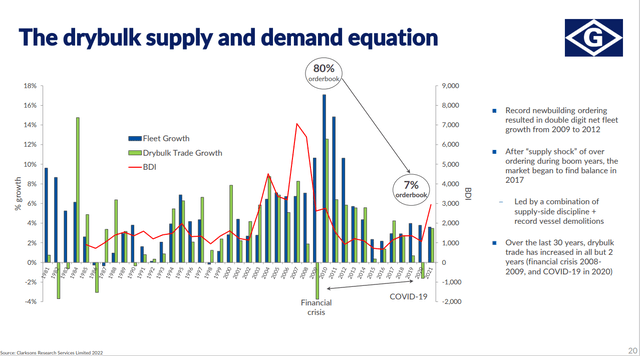

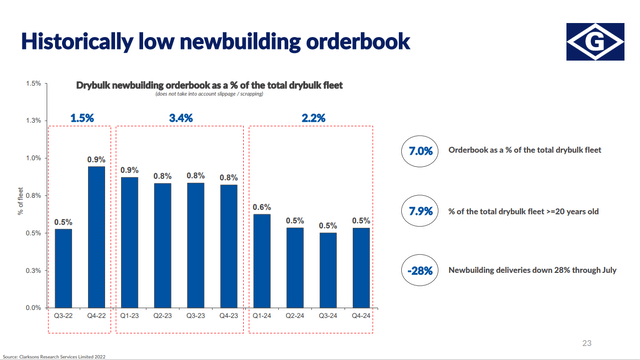

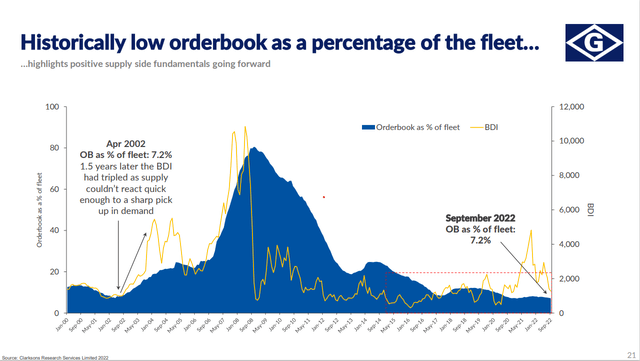

The supply of dry-bulk ships does not seem to be keeping up with increasing demand. It takes three years to build a dry-bulk vessel, and there are not many in production. The scrapping of older ships is reducing availability.

Shipping routes are longer as a result of the Ukraine war. In addition, ships are traveling slower to conserve fuel, reduce costs and enhance the environment. In effect, these factors cause a reduction in the supply of dry-bulk ships.

www.gencoshipping.com www.gencoshipping.com www.gencoshipping.com

Brazilian producer Vale (VALE) projects Sea-borne iron ore shipments will be 26% to 33% higher in volume during the second half of this year versus the first half. Coal demand has strengthened due to the availability and pricing of other energy types. Russia is exporting more coal to China and India, while Europe is sourcing more coal from the USA, Columbia, and Australia. Brazil’s strong corn harvest is forecasted to offset part of the reduced export volume from Ukraine. GNK expects a new long-haul route from Brazil to China for corn by the end of this year. These positive developments for dry-bulk shippers will probably be more evident in the fourth quarter. The black sea will see less shipment volume due to the Ukraine war. This information in this paragraph came from GNK’s August 4th earnings call webcast.

Freight Rates

I can see why some investors may think these factors will keep future dry-bulk freight rates relatively high, but I’m not sure how high and for how long. I only want to own this stock for 7 to 12 months, not years. It’s less clear where dry-bulk freight rates may be more than 12 months from now.

GNK’s second quarter fleet-wide Time Charter Equivalent was $28,756 per day, an increase of 36% versus last year and 19% versus last quarter. Time charter equivalent (TCE) is a method for determining the net profit or loss of operating a vessel per day. It is calculated by taking voyage revenues, subtracting voyage expenses, including canal, bunker, and port costs, and then dividing the total by the round-trip voyage duration in days. Voyage expenses are mainly fuel and the costs related to maintaining the crew onboard in terms of salary, food, and quarter.

CEO John Wobensmith said in an Aug. 3 press release:

For the third quarter, we have booked the majority of our available days at over $25,000 per day and are poised to continue to take advantage of favorable dry-bulk fundamentals. The market continues to be driven by an attractive supply and demand balance and the historically low newbuilding order book, which provides a low threshold for demand to exceed supply.

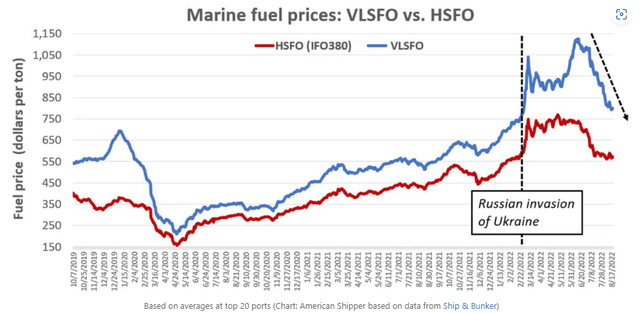

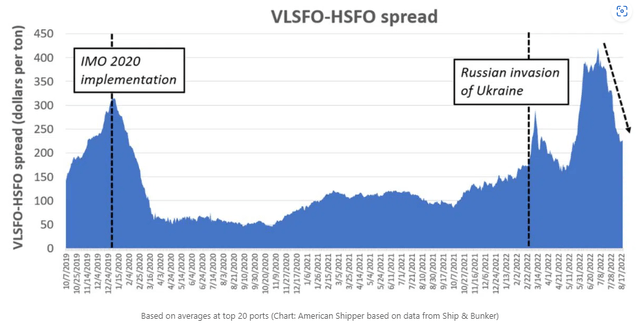

Marine Fuel Prices

The price of marine fuel oil is down to pre-Russian invasion levels, but they are still historically high. In addition, ship owners that invested in pollution-reducing equipment (scrubbers) can burn dirtier fuel. These vessels can use high-sulfur fuel oil at discounts of 33% compared to very low-sulfur fuel oil.

Genco is capturing the widening fuel spreads thru scrubbers installed on all 17 of their Capesize vessels. GNK has real-time performance management of fuel consumption.

www.freightwaves.com/news/the-sinking-price-of-ship-fuel-near-prewar-levels-after-summer-plunge www.freightwaves.com/news/the-sinking-price-of-ship-fuel-near-prewar-levels-after-summer-plunge

Comparing GNK with EGLE and NMM

The chart below shows the average one-year price targets from the most accurate analysts. The upside potential shows how much the price may go up in a year if they are correct. GNK has the most potential upside.

| Company | Number of Most Accurate Analysts | Average One Year Price Target | Upside Potential from 10/14/22 Closing Price |

| GNK |

6 |

$25.33 | 80% |

| EGLE | 6 | $72.33 | 46% |

| NMM | 2 | $38.00 | 50% |

Both GNK and EGLE pay very nice dividends. Genco has a lower net debt to EBITDA ratio. Since the start of 2021, GNK has paid down $260.7M, or 58% of its debt. Their debt reduction and lower interest payments have drastically reduced their all-in daily cost of running their ships. Genco plans to have no net debt by the end of 2023.

The 3-year forecasted change in EPS from the prior year is in the chart below. GNK’s EPS decline is visibly more gradual.

| Company | Dividend |

Net Debt to EBITDA |

2022 Forecasted EPS Change | 2023 Forecasted EPS Change | 2024 Forecasted EPS Change |

| GNK | 14.26% | 0.5 | -7% | -10% | -3% |

| EGLE | 17.79% | 0.7 | 4% | -40% | 0% |

| NMM | 0.79% | 1.4 | -27% | 27% | -11% |

GNK has 44 dry-bulk vessels and a 95.6% fleet utilization rate for the six months ending June 2022. EGLE owns 53 dry-bulk vessels, and 48 are scrubber fitted. NMM has 90 dry-bulk vessels, 49 container ships, and 49 tanker vessels. The average fleet age for all three companies is nearly 9 to 10 years.

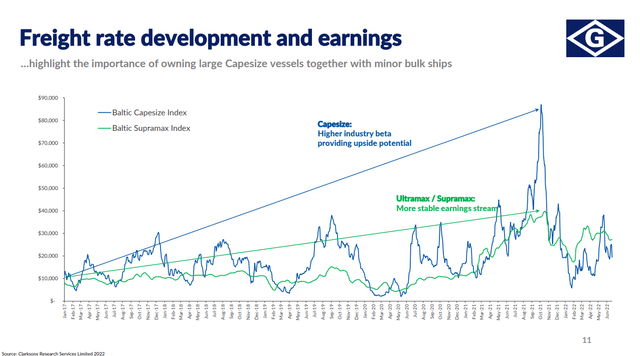

GNK has both Capesize and Ultramax/Supramax size vessels, but EGLE only owns Ultramax/Supramax size vessels. Capesize vessels have higher industry beta and provide more upside potential. Ultramax/Supramax vessels have a more stable earnings stream. I prefer GNK because they have both.

Genco provides better trade liquidity with a 3-month average daily volume of 1,141K shares. Both Eagle Bulk Shipping and Navios Maritime Partners have much lower volumes.

All three companies have low P/E ratios compared to the 18.3 market average. Dry-bulk shipper stock prices could go up significantly if the market decides to assign them higher P/E ratios nearer to 5.5, but I don’t expect that to happen anytime soon.

I consider institutional investors such as hedge funds, pension funds, mutual funds, and endowments as smart money because they have more resources available for research than retail traders. They control much more buying and selling than retail investors, which determines the stock price. Retail investors currently account for roughly 10% of the daily trading volume on the Russell 3000. I’m comfortable with the institutional ownership at 70.1% for GNK and 92.7% for EGLE. I am not comfortable with institutional ownership at only 11.3% for NMM.

| Company | Forward P/E | Price/Book | Institutional Investors |

3 Month Avg. Daily Trade Volume |

| GNK | 3.8 | 0.6 | 70.1% | 1,141K |

| EGLE | 4.7 | 0.9 | 92.7% | 359K |

| NMM | 1.1 | 0.4 | 11.3% | 181K |

The Seeking Alpha ratings summary and factor grades show strength for all three companies. The results are somewhat similar.

| Seeking Alpha | GNK | EGLE | NMM |

| SA Authors | Buy | Buy | Buy |

| Wall Street | Strong Buy | Strong Buy | Buy |

| Quant | Hold | Strong Buy | Buy |

| Valuation | A+ |

A+ |

A+ |

| Growth | A | A- | A+ |

| Profitability | A | A+ | A- |

| Momentum |

D+ |

B- | B+ |

| Revisions | C- | C | C+ |

Sell Covered Calls

My answer to this uncertainty is to sell covered calls on GNK seven months out. I bought 100 shares of GNK at $14.18 on 10/17 and sold one May $15 covered call at $1.38 to prove the point of this article. Each covered call contract controls 100 shares of stock. I will probably collect three dividends by May at $0.50 each and maybe more. GNK’s dividends are now flexible and expected to increase based on the results. If the stock trades above $15 on May 19th, it will be called away from me.

The investor can earn $138 from call premium, $150 from dividends, and $82 from stock price appreciation. This totals $370 in estimated profit on a $1,418 investment which is a 44.5% annualized return since the period is 214 days.

If the stock is below $15 on May 19th, I will still make a profit on this trade down to my net stock price of $11.30. Selling covered calls and collecting dividends reduces your risk.

Takeaway

Dry Bulk shippers are speculative investments, so I suggest keeping exposure to a small part of the portfolio. Earnings for Dry-bulk Shippers are volatile, but I see conditions improving enough for me to invest for less than 12 months. I think GNK’s stock price will appreciate based on developments in Dry Bulk shipping supply and demand plus marine fuel costs. I’m selling covered calls to reduce my risk and lock in some profit. There is nothing significantly wrong with owning EGLE or NMM. I like GNK better because of their higher analyst one-year upside price target potential, dividend, lower net debt to EBITDA ratio, diversified vessels, and more gradual annual forecasted EPS change. Even if GNK’s stock price only moves from $14.18 to $15 by May 19th, a 44.5% potential annualized return is possible including covered call premium and dividends.

Be the first to comment