FG Trade/E+ via Getty Images

Introduction

Alzheimer’s disease is the largest unmet medical need in neurology. Current drugs improve symptoms but do not have profound disease-modifying effects. In reality, no great drug is currently on the market for patients with this terrible disease. Currently, there are more than 6 million people with Alzheimer’s Disease (AD) in the United States alone, with that number projected to grow to over 13 million by the year 2050. Those 6 million patients will cost the United States $322 billion and over $1 trillion in 2050. IHealthcareAnalyst says,

The global market for Alzheimer’s disease is expected to attain $25 billion by 2027, growing at a staggering CAGR of 17.5% over the forecast period, driven by a rapidly aging population, increasing prevalence of AD, coupled with technological advancements in diagnostics and biomarkers

While there is a big market, it has been heavily targeted, with billions of dollars spent on drug development only for drug companies to receive a 99% failure rate. From IHealthcareAnalyst,

The U.S. FDA has approved three types of medications – cholinesterase inhibitors (Aricept, Exelon, Razadyne), NMDA receptor antagonist, memantine (Namenda) to treat the cognitive symptoms (memory loss, confusion, and problems with thinking and reasoning) of Alzheimer’s disease; as well as the anti-amyloid agents with disease-modifying treatments (DMTs) – Aduhelm (aducanumab).

Today there are 143 drugs in the developmental pipeline. Below is a graphic of current AD drug trials.

There are too many trials to dive into individually, and I will miss many trials. Still, I chose the ones I did because of their impact on the broader market or because I find them particularly interesting. I would advise looking at the company’s Seeking Alpha page to learn more. The final solution for AD will likely be a drug cocktail of multiple drugs as different drugs treat different issues. Many companies can get approvals and make money.

Amyloid Trials

The traditional approach for years has been around the Amyloid theory, which:

suggests that the deposition of Amyloid β (Aβ) in the brain triggers a chain of events, involving the deposition of phosphorylated Tau and other misfolded proteins, leading to neurodegeneration via neuroinflammation, oxidative stress, and neurovascular factors.

As of January 2022, Amoyloid represented the highest percentage of phase three trials at 29%. The amyloid theory is most embraced by big pharma and has recently made significant strides. There are four drugs to know in this theory. The first, Aducanumab (Aduhelm), was approved controversially in 2021, and the other three have been granted Breakthrough Drug designations (BTD) which give the drug an accelerated review and approval pathway. Those three drugs will be covered below and are the only AD drugs in the pipeline with this prestigious designation.

Aduhelm had such a controversial approval and was later not covered by Medicare because of a set of issues that appears to be shared across Amyloid theory drugs. Amyloid therapies are known to cause “amyloid-related imaging abnormalities (ARIA), referring to swelling/edema (ARIA-E) or bleeding/hemorrhage (ARIA-H) in the brain.”

Moreover, these drugs appear to have a limited patient population for which they are genuinely effective. APOE4 is considered the most decisive risk factor for AD, 25% of people carry one gene, and 2% have two genes. This gene causes an increased build-up of amyloid, which is likely why this subpopulation sees the best results; however, they also experience the most substantial side effects from this drug class, such as the ARIA mentioned above.

The amyloid trials are designed by big pharma companies with strong financial backing. The trials are extensive and lengthy, both costly characteristics, but they make it easiest to find statistical significance and drum up support for approval. It is not big pharma’s first rodeo.

Overall I am bearish on all of these drugs and was against Aduhelm’s approval. While there is money to be made from a potential approval of one, I think long-term, these drugs will not be prescribed or at least not prescribed to patients outside of the APOE4 subpopulation. Even with approval, it will be a commercial flop without Medicare’s backing. Medicare rejected covering Aduhelm for its questionable benefit and bad safety profile resulting in its failure. I would not be surprised if Medicare did the same for all of the below drugs if approved, unless one manages to have exceptionally better data than expected.

Lecanemab by Biogen and Eisai

In late September, Biogen Inc. (BIIB) and Eisai Co. (OTCPK:ESALY) announced their phase 3 trial data showing a clinical benefit in AD which subsequently sent their stocks skyrocketing, adding $20 billion in market cap to Biogen alone.

Lecanemab treatment met the primary endpoint and reduced clinical decline on the global cognitive and functional scale, CDR-SB, compared with placebo at 18 months by 27%, which represents a treatment difference in the score change of -0.45 (p=0.00005) in the analysis of Intent-to-treat (ITT) population. Starting as early as six months, across all time points, the treatment showed highly statistically significant changes in CDR-SB from baseline compared to placebo (all p-values are less than 0.01). All key secondary endpoints were also met with highly statistically significant results compared with placebo (p<0.01).

In July 2022, the FDA put lecanemab under the accelerated approval pathway with a PDUFA of January 6th, 2023. While Aduhelm by Biogen was controversially approved based on questionable benefits, lecanemab is claimed to have clear statistical significance. As for safety, in its phase 3 trial, “The overall rate of any ARIA event was 21.3% with lecanemab and 9.3% with placebo, which is ‘within expectations,’ according to the therapy’s developers.”

After the very questionable and controversial approval of Aduhelm, it will be interesting to see what the FDA does with this drug. Phase 3 data shows an improvement over placebo in that it slows decline, but this is not the blockbuster drug some are making it out to be. Lecanemab is not guaranteed approval, although I think approval is likely. Aduhelm tarnished the FDA’s reputation and was a massive commercial flop. The FDA has the chance to make a new statement about AD drugs. An approval will set a low bar for other drugs to reach, but it would also provide a new drug to be taken for the millions who suffer from this terrible disease.

Donanemab by Eli Lilly

In June 2021, the FDA granted Eli Lilly (LLY) Breakthrough Drug Designation (BTD) for donanemab, which is an investigational antibody that targets a modified form of beta-amyloid called N3pG. Despite being awarded a BTD, donanemab only has shown a slight effect of slowing down AD in APOE4 carriers and has failed to show an impact in non-carriers.

One hypothesized reason for donanemab’s effect is that APOE4 carriers were found to have increased amounts of amyloid in their brains, which allows a more drastic effect for a drug that targets amyloid.

The most significant upcoming catalyst for this drug is the January 6th decision on lecanemab. If lecanemab is approved, it will set a low bar for approval and suggest that donanemab will also be approved. If lecanemab is rejected, I suspect that donanemab would only have a chance of approval for APOE4 carriers but would most likely be rejected.

For my in-depth reading on the topic, I recommend checking out Seeking Alpha contributor Lane Simonian’s latest piece.

Gantenerumab by Roche

In November 2021, Roche (OTCQX:RHHBY) was granted BTD for its Amyloid theory drug gantenerumab.

Gantenerumab is a fully human IgG1 antibody designed to bind with subnanomolar affinity to a conformational epitope on Aβ fibrils. It encompasses both N-terminal and central amino acids of Aβ. The therapeutic rationale for this antibody is that it acts centrally to disassemble and degrade amyloid plaques by recruiting microglia and activating phagocytosis

There are currently five ongoing trials for gantenerumab that could provide catalysts. I have not seen much information about this drug since its BTD announcement. Similar to donanemab, a significant catalyst will be what happens with lecanemab.

Novel Approaches

Many companies with novel approaches run short trials with a small number of patients. I think this may prove to be a mistake in the end. One, it is much harder to achieve statistical significance unless there is a huge delta between the drug and placebo. A large delta is even more challenging when the trial is a small size. Two, companies will not be able to tell if the drug is disease-modifying or short-term treatment like Aricept. Ultimately, if the company gets approval for the shorter, smaller trial, it is a massive win. If not, they have more data to run their next trials and potentially get a better partnership deal, which is why I believe many companies are taking this approach.

The first data readout from one of these trials is from Anavex in December, so we shall see how the market reacts and if the company files an NDA or chooses to run another phase 3.

Simufilam by Cassava Sciences

Cassava Sciences, Inc. (SAVA) is a small biotech company out of Austin, Texas. The company is developing a small molecule pill targeting mild to moderate Alzheimer’s Disease called Simufilam in two concurrent phase 3 trials. I have covered the company with numerous articles on Seeking Alpha. Per the last quarterly filing, the company has $197 million in cash and $0 in debt. The burn rate from last quarter was ~$20 million. The company has stated they have enough cash to fund its phase 3 trials. Currently, Cassava Sciences sits at a $1.5 billion market cap.

Cassava Sciences’ theory is around Altered Filamin A (FLNA). The company believes that fixing this altered protein upstream the issues that cause AD will correct what eventually causes AD. From Cassava’s corporate slides, “Simufilam binds altered FLNA, restores its proper shape/function, disables Ab42 signaling via α7nAChR and TLR4.”

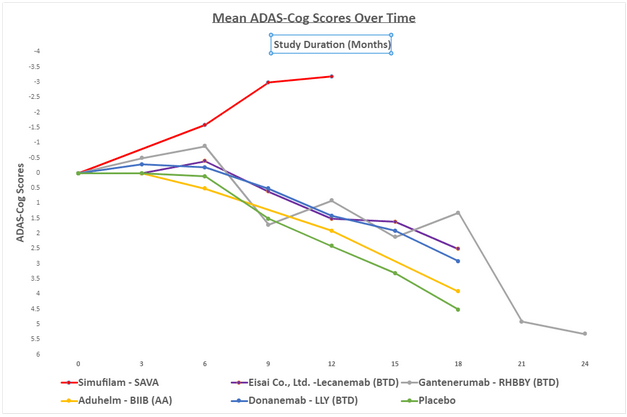

Simufilam has no known safety issues and has achieved remarkable trial data thus far. In an open-label trial, Simufilam has shown cognitive improvement at 3,6,9 and 12 months, with an ADAS-COG score at 12 months of an average improvement of 1.5 points in 100 patients, with 63% being “super responders” and an average improvement of 5.6 points. This data is the best in clinical trials for an AD drug candidate.

Simufilam is my personal favorite of all the AD plays. Below is a chart comparing its data to the BTD and AA drugs from the Amyloid Theory. The data in the graphic is from early 2022 and is not all up to date.

Created

Of the non-amyloid drugs discussed, Cassava Sciences has the most rigorous phase 3 program, running two phase 3 trials, one a year and the other one and a half years. In total, 1750 patients will be in these phase 3 trials. The long trial length will allow the company to show disease modification versus the short-term benefit of Cholinesterase Inhibitors. Additionally, the length will help more easily establish a difference compared to a placebo. Finally, more patients make it easier to show statistical significance. In my opinion, Cassava is the only non-amyloid company mentioned setting itself up for approval on its phase 3 trials. I believe other companies will need to run more trials. It is important to note that for companies with limited resources, this can be a smart move to show the efficacy of their therapy before doing a complete phase 3 for approval.

Key dates to watch for this company are the 200-patient 12-month open-label data before the end of 2022, the cognitive maintenance study data summer of 2023, and the phase 3 trial data and subsequent NDA application summer of 2024.

Anavex 2-73 by Anavex Life Sciences

Anavex 2-73 by Anavex Life Sciences Corp. (AVXL) is a disease-modifying AD drug candidate. Anavex currently sits at an $800 million market cap. According to the latest SEC filings, the company has $153 million in cash and a burn rate of only $12 million a quarter. I suspect this burn rate will increase significantly with more extensive trials and US-based trials.

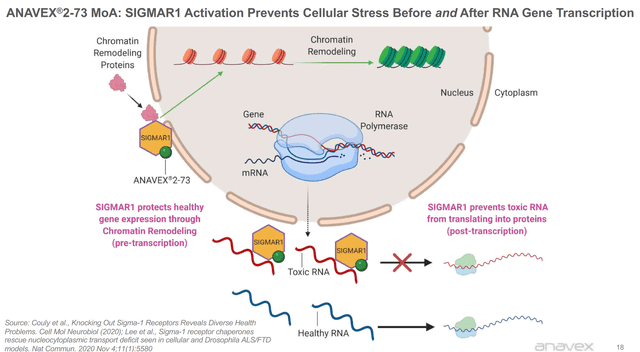

Anavex 2-73’s method of action is below,

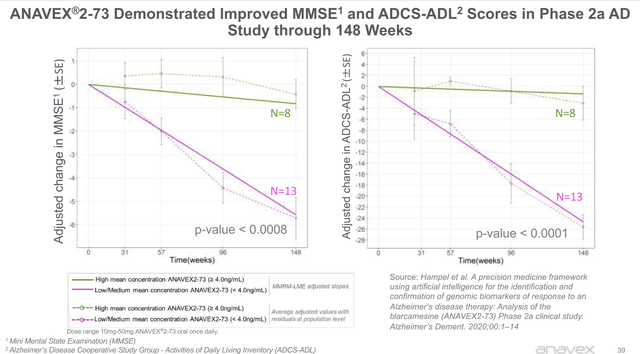

As far as data goes, we do not have much data to work with. The company has only released the data of 21 individuals in an open-label study. With so few individuals, it is challenging to analyze. Results have appeared promising, and I will include the corporate slide below.

The company completed a combined phase 2/3 trial with data coming December 1st at CTAD. The study is a 48-week trial with 509 early AD patients based entirely outside the United States. I will be watching for this data readout, but I do not believe it will be what many investors in AVXL are hoping for. It is very rare for a drug without U.S. sites to be approved, so I do not think this readout will lead to approval. It will most likely lead to another U.S.-based phase 3 trial, adding on at least two years until this drug is on the market; however, the benefit of having this data will be investors can feel much more confident in the outcome of the U.S.-based phase 3 trial. Additionally, the size of the trial is relatively small for approval. The Amyloid drug phase threes have well into the thousands of patients in their phase 3 trials, and Cassava Sciences has almost 2000 patients.

XPro by INmune Bio

XPro by INmune Bio, Inc. (INMB) is currently in phase 2 trials. The company sits at a $115 million market cap. Per the latest SEC filing, the company has $60 million in cash and a burn rate of $6.8 million per quarter. The company will likely have to raise cash before a phase three trial.

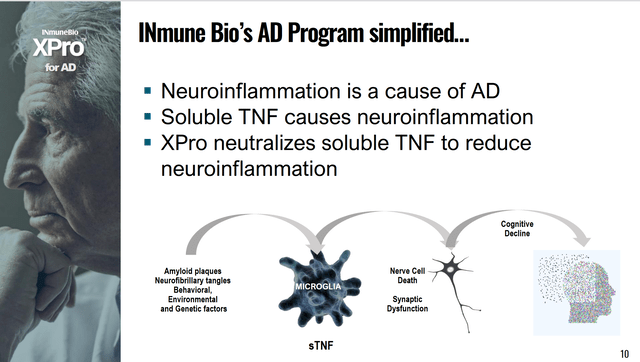

XPro’s goal from the corporate slides is “to prevent cognitive decline, not slow cognitive decline.” Below is a simplified explanation of XPro.

XPro has shown promise in early clinical work, but we lack enough data to talk about it further than this in such a high-level overview. The company states we should have phase 2 data in 2023. INmune Bio is a company I will be monitoring closely and one I believe could surprise people with its phase 2 data.

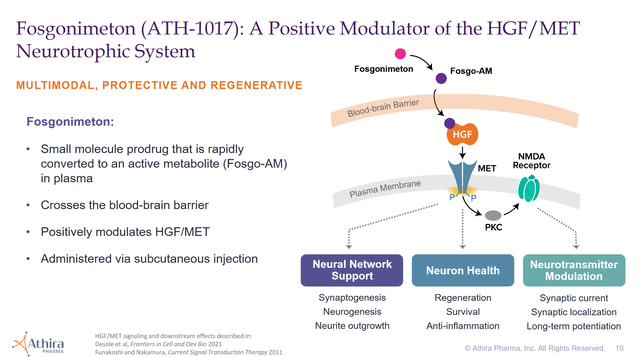

Fosgonimeton by Athira Pharma

Fosgonimeton by Athira Pharma, Inc. (ATHA) is currently in a phase 3 trial. The company now sits at a $136 million market cap. Per the last SEC filing, the company has $252 million in cash and short-term investments with a burn rate of just $24 million per quarter. I expect this burn rate to increase with a more significant phase 3 trial.

Below is an overview of how the drug works from Athira’s corporate slides.

The company states, “Every AD subject receiving fosgonimeton had a level of improvement in P300 latency” in their phase 1b trial. Additionally, the company believed in their phase 2 data enough to run a phase 3 trial. Although, the “Primary endpoint of change in biomarker ERP P300 latency was not statistically significant for the full study population as combination of fosgonimeton and standard-of-care (AChEIs) given together showed potential diminished effect of fosgonimeton.”

Athira reported topline phase 2 data in Q2 of this year and is enrolling their phase 3 trial LIFT. The company aims to have 420 patients enrolled for 26 weeks in a double-blinded placebo-controlled study that includes a high dose, low dose, and placebo arm with an optional 18-month open-label extension. With such a short trial, I suspect we could see data as early as 2023, but it depends on the company’s ability to enroll.

Athira will be an interesting one to watch, and I suspect it will have the same approval issues as Anavex after its phase 3 other than not having US-based trials. More than likely, they will need to run another phase 3.

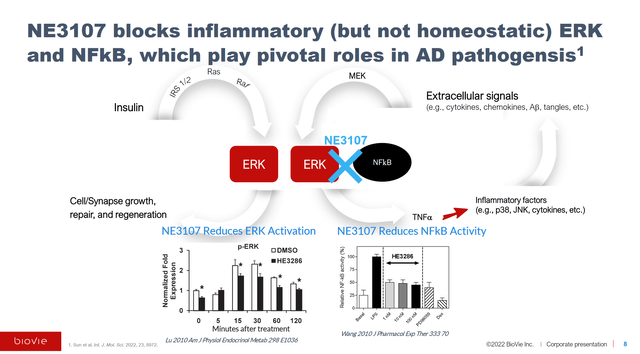

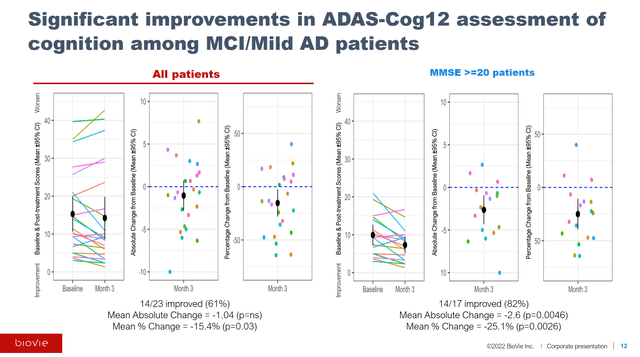

NE3107 by BioVie

NE3107 by BioVie Inc. (BIVI) reported topline phase 2 data in September. The company currently sits at an $83 million market cap. Per the company’s last SEC filing, the company has $18.6 million in cash and a burn rate of $27 million per quarter. They will need to raise cash if they have not already done so since their last quarterly filing.

How NE3107 works can be seen in the slide from BioVie’s corporate presentation below.

The company posts great data slides, one of which I will include below from their topline phase 2 readout.

The phase 3 trial will have everyone on the drug for two weeks before having a double-blind placebo control for 26 weeks. Similar to Athira and Anavex, this trial is very short and small, so subsequently will likely run into the same issues. The company expects its phase 3 to be done and have data announced by Q3 2023.

Risks and Conclusions

Biotech is a very volatile and risky field, and AD drug development takes all aspects of biotech investing to extremes. Many catalysts from these companies have binary results that can be played long or short. Additionally, there are long-term plays to be made. This list is not comprehensive and does not dive deeply into any company. As with any investment, do your additional research and understand the risks you are taking on.

Be the first to comment